Last updated: March 6th, 2020 4:22 PM

Last updated: March 6th, 2020 4:22 PM

How to File GSTR 4 Return

GSTR 4 return must be filed persons registered under GST and enrolled under the GST composition scheme. To prepare and file GSTR 4 return, LEDGERS GST Software can be used. To prepare GSTR 4 return in offline mode, download the excel sheet, populate data and upload it to LEDGERS GST Software. Based on the invoice data provided by the individual, the portal prepares the GSTR 4 return automatically.Download GSTR 4 Excel Format

Continuation of GSTR 4 Return Article

In this article, we continue to review the procedure for preparing and filing GSTR 4 return. To read the first part on how to prepare details of inward supply on GSTR 4 return, click on the link below:GSTR 4 Return

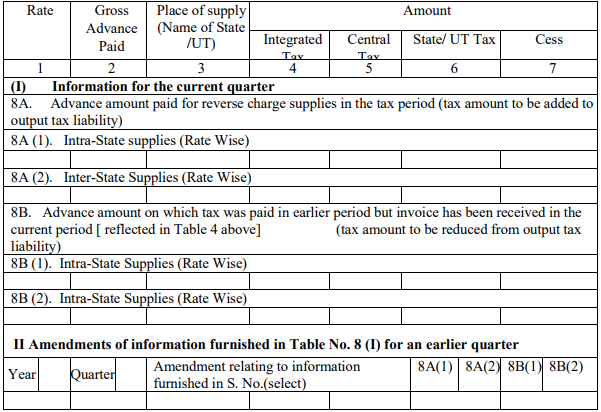

Consolidated Statement of Advances Paid

As discussed in the earlier article, dealers enrolled under the composition scheme should pay GST on all purchases and pay GST on supplies based on the turnover of the business. Even on purchases from an unregistered dealer wherein GST is not applicable, dealers registered for GST composition scheme should pay GST on reverse charge basis. Hence, in GSTR 4 return filed by composition scheme taxpayers, focuses on gathering details of inward supplies. Thus in GSTR 4 return, the dealer registered under composition scheme is required to declare details of advances paid and advance adjusted on account of receipt of supply in the following format. [caption id="attachment_33432" align="aligncenter" width="601"] GSTR 4 Statement of Advances Paid

In this table, the taxpayer must provide details of all invoices paid with the following details:

GSTR 4 Statement of Advances Paid

In this table, the taxpayer must provide details of all invoices paid with the following details:

- GST Rate applicable

- Amount of advance paid

- Place of supply

- Amount of IGST applicable

- Amount of CGST applicable

- Amount of SGST applicable

- Amount of GST cess applicable

- Advance amount paid for reverse charge supplies in the tax period (adding tax amount to output tax liability)

- Intra-State supplies (Rate Wise)

- Inter-State Supplies (Rate Wise)

- Paid tax for the advance amount in the earlier period but the received the invoice in the current period [ reflected in Table 4 above] (reducing the tax amount from output tax liability)

- Intra-State Supplies (Rate Wise)

- Intra-State Supplies (Rate Wise)

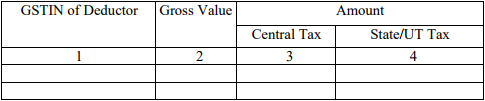

TDS Credit Received

In this table, the taxpayer can provide details of TDS credit received during the previous quarter. Certain government departments and agencies have been given powers under GST to deduct tax at source. If any such TDS under GST is applicable, such details must be provided. If there was no TDS, then the following information need not be provided. [caption id="attachment_33433" align="aligncenter" width="677"] GSTR 4 TDS Credit Received

GSTR 4 TDS Credit Received

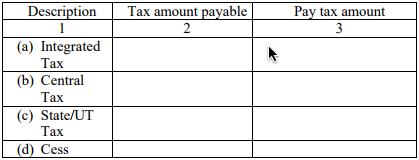

GST Payable and Paid

In this table, the taxpayer must provide details of GST payable and GST paid. The amount of GST payable can be determined based on the turnover of the business and the applicable GST composition rate. In case of LEDGERS GST software, the amount of GST payable is automatically calculated based on the nature of the business of the taxpayer. [caption id="attachment_33434" align="aligncenter" width="662"] GST Paid and Payable

GST Paid and Payable

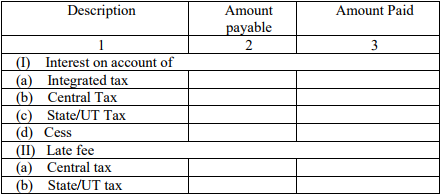

Interest, Late Fee Payable and Paid

In case the taxpayer failed to pay the GST amount due on time, then the taxpayer must make payment along with interest and a late fee. In this table, the system would automatically calculate the amount of interest and late fee payable. Based on the amount of GST paid, the balance pending is provided. [caption id="attachment_33435" align="aligncenter" width="700"] GSTR 4 Interest and Late Fee

GSTR 4 Interest and Late Fee

Refund Claimed from Electronic Cash Ledger

Finally, in the following table, the taxpayer can provide information about GST refund claim if any. Along with the amount of refund requested, the taxpayer must provide details of bank account to which the refund is to be processed. [caption id="attachment_33436" align="aligncenter" width="768"] GSTR 4 Refund Claim

Click here for GST Registration or GST Return Filing

GSTR 4 Refund Claim

Click here for GST Registration or GST Return Filing

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...