Last updated: March 7th, 2020 3:12 PM

Last updated: March 7th, 2020 3:12 PM

How to File Nil GSTR1 Return?

All regular taxpayers having GST registration are required to file nil GSTR1 return even if there was no business activity during a month. The taxpayer can file a nil GSTR1 return online within a few minutes. In this article, we look at the procedure for filing nil GSTR1 return with examples. Details required for filing GSTR1 return.Due Dates for GSTR-1

The Ministry of Finance classified the filing of GSTR 1 into two categories:|

S.No. |

Applicable for |

Month |

Due Date |

|

1 |

For taxpayers having an aggregate turnover of up to Rs.1.5 cr |

January – March 2020 |

April 30th 2020 |

|

2 |

For taxpayers having an aggregate turnover exceeding Rs.1.5 cr |

February 2020 |

March 11th 2020 |

Import of E-way Bill Data

It is essential for taxpayers to validate the data of their transactions before proceeding with the process of filing returns, as it saves time and unnecessary data entry. To cater to this purpose, the GST portal has now been integrated with the E-way Bill Portal (EWB). The integration enables the users to import the B2B and B2C invoice sections and the HSN-wise-summary of outward supplies section. Using these details, the taxpayers may verify the data and complete the filing. The Ministry introduced the feature on considering the major data gaps between self-declared liability in Form GSTR 1 and Form GSTR 3B. A similar rule also applies to Input Tax Credit (ITC) claimed in GSTR 3B, as it could be compared with the credit available in Form GSTR 2A. The user can purse the data validation and comparison through the following tabs of the portal:- Liability other than export/reverse charge

- Liability due to reverse charge

- Liability due to export and SEZ supplies.

- ITC credit claimed and due

Is filing GST nil return mandatory?

Yes, taxpayers having GST registration are mandatorily required to file nil GST return when there was no business activity during the return period. If nil GST return is not filed, then the taxpayer would liable for paying a penalty of Rs.100 per day until the default continues.How can file nil GSTR1 return?

Nil GSTR1 return can be filed by any person registered under GST who did not have any sales transaction in a month. Also, GSTR1 return includes details of credit notes issued, debit notes issued, advances received, amount of advance adjusted and document summary. Hence, a nil return can be filed only if none of the above documents was issued and the business did not undertake any activity during a month.Procedure for Filing NIL GSTR1 Return

To file nil GSTR1 return, follow the steps below. In case you use LEDGERS GST Software for GST Return Filing, you can easily complete steps 1 to 5 on the software with a click of a button.Step 1: Login to your GST Account

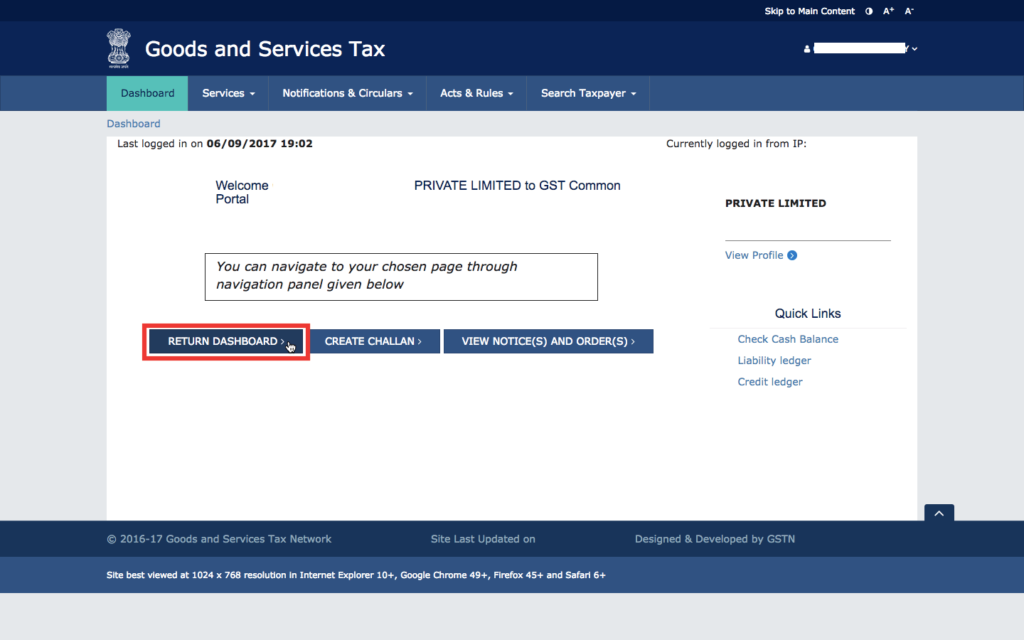

Go to the GST Login page and log in to your GST account. In the dashboard page, click on the Return Dashboard. Step 1 - GSTR1 Nil Return Filing

Step 1 - GSTR1 Nil Return Filing

Step 2: Begin preparing GSTR1 Return

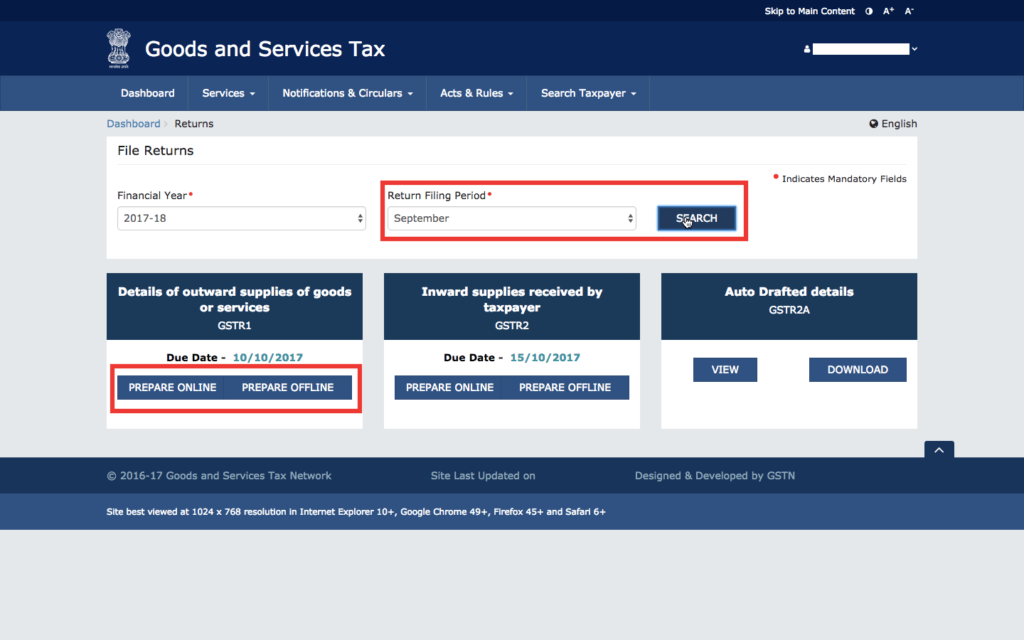

In the Returns dashboard, click on the month you wish to file GSTR1 return and select prepare online. Step 2 - GSTR1 Nil Return Filing

Step 2 - GSTR1 Nil Return Filing

Step 3: Verify auto-populated GSTR1 return

On clicking prepare online, the taxpayer will be provided with a summary of GSTR1 return. Ensure that all the sections in the GSTR1 return are nil or zero. [caption id="attachment_33560" align="aligncenter" width="819"] Step 3 - GSTR1 Nil Return Filing

Step 3 - GSTR1 Nil Return Filing

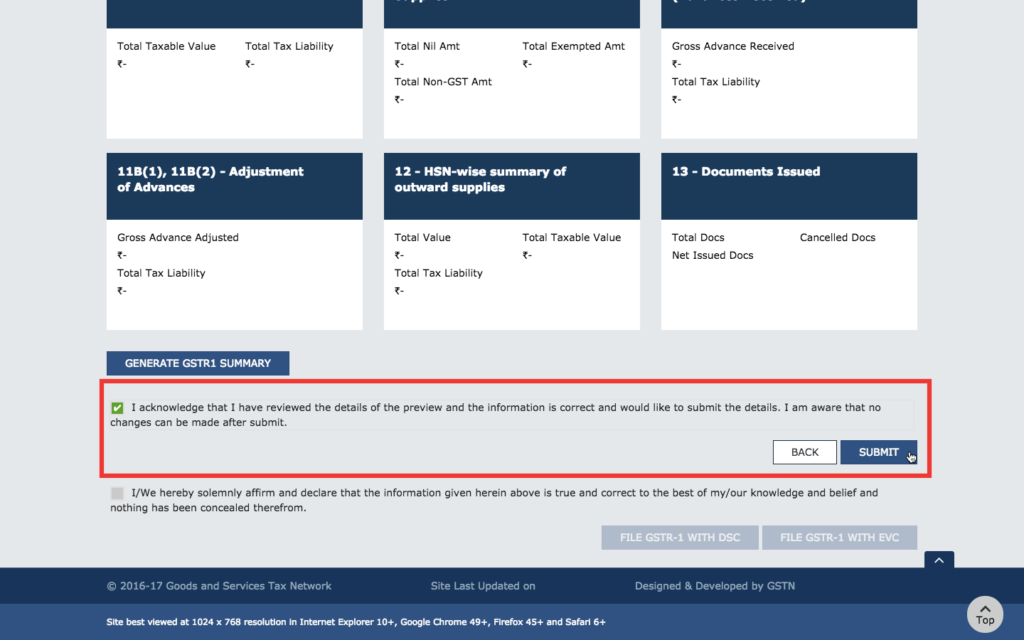

Step 4: Submit GSTR1 Return

Once the details are verified, select the checkbox showing you acknowledge that the details in the filing are correct and click on submit. Step 4 - Submit GSTR1 Return on GST Portal

Step 4 - Submit GSTR1 Return on GST Portal

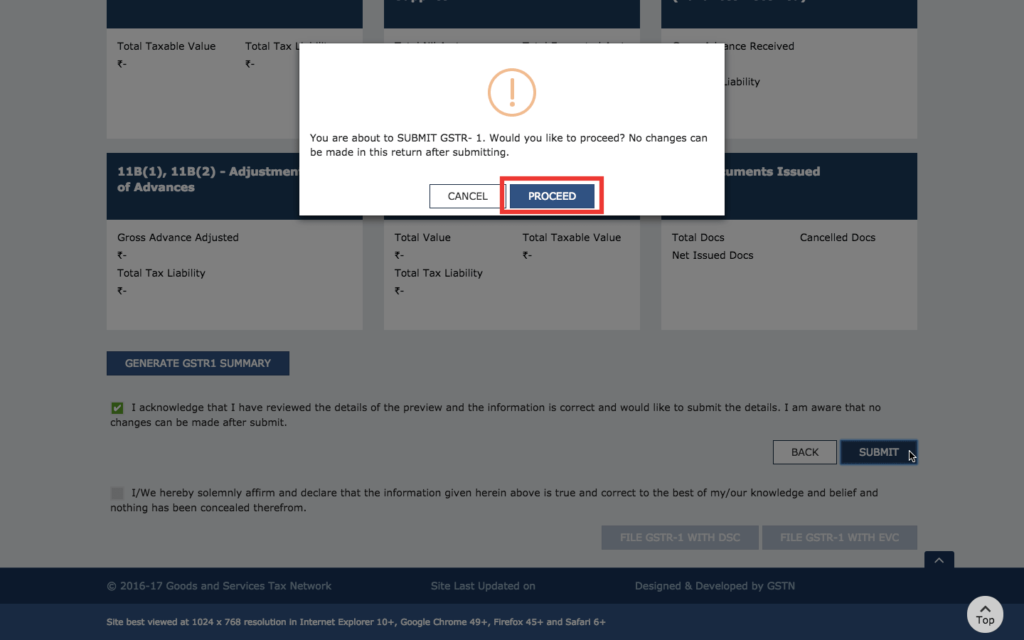

Step 5: Accept the GSTR1 Filing

In the confirmation window, click on proceed to accept the GSTR1 filing. After clicking on the proceed button, the taxpayer will not be able to change any information submitted. Hence, ensure that the GSTR1 return is final. Step 5 - Accept GSTR1 Filing

Step 5 - Accept GSTR1 Filing

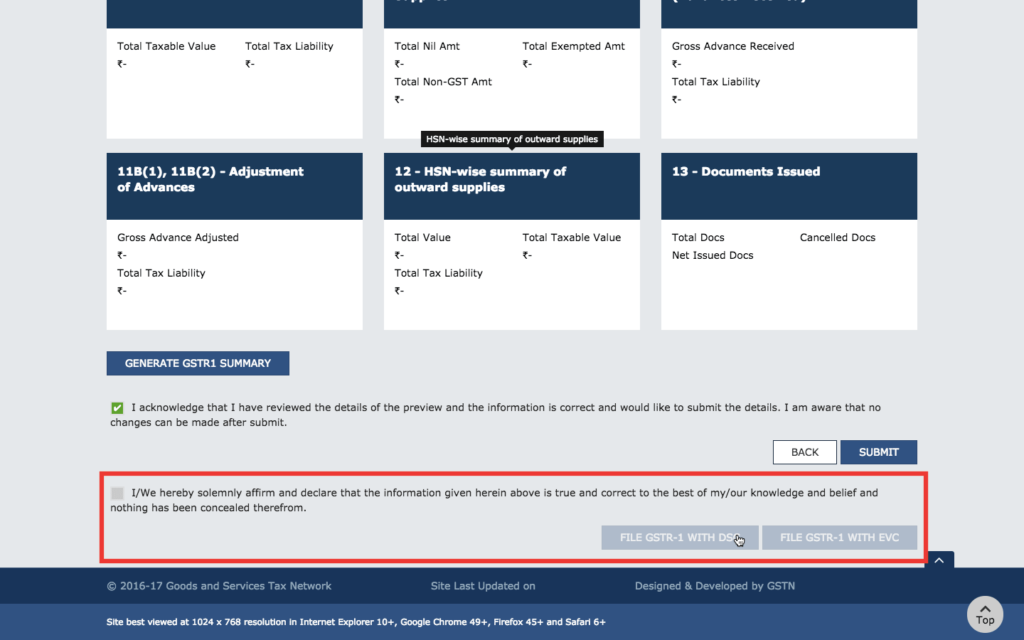

Step 6: Digitally sign the GSTR1 Filing

After the final GSTR1 return is submitted, the taxpayer must digitally sign the GSTR1 return using a class 2 digital signature or EVC verification to complete the nil GSTR1 return filing. Step 6 - File Nil GSTR1 Return

Click here to register Private Limited Company, Public Limited Company or One Person Company

Step 6 - File Nil GSTR1 Return

Click here to register Private Limited Company, Public Limited Company or One Person Company

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...