Last updated: July 14th, 2023 3:57 PM

Last updated: July 14th, 2023 3:57 PM

Filing NIL GST Return - In Less than One Minute

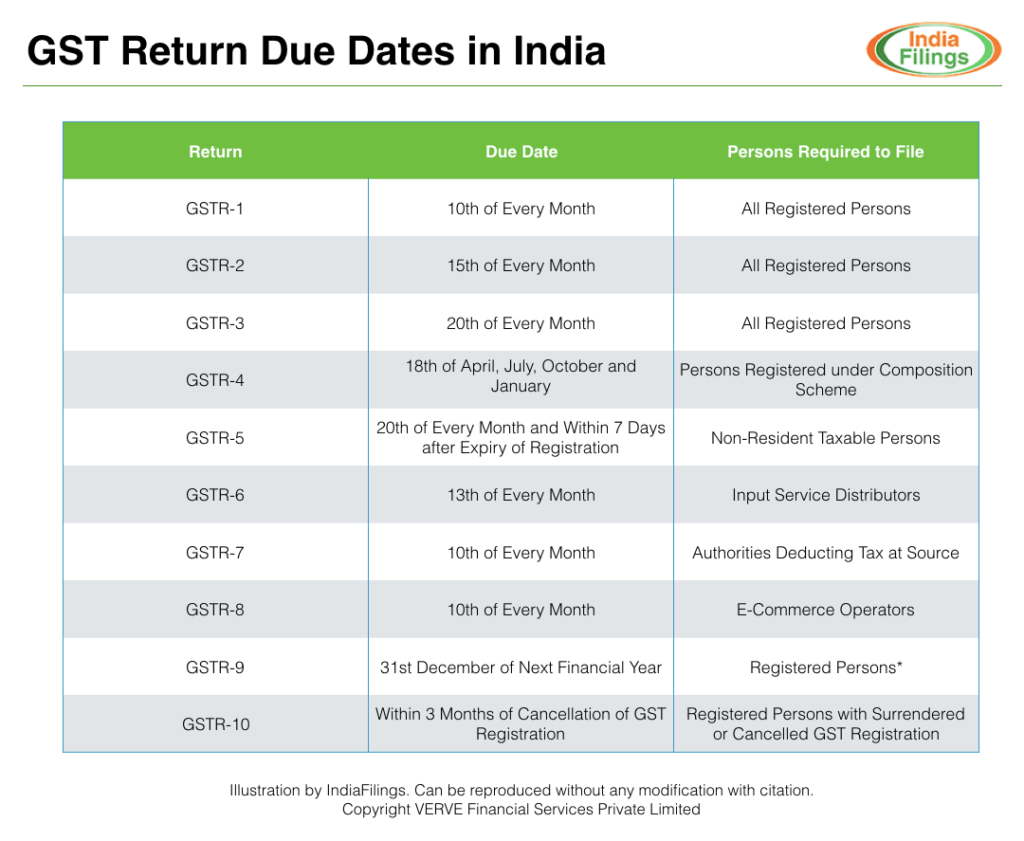

GST return filing has to be filed by everyone having GST registration irrespective of business turnover or profitability in a month. Hence, the taxpayer must log in to the GST portal and submit NIL returns, even if the taxpayer reports on issuing no invoices for the registered business. If the taxpayer fails to file NIL return, a penalty of Rs.100 per day shall apply until completing the filing. Hence, all taxpayers having GST registration must submit NIL GST return before the deadline. The due dates for GST returns are as follows: GST Return Filing Due Dates

GST Return Filing Due Dates

Is nil return required under GST?

Yes, all taxpayers having GST registration should file GST returns on the 10th, 15th and 20th of each month. Even if there was no business activity or transaction during a month, the taxpayer must still log in to the GST portal and file NIL GST return to avoid penalty.Do I have to file Nil GSTR3B return?

All taxpayers having GST registration shall file GSTR-3B return for the months of July and August 2017. Even the businesses that had no business or transaction during the month of July and August 2017 must file nil GSTR-3B return.Do I have to file Nil GSTR-1 return?

Yes, nil GSTR-1 return must be filed by all regular taxpayers having GST registration even if there were no sales transaction in a month. If the taxpayer fails to file GSTR-1 return, a penalty of Rs.100 per day shall apply.Procedure for filing nil GSTR1 return.

In GSTR-1 return, the taxpayer provides information about all sales transactions in the previous month and upload invoices issued to the GSTN portal. The taxpayer shall still state on NIL transactions even if the business makes NIL sales. The taxpayer shall file the NIL returns on the GST portal by logging into the GST portal. submit that no transactions were done, e-sign and file GSTR-1 return.Do I have to file nil GSTR-2 return?

Yes, nil GSTR-2 return must be filed by a taxpayer even if there were no purchase transactions in a month. If GSTR-2 return is not filed, a penalty of Rs.100 shall apply. While filing GSRT-2 return, most of the information is auto-populated based on the GSTR-1 return filed by all other taxpayers. Hence, if there were no purchases, the auto-populated form of GSTR-2 would show no transaction. The taxpayer can verify GSTR-2, e-sign and submit a nil GSTR-2 return easily.Do I have to file nil GSTR-3 return?

Yes, nil GSTR-3 return must be filed by a taxpayer even if there were no business activity in a month. Upon failure to file the GSTR-3 returns, a penalty of Rs.100 per day shall apply. Since most of GSTR-3 return is auto-populated, filing of nil GSTR-3 return would be very easy. The taxpayer would have to login to the GST Portal, verify the amount of tax payable, if any, e-sign and submit the GSTR-3 return.Procedure for Filing NIL GSTR-3B Return

A nil GSTR-3B return can be filed very easily in a matter of minutes through the GST portal directly. Hence, any person having GST registration should file nil return before the due date without fail to avoid the penalty.Step 1: Login to GST Portal

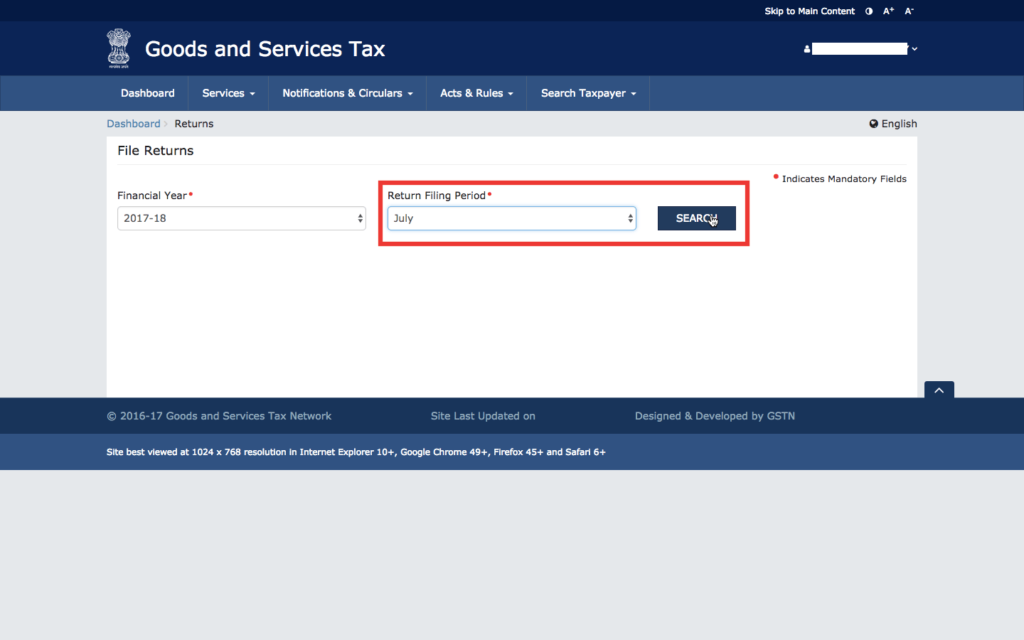

Login to your GST account through the GST Portal. Click on Return Dashboard. Select GST Return Dashboard

Select GST Return Dashboard

Step 2: Select the month of filing

GSTR-3B return must be filed only for the months of July and August. Hence, select July or August from the drop down and click on continue. Select GST Return Month and Click Search

Select GST Return Month and Click Search

Step 2: Select the month of filing

The user shall select the months as July and August on filing GSTR-3B return. Hence, select July or August from the drop-down and click on continue.Step 3: Select prepare GSTR-3B return

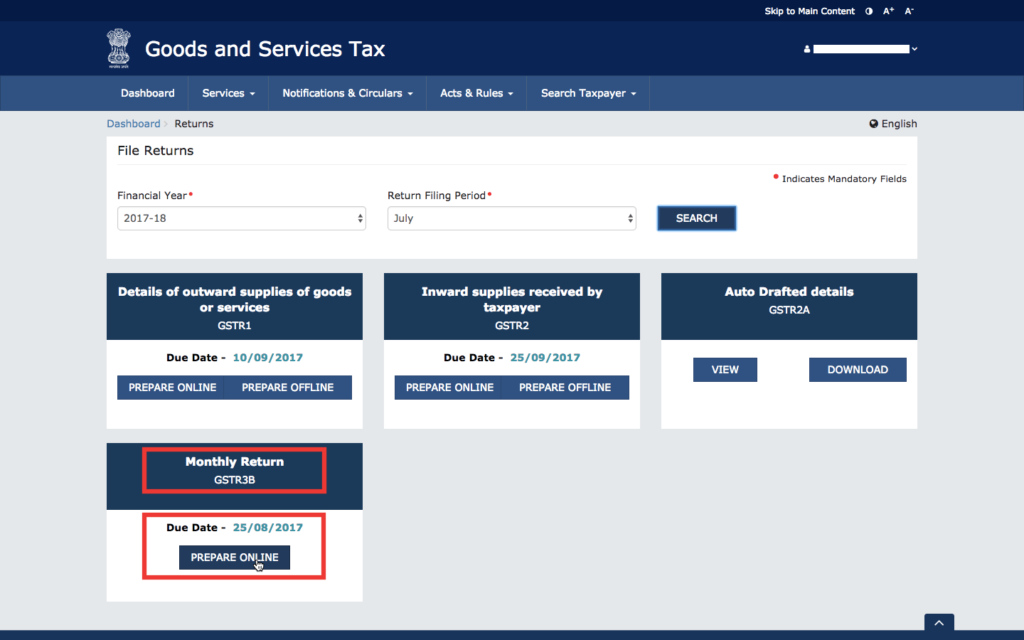

Click on prepare online in the section titled Monthly Return - GSTR3B. Click Prepare GSTR-3B Return Online

Click Prepare GSTR-3B Return Online

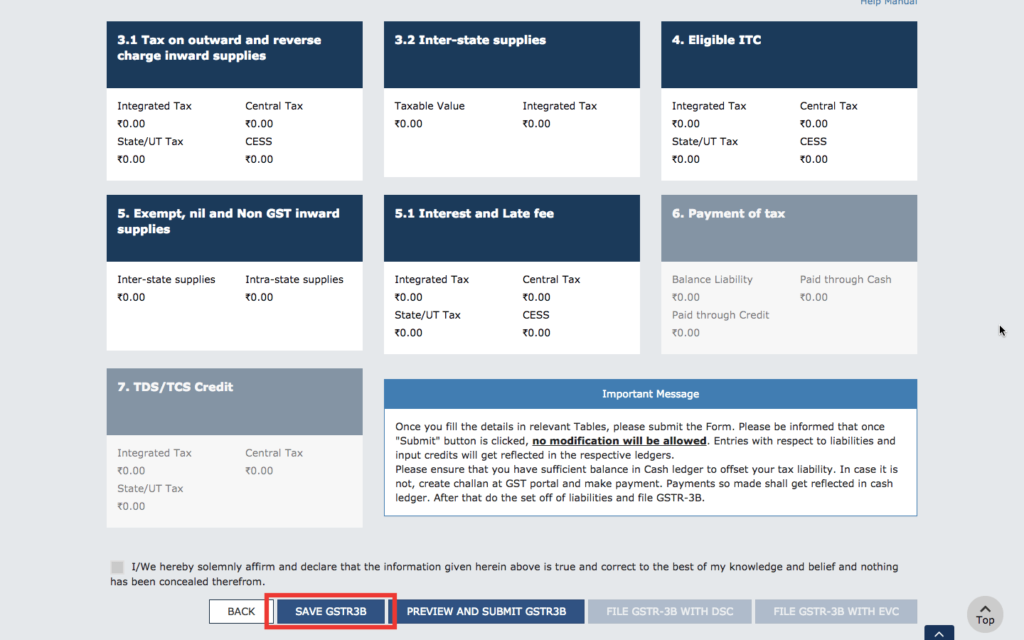

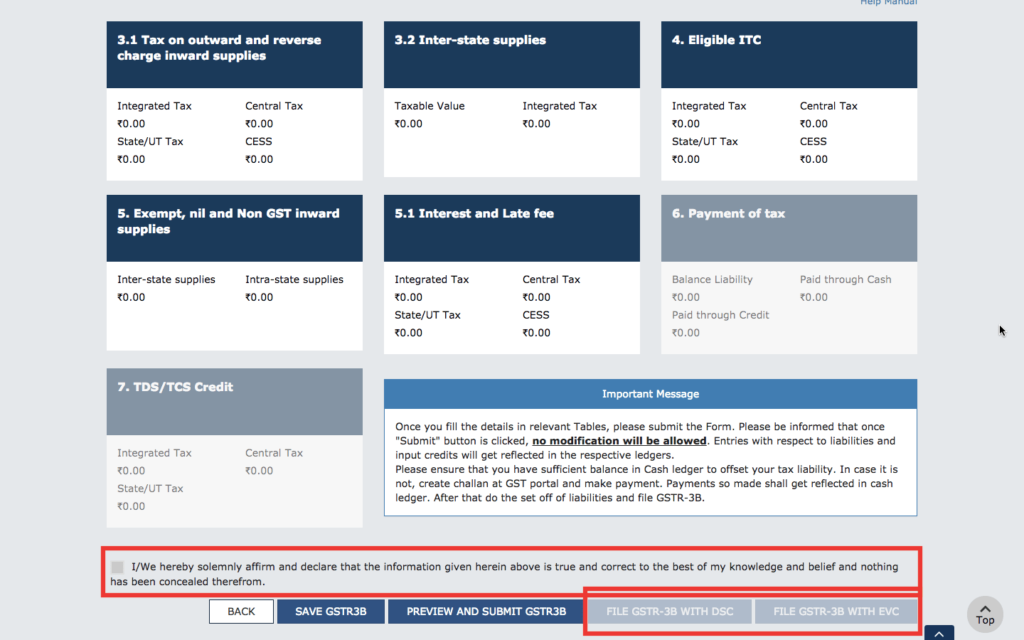

Step 4: Ensure that all fields are nil in the return

If all fields are nil in the GSTR3B return summary, click on save. You can save the GSTR3B returns multiple times during the preparation time to save your progress. Click on Save GSTR-3B Return

Click on Save GSTR-3B Return

Step 5: Preview and Submit GSTR3B Return

After preparing with proper details and saving the GSTR3B return, click on Preview and Submit GSTR3B. Submit GSTR3B Return

Submit GSTR3B Return

Step 5: Accept the return summary

After submitting the GSTR3B return, a window shall ask for the final confirmation. Click on confirm and submit to file the GSTR3B return. Once the button is clicked, the taxpayer will not be able to change any of the information submitted. Confirm GSTR-3B Filing

Confirm GSTR-3B Filing

Step 6: Digitally sign the GSTR3B return

The portal provides an option for the user to click on the 'Agree' checkbox after submitting the GSTR3B return. The user shall also digitally sign the GSTR3B return to complete the nil GST return filing. Accept and Submit GSTR3B Return

Accept and Submit GSTR3B Return

Visit IndiaFilings or sign up for LEDGERS to prepare and file GST returns online.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...