Last updated: March 29th, 2024 10:46 AM

Last updated: March 29th, 2024 10:46 AM

Filing of eForm CSR-1

Ministry of Corporate Affairs has mandated filing of eForm CSR-1 by implementing entities intending to undertake CSR activities for all CSR projects effective from 1st April 2021. MCA has announced that eForm CSR-1 is now live for Filing on MCA Portal and advised stakeholders to file the Form as soon as possible. A unique CSR Registration Number shall be generated for all entities submitting Form CSR-1. The current article briefs the application procedure for Filing of eForm CSR-1.Latest Due Date Update - 2024

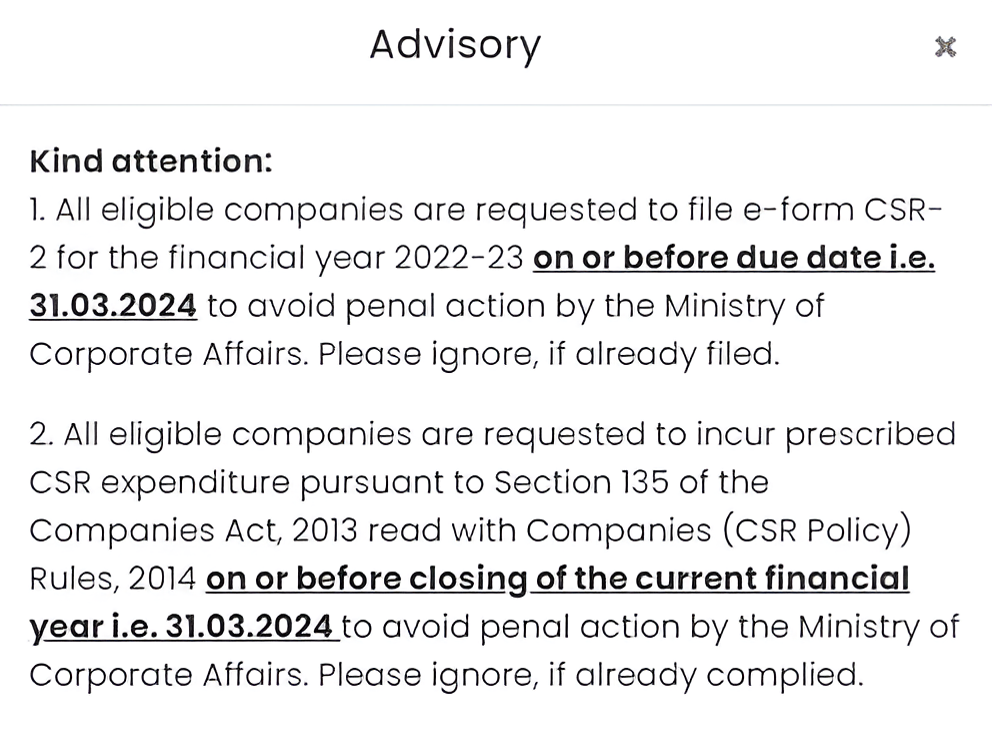

MCA announced that all eligible companies must file e-form CSR-2 for the financial year 2022-23 on or before the due date of 31.03.2024 to avoid penal action.

Form CSR-1

Form CSR-1 is a registration form for getting CSR funding by implementing agencies from the corporates. The Form CSR-1 is termed as Form for “Registration of Entities for undertaking CSR Activities”. The Form CSR-1 mainly consists of two parts:- The first part is relating to the information about the entity that intends to undertake CSR activities.

- The second part of Form CSR-1 is certification by practising professional.

Law Governing the eForm CSR-1

eForm CSR-1 is required to be filed according to Section 135 of the Companies Act, 2013 and the Companies (Corporate Social Responsibility Policy) Rules, 2014.Purpose of the Form CSR-1

As per the Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021, the company can undertake CSR activities either itself or through entities defined under Companies (Corporate Social Responsibility Policy) Rules, 2014 These companies/entities are required to mandatorily register themselves with the central government for undertaking any CSR activity by filing the e-form CSR-1 with the Registrar.CSR Registration by NGOs

The Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021 (“New CSR Rules”) has introduced substantial changes in the specifications and procedure to be followed by the NGOs while discharging their CSR obligations One of the major changes introduced via New CSR Rules for the NGOs is making registration compulsory for undertaking CSR activities on behalf of companies. Such registration is required to be taken in e-form CSR-1. The purpose of mandatory registration is for monitoring the activities of the NGOs and other agencies.Eligibility Criteria for NGO

The conditions for an NGO to receive CSR funds from a company only if are as follows:- A section 8 company Registered under section 12A and 80G of the Income Tax and have at least 3 years of undertaking charitable activities.

- A registered public trust Registered under section 12A and 80G of the Income Tax and have at least 3 years of undertaking charitable activities.

- A registered society Registered under section 12A and 80G of the Income Tax and have at least 3 years of undertaking charitable activities.

Registration of an NGO with MCA portal for accessing CSR funds

Rule 4(2) of the New Companies CSR Amendment Rules, 2021 specifies the following procedure for the registration of an NGO with an MCA portal for accessing corporate CSR funds:- Every NGO that intends to undertake the CSR activity need to register itself with the Central Government by filing the form CSR-1 electronically with the Registrar

- Form CSR-1 will be verified digitally by a Chartered Accountant in practice or a Company Secretary in practice or a Cost Accountant in practice

- On the submission of the Form CSR-1 on the portal, a unique CSR Registration Number will be generated by the system automatically.

Documents Required for CSR-1 Registration

The documents required to upload for CSR-1 Registration is as follows:- Copy of the registration certificate

- Copy of the PAN of the NGO with Form CSR-1

- DIN/PAN of the Director, Trustee, Secretary, etc. of the organization

- Copy of the Resolution authorizing the person by the entity with Resolution number and date of the resolution

- DSC of the person

Procedure to Download Form CSR-1

The procedure to download Form CSR-1 from the MCA website is as follows:- The applicant needs to access the official webpage of the Ministry of Corporate Office (MCA) and Click on Forms & Downloads on the top of the webpage.

- Scroll down the page till the topic ‘Incorporation services’ is reached. Click on the “Registration of Entities for undertaking CSR activities Form CSR-1” Download the e-Form with or without Instruction. This will be downloaded in zip file format. Unzip it and extract the relevant pdf files.

- Open the pdf file named ‘Form_CSR-1’. This is Form CSR-1 for the registration of entities for undertaking CSR activities.

Procedure for Filing of Form CSR-1

The following steps can be used for filing the Form CSR-1 on the MCA portal.- The applicant needs to access the official website of the Ministry of Corporate Affairs to file Form CSR-1. By login into the portal, the applicant can upload the Form CSR-1

- After login to the portal, enter a valid ‘Corporate identity number’ (CIN) for cancellation of unused issued Share of one class and increase in share capital.

- Select the purpose of the eForm from the drop-down menu and in case of others selected, specify the entity in the description box

Declaration and Designation

Select any one of the options from the drop-down values for declaration and digitally sign the Form CSR-1.- In case the person digitally signing the Form CSR-1 is a Director, approved DIN need to be provided.

- In case the person digitally signing the Form CSR-1 is Manager, enter approved DIN or valid income-tax PAN.

- Membership number need to be filed, in case the person digitally signing the Form CSR-1 is Company Secretary

Upload Documents

By clicking on the attach button, the required document can be uploaded and click on the pay the payment button for making the fee. On successful submission of the Form CSR-1, the eForm will be processed by the office of the Registrar of Companies.SRN Generation

SRN will be generated and displayed to the applicant on successful submission of the Form CSR-1. This SRN will be used for future correspondence with MCA.Challan Generation

On successful submission, a challan will be generated depicting the details of the fees paid by the user to the Ministry. It is the acknowledgement to the applicant that the Form CSR-1 has been filed.Get Acknowledgement

When the Form CSR-1 is completely processed by the authority, an acknowledgement will be sent to the official mail of the company.Get CSR Registration Number

On the submission of the Form CSR-1 on the portal, a unique CSR Registration Number shall be generated by the system automatically.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...