Last updated: April 15th, 2019 3:09 PM

Last updated: April 15th, 2019 3:09 PM

Form TRAN-1 is specifically meant for the taxpayers who are having Input Tax Credit (ITC) on closing stock and have migrated to the GST form of taxation from any of the previous tax systems. The form must include details of the balance of closing stock held by a business as on the 1st of July 2017 so as to facilitate the claim of ITC in the old stock. The due date for filing this form was previously stipulated to be on the 27th of December 2017, but technical glitches prompted the need for an extension. As a result, taxpayers may now complete their filing by the 31st of March, 2019.Filing of GST Tran-1

A Preface to the Concept

Transitional provisions in GST provides the taxpayers with an opportunity to avail the credit of taxes or duties paid under various State or Central laws; the likes of which include Value Added Tax Act, Central Excise Tax Act and service tax laws; and carry the same to the GST regime by paying heed to the eligibility requirements. These transitional credits can be applied for in Form GST TRAN-1 and TRAN-2.Submission of TRAN-1

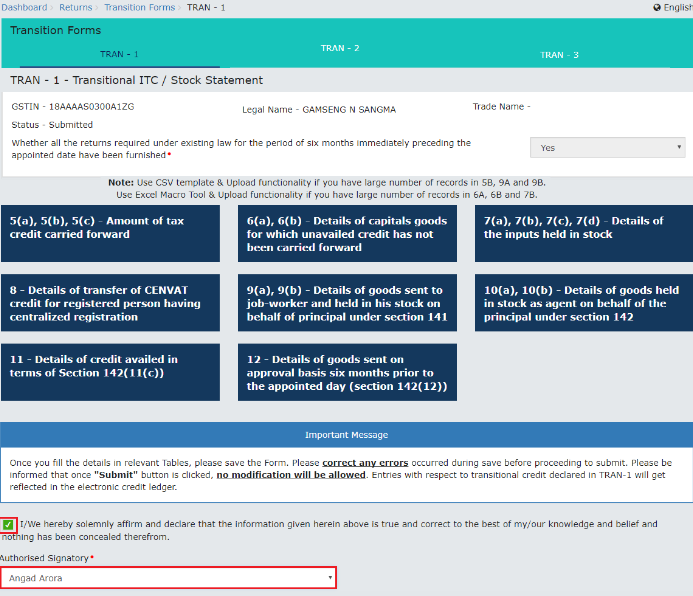

The submission of TRAN-1 can be completed by following the procedures specified below: Step 1: User Login The proceedings may be initiated by the applicant by logging into the official GST portal. Step 2: The option of Transition Forms From the ‘Services’ drop-down menu, choose ‘Returns,’ followed by the option of ‘Transition Forms.’ Transition Forms

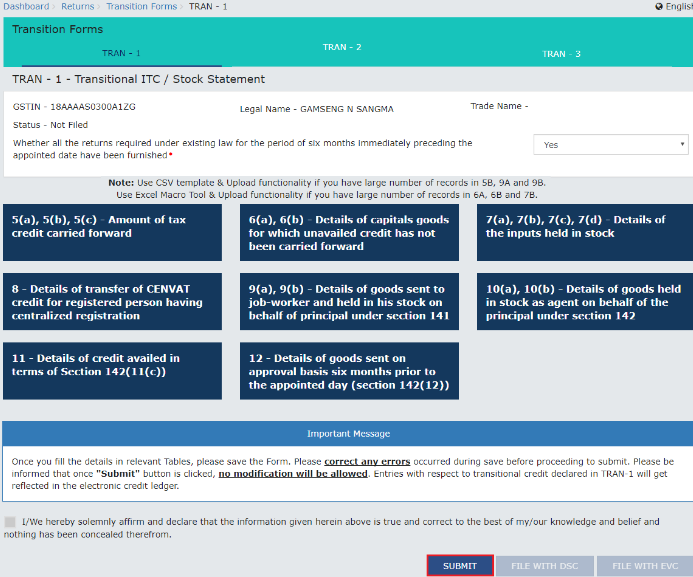

Step 3: Affirmative or Negative

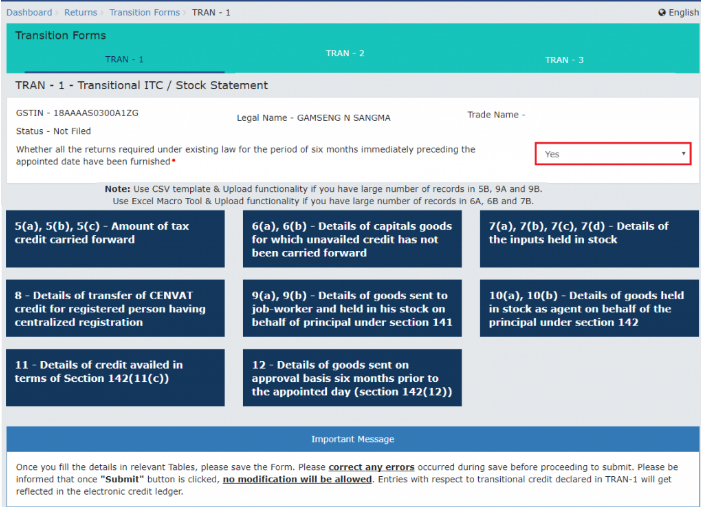

The subsequent page will display the tiles related to TRAN-1. The user may choose the option ‘Yes’ or ‘No’ based on whether a return is filed for the last six months (those who have already furnished Form TRAN-1 will be provided with a reopen button so as to modify/add previously filled data).

Transition Forms

Step 3: Affirmative or Negative

The subsequent page will display the tiles related to TRAN-1. The user may choose the option ‘Yes’ or ‘No’ based on whether a return is filed for the last six months (those who have already furnished Form TRAN-1 will be provided with a reopen button so as to modify/add previously filled data).

Confirm Yes or No

Step 4: Sum of tax credit carried forward

This step effectively initiates the process of furnishing the requisite details. This section (sum of tax credit carried forward) and the subsequent ones can be accessed from the same page.

This particular section must comprise of the particulars of ITC that needs to be carried forward from the pre-GST regime to that of the existing one. The details so furnished must be saved. The taxpayer will be notified of any errors, which must be rectified before moving ahead.

Step 5: Details of Unavailed Credit not being carried forward

This section depicts the credits not availed, but which is to be carried forward. Each tab must comprise of the invoice details. In case of multiple entries, a JSON page can be utilized. The details so furnished must be saved. The taxpayer will be notified of any errors, which must be rectified before moving ahead.

Step 6: Details of Inputs held in Stock

The taxpayer must include the following details under this section:

Confirm Yes or No

Step 4: Sum of tax credit carried forward

This step effectively initiates the process of furnishing the requisite details. This section (sum of tax credit carried forward) and the subsequent ones can be accessed from the same page.

This particular section must comprise of the particulars of ITC that needs to be carried forward from the pre-GST regime to that of the existing one. The details so furnished must be saved. The taxpayer will be notified of any errors, which must be rectified before moving ahead.

Step 5: Details of Unavailed Credit not being carried forward

This section depicts the credits not availed, but which is to be carried forward. Each tab must comprise of the invoice details. In case of multiple entries, a JSON page can be utilized. The details so furnished must be saved. The taxpayer will be notified of any errors, which must be rectified before moving ahead.

Step 6: Details of Inputs held in Stock

The taxpayer must include the following details under this section:

- Inputs held in stock as on the 1st of July, 2017.

- Input contained in semi-finished or finished goods held in stock as on the 1st of July 2017.

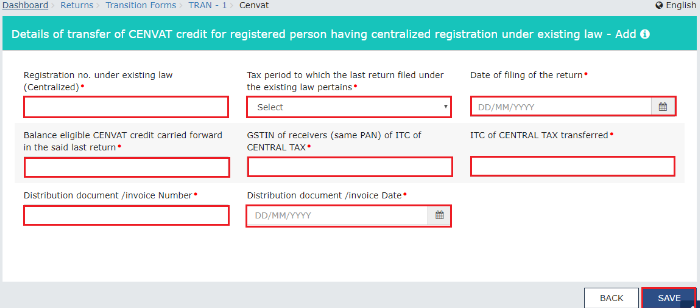

Details of Cenvat Credit

Step 8: Details of Goods Sent to Job Worker

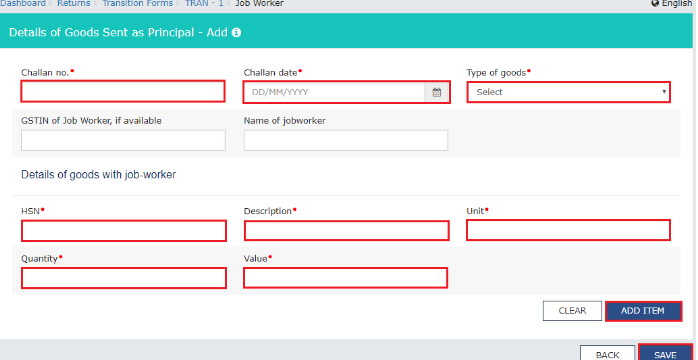

Here, the user needs to specify details pertaining to the goods sent to the job-worker, as well as those held in stock by the job-worker on behalf of the principal. The tabs to be filled-in here include:

Details of Cenvat Credit

Step 8: Details of Goods Sent to Job Worker

Here, the user needs to specify details pertaining to the goods sent to the job-worker, as well as those held in stock by the job-worker on behalf of the principal. The tabs to be filled-in here include:

- Details of goods sent as principal.

Details of Goods Sent as Principal

Details of Goods Sent as Principal

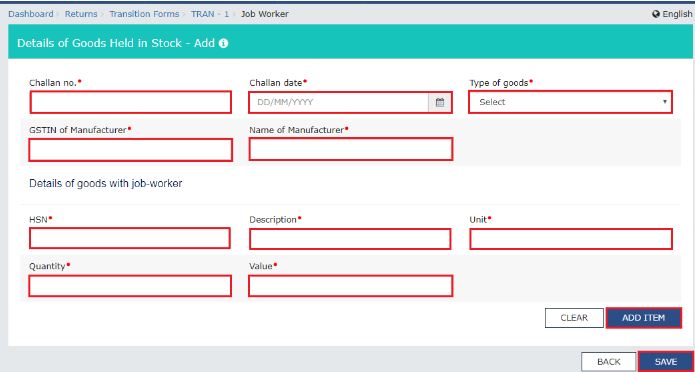

- Details of goods held in stock.

Details of Goods Held in Stock

The ‘Save’ button may be clicked after entering the details in each of the tabs. The taxpayer will be notified of any errors, which must be rectified before moving ahead.

Step 9: Details of Goods Stocked as Agent on Behalf of the Principal

This section must include the particulars of goods held in stock as agent on behalf of the principal, along with the credit permissible to the agents on such stock.

The following tabs must be filled-in for this purpose:

Details of Goods Held in Stock

The ‘Save’ button may be clicked after entering the details in each of the tabs. The taxpayer will be notified of any errors, which must be rectified before moving ahead.

Step 9: Details of Goods Stocked as Agent on Behalf of the Principal

This section must include the particulars of goods held in stock as agent on behalf of the principal, along with the credit permissible to the agents on such stock.

The following tabs must be filled-in for this purpose:

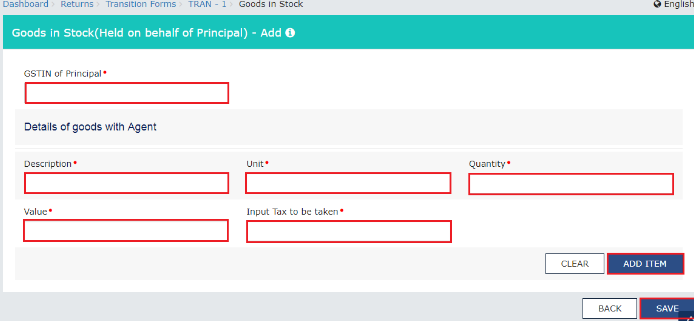

- Goods in Stock (Held on behalf of principal).

Good in Stock (Held on Behalf of Principal)

Good in Stock (Held on Behalf of Principal)

- Goods in Stock (Held by Agent).

Goods in Stock (Held by Agent)

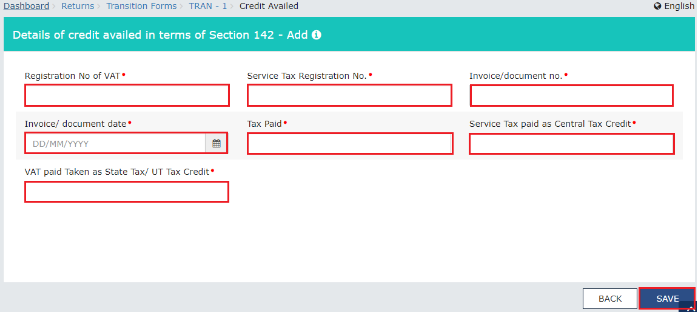

Step 10: Details of Credit Availed in Terms of Section 142(11) C))

In this section, summary details of the tax paid under the pre-GST regime and permissible credit under GST on supplies (which is taxable under both the previous tax regime and the GST regime) must be mentioned.

Goods in Stock (Held by Agent)

Step 10: Details of Credit Availed in Terms of Section 142(11) C))

In this section, summary details of the tax paid under the pre-GST regime and permissible credit under GST on supplies (which is taxable under both the previous tax regime and the GST regime) must be mentioned.

Credits availed in Section 142

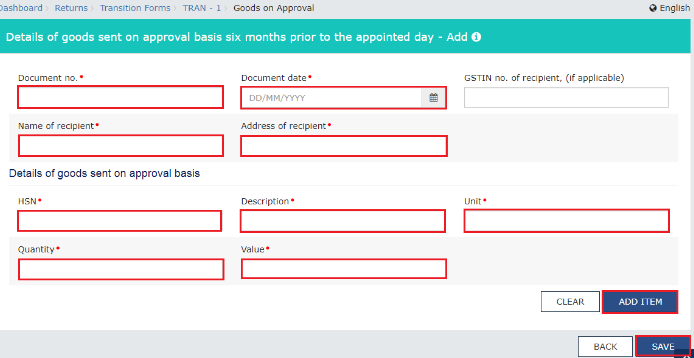

Step 11: Details of Goods Sent on Approval Basis

This section must include the summary details of goods sent on approval basis after the 1st of January, 2017, but not before the 1st of July, 2017. Also, these goods should have been returned after the 1st of July, 2017.

Credits availed in Section 142

Step 11: Details of Goods Sent on Approval Basis

This section must include the summary details of goods sent on approval basis after the 1st of January, 2017, but not before the 1st of July, 2017. Also, these goods should have been returned after the 1st of July, 2017.

Goods Sent on Approval Basis

Step 12: Freezing of Details

Now, the details furnished by the taxpayers will freeze upon clicking the ‘Submit’ button, before which the taxpayer is advised to verify the details thoroughly, given that the frozen details cannot be modified any further.

Goods Sent on Approval Basis

Step 12: Freezing of Details

Now, the details furnished by the taxpayers will freeze upon clicking the ‘Submit’ button, before which the taxpayer is advised to verify the details thoroughly, given that the frozen details cannot be modified any further.

Freezing of Details

Freezing of Details

Filing of Tran-1

The filing of Tran-1 can be initiated post its submission, which can be performed using a DSC or EVC. For this purpose, the user is required to enter the details of the authorized signatory and chose to file TRAN 1 either by means of DSC or EVC. Let us explore the procedure with respect to each of the options.Filing with DSC

Step 1: Make your Choices Select the DSC option from the ‘Transition Forms’ page, and click 'Proceed' on the warning screen. Step 2: Choice of Certificate Select the relevant certificate. Step 3: Sign Click on the ‘Sign’ button. After the success message is displayed, click on the ‘OK’ button, upon which the status of TRAN-1 is changed to “Filed” from that of “Submitted.”Filing with EVC

Step 1: Choose EVC Choose the “EVC” option on the page. Step 2: Enter OTP After choosing the EVC option, the user will receive an OTP in his/her mobile number or e-mail ID. The same must be entered in the space provided. Step 3: Verify Click on the “Verify” option. After the depiction of the success message, click on the ‘OK ’button. Upon successful performance of the above procedures, the credit claimed in TRAN-1 will be credited to the taxpayer’s credit ledger. The ITC posted in the Electronic Credit Ledger may be utilized for offsetting the liabilities of GSTR-3B or any other subsequent forms. Filing of TRAN-1

Filing of TRAN-1

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...