Last updated: October 18th, 2022 6:25 PM

Last updated: October 18th, 2022 6:25 PM

Foreign Non-Resident Taxpayer - GST Registration

After the rollout of GST, the Government of India made GST registration compulsory for all Foreign non-resident taxpayers upon supplying goods or services to residents in India. According to the GST Act, "non-resident taxable person” means any person who occasionally undertakes transactions involving the supply of goods or services or both, whether as principal or agent or in any other capacity, but who has no fixed place of business or residence in India. In this article, we look at the GST registration procedure for foreign non-resident taxpayers and the documents required for obtaining GST registration.Foreign Non-Resident Taxpayer - GST Registration Procedure

All foreign non-resident taxpayers are required to obtain GST registration at least 5 days prior to commencement of business or undertaking of supply to residents in India. To obtain GST registration in India, the following steps can be followed by a non-resident taxpayer :Step 1: Appoint an Authorized Signatory

Application for GST registration as a non-resident taxable person must be signed by an authorized signatory who is a person resident in India having a valid PAN. Hence, prior to beginning the GST registration process, all foreign non-resident taxpayers should appoint an authorized signatory in India for GST registration and GST compliance purposes.Step 2: Provide Authorization to Authorized Signatory

The promoters or Officers of the foreign company must then prepare and sign a GST Declaration, validating the appointment of an authorized signatory in India and his/her acceptance of responsibility for complying with GST regulations on behalf of the foreign company.Step 3: Apply for GST Registration

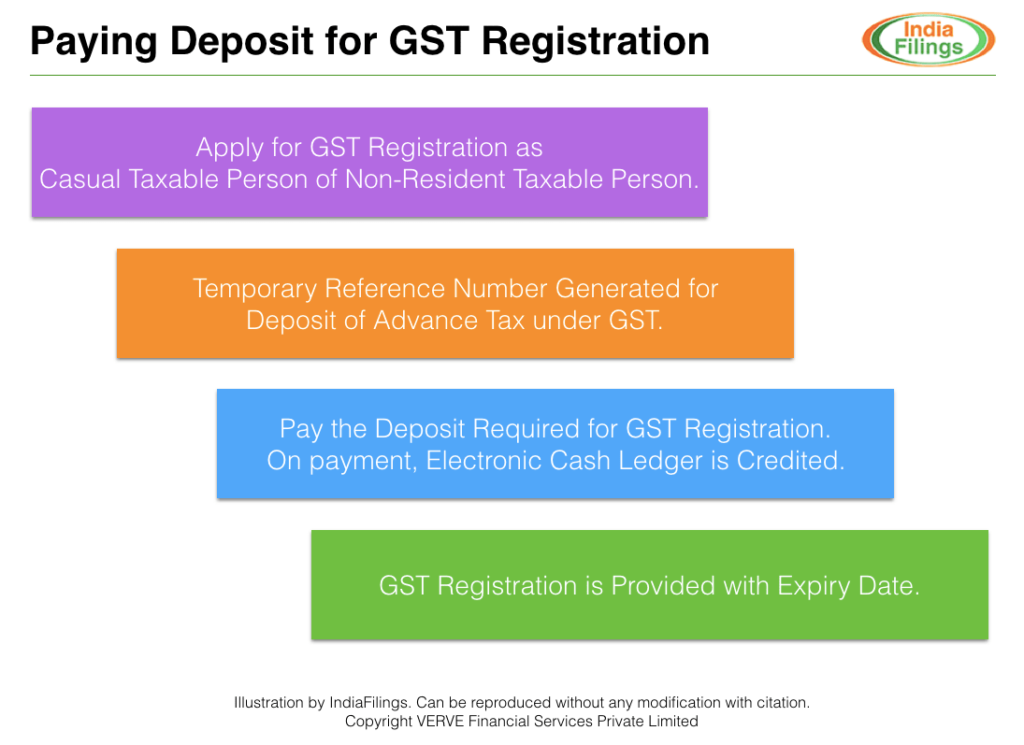

After processing all the required documents and completing all the steps, the non-resident taxable person shall submit the application for GST registration. After submitting the application for GST registration, the Portal provides a temporary reference number for remitting GST deposit. India Filings can provide assistance with GST registration for foreign non-resident taxpayers under GST.Step 4: Pay GST Deposit

All non-resident taxable persons are required to remit a deposit for obtaining GST registration. The amount of GST deposit would depend on the validity period of GST registration requested and the amount of GST liability the taxpayer is expected to accrue during the period. Hence, based on the validity and expected tax liability, the GST deposit must be deposited into the notified banks. Once the GST deposit is remitted, the electronic cash ledger of the taxpayer would be credited for the amount. The GST deposit can then be used against any GST payments that are to be made by the taxpayer.Step 5: GST Registration Certificate Issued

On remittance of the GST deposit and the necessary documents, GST registration certificate is issued. GST registration certificate for foreign non-resident taxpayers and casual taxable persons have a fixed validity period. In case the foreign non-resident taxpayer needs to extend the validity period, the concerned individual shall submit the application for extension, prior to the expiry of registration. While applying for an extension, the applicant shall pay the required amount of tax liability occurred during the extension period. Paying Deposit for GST Registration

Paying Deposit for GST Registration

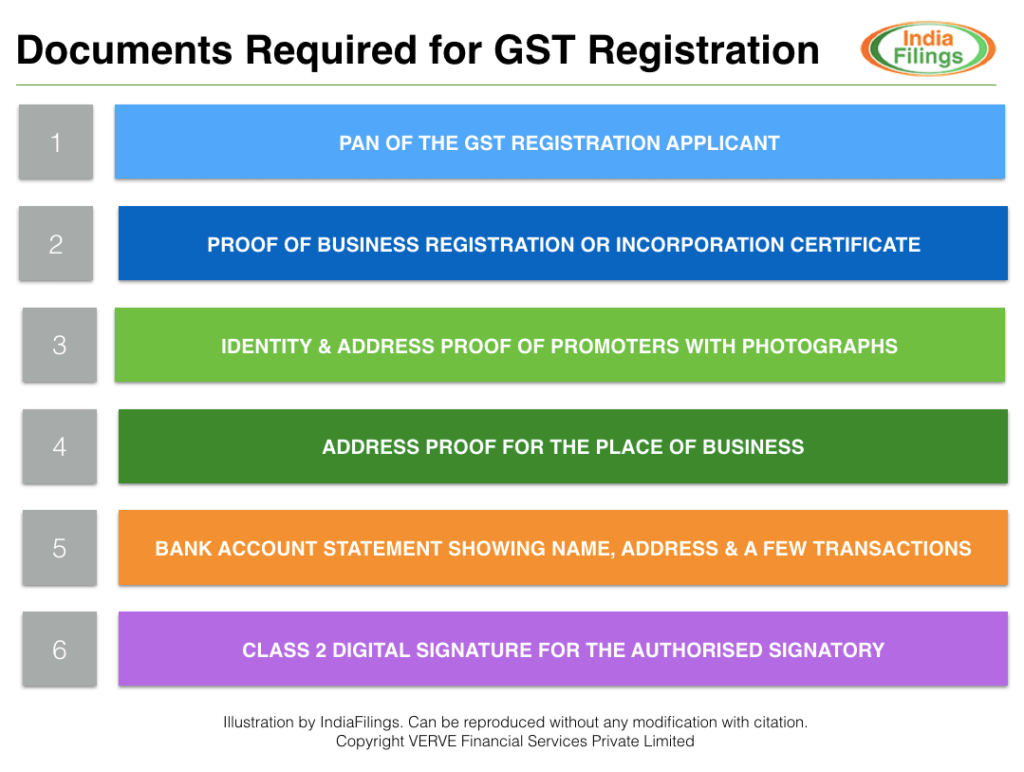

Documents Required for GST Registration

The documents required for GST registration can be classified into five major heads, as shown in the following infographic. Documents Required for GST Registration

Documents Required for GST Registration

PAN or Tax Identification Number of the Applicant

All regular taxpayers having residence in India should obtain Permanent Account Number (PAN). However, the foreign non-resident taxpayer can submit the application for GST registration, whether incorporated or established outside India. The application should include the tax identification number or unique number as identified by the Government of that country or its PAN, if available. Hence, PAN is not mandatory for the GST registration applicant, in case of a foreign non-resident taxable person.Proof of Business Incorporation

To validate the business, the taxpayer should provide proof of business incorporation or certificate of incorporation from an appropriate authority of the foreign Government.Identity & Address Proof of Promoters with Photographs

For registering GST, the individual should provide relevant Identity and address proof of the promoters of the business. In the case of foreign nationals, the non-resident taxable person shall attach the scanned copy of the passport with VISA details along with other documents. For an authorized signatory in India, the individual shall attach PAN along with an acceptable address proof like passport, driving license, voters identity, and other necessary government proof.Proof of Address

The taxpayer shall provide the following proof of principal place of business:- For own premises – Any document in support of the ownership of the premises like Latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill.

- Rented or Leased premises – A copy of the valid Rent / Lease Agreement with any document in support of the ownership of the premises of the Lessor like latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill.

- For all other scenarios – A copy of the Consent Letter with any document in support of the ownership of the premises of the Consenter like Municipal Khata copy or Electricity Bill copy. The applicant shall also use the same document to upload for shared properties.

Bank Account Statement

Scanned copy of the first page of bank passbook or the relevant page of bank statement or scanned copy of a cancelled cheque containing the name of the Proprietor or Business entity, Bank Account No., MICR, IFSC and Branch details including code should be uploaded.Class 2 Digital Signature

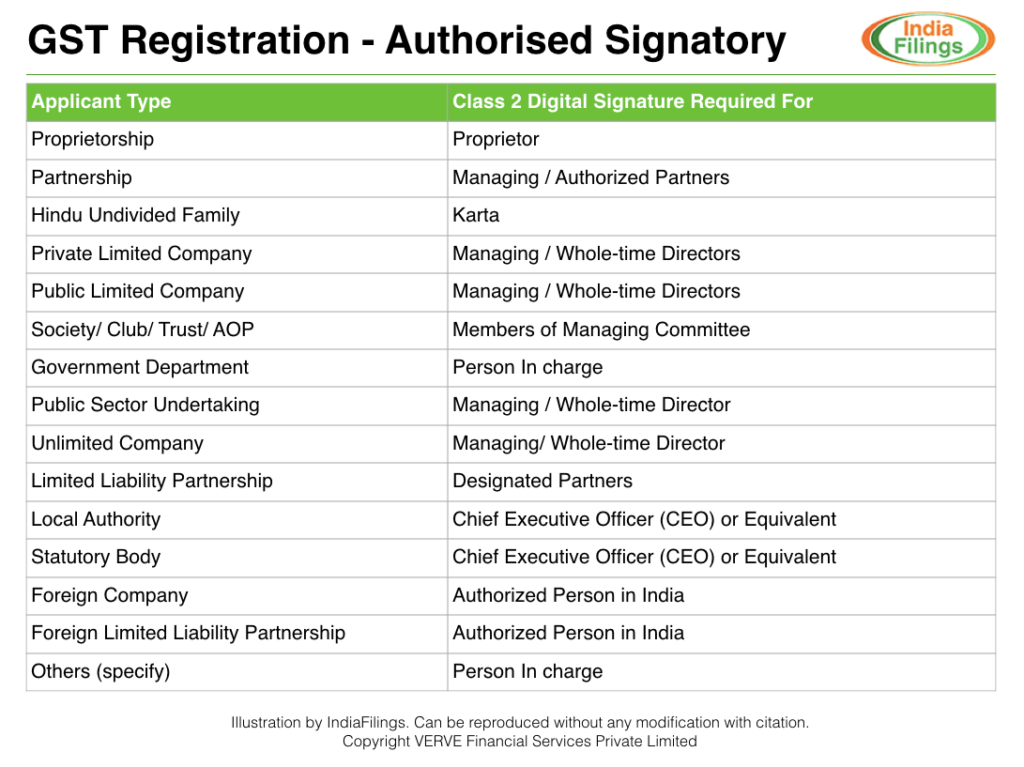

A class 2 digital signature must be obtained for the authorized signatory in India to apply for GST registration. GST Registration - Digital Signature for Authorized Signatory

GST Registration - Digital Signature for Authorized Signatory

Know more about GST registration, GST return filing, etc., on the IndiaFilings GST Portal.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...