Last updated: April 30th, 2022 6:38 PM

Last updated: April 30th, 2022 6:38 PM

Form 10E- Income Tax

Form for furnishing particulars of income under section 192(2A) for the year ending 31st March, for claiming relief under section 89(1) by a Government servant or an employee in a company, co-operative society, local authority, university, institution, association or body

Income Tax Form 10E is a form that is essential to save taxes on the income generated as arrears by utilising the provisions given by Section 89(1) of the Income Tax Act of 1961. This article talks about Form 10E and how one can reduce their tax liability by filing the same.Relief under Section 89(1)

An individual's tax liabilities for a financial year are calculated from the income that they earn during that particular year. At times, such incomes could include the arrears or the past dues paid in the current year. Generally, tax rates increase with time, and that translates to paying higher taxes in such cases. However, the Income Tax Act has been designed to offer you relief in these kinds of situations under Section 89(1). This depends on the principle that a taxpayer should be liable to pay the taxes on their income based on the tax rated that are applicable for that year to which the income belongs. If an individual has received any portion of their income or salary in arrears or in advance, or they have received their family pension in arrears, they may choose to avail some tax relief under Section 89(1) and Rule 21A.Filing Income Tax Form 10E

The Income Tax Department has declared it mandatory for an individual claiming the relief under Section 89 to file an online Income Tax Form 10E in the official e-filing portal of the Department. Taxpayers will receive a notice from the Income Tax Department if they claim relief under Section 89(1) without filing Form 10E. Taxpayers who have missed or failed to file this particular Form would not be allowed for the relief while their tax returns are being processed and would also receive a notice for non-filing of Form 10E.Calculation of Relief

The following are the steps to be followed when relief is being calculated under Section 89(1) in order to file Income Tax Form 10E.- Step 1: Find out the tax payable on the total income (including arrears) of the previous year in which the same is received. Here, we denote it as "X".

- Step 2: Find out the tax payable on the total income (excluding arrears) of the same previous year when the same is received. Here, we denote it as “Y”.

- Step 3: Subtract the value from Step 2 from the value from Step 1. Hence, it would be X - Y. Let’s denote the result as “Z”.

- Step 4: Find out the tax payable on the total income (including arrears) of the year to which the arrears belong. Here, we denote it as “A”.

- Step 5: Find out the tax payable on the total income (excluding arrears) of the year to which the arrears belong. Here, we denote it as “B”.

- Step 6: If the arrears relate to more than 1 year, repeat Step 4 and Step 5 for all the years to which the arrears are related and total the figures obtained at Step 4 and Step 5

- Step 7: Subtract the value from Step 5 from the value from Step 4. Hence, it would be A - B. Let’s denote the result as “C”.

- Step 8: Excess of the tax computed at Step 3 over the tax calculated in Step 7 is the amount of relief that would be allowable under Section 89(1). If the tax computed at Step 3 is less than the tax calculated in Step 7, then the assessee would not be eligible for any relief under the Section.

Filing Procedure of Income Tax Form 10E

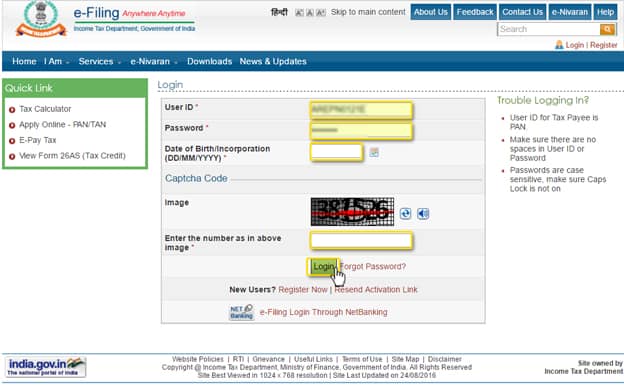

The following are the procedures that are to be followed when filing Form 10E on the Income Tax Department Portal. Step 1: Visit the official Income Tax Department Portal. Step 2: Log in to the relevant account using the User ID, Date of Birth and Password. Step 2 - Income Tax Form 10E

Step 3: Click on the e-File Tab on the top menu and select the option to Prepare and Submit Online Form (Other than ITR) from the drop-down menu.

Step 2 - Income Tax Form 10E

Step 3: Click on the e-File Tab on the top menu and select the option to Prepare and Submit Online Form (Other than ITR) from the drop-down menu.

Step 3 - Income Tax Form 10E

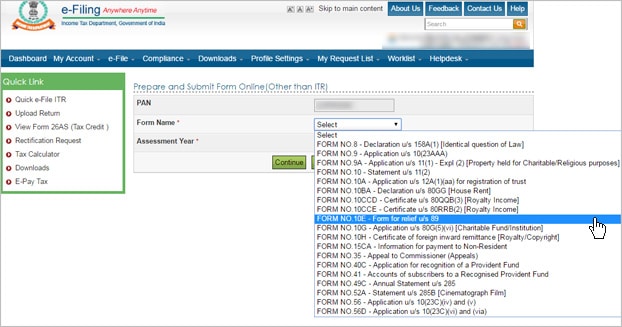

Step 4: Select Form 10E from the drop-down menu and complete the given space with the relevant Assessment Year. Click on the Continue tab to continue.

Step 3 - Income Tax Form 10E

Step 4: Select Form 10E from the drop-down menu and complete the given space with the relevant Assessment Year. Click on the Continue tab to continue.

Step 4 - Income Tax Form 10E

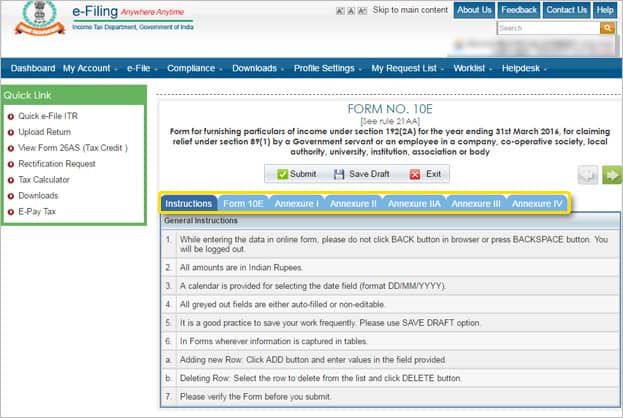

Step 5: On the following page, there would be proper instructions on how to file Form 10E online.

Step 6: On the same page, click on the blue tabs in order to fill the relevant details under each section.

Step 4 - Income Tax Form 10E

Step 5: On the following page, there would be proper instructions on how to file Form 10E online.

Step 6: On the same page, click on the blue tabs in order to fill the relevant details under each section.

Step 6 - Income Tax Form 10E

Step 7: Click on the Submit icon once all the relevant details have been filled and completed appropriately.

Note: If the whole process cannot be completed at one go, the user may choose to save the information already filled by clicking on the Save Draft icon at the bottom of the page and may continue to complete the same at their own time.

Step 6 - Income Tax Form 10E

Step 7: Click on the Submit icon once all the relevant details have been filled and completed appropriately.

Note: If the whole process cannot be completed at one go, the user may choose to save the information already filled by clicking on the Save Draft icon at the bottom of the page and may continue to complete the same at their own time.

Other key elements

A few critical points to keep in mind while filing Income Tax Form 10E are as follows.- It is always essential to file Form 10E prior to filing one's tax returns in order to avoid receiving a notice from the Income Tax Department concerning non-compliance.

- There would be no requirement of attaching a copy of Income Tax Form 10E or any other related proof with one's Income Tax Returns as the Form would be filed online on the Income Tax Department's website.

- In order to gain tax benefits or reliefs from one's employer, it is necessary to submit proof that they have filed Income Tax Form 10E.

- While filing Form 10E, it is necessary to choose the Assessment Year as the Financial Year to which the arrears belong to at the time of filing Form 10E.

- The following details have to be provided while filling Table A of the Income Tax Form 10E:

- Details of the previous year for the arrears received.

- Arrears received related to the previous year.

- Total income of the previous year excluding arrears.

- Total income of the previous year including arrears: Total of 2 and 3.

- Tax on the total income including arrears: Tax on 4.

- Tax on the total income excluding arrears: Tax on 2.

- The difference between the value obtained in 5 from the value obtained in 6.

- Other annexures, if applicable, would be required to be filled as per the details of one's salary or income.

[maxbutton id="17" url="https://www.indiafilings.com/learn/wp-content/uploads/2018/04/Form-10E.pdf" text="Download Form 10E in PDF Format" ]

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...