Last updated: March 30th, 2020 2:30 AM

Last updated: March 30th, 2020 2:30 AM

Form 12BA

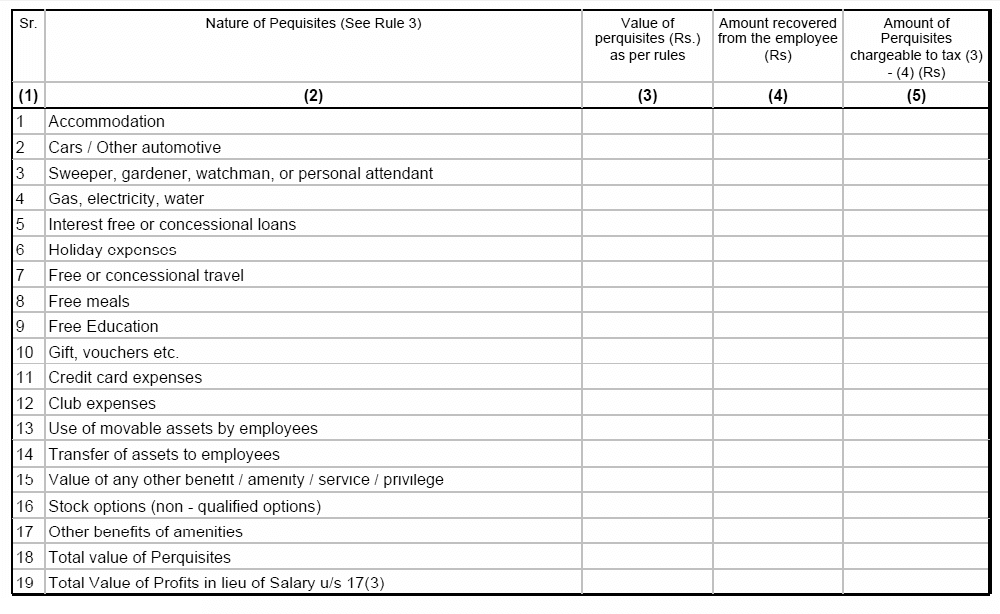

Form 12BA is an income-tax statement which depicts the particulars of prerequisites, employer-provided amenities, profits in lieu of salary and other fringe benefits. Form 12BA highlights the value of the payments and the taxable amount indebted to the Central Government by the beneficiary. This form is rendered to employees along with Form 16. The present article provides a brief discussion on Form 12BA.Perquisites

Perquisites, commonly referred to as perks, is a casual emolument or benefit accorded to an employee on account of the services rendered to an employer. These benefits, which are rendered in addition to the periodical remuneration, are classified into the following kinds:- Monetary Perks – benefits provided in cash, the likes of which include holiday expenses, travel expenses, and so on.

- Non-monetary perks – benefits provided in kind, which includes rent-free accommodation/accommodation at concessional rent, employee stock options/restricted stock units, free meals, water, gift vouchers, car, and so on.

Applicability

Form 12BA is only issued to an employee if the annual salary is more than Rs. 1,50,000. If not, the particulars specified in ‘Part B’ of Form 16 is considered sufficient. The calculation of salary for the purpose of inclusion in Form 12BA includes the following components:- Basic pay

- Allowances

- Bonus

- Commission

- Any other monetary payment

- Dearness allowance

- Employer’s contribution towards provident fund

- Exempt allowances

- Value of perquisites

- Payments which are not a part of perquisites

- Lump-sum payments provided during the cessation of service

- Superannuation

- Voluntary retirement benefits

- Commutation of pension and the like

Deadline

Employers may furnish this form by June 15th of the financial year that immediately succeeds the particular year. The date is determined in accordance with the due date for Form 16, given that these two documents are to be furnished simultaneously.Difference Between Form 12BA and Form 12B

The only aspect of similarity between these forms is that both of them are governed by the same Rule (Rule 26). Form 12BA is a statement of perquisites issued by an employer to an employee, whereas the statement in Form 12B is provided by an employee who moves to another employer in the middle of a financial year. The latter is issued to ensure that the employees joining a new organization under these circumstances has submitted the requisite details pertaining to TDS deductions of the previous salary. Form 12BA must include the particulars of income earned by the employee and the tax deducted at source on such income.Structure of the Form

Form 12BA comprises of the following sections:The First Section

The initial part of the form relates to the particulars of both the employer and the employee. The particulars related to the employer include:- Name and Address of the employer

- TAN Number

- TDS Assessment range of the employer

- Name of the employee

- Particulars of designation

- Details of income

- The relevant financial year

- The value of perquisites (if any)

Value of Perquisites

This section comprises of the details of particulars and its calculation. Further reference to its contents can be found on the below-furnished image: Contents of Form 12BA

Contents of Form 12BA

Details of Tax and Deduction

This section necessitates the re-speciation of data already mentioned in Form 16. The details to be furnished here are:- Tax deducted from the employee’s salary.

- Tax remitted by the employer on behalf of the employee.

- Total tax paid.

- Date of remittance into governmental accounts.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...