Updated on: December 29th, 2022 11:24 AM

Updated on: December 29th, 2022 11:24 AM

Form 15CA - Income Tax

It is not just individuals who are required to ensure that all the essential and accurate procedures are followed and forms are submitted for filing taxes. Banks and Financial Institutions are also deemed to follow specific rules that would give the Income Tax Department the upper hand when it comes to determining the taxable amounts of Non-Resident Indians. This article talks about Income Tax Form 15CA which banks utilise to report the payments chargeable to tax.Form 15CA

Income Tax Form 15CA is a declaration of a remitter and is used as a medium to collect information regarding the payments which are chargeable to tax in the hands of a recipient non-resident. This Form helps the Income Tax Department to keep track of foreign remittances and their taxability. As per Income Tax Rule 37BB, it is the responsibility and the duty of authorised banks or dealers to ensure that they obtain such forms from a remitter. Income Tax Form 15CA is required to be filed only if the remittances is chargeable to tax within India. If the remittances or payment is not liable to Non-Resident Indians, then the Form 15CA is not required to be filed. However, a customer may submit a declaration in the form of a note to the bank stating the nature of the payment and the reason as to why the same is not chargeable under tax in order to be exempted from the submission of Form 15CA.Information required to file Form 15CA

The following are the details required to file Income Tax Form 15CA.- Details of the Remitter

- Name of the remitter

- Address of the remitter

- Principal place of business of the remitter

- PAN of the remitter

- E-Mail address and phone no. of the remitter

- Status of the remitter (firm/company/other)

- Details of the Remittee

- Name and status of the remittee

- Address of the remittee

- Principal place of business of the remittee.

- Country of the remittee (country to which the remittance is made)

- Details of the Remittance

- Country to which remittance is made.

- Amount of remittance in Indian currency.

- Currency in which remittance is made.

- Nature of the remittance as per agreement (invoice copy to be asked from a client).

- Proposed date of remittance

- Bank details of the Remitter

- Name of the bank of the remitter

- Name of the branch of the bank

- BSR Code of the bank

- Other Details

- Designation of the signing person

- Father’s name of the signing person

- Documents required from the Remittee

- A duly filled Income Tax Form 10F by the authorised individual of the remittee.

- Tax residency certificate from the proper Remittee/ Tax registration of the country in which the Remittee is registered.

- Certificate that proves the Remittee does not have any permanent establishment within India.

Procedure to File Form 15CA

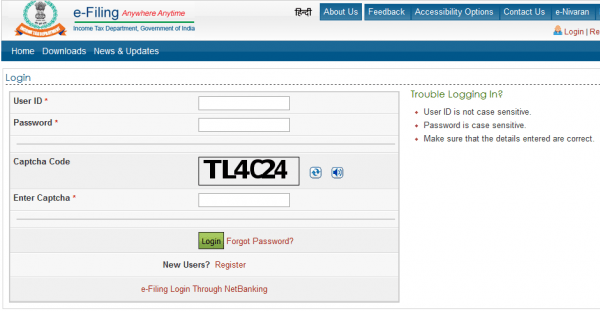

The steps mentioned below are to be followed while filing Income Tax Form 15CA on the official Income Tax Department website. Step 1: Visit the Income Tax Department website. Step 2: Log in to the relevant account with the appropriate login credentials. Step 2 - Income Tax Form 15CA

Step 2 - Income Tax Form 15CA

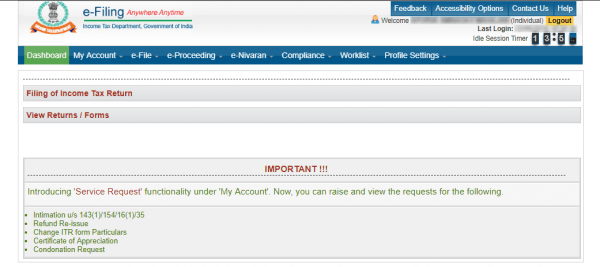

Step 2A - Income Tax Form 15CA

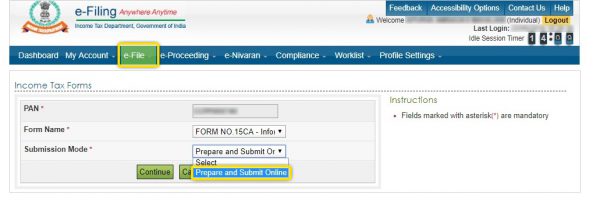

Step 3: Click on the e-File tab and select the Income Tax Forms tab from the drop-down menu.

Step 2A - Income Tax Form 15CA

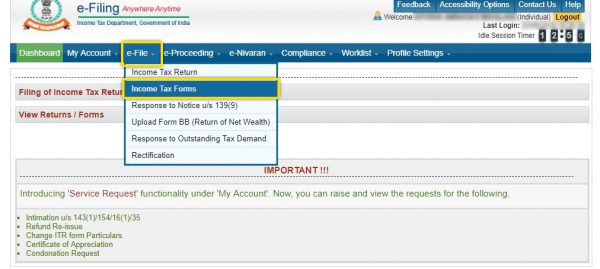

Step 3: Click on the e-File tab and select the Income Tax Forms tab from the drop-down menu.

Step 3 - Income Tax Form 15CA

Step 4: Select Form 15CA from the drop-down menu and click on the Continue tab.

Step 3 - Income Tax Form 15CA

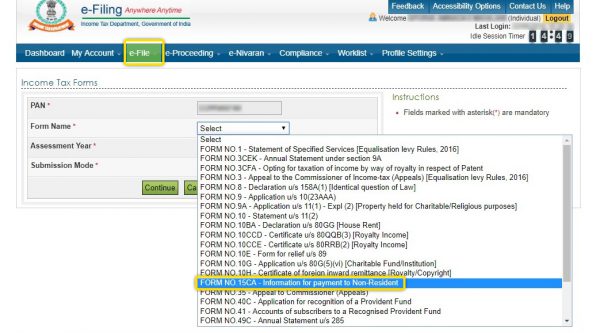

Step 4: Select Form 15CA from the drop-down menu and click on the Continue tab.

Step 4 - Income Tax Form 15CA

Step 4 - Income Tax Form 15CA

Step 4A - Income Tax Form 15CA

Step 5: Select the Type of Form 15CA applicable to the user from the drop-down menu.

Step 4A - Income Tax Form 15CA

Step 5: Select the Type of Form 15CA applicable to the user from the drop-down menu.

Step 5 - Income Tax Form 15CA

Step 5 - Income Tax Form 15CA

Step 5A - Income Tax Form 15CA

Step 6: Complete the Form 15CA and click on the Submit icon to complete the process.

Note: It is deemed mandatory to upload Form 15CB before filing Part C of Form 15CA. The acknowledgement number of the e-Filed Form 15CB must be provided in order to prefill the details in Part C of Form 15CA.

After the process is completing, the user would receive a message indicating successful filing on the screen and a confirmation email in the user's registered email account.

Step 5A - Income Tax Form 15CA

Step 6: Complete the Form 15CA and click on the Submit icon to complete the process.

Note: It is deemed mandatory to upload Form 15CB before filing Part C of Form 15CA. The acknowledgement number of the e-Filed Form 15CB must be provided in order to prefill the details in Part C of Form 15CA.

After the process is completing, the user would receive a message indicating successful filing on the screen and a confirmation email in the user's registered email account.

Amendments for Filing Form 15CA

The following are the amendments that are made to the procedure of filing Form 15CA.- Income Tax Form 15CA would not be required to be furnished by an individual if the remittance does not require the Reserve Bank of India's (RBI's) approval under its Liberalized Remittance Scheme (LRS).

- The list of payments of specific nature under Income Tax Rule 37BB where submission of Income Tax Form 15CA is not necessary has been extended from 28 to 33.

Non-Requirement for Form 15CA

The following are the latest list of payments when the Income Tax Form 15CA is not required to be furnished.| Serial Number | Nature of the Payment | RBI Purpose Code |

| 1 | Indian investment abroad: in equity capital (shares) | S0001 |

| 2 | Indian investment abroad: in debt securities | S0002 |

| 3 | Indian investment abroad: in branches and wholly owned subsidiaries | S0003 |

| 4 | Indian investment abroad: in real estate | S0004 |

| 5 | Indian investment abroad – in real estate | S0005 |

| 6 | Loans extended to Non-Residents | S0011 |

| 7 | Advance payment against imports | S0101 |

| 8 | Payment towards imports: settlement of the invoice | S0102 |

| 9 | Imports by diplomatic missions | S0103 |

| 10 | Intermediary trade | S0104 |

| 11 | Imports below INR 5,00,000: (For use by ECD offices) | S0190 |

| 12 | Payment for operating expenses of Indian shipping entities operating abroad | S0202 |

| 13 | Operating expenses of Indian Airline companies operating abroad | S0208 |

| 14 | Booking of passages elsewhere: Airline companies | S0212 |

| 15 | Remittance towards business travel | S0301 |

| 16 | Travel under basic travel quota (BTQ) | S0302 |

| 17 | Trip for pilgrimage | S0303 |

| 18 | Travel for medical treatment | S0304 |

| 19 | Travel for education including fees, hostel expenses and so on. | S0305 |

| 20 | Postal services | S0401 |

| 21 | Construction of projects abroad by Indian entities including import of goods at the project site. | S0501 |

| 22 | Freight insurance: relating to import and export of goods | S0602 |

| 23 | Payments for maintenance of offices abroad | S1011 |

| 24 | Maintenance of Indian embassies abroad | S1201 |

| 25 | Remittances by foreign embassies in India | S1202 |

| 26 | Remittance by Non-Resident Indians towards family maintenance and savings | S1301 |

| 27 | Remittance towards personal gifts and donations | S1302 |

| 28 | Remittance towards donations to charitable and religious institutions abroad. | S1303 |

| 29 | Remittance towards donations and grants to other Governments and charitable institutions established by the Governments | S1304 |

| 30 | Donations or contributions by the Government to international institutions | S1305 |

| 31 | Remittance towards payment or refund of taxes | S1306 |

| 32 | Refunds, rebates or reduction in the invoice value on account of exports | S1501 |

| 33 | Payments by residents for international bidding. | S1503 |

Details in the Form 15CA

Four parts of Income Tax Form 15CA are given below. Certain parts of the Form 15CA is required to be filled appropriately depending on the amount and taxability of the remittance.| Part of the Form | Description |

| Part A | If the remittance is taxable and the total value of such payments during a Financial Year is less than INR 5 Lakhs. |

| Part B | If the remittance is taxable and the total value of such payments during the Financial Year is more than INR 5 Lakhs and order or a certificate under Section 195(2)/ 195(3)/ 197 of the Income Tax Act has been received from the Assessing Officer. |

| Part C | If the remittance is taxable and the total value of such payments during the Financial Year is more than INR 5 Lakhs, and a certificate in Form No. 15CA from an accountant as defined in the explanation below the sub-section (2) of Section 288 has been obtained. |

| Part D | To be filled up if the remittances are not taxable other than the payments referred to in the Rule 37BB(3) by the individual referred to in the Rule 37BB(2). |

Information to be furnished for payments to a nonresident not being a company, or to a foreign company.

[maxbutton id="17" url="https://www.indiafilings.com/learn/wp-content/uploads/2018/04/Form-15CA.pdf" text="Download Form 15CA in PDF Format" ]

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...