Last updated: August 5th, 2024 4:50 PM

Last updated: August 5th, 2024 4:50 PM

Form 16A: How to Get and Fill Form No.16A?

Form 16A is a crucial document in the Indian tax system, serving as a TDS (Tax Deducted at Source) certificate issued for income other than salaries. It certifies the tax deducted amount and deposited on various payments such as interest, rent, and professional fees. This form is essential for individuals and businesses who receive such payments and must verify the deducted TDS. This form contains detailed information, including the deductor's and deductee's details, the nature of payment, and the amount of TDS deducted and deposited. It can be obtained from the deductor, typically downloaded from the TRACES portal, and must be accurately filled to ensure proper credit of the TDS in the income tax returns. Read this article for detailed information on Form 16A and how to fill it.What is Form 16A?

Form 16A is a TDS certificate issued for tax deducted at source on income other than salaries. It is provided by the entity that has deducted the tax, such as banks for interest income or companies for contractor payments. This certificate plays a significant role in the Indian tax system by serving as proof that the specified amount of tax has been deducted and deposited with the government. It helps the taxpayer reconcile the TDS deducted with the income shown in their tax return, ensuring that the tax credit is accurately reflected and claimed. Additionally, this Form is essential during tax assessments and verifications by the Income Tax Department, helping prevent discrepancies and legal issues.What is the Significance of Form 16A in Income tax?

Form 16A holds significant importance in the Indian income tax system. Here’s why:- Proof of TDS: Form 16A serves as an official certificate confirming that tax has been deducted at source on income other than salary, such as interest, rent, or professional fees. This acts as evidence for taxpayers when they file their income tax returns.

- Tax Credit: The form ensures that the TDS deducted by the payer is credited to the recipient's tax account. It helps taxpayers claim the TDS amount as a credit against their total tax liability, preventing double taxation.

- Accurate Tax Filing: By providing detailed information about the amount of income and TDS, it aids in the accurate filing of income tax returns. It ensures that the income and TDS figures reported match the records with the Income Tax Department.

- Compliance and Verification: The 16A Form helps maintain compliance with tax laws. It is an essential document during tax assessments and audits, enabling the Income Tax Department to verify the TDS claimed by taxpayers.

- Avoiding Penalties: Accurate reporting and claiming of TDS through this form can help taxpayers avoid penalties for under-reporting or misreporting income.

- Facilitates Refunds: If the TDS deducted exceeds the taxpayer's actual tax liability, this form assists in claiming refunds by providing proof of excess tax deducted.

Who is eligible for Form 16A?

Form 16A is a TDS (Tax Deducted at Source) certificate issued for income other than salary. Individuals and entities eligible for 16A Form include:- Recipients of TDS on Non-Salary Income: This includes individuals or entities receiving income from sources such as:

- Interest on fixed deposits

- Rent

- Professional fees

- Commission

- Winnings from lotteries or games

- Entities Deducting TDS: Form 16A is issued by the entity that has deducted the TDS, which could be banks, financial institutions, tenants, or contractors.

Form 16A Format: What information is included in Form 16A?

Form 16A includes comprehensive information for verifying the tax deducted at source (TDS) on “income other than salaries”. The key details in this Form are:- Deductor Information:

- Name of the deductor

- TAN (Tax Deduction and Collection Account Number)

- PAN (Permanent Account Number) of the deductor

- Address of the deductor

- Deductee Information:

- Name of the deductee

- PAN of the deductee

- Address of the deductee

- Payment Details:

- Nature of payment (e.g., interest, rent, professional fees)

- Amount paid or credited

- Date of payment or credit

- TDS Details:

- Amount of tax deducted

- Date of tax deduction

- The rate at which tax is deducted

- Challan identification number (CIN) of the payment made to the government

- Receipt number of the TDS payment

- Summary of Transactions:

- Quarterly details of TDS deductions and deposits

- Verification:

- Certification by the deductor that the information provided is correct and the tax has been deposited with the government.

How to Obtain and Fill Form 16A through the TRACES Portal?

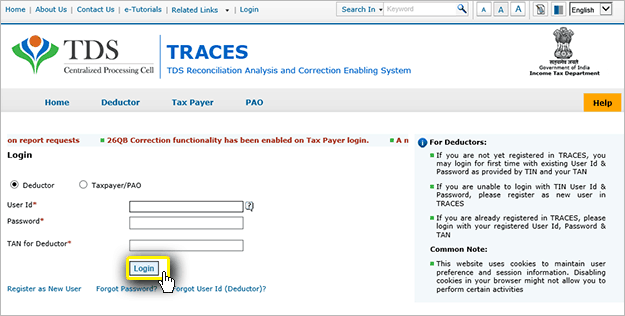

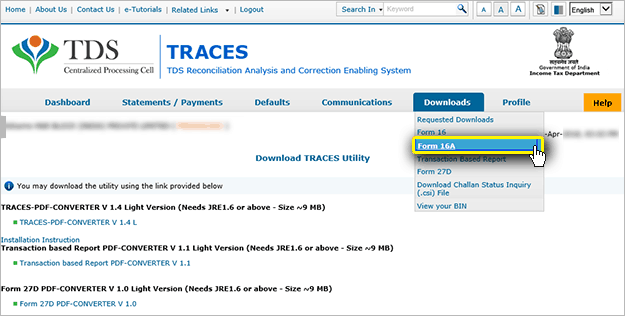

Typically, this document is issued by a Deductor, the person who makes the payment and collects the taxes on behalf of the Deductee. This is issued for a particular Financial Year representing the details concerning the amount produced and taxes collected from the same. The following are the steps to download Form 16A from the TRACES website. Step 1: The Deductor has to visit the TRACES webpage. Step 2: Log in using valid credentials. Step 3: Select the Downloads tab and select the Form 16A option.

Step 3: Select the Downloads tab and select the Form 16A option.

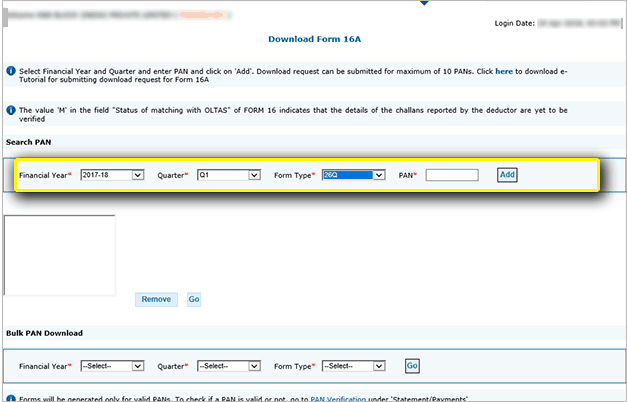

Step 4: Enter the details required in the fields displayed such as Financial Year, Quarter, Form Type, PAN and click on the Add tab. An individual may either select for a bulk PAN download option or a single form download option according to their need.

Step 4: Enter the details required in the fields displayed such as Financial Year, Quarter, Form Type, PAN and click on the Add tab. An individual may either select for a bulk PAN download option or a single form download option according to their need.

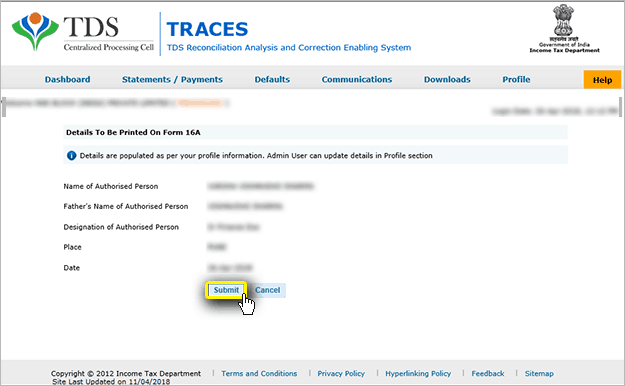

Step 5: In this page, details in Form 16A would be displayed where one could review and update the details if necessary. Click on the Submit tab.

Step 5: In this page, details in Form 16A would be displayed where one could review and update the details if necessary. Click on the Submit tab.

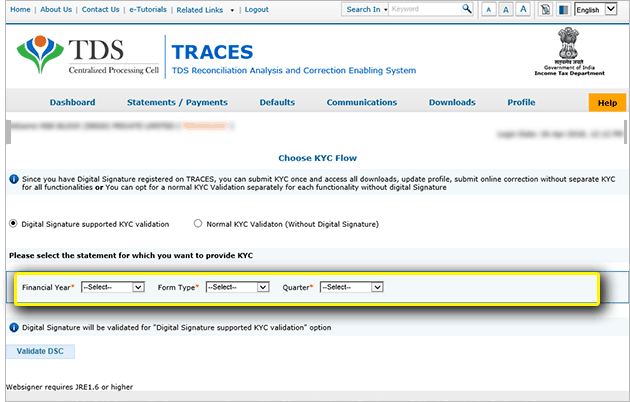

Step 6: Next, the validation of the Deductor's page would be displayed and would ask for KYC through Digital Signature. The user could also do normal KYC.

Step 6: Next, the validation of the Deductor's page would be displayed and would ask for KYC through Digital Signature. The user could also do normal KYC.

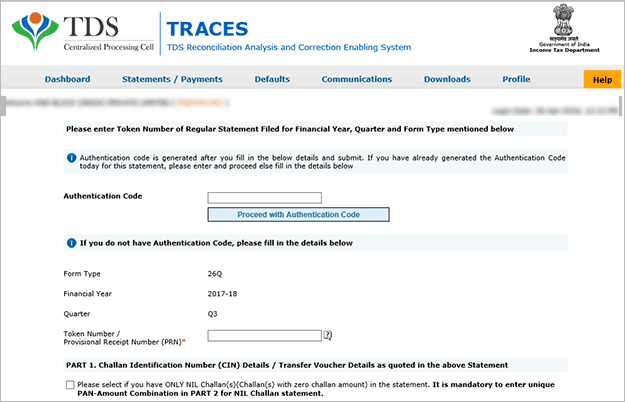

Step 7: After that, enter the required details such as the Authentication Code. If the user does not have a code, they may choose to fill in the details below the Authentication Code section.

Step 7: After that, enter the required details such as the Authentication Code. If the user does not have a code, they may choose to fill in the details below the Authentication Code section.

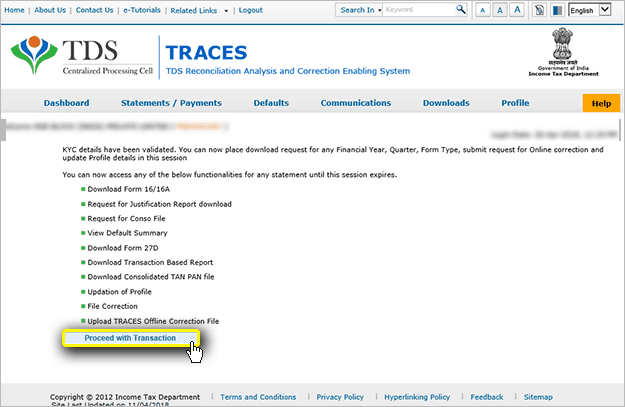

Step 8: After the KYC process is done, all the actions that may be done by a Deductor on Traces is displayed. Choose the Download Form 16A option and click on the Proceed with Transaction tab to continue.

Step 8: After the KYC process is done, all the actions that may be done by a Deductor on Traces is displayed. Choose the Download Form 16A option and click on the Proceed with Transaction tab to continue.

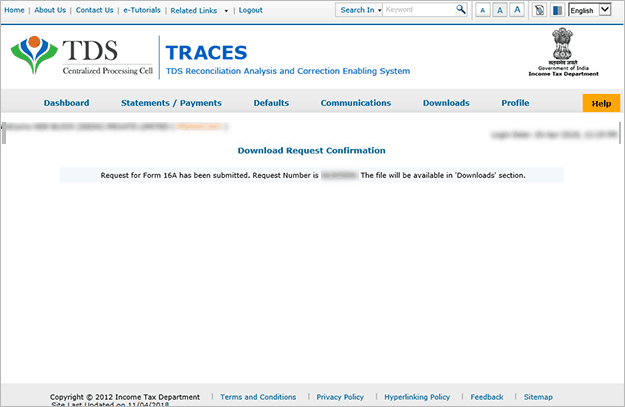

Step 9: Next, a Download Request Confirmation page would pop up and would contain a Request Number for the request for downloading this form.

Step 9: Next, a Download Request Confirmation page would pop up and would contain a Request Number for the request for downloading this form.

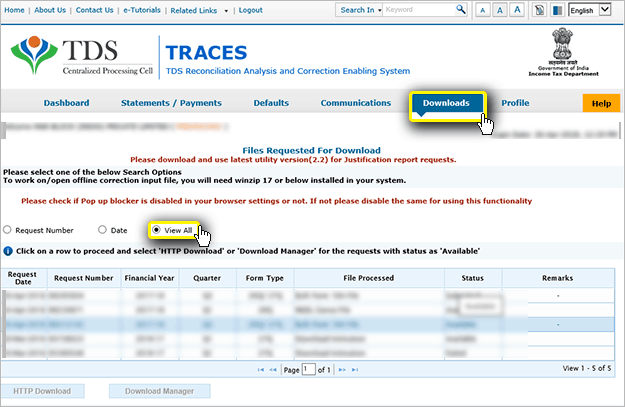

Step 10: The request file may be searched using the Request Date or Request Number. One may view all the requests as well. If the Status shows as Submitted, the person would be required to wait for 24 - 48 hours.

Step 10: The request file may be searched using the Request Date or Request Number. One may view all the requests as well. If the Status shows as Submitted, the person would be required to wait for 24 - 48 hours.

Step 11: Select the required row and click on the HTTP Download tab.

Step 12: If the user does not have a Traces PDF Utility, they would be unable to see the file in a PDF Format.

Step 13: Choose the requested downloads, and the user will be able to view the link to the download utility as Click here to Download the Utility.

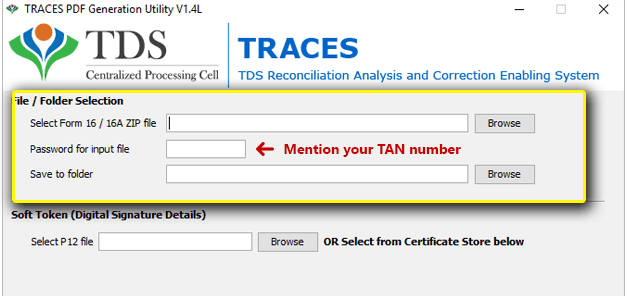

Step 14: Download the PDF Utility for the PDF converter under the file name TRACES-PDF-CONVERTOR V 1.4 L. The user has to ensure that they have Java 8 update 45, JRE version 1.7 or above.

Step 15: Run the downloaded zip file with Java.

Step 16: Browse the PDF file for Form 16A and enter the User's TAN as the Password.

Step 11: Select the required row and click on the HTTP Download tab.

Step 12: If the user does not have a Traces PDF Utility, they would be unable to see the file in a PDF Format.

Step 13: Choose the requested downloads, and the user will be able to view the link to the download utility as Click here to Download the Utility.

Step 14: Download the PDF Utility for the PDF converter under the file name TRACES-PDF-CONVERTOR V 1.4 L. The user has to ensure that they have Java 8 update 45, JRE version 1.7 or above.

Step 15: Run the downloaded zip file with Java.

Step 16: Browse the PDF file for Form 16A and enter the User's TAN as the Password.

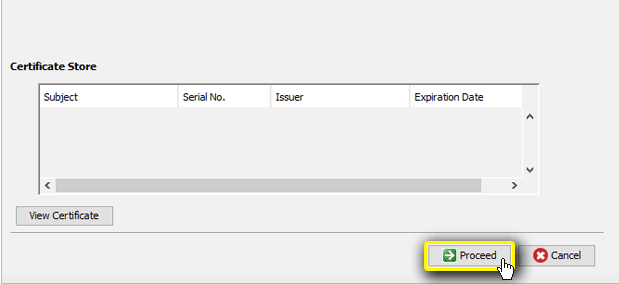

Step 17: Choose the folder on the system where the files have to be saved and click on the Proceed option.

Step 17: Choose the folder on the system where the files have to be saved and click on the Proceed option.

Form 26AS would also work as a substitute for Form 16. It could be downloaded online by the Deductee which would display all the sources of their income with TDS against a specific year.

Form 26AS would also work as a substitute for Form 16. It could be downloaded online by the Deductee which would display all the sources of their income with TDS against a specific year.

How to open a downloaded Form 16A?

Form 16A can be downloaded from the TRACES portal, provided your PAN is accurately reported in the TDS statements. This downloaded certificate is non-editable and serves as valid proof of tax deducted. The password to open the Form 16A PDF version is the TAN Number in Capital letters.When is the due date for Form 16A?

The due date for issuing Form 16A is quarterly. Deduction made on payments like commission, professional fees, rent, and others must be accompanied by a this form issued by the 15th of August for the April-June quarter, 15th of November for July-September, 15th of February for October-December, and the 15th of June for the January-March quarter.Conclusion

In conclusion, Form 16A is a crucial document for Indian taxpayers, serving as a TDS certificate on income other than salaries. This form is essential for individuals and businesses as it ensures transparency in tax transactions and aids in filing. By providing detailed information about the deductor, deductee, and the amount of TDS, This TDS Certificate helps taxpayers reconcile their TDS with their actual tax liability. Understanding the importance of this form and ensuring its timely collection can significantly streamline the tax filing process and ensure compliance with the Income Tax Act.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...