Updated on: April 15th, 2019 2:56 PM

Updated on: April 15th, 2019 2:56 PM

Form GST ITC-01 Offline Tool

A registered individual who is entitled to claim a credit of input tax under Section 18(1) of the CGST Act of 2017, can claim such credit by filing a declaration as Form GST ITC-01. This credit may be availed for inputs held in stock, semi-finished or finished goods carried in stock or capital goods under certain conditions. In this article, we look at the procedure for filing Form GST ITC-01 using the GST offline tool in detail.Form GST ITC-01

As stated in Section 18(1) of the CGST Act of 2017, a registered individual may claim input tax credit by filing the form GST ITC-01 as a declaration. For inputs in stock in finished, semi-finished or capital goods, input tax credit may be availed as mentioned below:- For once during the lifetime of the taxpayer, on the day before the date of registration, the taxpayer may claim ITC under clause (a) or clause (b) of subsection (1) of Section 18.

- During the fiscal year, on the day before the day from when the taxpayer is liable to pay tax under Section 9, to claim as per clause (c) of sub-section (1) of Section 18.

- The claims, as stated in clause (D0 of sub-section(1) of Section 18, supplies made by a registered taxpayer from a day before the daye is liable for the tax.

Key Features

The significant features for filing FORM GST ITC-01 using the offline utility are as follows.- Preparation of the ITC-01 form and completing the details with no requirement of an internet connection.

- Majority of the data entry and business validations come inbuilt with the offline utility and therefore, reducing errors upon upload to the GST Portal.

System Requirements

The offline tools for Form GST ITC-01 work best on Windows 7 and above that works Microsoft Excel 2007 and above.Downloading and Installing the Offline Tool

The Form GST ITC-01 Offline Tool needs to be downloaded only once and may require regular updates as released by the GST Portal. Ensure to recheck the version of the software before downloading the file from the Portal. The following steps have to follow to download and install the FORM GST ITC-01 Offline Tool. Step 1: Visit the official webpage of the GST Portal by clicking here. Step 2: After the home page is loaded completely, click on the Downloads option. Under the Offline Tools section, click on the ITC01 Offline Tool. Step 2- Form GST ITC-01 Offline Tool

Downloading the Form GST ITC-01 Offline Tool takes about 2 to 3 minutes depending on the speed of the internet connection.

Step 3: Click on the Download icon after the Form GST ITC-01 Offline Tool page is loaded.

Step 2- Form GST ITC-01 Offline Tool

Downloading the Form GST ITC-01 Offline Tool takes about 2 to 3 minutes depending on the speed of the internet connection.

Step 3: Click on the Download icon after the Form GST ITC-01 Offline Tool page is loaded.

Step 3- Form GST ITC-01 Offline Tool

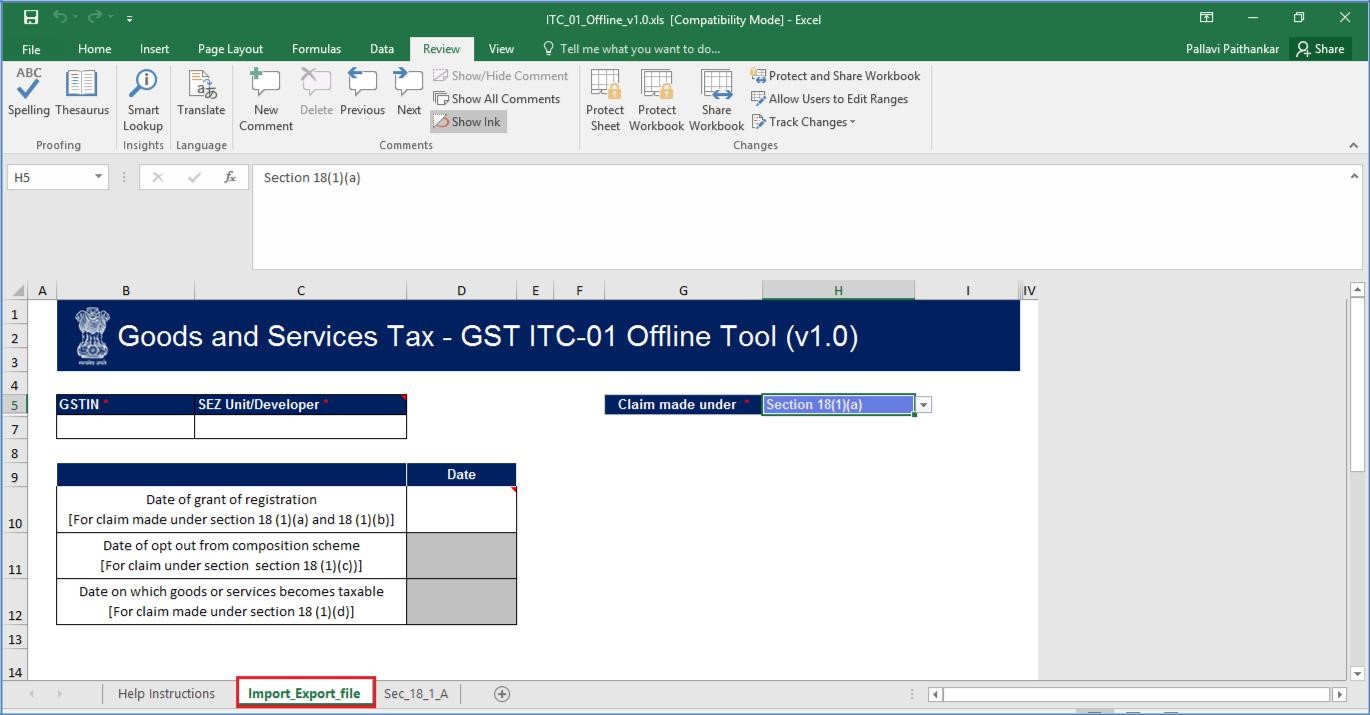

Step 4: Form GST ITC-01 Offline Tool is downloaded into the system's Downloads folder.

Step 3- Form GST ITC-01 Offline Tool

Step 4: Form GST ITC-01 Offline Tool is downloaded into the system's Downloads folder.

Step 5- Form GST ITC-01 Offline Tool

Step 5: After ensuring that the file is uncorrupted, the files need to be unzipped and saved in the required location on the system.

Step 5- Form GST ITC-01 Offline Tool

Step 5: After ensuring that the file is uncorrupted, the files need to be unzipped and saved in the required location on the system.

Step 6- Form GST ITC-01 Offline Tool

Step 6: The unzipped folder would consist of the ITC_01_Offline_v1.0 file as a Microsoft Excel sheet. Along with the Excel file, other files such as Readme and Release notes files would be included.

Step 6- Form GST ITC-01 Offline Tool

Step 6: The unzipped folder would consist of the ITC_01_Offline_v1.0 file as a Microsoft Excel sheet. Along with the Excel file, other files such as Readme and Release notes files would be included.

Step 6a- Form GST ITC-01 Offline Tool

Step 7: Open the ITC_01_Offline_v1.0.xls file.

Note: The Excel worksheet template would contain three significant worksheets to help in filing the form.

Step 6a- Form GST ITC-01 Offline Tool

Step 7: Open the ITC_01_Offline_v1.0.xls file.

Note: The Excel worksheet template would contain three significant worksheets to help in filing the form.

- Help Instructions: This sheet consists of an introduction to the offline tool along with other helpful instruction.

- Import_Export_file: This file helps to import data from a file or import and edit an existing JSON file. This may be used to generate a JSON file from the data entered in Sheet 3 and Sheet 4.

- Sec_18_1_A or Sec_18_1_B or Sec_18_1_C or Sec_18_1_D: This worksheet is populated according to the drop-down menu in the Clain Made Under field provided in the Import_Export_File worksheet.

Preparing the FORM GST ITC-01 Return

To prepare the Form GST ITC-01 Return, the following steps have to be performed in order.- Enter the details in the Sec_18_A worksheet of Form GST ITC-01 Offline Tool.

- Generate JSON file using the Generate File to Upload icon and save the JSON file on the system.

- Upload the generated JSON on the GST Portal. Review the information uploaded, submit, sign and file returns on the GST Portal.

-

Entering the details

Step 1- Form GST ITC-01 Offline Tool

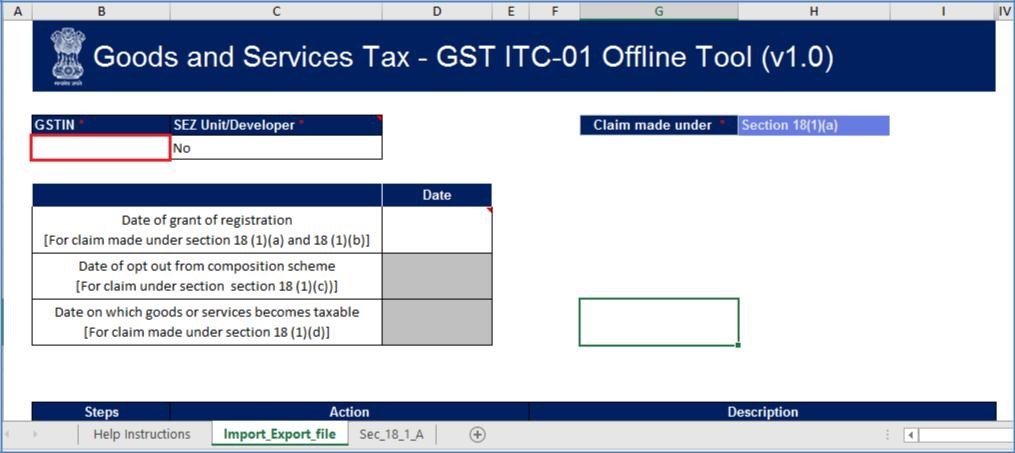

Step 2: In the GSTIN field, enter the appropriate GSTIN.

Step 1- Form GST ITC-01 Offline Tool

Step 2: In the GSTIN field, enter the appropriate GSTIN.

Step 2- Form GST ITC-01 Offline Tool

Step 3: Select the option from the SEZ Unit/ Developer drop-down menu which would contain a Yes/ No choice.

Step 2- Form GST ITC-01 Offline Tool

Step 3: Select the option from the SEZ Unit/ Developer drop-down menu which would contain a Yes/ No choice.

Step 3- Form GST ITC-01 Offline Tool

Step 4: Select the appropriate claim section from the Claim Made Under the drop-down menu.

Step 3- Form GST ITC-01 Offline Tool

Step 4: Select the appropriate claim section from the Claim Made Under the drop-down menu.

Step 4- Form GST ITC-01 Offline Tool

Step 5: Complete the Date of grant of registration according to the claim section 18(1)(a) selected.

Step 4- Form GST ITC-01 Offline Tool

Step 5: Complete the Date of grant of registration according to the claim section 18(1)(a) selected.

Step 5- Form GST ITC-01 Offline Tool

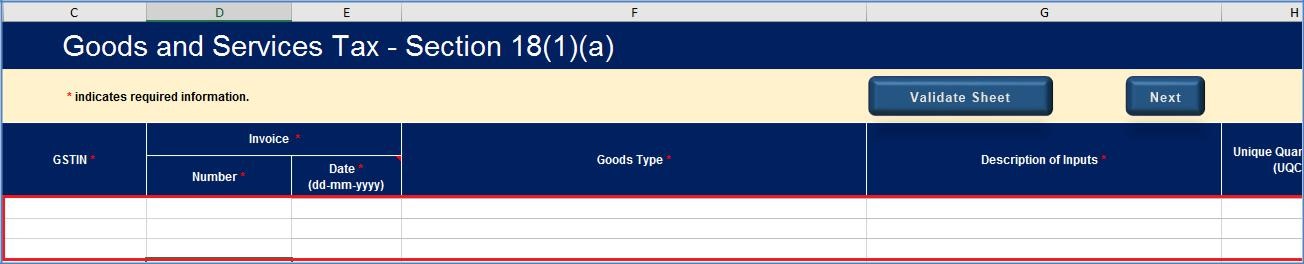

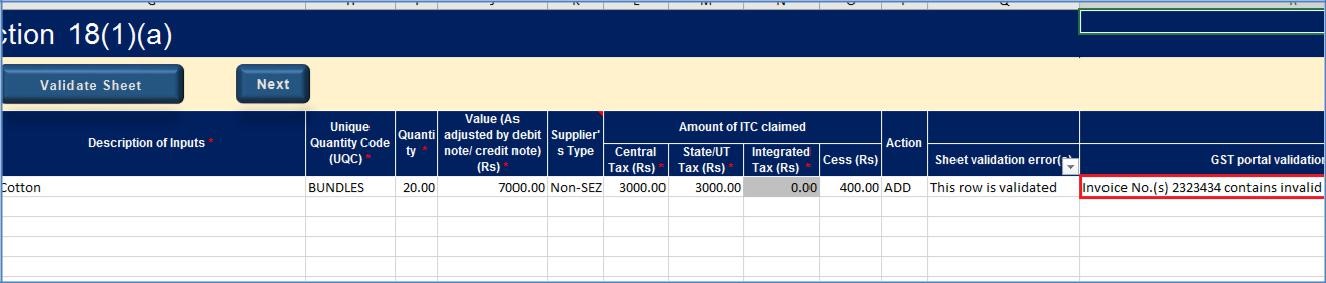

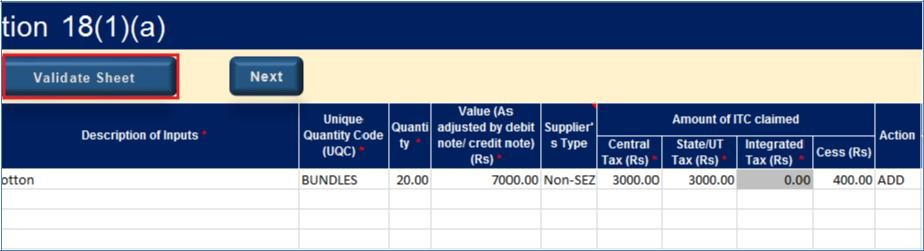

Step 6: Complete the details in each field of the worksheet Sec_18_1_A. Section 18(1)(a) is applicable for taxpayers who have requested for registration within 30 days of becoming liable and can be filed only once.

Step 5- Form GST ITC-01 Offline Tool

Step 6: Complete the details in each field of the worksheet Sec_18_1_A. Section 18(1)(a) is applicable for taxpayers who have requested for registration within 30 days of becoming liable and can be filed only once.

Step 6- Form GST ITC-01 Offline Tool

Step 7: After all the details are completed, click on the Validate Sheet icon to validate the worksheet.

Step 6- Form GST ITC-01 Offline Tool

Step 7: After all the details are completed, click on the Validate Sheet icon to validate the worksheet.

Step 7- Form GST ITC-01 Offline Tool

Step 7- Form GST ITC-01 Offline Tool

In the case of a successful validation

Step 8: The Sheet Validation error(s) column would show that the row is validated. Step 8- Form GST ITC-01 Offline Tool

Step 8- Form GST ITC-01 Offline Tool

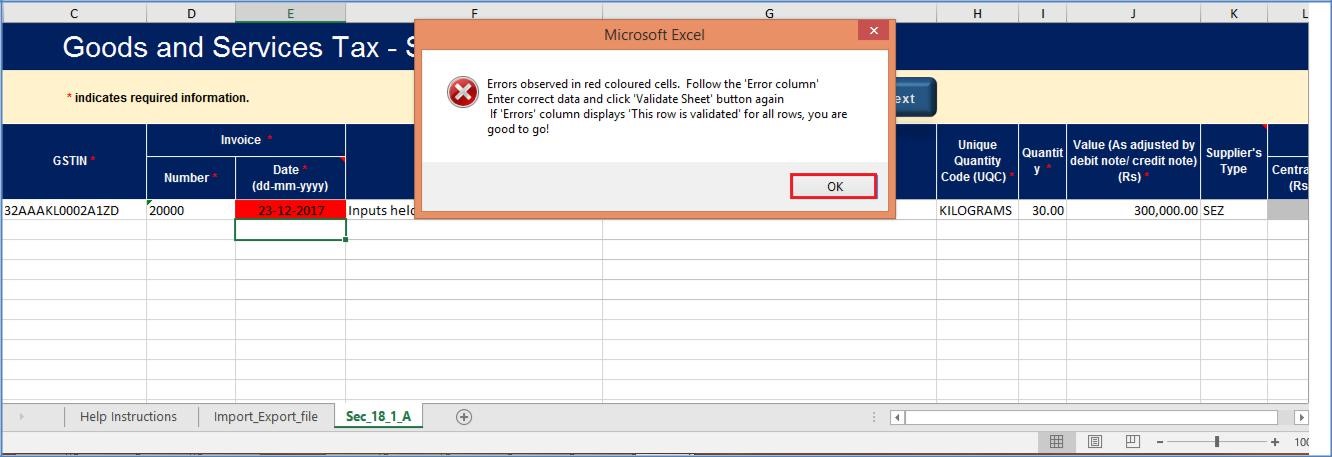

In the case of an unsuccessful validation:

Step 8: A error message would pop up indicating that the errors are displayed in the cells highlighted in red. Select the OK icon to continue further. Step 8a- Form GST ITC-01 Offline Tool

Step 9: Once all the errors are cleared and corrected, click on the Validate Sheet icon to validate the worksheet again. The Sheet Validation Error(s) column would show that the row is validated.

Step 8a- Form GST ITC-01 Offline Tool

Step 9: Once all the errors are cleared and corrected, click on the Validate Sheet icon to validate the worksheet again. The Sheet Validation Error(s) column would show that the row is validated.

Step 9- Form GST ITC-01 Offline Tool

Step 9- Form GST ITC-01 Offline Tool

-

Generate the JSON file

Step 10- Form GST ITC-01 Offline Tool

Step 11: Click on the Generate File to Upload to generate the JSON to upload on the GST Portal.

Step 10- Form GST ITC-01 Offline Tool

Step 11: Click on the Generate File to Upload to generate the JSON to upload on the GST Portal.

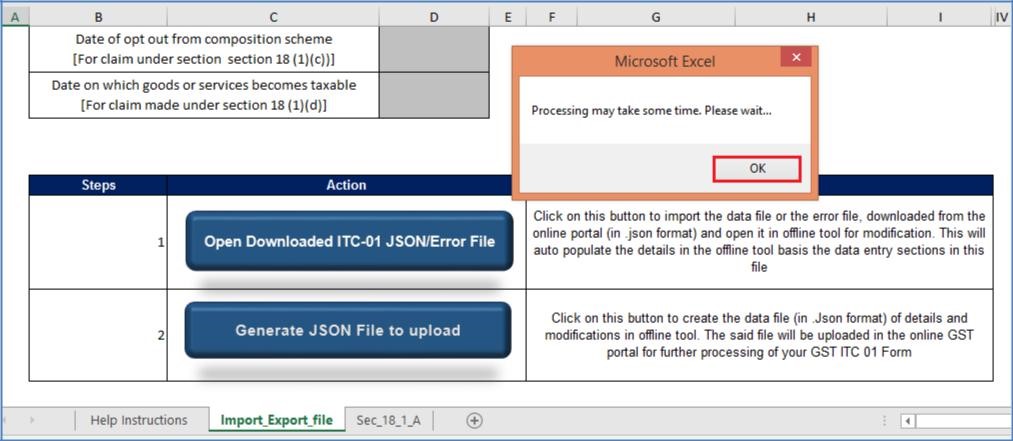

Step 11- Form GST ITC-01 Offline Tool

Step 12: A message indicating that the process may take some time is displayed. Click on the OK icon to continue.

Step 11- Form GST ITC-01 Offline Tool

Step 12: A message indicating that the process may take some time is displayed. Click on the OK icon to continue.

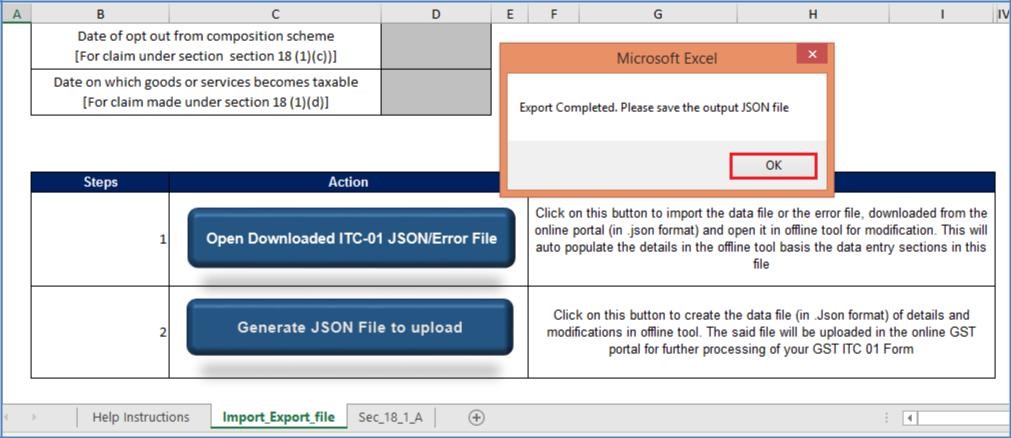

Step 12- Form GST ITC-01 Offline Tool

Step 13: A confirmation message indicating the JSON file has been exported successfully would be displayed. Click on the OK icon to continue further.

Step 12- Form GST ITC-01 Offline Tool

Step 13: A confirmation message indicating the JSON file has been exported successfully would be displayed. Click on the OK icon to continue further.

Step 13- Form GST ITC-01 Offline Tool

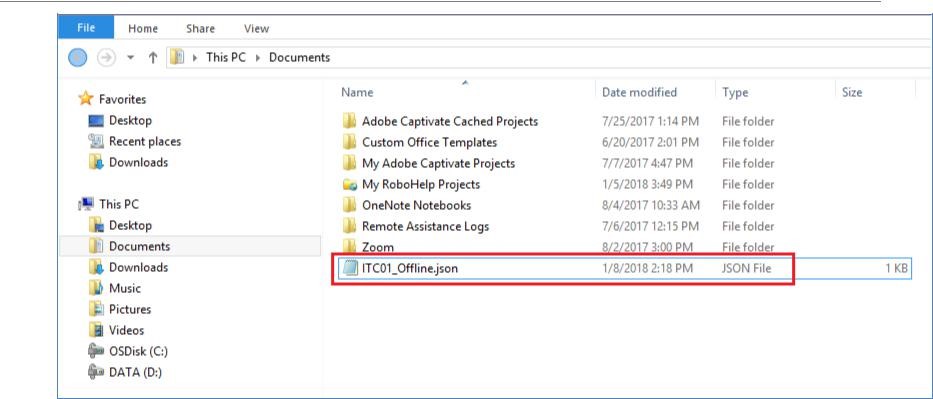

The JSON would be generated only if the worksheet has been validated successfully.

Step 14: Save the generated JSON file on the system in the preferred location.

Step 13- Form GST ITC-01 Offline Tool

The JSON would be generated only if the worksheet has been validated successfully.

Step 14: Save the generated JSON file on the system in the preferred location.

Step 14- Form GST ITC-01 Offline Tool

Step 14- Form GST ITC-01 Offline Tool

-

Upload the JSON on the GST Portal

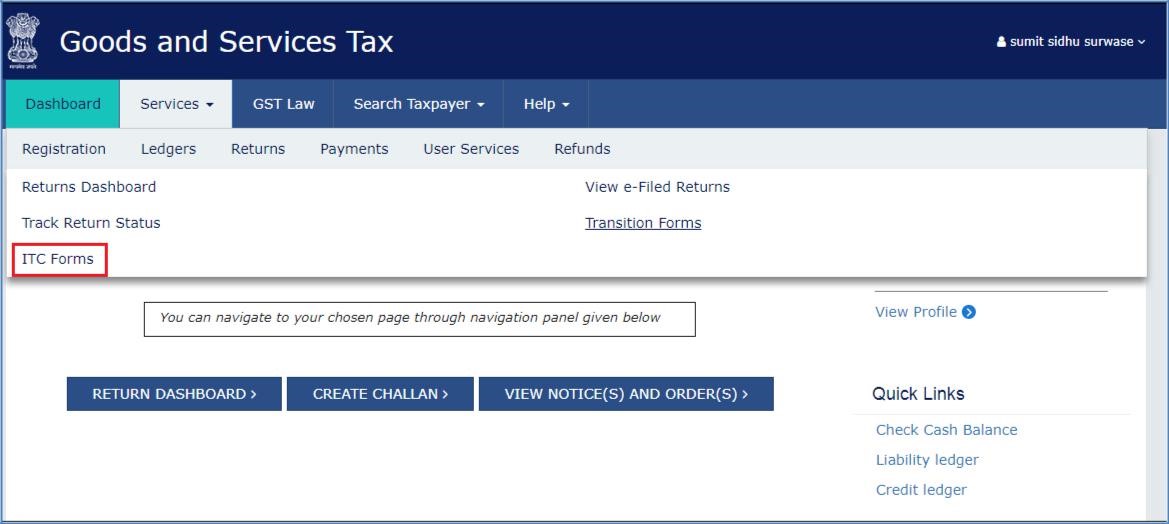

Step 16- Form GST ITC-01 Offline Tool

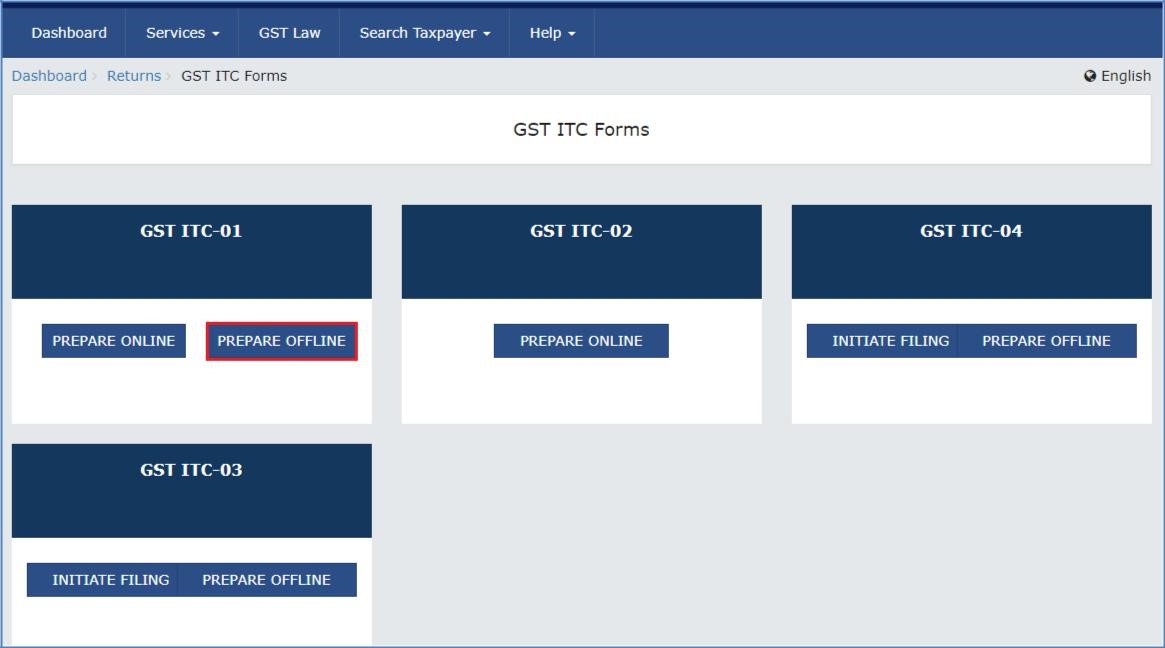

Step 17: After the GST ITC Forms page is displayed, click on the GST ITC-01 option and select the Prepare Offline option.

Step 16- Form GST ITC-01 Offline Tool

Step 17: After the GST ITC Forms page is displayed, click on the GST ITC-01 option and select the Prepare Offline option.

Step 17- Form GST ITC-01 Offline Tool

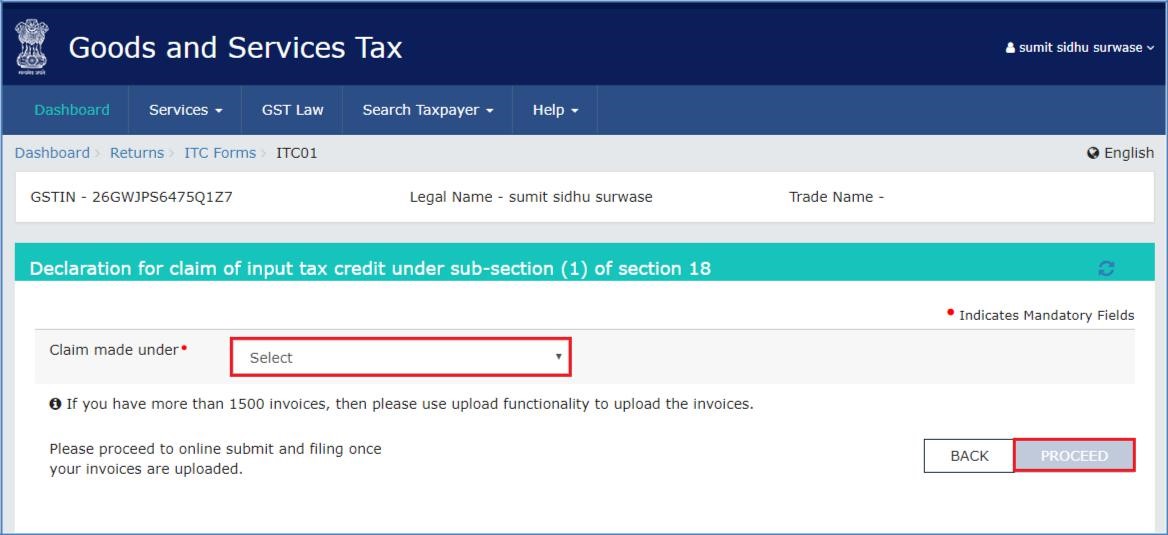

Step 18: Select the Claim Made Under option from the drop-down menu and click on the Proceed icon.

Step 17- Form GST ITC-01 Offline Tool

Step 18: Select the Claim Made Under option from the drop-down menu and click on the Proceed icon.

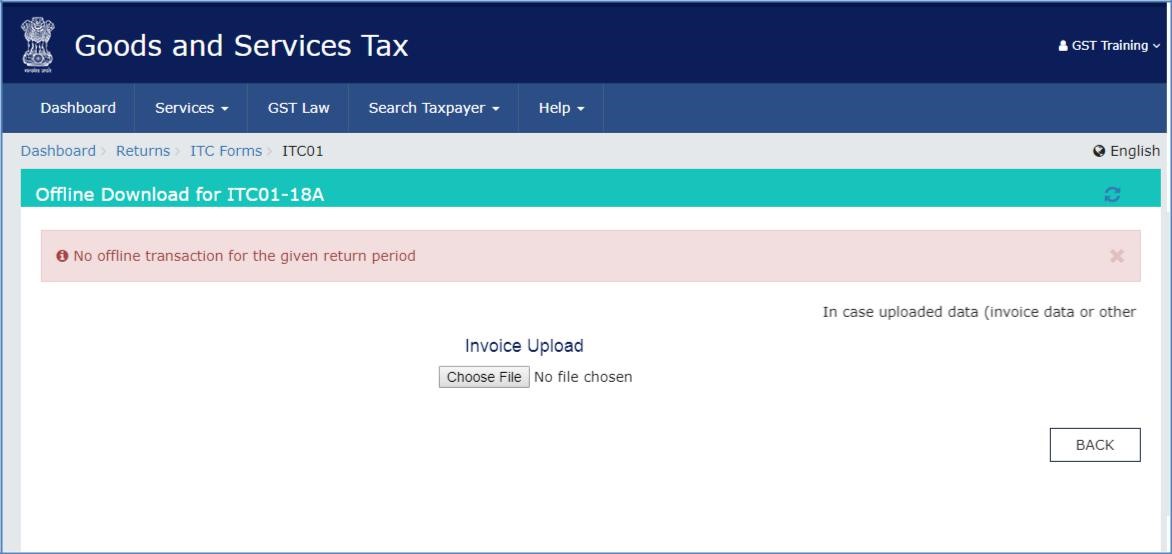

Step 18- Form GST ITC-01 Offline Tool

Step 19: The Offline Upload page for the Form GST ITC-01 would be displayed. After which, the Choose File icon should be selected.

Step 18- Form GST ITC-01 Offline Tool

Step 19: The Offline Upload page for the Form GST ITC-01 would be displayed. After which, the Choose File icon should be selected.

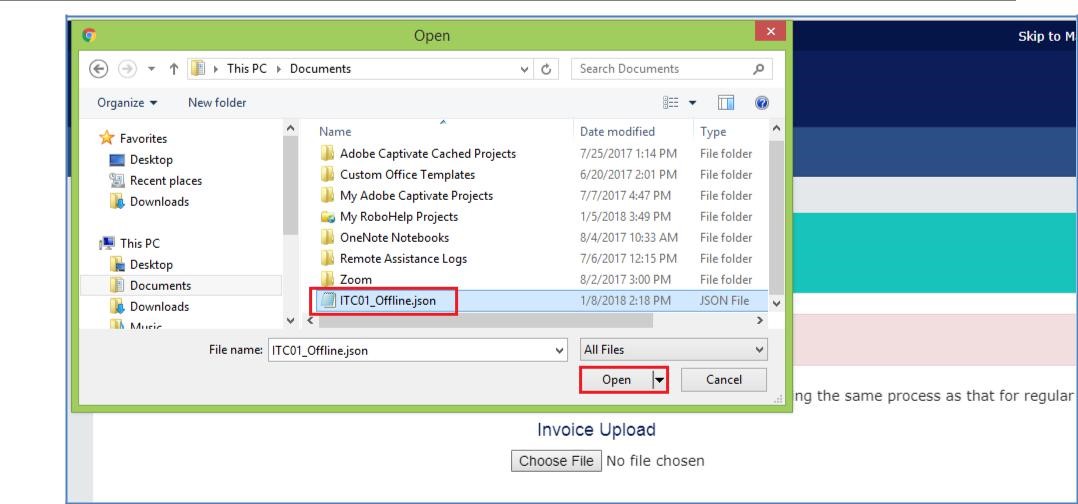

Step 19- Form GST ITC-01 Offline Tool

Step 20: Browse and select the JSON file that was generated and click on the Upload icon.

Step 19- Form GST ITC-01 Offline Tool

Step 20: Browse and select the JSON file that was generated and click on the Upload icon.

Step 20- Form GST ITC-01 Offline Tool

Step 21: The JSON file that was uploaded would be validated and processed. After a successful validation and processing, the information entered would be gathered and displayed as a summary. In case the validation fails due to errors, the same would be shown on the GST Portal.

Step 20- Form GST ITC-01 Offline Tool

Step 21: The JSON file that was uploaded would be validated and processed. After a successful validation and processing, the information entered would be gathered and displayed as a summary. In case the validation fails due to errors, the same would be shown on the GST Portal.

-

Open downloaded error file

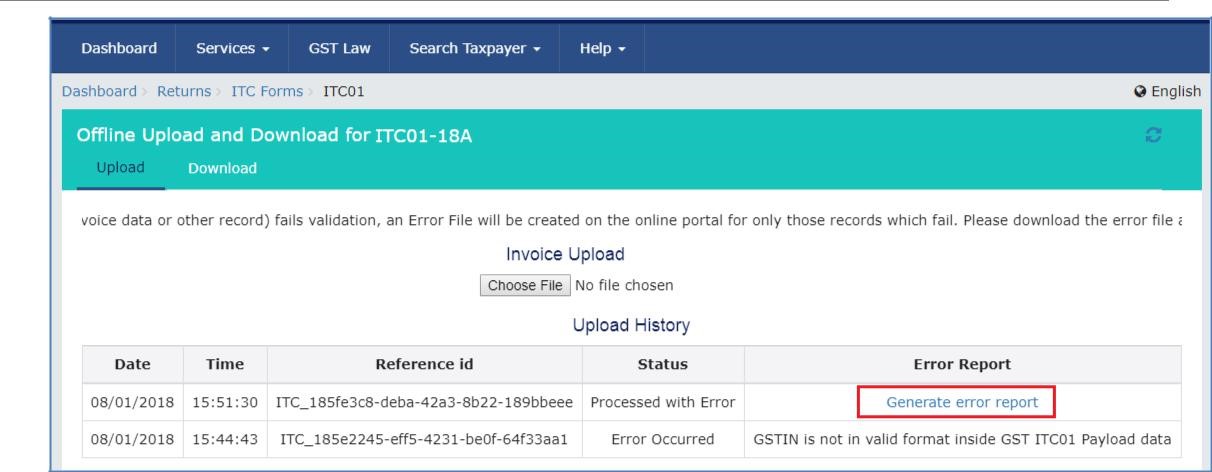

Step 0- Form GST ITC-01 Offline Tool

After the Status is displayed as Processed or Processed with Error, the following steps should be performed.

Step 1: In case of an error, the Error Report column would display a link to Generate Error Report.

Step 2: Click on the Generate Error Report link to generate the file.

Step 0- Form GST ITC-01 Offline Tool

After the Status is displayed as Processed or Processed with Error, the following steps should be performed.

Step 1: In case of an error, the Error Report column would display a link to Generate Error Report.

Step 2: Click on the Generate Error Report link to generate the file.

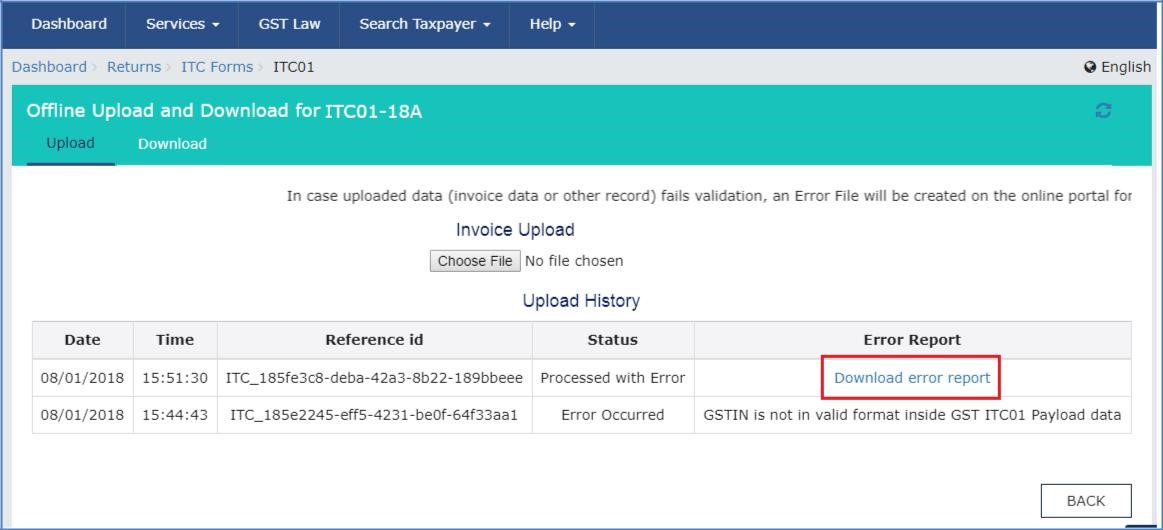

Step 2- Form GST ITC-01 Offline Tool

Step 3: Once the report is generated, select the Download Error Report link to download the error report.

Step 2- Form GST ITC-01 Offline Tool

Step 3: Once the report is generated, select the Download Error Report link to download the error report.

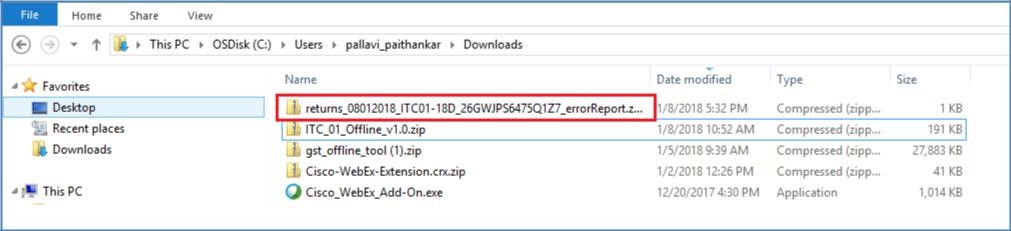

Step 3- Form GST ITC-01 Offline Tool

Note: The generation of the error report may take some time.

Step 4: The error report is downloaded in a zip file and saved on the system.

Step 3- Form GST ITC-01 Offline Tool

Note: The generation of the error report may take some time.

Step 4: The error report is downloaded in a zip file and saved on the system.

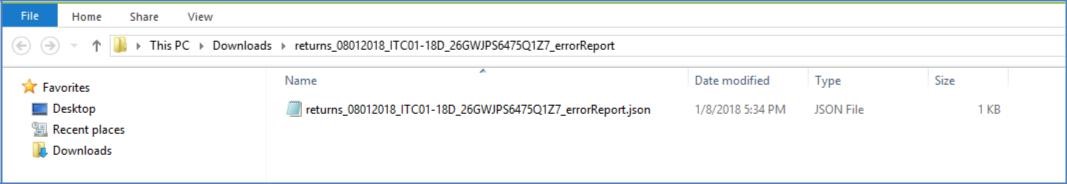

Step 4- Form GST ITC-01 Offline Tool

Step 5: Unzip and extract all the files from the downloaded folder.

Step 6: Save the extracted documents in the preferred location on the system.

Step 7: The unzipped folder would contain a JSON file.

Step 4- Form GST ITC-01 Offline Tool

Step 5: Unzip and extract all the files from the downloaded folder.

Step 6: Save the extracted documents in the preferred location on the system.

Step 7: The unzipped folder would contain a JSON file.

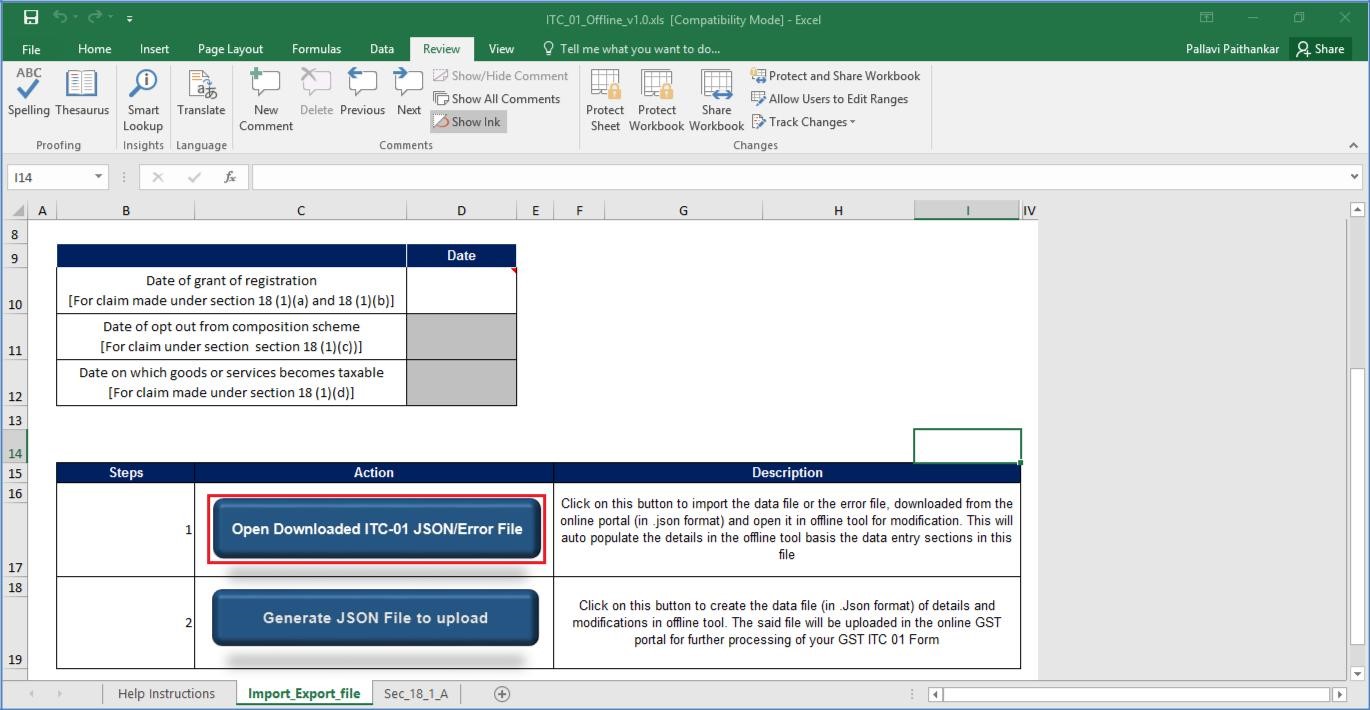

Step 7- Form GST ITC-01 Offline Tool

Step 8: Open the ITC-01 Offline Tool and navigate to the Import_Export_file. Under the section of Error File Handling, click on the Open Downloaded ITC-01 JSON/ Error File icon.

Step 7- Form GST ITC-01 Offline Tool

Step 8: Open the ITC-01 Offline Tool and navigate to the Import_Export_file. Under the section of Error File Handling, click on the Open Downloaded ITC-01 JSON/ Error File icon.

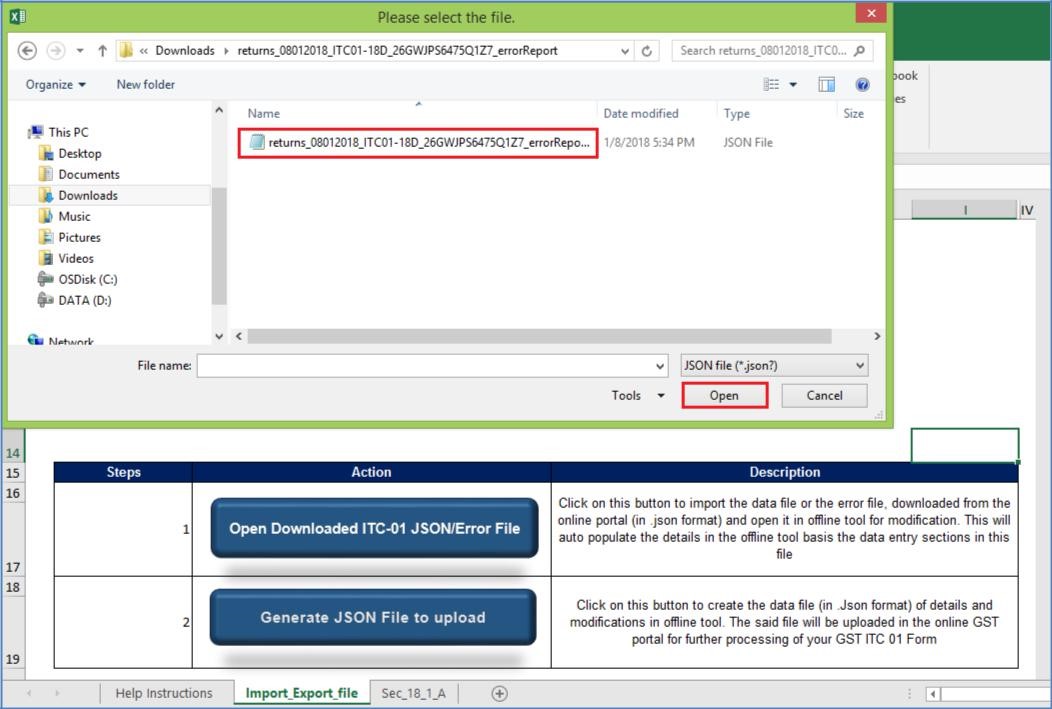

Step 8- Form GST ITC-01 Offline Tool

Step 9: A dialogue box to navigate to the extracted error file would open. Select the error file and click on the Open icon.

Step 8- Form GST ITC-01 Offline Tool

Step 9: A dialogue box to navigate to the extracted error file would open. Select the error file and click on the Open icon.

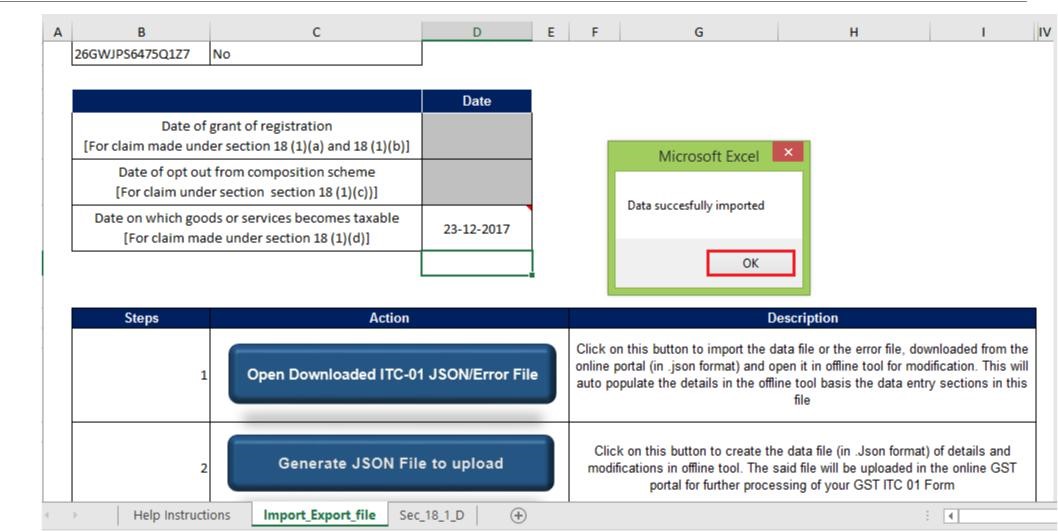

Step 9- Form GST ITC-01 Offline Tool

Step 10: A successful message would be displayed. Click on the OK icon to proceed further.

Step 9- Form GST ITC-01 Offline Tool

Step 10: A successful message would be displayed. Click on the OK icon to proceed further.

Step 10- Form GST ITC-01 Offline Tool

Step 11: Navigate to the worksheet using the Next icon and ensure that all the records from the files have been successfully opened in the tool.

Step 12: Correct the errors mentioned in the column indicated as GST Portal Validation Errors in all the sheets.

Step 10- Form GST ITC-01 Offline Tool

Step 11: Navigate to the worksheet using the Next icon and ensure that all the records from the files have been successfully opened in the tool.

Step 12: Correct the errors mentioned in the column indicated as GST Portal Validation Errors in all the sheets.

Step 12- Form GST ITC-01 Offline Tool

Step 13: After the necessary corrections are made, click on the Validate Sheet icon to validate the sheets.

Step 12- Form GST ITC-01 Offline Tool

Step 13: After the necessary corrections are made, click on the Validate Sheet icon to validate the sheets.

Step 13- Form GST ITC-01 Offline Tool

Step 14: After successful validation, generate the JSON file as previously mentioned in this article.

Step 13- Form GST ITC-01 Offline Tool

Step 14: After successful validation, generate the JSON file as previously mentioned in this article.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...