Last updated: September 16th, 2021 10:11 AM

Last updated: September 16th, 2021 10:11 AM

Form GSTR-4 Due Date Extension 2020

Form GSTR-4 is a quarterly GST return that must be filed by a person enrolled under the GST Composition Scheme. The Central Board of Indirect Taxes and Customs (CBIC) extend the due date for filing form GSTR-4 annual returns for the financial year 2019-2020 till October 31, 2020. The original deadline for filing the Form GSTR-4 return was 15.07.2020 which was earlier extended till 31.08.2020, on July 13th, 2020.Synopsis of Notification

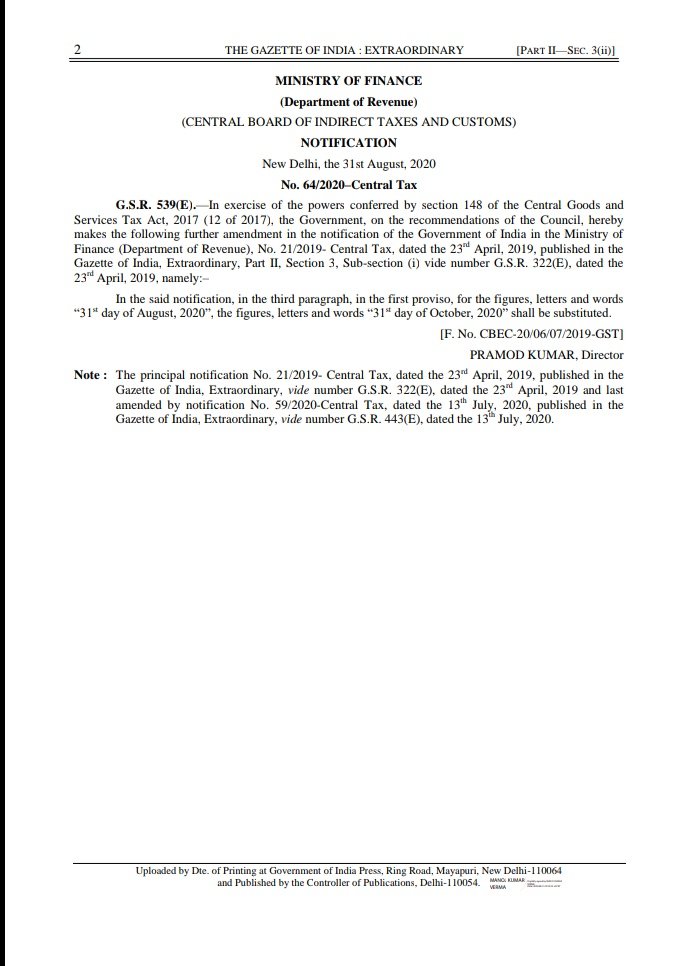

The Central Board of Indirect Taxes and Customs (CBIC) vide its notification No. 64/2020-Central Tax dated 31.08.2020 extends the due date of filing form GSTR-4 till August 31, 2020, by amending the Notification No. 21/2019- Central Tax dated April 23, 2019. This notification specifies the guidelines for registered persons paying taxes under Section 10 of the Central Goods and Service Tax Act, 2017, which is related to composition levy. For extension, CBIC amends the first provision of the third paragraph of the Notification No. 21/2019, to extend the due date of Form GSTR-4 till “August 31, 2020” instead of “July 15, 2020”.GSTR- 4 Filing – Annual Return for Composition Scheme

The person enrolled under the GST composition scheme needs to file the GSTR 4 annual return. Unlike a normal taxpayer who needs to furnish 3 monthly returns, businesses registered under the GST Composition Scheme is required to furnish only one return which is GSTR-4 and its is need to be filed by 30th of April, following a financial year. The dealer opted the composition scheme can pay a flat GST tax based on the sales turnover. Entities with an annual turnover of up to Rs 1.5 crore and satisfying other criteria can be enrolled under the GST Composition Scheme.GST Composition Scheme

The GST composition scheme is formed to help small taxpayers having a turnover of up to Rs.1.5 crore per annum (The limit for north-Eastern states and Himachal Pradesh is Rs.75 lakh.) with a simple GST compliance mechanism. Firms registered under the GST composition scheme can able to pay tax at prescribed rates and file GST returns. Service providers are not eligible for GST composition scheme, expect for restaurant service providers (which do not serve alcohol). Under the Composition Scheme, manufacturers and traders are liable to pay GST at 1 per cent, while it is 5 per cent for restaurant service providersForm GSTR-4 Return Filing

To help taxpayers to file GSTR-4 return offline, Goods and Service Tax Network (GSTN) provides the Excel-based GSTR 4 Offline Utility. Taxpayers can file form GSTR-4 return by uploading the JSON file generated from the Offline utility to the GST portal. Know more about Form GSTR-4 Return FilingFORM GST CMP-08

The composition scheme taxpayers also need to file a self-assessed tax return in a one-page statement, that is Form GST CMP 08 as per the Central Goods and Service Tax (GST) Rules, 2017. The taxpayer is required to file this quarterly return (Form GST CMP 08) by the 18th day of the month.Penalty for GSTR-4 Late Filings

A late fee of Rs.200 per day will be levied from the taxpayer if the form GSTR- 4 is not filed within the due date. As per the rules, the maximum late fee should not exceed Rs. 5000. The CBIC’s notification pertaining to the Form GSTR-4 return Due Date Extension is attached below for reference.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...