Last updated: October 20th, 2022 3:46 PM

Last updated: October 20th, 2022 3:46 PM

Form STK-2 for Winding Up of Companies

The Ministry of Corporate Affairs (MCA) has recently announced Form STK-2 for removing name from register of companies, i.e., winding up of a company. Form STK-2 will be made available by the MCA from the 5th of April, 2017 for filing on the MCA platform. In this article, we look at Form STK-2 in detail.Removal of Company Name from Register of Companies by Registrar

The MCA is December, 2016 brought to force Section 248 to 252 of the Companies Act, 2013 to lay the foundation for removal of company name from Register of Companies. As per Section 248 to 252, the Registrar of Companies has the following powers to remove name of company from the register of companies, if the Registrar has reasonable cause to believe that:- The company has failed to commence its business within one year of its incorporation;

- The company is not carrying on any business or operation for a period of two immediately preceding financial years and has not made any application for obtaining the status of a dormant company.

Voluntarily Removing Company Name using Form Form STK-2

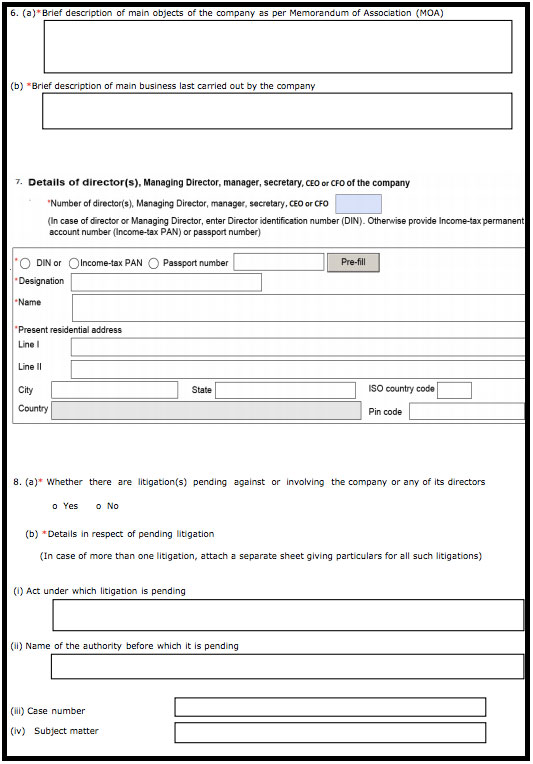

This process for removing a company name from the register of companies can also be initiated by the company by filing Form STK-2. To file Form STK-2, the company should have extinguished all its liabilities and execute a special resolution for removal of company name from register of companies with the consent of 75% of members in terms of paid-up share capital. In case the company is regulated under a special Act, approval of the regulatory body constituted or established under that Act should also be obtained and enclosed with the application.Closing of Company by Filing Form STK-2

After filing of Form STK-2 by the company, the Registrar has the powers and duty to satisfy him/herself that sufficient provision has been made for the realisation of all amount due to the company and for the payment or discharge of its liabilities and obligations by the company within a reasonable time. If necessary, the ROC can also obtain necessary undertakings from the managing director, director or other persons in charge of the management of the company. On completion of the above formalities, the ROC would cause a public notice to be issued regarding the intended closure of the company. After expiry of the time mentioned in the notice, the Registrar can, strike off its name from the register of companies, and publish notice of striking-off of name of company in the Official Gazette. On publication in the Official Gazette of this notice, the company is held to be dissolved.Requirements for Filing Form STK-2

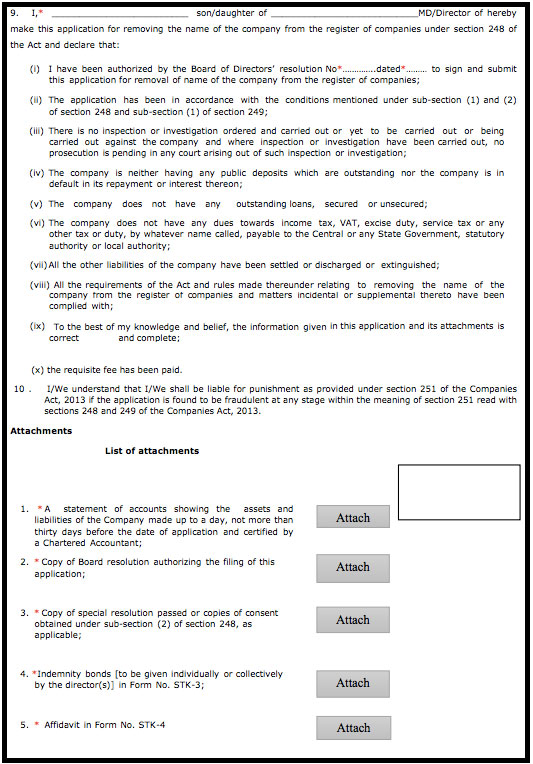

All types of companies like private limited company, one person company, limited company can apply for closure using Form STK-2. The following are the enclosures that must be attached with Form STK-2:- Indemnity bond duly notarized by every director in Form STK 3;

- A statement of accounts comprising assets and liabilities of the company made up to a day, not exceeding thirty days before the date of application and certified by a Chartered Accountant;

- An affidavit in Form STK 4 by every director of the company;

- A copy of the special resolution accordingly certified by each of the directors of the company or approval of 75 % of the members of the company in terms of paid up share capital as on the date of application

- A statement with reference to pending litigations, if any, involving the company.

- There is no inspection or investigation ordered and carried out or yet to be carried out or being carried out against the company and where inspection or investigation have been carried out, no prosecution is pending in any court arising out of such inspection or investigation;

- The company is neither having any public deposits which are outstanding nor the company is in default in its repayment or interest thereon;

- The company does not have any outstanding loans, secured or unsecured;

- The company does not have any dues towards income tax, VAT, excise duty, service tax or any other tax or duty, by whatever name called, payable to the Central or any State Government, statutory authority or local authority;

- All the other liabilities of the company have been settled or discharged or extinguished;

- All the requirements of the Companies Act and rules made thereunder relating to removing the name of the company from the register of companies and matters incidental or supplemental thereto have been complied with;

- The company changed its name or shifted its registered office from one State to another before three months of filing of Form STK-2;

- The company disposed property or rights held by it, before three months of filing of Form STK-2. This provision is not applicable for trade wherein disposal of property for gain is in the normal course of trading or carrying on of business;

- The company engaged in any other activity except the one which is provided in the MOA or expedient before three months of filing of Form STK-2.

- The company has made an application to the Tribunal for the sanctioning of a compromise or arrangement and the matter has not been finally concluded;

- The company is being wound up under Companies Act or under the Insolvency and Bankruptcy Code, 2016.

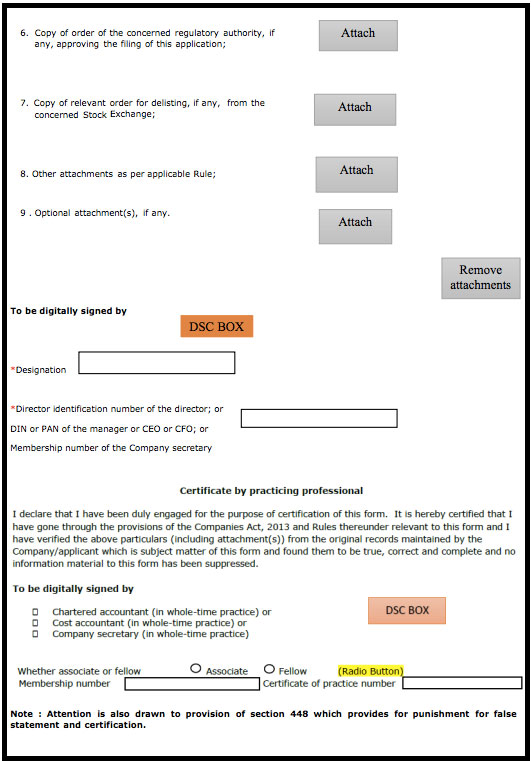

Certification of Form

Form STK 2 should be certified by a Chartered Accountant in full-time practice or Company Secretary in full-time Practice or Cost Accountant in whole time practice.Effect of Removing Name from Register of Companies

If STK-2 is filed and accepted by the ROC, the company would be dissolved under section 248 of the Companies Act, 2013. Further, the business would cease to operate as a company and the Certificate of Incorporation issued to it shall be deemed to have been cancelled from such date - except for the purpose of realising the amount due to the company and for the payment or discharge of the liabilities or obligations of the company. Also, if a company is closed using Form STK-2, the liability of all director, manager or other officer who was exercising any power of management, and of every member of the company would continue and can be enforced as if the company had not been dissolved.[caption id="attachment_25361" align="aligncenter" width="533"]Form STK-2 Model

[caption id="attachment_25360" align="aligncenter" width="530"]Form STK-2 - Page 1

Form STK-2 - Page 2

[caption id="attachment_25362" align="aligncenter" width="533"]

Form STK-2 - Page 2

[caption id="attachment_25362" align="aligncenter" width="533"] Form STK-2 - Page 3

[caption id="attachment_25363" align="aligncenter" width="531"]

Form STK-2 - Page 3

[caption id="attachment_25363" align="aligncenter" width="531"] Form STK-2 - Page 4

Form STK-2 - Page 4

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...