Last updated: November 5th, 2022 12:19 PM

Last updated: November 5th, 2022 12:19 PM

FSSAI License Number

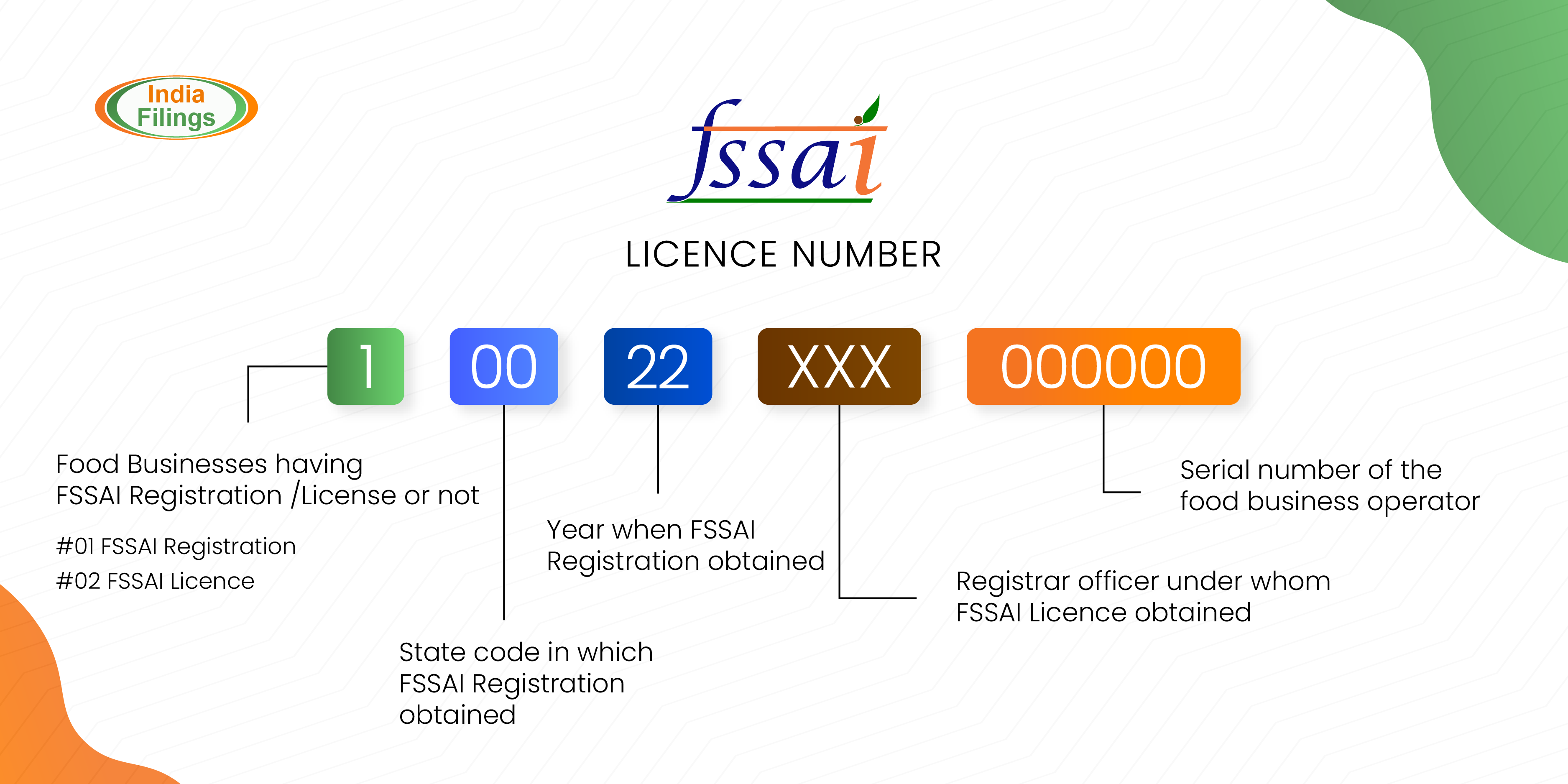

The food business operator must obtain a food license or FSSAI registration before commencing their business. FSSAI issues the food licenses to the FBOs certifying the safety of the food products for consumption. A 14-digit license number is assigned to each FBO (Food Business Operator). Along with the FSSAI logo, this must be applied to the food product package. The 14-digit license number shown on the food container or premises can be used to check the validity or status of the FSSAI license number.FSSAI License Number

All FBOs have to display the FSSAI license number received at the time of grant of the FSSAI license in the product and within the premises. An FSSAI License is valid for up to the next 5 years, after which, one has to renew the FSSAI License by providing the necessary documents. The FSSAI license number which is issued to all types of food businesses consists of 14 digits. Basically, there are different kinds of FSSAI registration numbers depending on the scale of the food business operation. These 14-digits of an FSSAI license number are further divided into 5 groups. FSSAI License Number

FSSAI License Number

- Section 1: The first digit of the FSSAI Number indicates whether the food business has received the FSSAI registration/license or not.

- Section 2: In the 2 and 3 numbers users can get information related to the State in which the Food Business is registered.

- Section 3: The 4 and 5 number of the FSSAI License indicates the year in which the Food Business received the FSSAI License.

- Section 4: The license number's sixth, seventh and eighth digits indicate the number of enrolling masters.

- Section 5: The last 6 digits that are from 9 – 14 of the FSSAI Number indicated the unique License Number for the Food Business Operator (FBO).

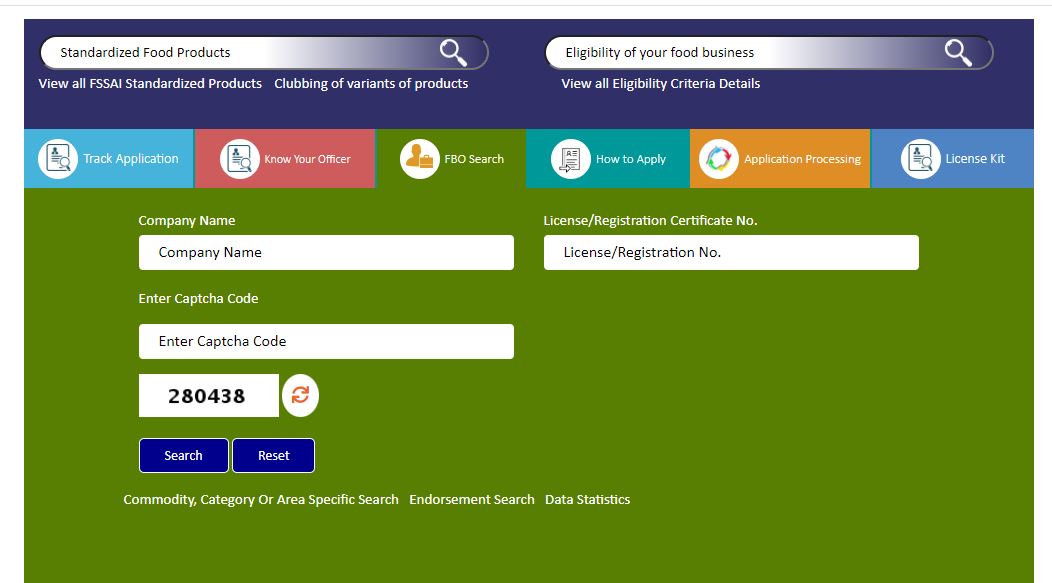

Procedure to check FSSAI License Number

The steps to check the validity and details of the FSSAI license number of an FBO online are as follows:- Access the official website of FoSCoS website. Click on the ‘FBO Search’ tab on the homepage.

- Enter the license number, and captcha, and click on the ‘Submit’ button.

- The FSSAI license details will appear on the screen. The following details will be displayed:

- FBO/company name.

- Premises address.

- License number.

- License type (State License or Central License).

- Validity (whether active or inactive).

- List of products of the FBO.

FSSAI Licence Number Guidelines

- The FBOs must display the 14-digit license number that they obtain from FSSAI on the packaged products.

- FSSAI also issues the FSSAI logo to the FBOs that they must display on the packed food products. The font and color of the FSSAI logo and license number should be contrasting the background color of the packaged food products so that they are clearly visible.

- The FSSAI license number needs to be produced before the authorities while importing a product into India.

- The measure of the alphabet, letters, and digits should be in accordance with the provisions of the Food Safety and Standards (Packaging and Labelling) Regulation, 2011.

- Display of the FSSAI logo and the license number on the food products indicates that the FBO has a legitimate license in compliance with the Food Safety and Standards Act, 2006.

- The FBOs must put the license number on the food premises/addresses of the various units of the FBO.

- The FBOs must display Food Safety Display Boards at their premises having the license number and color code for different sectors.

- FBOs should display the logo and license number on their products until the validity of their FSSAI license, i.e. maximum of five years.

- The FBOs need to renew their FSSAI license within 180 days before its expiry period and display the logo and license number after its renewal.

- All food businesses should mention the FSSAI license number on purchase invoices, cash receipts, bills, cash memos, etc. However, there is an exemption for mentioning the FSSAI license number on the GST E-way bills and other government documents that are system-generated.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...