Last updated: December 19th, 2022 2:48 PM

Last updated: December 19th, 2022 2:48 PM

GHMC Property Tax

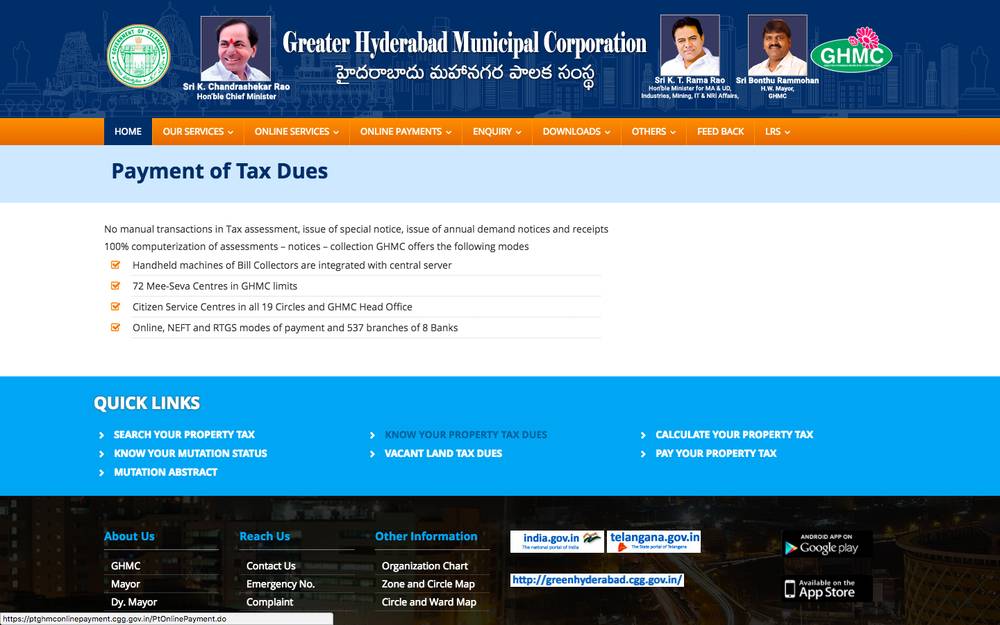

GHMC or Greater Hyderabad Municipal Corporation has implemented one of the most accessible online systems for property tax payment. Hyderabad is the capital of Telangana state and the temporary capital of Andhra Pradesh state. Telangana state came into existence on June 2nd, 2014, with Hyderabad as the capital city. In this article, we look at the procedure for paying GHMC property tax and checking property tax arrears.GHMC Property Tax Check

Greater Hyderabad Municipal Corporation (GHMC) has implemented a completely online system for property tax status checking and property tax payment. There are no manual transactions in property tax, and everything from the issue of notices and receipt of payment has been made 100% online to ensure complete transparency. GHMC property tax can now be paid online or through one of the options below:- Handheld machines of Bill Collectors which are integrated with the central server

- 72 Mee-Seva Centres in GHMC limits

- Citizen Service Centres in all 19 Circles and GHMC Head Office

- Online, NEFT and RTGS modes of payment and 537 branches of 8 Banks

Check GHMC Property Tax Status

Before paying the GHMC property tax, one must check the status of property tax due and arrears, if any. Hyderabad property tax status can be checked online by following the steps below:Step 1: Visit the GHMC Property Tax Website

Visit the GHMC property tax website. Click on the Know your Property Tax Dues section. Step 1 - GHMC Property Tax

Step 1 - GHMC Property Tax

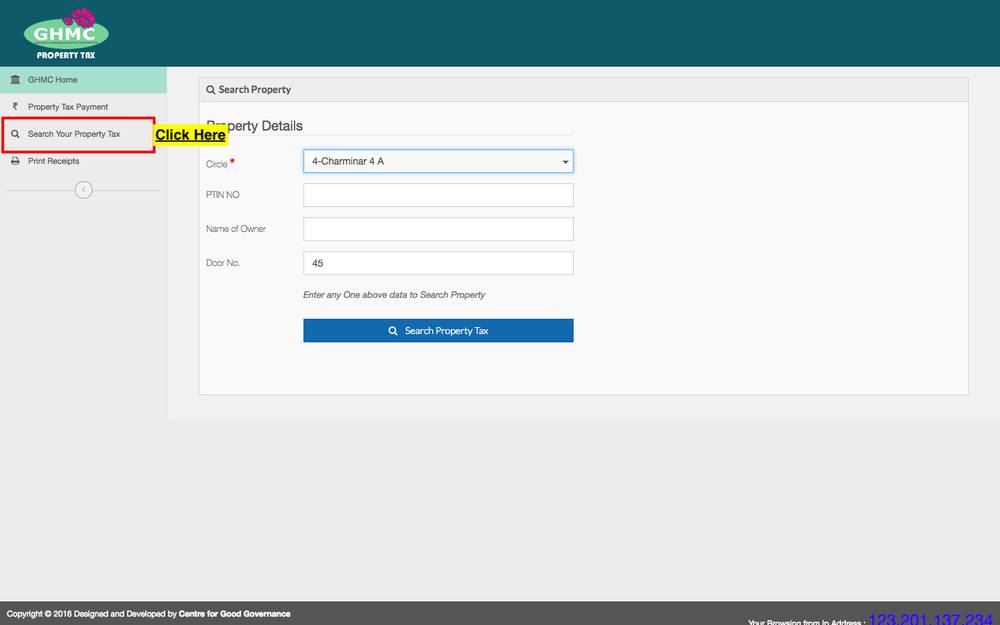

Step 2: Select Search Your Property Tax

In the Know your Property Tax Dues page, select the Search Your Property Tax on the left side menu. It will load the page below. In case one knows their GHMC PTI number, they can proceed directly to payment using the Property Tax Payment link. In the page, select the Circle in which the property is present and enter one of the following details:- PIT Number

- Name of Owner

- Door Number

Step 2 - GHMC Property Tax Status Check

Step 2 - GHMC Property Tax Status Check

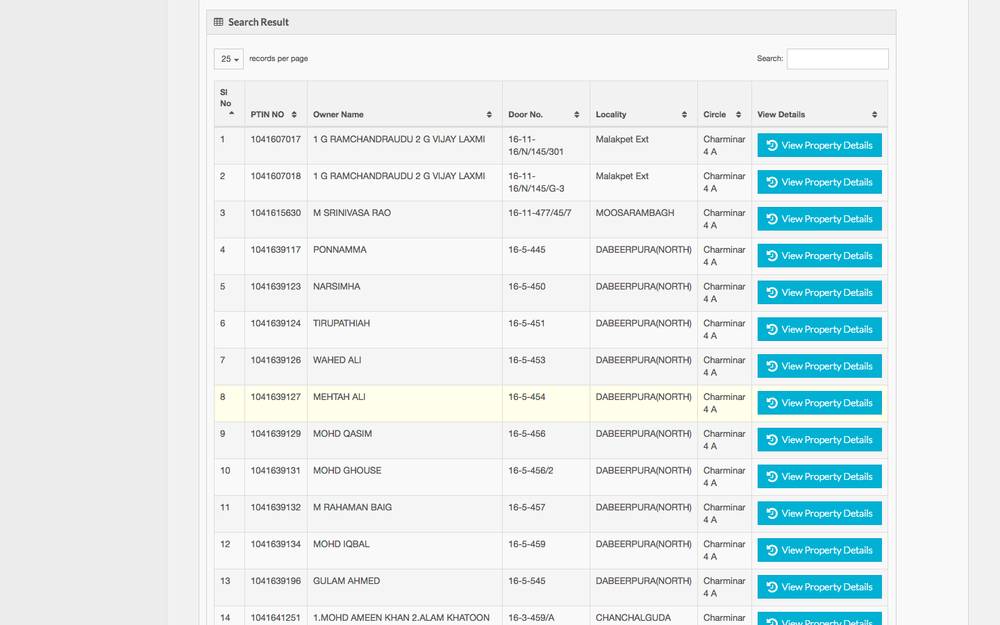

Step 3: Select Your Property

In the list of properties populated, select your property based on the name of the owner. Step 3 - Select the Property

Step 3 - Select the Property

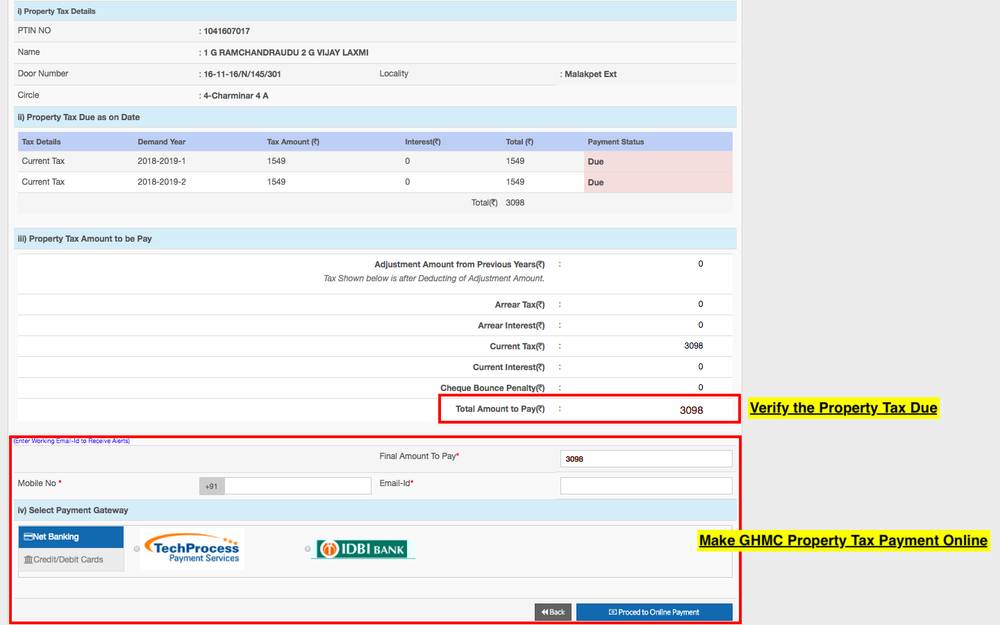

Step 4: Verify Dues and Make GHMC Property Tax Payment

The system will now show the entire amount of GHMC property tax due, arrears if any, and the total amount payable. Verify the amount, provide the mobile number and email and pay through Net Banking or Credit or Debit Card. Step 4 - Make GHMC Property Tax Payment

Step 4 - Make GHMC Property Tax Payment

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...