Last updated: December 7th, 2019 12:54 PM

Last updated: December 7th, 2019 12:54 PM

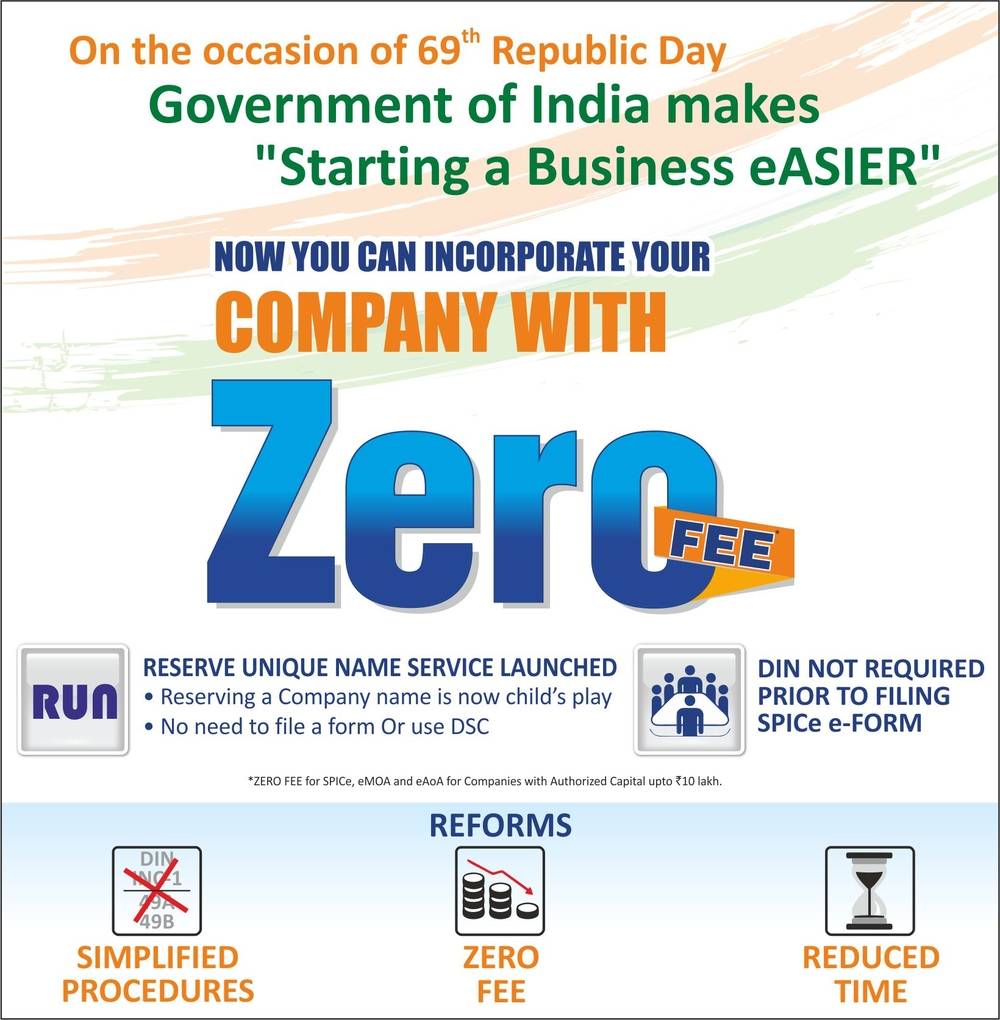

Government Fee for Company Registration

In the words of LAO TZU, “A journey of a thousand miles begins with a single step”. Registering a company is akin to taking baby steps in a journey that might span up to a plethora of years. In this article, we look at the Government Fee for company registration in India.The Government has waived off the Government fee for incorporation of company in India on 26th January 2019. Hence, the fees mentioned in the article, are before the waiver introduced by the Government.

Company Incorporation 2018

Company Incorporation 2018

Fee for One Person and Small Companies

Let us begin our article by examining the fee to be remitted for the registration of a One Person Company and Small Company:- The registration fee for organization’s whose nominal share capital is limited to Rs.10,00,000 – Rs 2,000.

- The registration fee for organization’s whose nominal share capital ranges between Rs 10,00,000 to Rs 50,00,000 – Rs 2000. Rs.200 will be added for every Rs. 10,000 or part thereof of nominal share capital.

- The registration fee for organization’s whose nominal share capital ranges above Rs 50,00,000 to Rs one crore – Rs 1,56,000. Rs.100 will be added for every Rs. 10,000 or part thereof of nominal share capital.

- The registration fee for organization’s whose nominal share capital exceed Rs one crore – Rs 2,06,000. Rs.75 will be added for every Rs. 10,000 or part thereof of nominal share capital subject to a maximum of Rs. 250 crore.

Fee for Companies Other Than One Person and Small Companies

The fee structure for registration of companies other than one person person and small companies are as follows:- The registration fee for organization’s whose nominal share capital is limited to Rs. 1,00,000 – Rs 5,000.

- The registration fee for organization’s whose nominal share capital ranges between Rs. 1,00,000 to Rs. 5,00,000 – Rs. 5,000. Rs. 400 will be added for every Rs. 10,000 or part thereof of nominal share capital.

- The registration fee for organization’s whose nominal share capital ranges between Rs. 5,00,000 to Rs. 50,00,000 – Rs 21,000. Rs. 300 will be added for every Rs. 10,000 or part thereof of nominal share capital.

- The registration fee for organization’s whose nominal share capital ranges between Rs. 50,00,000 to Rs. one crore – Rs 2,06,000. Rs. 100 will be added for every Rs. 10,000 or part thereof of nominal share capital.

- The registration fee for organization’s whose nominal share capital exceed Rs. one crore – Rs 2,06,000. Rs. 75 will be added for every Rs. 10,000 or part thereof of nominal share capital subject to a maximum of Rs. 2.50 crores.

Fee for Companies Without a Share Capital

Companies without share capital is required to remit the fee as specified below:- The registration fee for companies whose number of members as declared in the MOA is limited to 20 – Rs 2,000.

- The registration fee for companies whose number of members as declared in the MOA exceeds 20, but is limited to 200 – Rs 5,000.

- The registration fee for companies whose number of members as stated in the MOA exceeds 200, on the condition that the number of members stated in the AOA isn’t “unlimited” – Rs 5,000. Rs ten will be added for every member after counting the first 200, subject to a maximum of Rs 10,000.

Filing, Submitting, Registering or Recording Fee for Documents with ROC

For Companies with Share Capital

- The registration fee for a company whose nominal share capital is limited to 1,00,000 – Rs 200

- The registration fee for a company whose nominal share capital amounts to Rs 1,00,000 or more but is limited to less than Rs 5,00,000 – Rs 300

- The registration fee for a company whose nominal share capital amounts to Rs 5,00,000 or more but is limited to less than Rs 25,00,000 – Rs 400

- The registration fee for a company whose nominal share capital amounts to Rs 25,00,000 or more but is limited to less than Rs one crore – Rs 500

- The registration fee for a company whose nominal share capital amounts to Rs 1 crore and above – Rs 600

For Companies without Share Capital

The registration fee for companies without share capital is set at Rs 200, irrespective of their turnoverFee Applicable for Delayed Filing of Forms

Companies will have to pay additional fees for delays in filing of the forms other than for an increase in nominal share capital. The following will be the implications of delay:- For a delay of up to 15 days, the fee will constitute the amount of normal filing fee.

- For delays ranging between 16 to 30 days, the fee will be two times of the normal filing fee.

- For delays ranging between 31 to 60 days, the fee will be four times of the normal filing fee.

- For delays ranging between 61 to 90 days, the fee will be six times of the normal filing fee.

- For delays ranging between 91 to 180 days, the fee will be ten times of the normal filing fee.

- For more than 180 days of delay, the fee will be twelve times of the normal filing fee.

Fee on Applications Furnished to Central Government

Fee for applications furnished to the Central Government will vary according to the type of organization. The fee structure is specified below:Companies with Authorized Share Capital

- The application fee for companies whose authorized share capital is limited to Rs 25,00,000 – Rs 1,000 in case of OPC’s and Small Companies, and Rs 2000 in case of other companies.

- The application fee for companies whose authorized share capital is above 25,00,000 but is limited to Rs 50,00,000 – Rs 2500 in case of OPC’s and Small Companies, and Rs 5,000 in case of other companies.

- The application fee for companies whose authorized share capital is above 50,00,000 but is limited to Rs 5 crores – No fee for OPC’s and Small Companies, and Rs 5,000 in case of other companies.

- The application fee for companies whose authorized share capital is above Rs 10 crores – No fee for OPC’s and Small companies, and Rs 20,000 for other companies

Company Limited by Guarantee but without a Share Capital

Given this scenario, OPC’s and Small Companies will not be charged any fee, and other companies will be levied with a fee of Rs 2,000.Companies with a Valid License

Companies holding a valid license issued u/s 8 of the ACT will be levied with a fee of Rs 2,000. OPC’s and Small Companies are exempt from making any payments.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...