Last updated: December 17th, 2024 11:09 AM

Last updated: December 17th, 2024 11:09 AM

GST Audit & Certifications - By Chartered Accountants

GST audit would have to be periodically conducted on entities registered under GST by a Practising Chartered Accountant or GST officer to ensure that proper compliance is maintained. In this article, we look at the different types of GST audit and certifications conducted or provided by a practising Chartered Accountant from time to time.GST Annual Return

All entities required to file monthly GST returns are required to file GST annual return before 31st December of each financial year. Only Input Service Distributors, Casual Taxable Persons and Non-Resident Taxable persons are exempt from filing GST annual return. Entities required to file GST annual return having an aggregate turnover of over Rs.2 crores in a financial year must get the annual GST accounts audited and certified by a practising Chartered Accountant. Know more about GST Return Due Dates.GST Input Tax Credit Claim under Special Circumstances

For instance, a registered person files FORM GST ITC-01 within 30 days of becoming eligible to avail input tax credit on existing stocks. In the details furnished in the declaration for the claim of input tax credit under special circumstances, Chartered Accountant certification shall apply if the aggregate value of the claim on account of central tax, State tax, Union territory tax and integrated tax exceeds Rs.2 lakhs. In an input tax credit claim under special circumstances, where the tax invoices related to the inputs held in stock are not available, the registered person can estimate the amount based on the prevailing market price of the goods on the effective date. In these instances, a practising chartered accountant or cost accountant shall duly certify the details provided by the taxpayer. Know more about input tax credit under GST.Special Audit Ordered by GST Officer

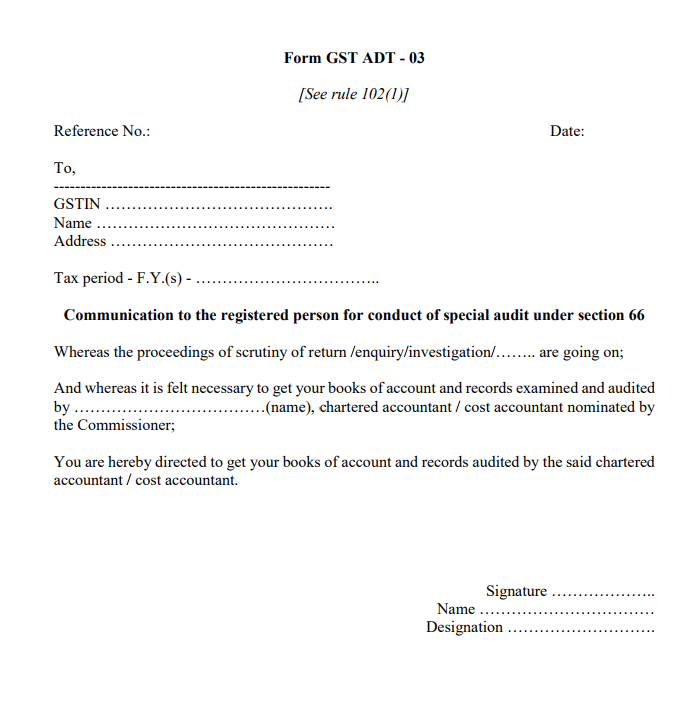

A GST Officer (not below the rank of Assistant Commissioner) can order for scrutiny, inquiry or investigation if at any stage of scrutiny, inquiry, investigation or any other proceedings believes that the entity failed to declare the correct value or the credit availed mismatches within the normal limits. In such cases, the GST Officer with the prior approval from the Commissioner shall direct the taxpayer to provide the records including books of account examined and audited by a Chartered Accountant or Cost Accountant. After issuing the directions for special audit through FORM GST ADT-03 to the registered person, the nominated Chartered Accountant should submit the audit report duly signed and certified by the CA to the Assistant Commissioner within a period of 90 days. In case of difficulty in completing the audit within the provided time period, the registered person or the chartered accountant for any material and sufficient reason, request for an extension of the period by an additional 90 days. [caption id="attachment_33038" align="aligncenter" width="697"] Sample Special Audit Order

Simplify your GST registration and GST return filing process with IndiaFilings experts!

Sample Special Audit Order

Simplify your GST registration and GST return filing process with IndiaFilings experts!

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...