Last updated: March 14th, 2020 3:23 PM

Last updated: March 14th, 2020 3:23 PM

GST Bill of Entry

GST implementation on 1st July, 2017 will significantly change the procedure for import of goods into India. IGST applicable on imports along with GST Compensation Cess. Further, input tax credit is also provided on the IGST charged during import. Hence, to tax all imports and provide input tax credit, GST registration would be mandatory for all importers.Bill of Entry

Bill of Entry is a document filed by importers or customs clearance agents with the Customs Department. On arrival of good or before arrival of goods, bill of entry can be filed along with the requisite documents to initiate the customs clearance formalities. Once a bill of entry is filed, the goods are examined and assessed by proper officer of Customs. Basics customs duty, IGST and GST Compensation Cess must then be paid by the importer to clear the goods through customs. If bill of entry is not filed within 30 days of arrival of goods at a customs station, then the cargo can be auctioned by the authorities. A request for extension for filing of bill of entry can also be filed by importers within 30 days of the goods arriving in India, under special cases.HSN Code for GST

GST uses HSN code for classification of goods and levy of tax. Since HSN code is already used by the Customs Department and is an internationally accepted methodology for tracking goods in the course of international trade.Changes to Bill of Entry under GST

Once GST is implemented, the bill of entry format would change as GSTIN of the importer must be mentioned on the document. In case GSTIN is not available, provisional GSTIN can be used. Based on the GSTIN, input tax credit would be provided to the importer for IGST and GST Compensation Cess paid during import. However, input tax credit would not be provided for the basic customs duty paid on the import.Bill of Entry Format - Warehousing

The new GST Bill of Entry format for warehousing is as under: Bill of Entry - For WarehousingBill of Entry Format - Home Consumption

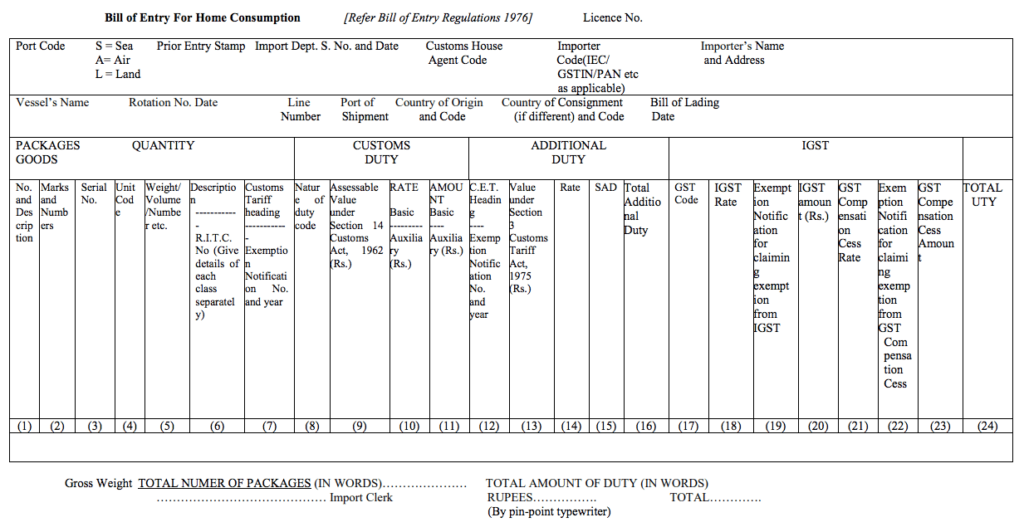

The new GST Bill of Entry format for home consumption is as under: Bill of Entry - For Home Consumption

Bill of Entry - For Home Consumption

Bill of Entry Format - Ex-Bond Clearance

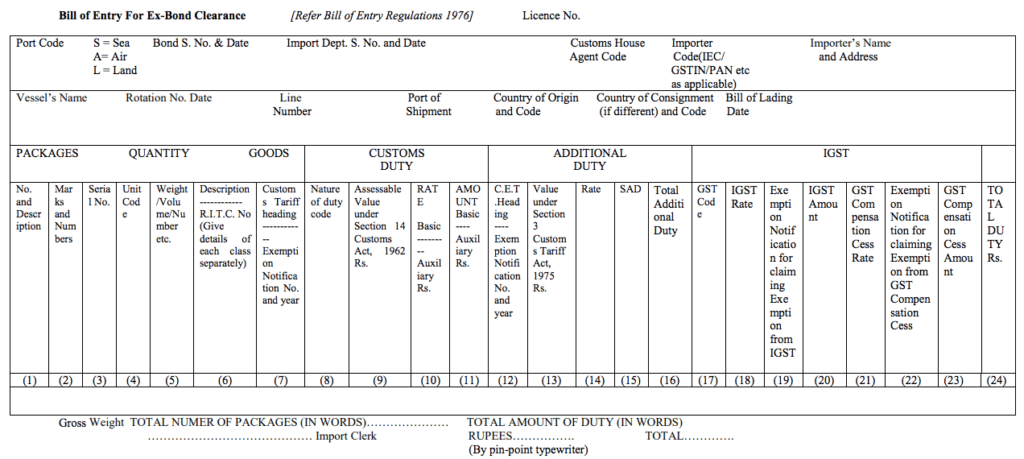

The new GST Bill of Entry format for ex-bond clearance is as under Bill of Entry - Ex Bond Clearance

Bill of Entry - Ex Bond Clearance

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...