Last updated: August 7th, 2024 10:56 AM

Last updated: August 7th, 2024 10:56 AM

GST Certificate: Importance, Validity, & How to Obtain it?

When a business registers for Goods and Services Tax (GST), businesses are given a GST Registration Certificate, known as Form GST REG-06. This GST certificate outlines the GSTIN (15-digit GST Identification Number) and the primary and secondary business locations. Notably, the government does not issue physical copies of GST certificates, which can be downloaded from the GST Portal. This article will give you detailed information on GST certificates, benefits, components, and how to download from the GST portal. IndiaFilings can help in GST registration, offering expert guidance and support. [shortcode_4]GST Registration

GST registration is a vital requirement for businesses operating in India. If the business turnover exceeds the specified threshold limits or falls under any specific categories mandating GST registration, you must complete the registration process to comply with the GST laws.- Businesses whose total sales in a financial year exceed Rs. 40 lakhs (Rs. 20 lakhs for particular category states) must register for GST.

- This also applies to service providers with a turnover exceeding Rs. 20 lakhs (Rs. 10 lakhs for special category states) in a financial year.

What is a GST Certificate?

The GST Certificate is a document given by the Indian government to businesses registered for GST. It shows that a business is registered for GST and includes important details like its GST number, name, and address.- This certificate is essential for businesses because it allows them to add GST to their sales and get back some of the GST they paid on their purchases.

- These businesses must display the certificate at their premises, failing which they may incur penalties under GST regulations.

Benefits of obtaining GST Certificate Online

The GST Certificate online offers a range of benefits for businesses registered under the Goods and Services Tax system in India:- Legal Recognition as a Supplier: Possessing a GST Certificate legitimizes a business as an authorized supplier of goods or services. This enhances the business's credibility and integrity, especially when dealing with B2B (business-to-business) customers.

- Authority to Collect Tax: Registered businesses can legally collect GST from their customers. This authority is crucial for maintaining compliance with tax laws.

- Input Tax Credit Benefits: Businesses can avail themselves of the input tax credit, which allows them to deduct the GST paid on their purchases from their GST liability on sales. This is beneficial in reducing the overall tax burden.

- Seamless Credit Flow: GST facilitates a smooth and uninterrupted flow of input tax credits from suppliers to buyers at the national level, enhancing the efficiency of the tax system.

- GST Refunds for Exporters: Exporters who have registered for GST can claim refunds on the GST paid on exported goods or services. This is particularly advantageous as it helps improve the competitiveness of Indian goods in the international market.

Importance of GST Certificate

The GST Registration Certificate plays a crucial role in the business landscape due to its manifold benefits:- Legal Recognition: It legitimizes you as an authorized supplier of goods and services, ensuring that your business operations align with legal requirements.

- Authority to Collect GST: With this certificate, you are legally empowered to collect GST from your customers on the government's behalf.

- Input Tax Credit (ITC) Benefits: This certificate enables you to claim an Input Tax Credit on the GST paid on purchases, which can be offset against your GST liability on sales.

- Seamless Credit Flow: It facilitates a smooth flow of Input Tax Credit from suppliers to buyers across the country, enhancing the efficiency of tax processes.

- Enhanced Credibility: A GST Registration Certificate boosts your business's credibility, signalling to customers and partners that you comply with current tax laws.

Components of the GST Certificate

The primary section of the GST Registration Certificate encompasses vital information, including:- GSTIN: The unique Goods and Services Tax Identification Number assigned to the taxpayer.

- Legal and Trade Name: The official and trading names of the business or individual.

- Business Constitution Type: The nature of the business entity (e.g., sole proprietorship, partnership, corporation).

- Date of Liability: The date from which the taxpayer is liable to pay GST.

- Principal Business Address: The main location of the business operations.

- Validity Period: Indicates the 'From date'. The 'To date' is typically not specified for ordinary taxpayers, whereas it is mentioned for non-resident or casual taxpayers.

- Registration Type: Specifies the taxpayer category.

- Approval Details: Name, designation, jurisdiction office, and the digital signature of the authorizing official.

- Issue Date: The date on which the certificate was issued.

Validity of GST Certificate

The GST Registration Certificate's validity varies based on the taxpayer category:Normal Taxpayers

The registration certificate does not have an expiry date for businesses operating as normal taxpayers under GST. It remains valid indefinitely unless it is specifically cancelled or surrendered by the taxpayer or revoked by the tax authorities for compliance reasons.Non-Residents and Casual Taxpayers

These taxpayers, often engaged in temporary business activities within India, are issued GST certificates with a limited validity of 90 days from the date of issuance. However, they can apply for an extension before the expiry of the initial validity period if they intend to continue their business activities beyond this timeframe.How to Obtain a GST Certificate?

To obtain a GST Registration Certificate, follow these steps:- Visit GST Portal: Go to the official GST website.

- Access Services for Registration: On the homepage, select "Services" and choose "Registration" from the dropdown menu.

- Initiate New Registration: Click on "New Registration" under the "Registration" section.

- Select Taxpayer Category: Choose the "Taxpayer" category to proceed.

- Complete GST Registration Form (REG-01): Fill in all required details in Form REG-01, including PAN, mobile number, and email address. You'll receive an OTP for verification on your mobile and email.

- Receive Application Reference Number (ARN): After submitting the form, you'll get an ARN sent to your mobile and email.

- Upload Required Documents: Provide necessary documents as listed on the portal, like PAN card, Aadhaar card, business certificates, and bank details.

- Undergo Verification and Approval: The GST authorities will review your application and documents. Upon successful verification, they will approve the registration.

- Get Your GSTIN: Once your application is approved, you'll receive your GST Certificate with your unique GSTIN.

How to Download GST Certificate

To download your Certificate, follow these simple steps:- Go to the official Goods and Services Tax (GST) website and Click the 'Login' button. Enter your username and password.

- Fill in the captcha code and click on 'Login'. Once logged in, click on the 'Services' tab.

- Select 'User Services'. From the dropdown menu, choose 'View/Download Certificate'. You'll see the option to 'Download' in the new window.

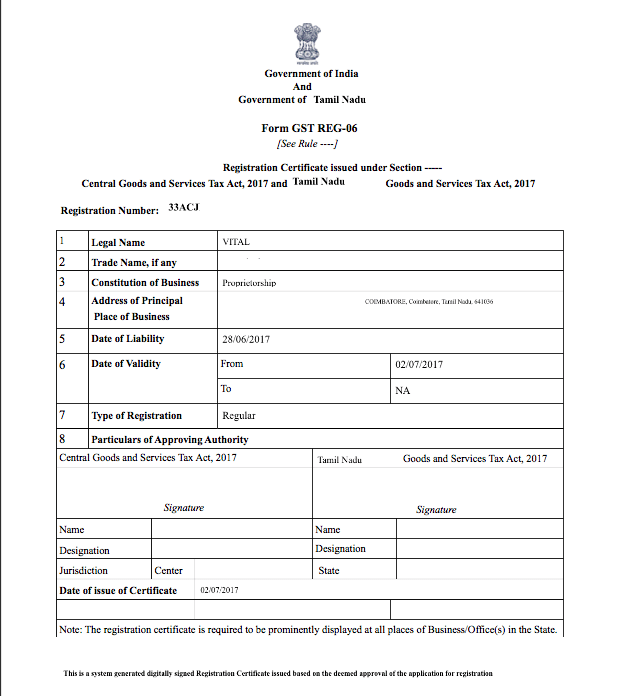

GST Registration Certificate Sample - Annexure A

GST RC has four annexures. The following is a GST registration sample for Annexure A containing details of the business, GST registration validity and address of the principal place of business. In Annexure A, the GST registration number is provided on the top left-hand side corner followed by the legal name of the business, trade name, constitution, the address of principal place of business, the date on which the business became liable to register for GST and GST registration validity date. Only GST registration for casual taxable persons and non-resident taxable persons have an expiry date. GST registration for normal taxpayers does not have an expiry date.

The type of GST registration and particulars of the person approving the GST registration is also provided in Annexure A along with the date of issue of GST registration certificate.

In Annexure A, the GST registration number is provided on the top left-hand side corner followed by the legal name of the business, trade name, constitution, the address of principal place of business, the date on which the business became liable to register for GST and GST registration validity date. Only GST registration for casual taxable persons and non-resident taxable persons have an expiry date. GST registration for normal taxpayers does not have an expiry date.

The type of GST registration and particulars of the person approving the GST registration is also provided in Annexure A along with the date of issue of GST registration certificate.

Signature on GST Registration Certificate

GST registration certificates are provided in soft-copy pdf format only. There are no hard copies provided by the Government. Further, as the certificate is digitally generated, the signature of the authority sanctioning the certificate will not be visible on the certificate. The system generated document itself is proof of registration under GST.Display of GST Registration

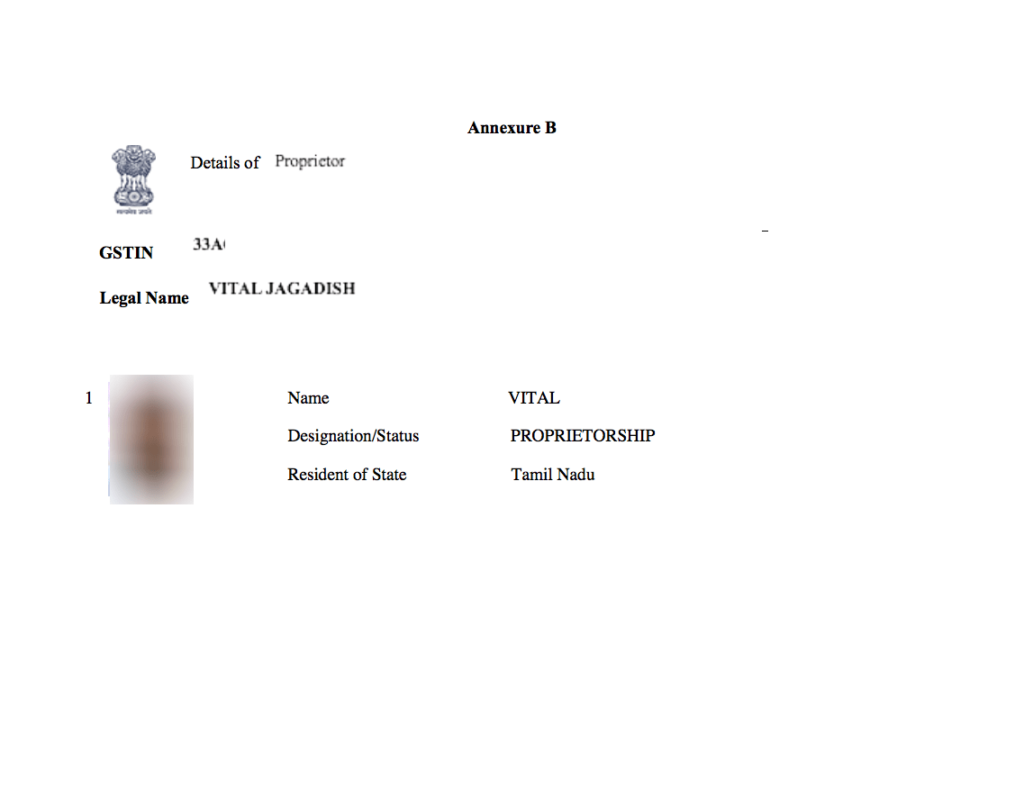

According to the GST Act, GST RC must be displayed in all branches of the business. In the case of composition supplier, the words "composition supplier, not eligible to collect tax" must also be displayed prominently. Click here to read on Rules on Display of GST Registration CertificateGST Registration Certificate Sample - Annexure B

In Annexure B of the GST Registration Certificate, details of the promoters of the business are provided. Fora proprietorship, there would be only one promoter. In other types of entities including private limited company, LLP and others, there would be more than one promoter. The name of the promoter, photo and designation are provided in Annexure B as shown above in the sample GST RC.

The name of the promoter, photo and designation are provided in Annexure B as shown above in the sample GST RC.

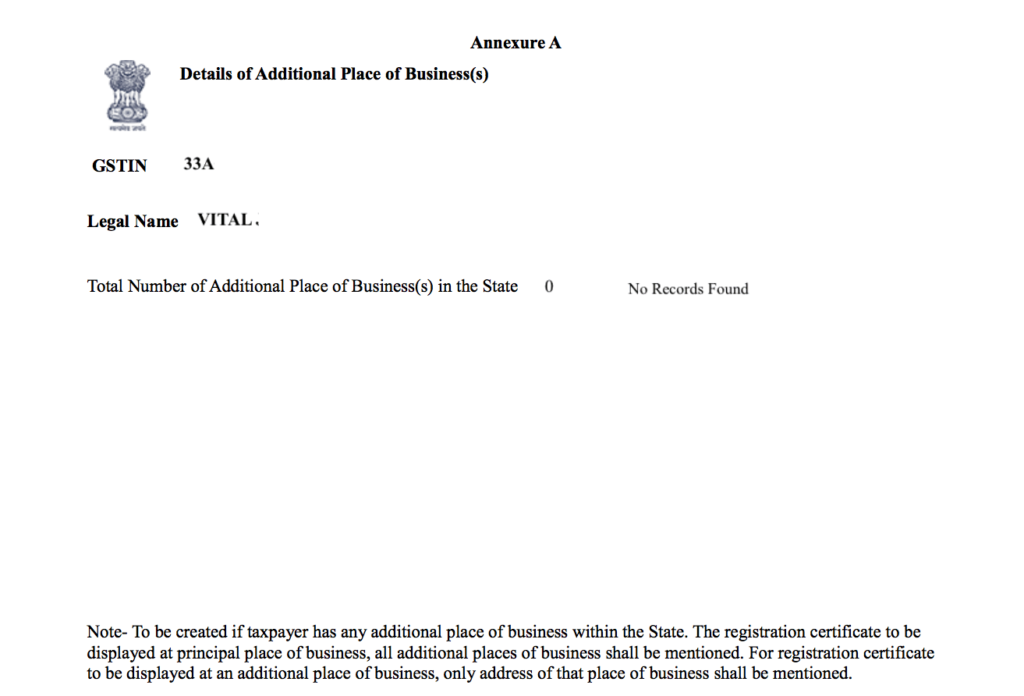

GST Registration - Additional Places of Business

Under GST, each branch engaged in the supply of goods or services is required to be registered. Hence, if more than one branch is registered, the details of such branches would be provided in the GST RC - Additional Places of Business Page. Entities having only one address will not have any information on this page. Know more about GST registration for branches.

Provisional GST Registration Certificate

The GST RC displayed above is a sample GST RC that is final. Before the issue of final GST RC, a provisional GST RC as shown below will be issued. Until the taxpayer receives the final certificate, the entity shall use the provisional GSTIN and provisional certificate. In addition to the provisional GSTIN, which will become final GSTIN on the issue of GST RC, a provisional GST RC will also contain details of VAT registration or Service Tax Registration held by the business.

In addition to the provisional GSTIN, which will become final GSTIN on the issue of GST RC, a provisional GST RC will also contain details of VAT registration or Service Tax Registration held by the business.

Amendments to GST Certificate

If any detail on the GST certificate is incorrect, the taxpayer can edit the core field on the GST site. The Tax Officials must pass any changes to the cor field before a new modified registration certificate may be downloaded.GST Registration Assistance by IndiaFilings

IndiaFilings offers expert help for businesses to complete GST registration and obtain GST certificates smoothly. We handle the entire process, ensuring all documents are correctly filled out and guiding businesses at every step. Ready to simplify your GST registration? Contact IndiaFilings today to get started! [shortcode_4]Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...