Last updated: February 3rd, 2020 5:10 PM

Last updated: February 3rd, 2020 5:10 PM

GST Composition Levy - Eligibility & Application Procedure

Small businesses are the backbone of the Indian economy and there are an estimated 55 million Micro, Small and Medium Enterprises operating in India. The rollout of GST would have extensive impact on over ten million SME businesses operating in India and would require compliance under the GST regime. However, many small businesses would not have the expertise or the capability to comply with many of the GST regulations, unlike medium and large sized businesses. Hence, to make GST compliance easy for micro, small and medium enterprises operating in India, there exists a GST composition levy scheme. In this article, we look at the GST Composition Levy scheme in detail along with eligibility criteria and application procedure.GST Composition Levy

As per Section 10 of the GST Act, the following details the concept of Composition Levy:Notwithstanding anything to the contrary contained in this Act but subject to the provisions of sub-sections (3) and (4) of section 9, a registered person, whose aggregate turnover in the preceding financial year did not exceed seventy five lakh rupees, may opt to pay, in lieu of the tax payable by him, an amount calculated at such rate as may be prescribed, but not exceeding,

- one per cent of the turnover in State or turnover in Union territory in case of a manufacturer

- two and a half per cent of the turnover in State or turnover in Union territory in case of persons engaged in making supplies referred to in clause (b) of paragraph 6 of Schedule II, and

- half per cent. of the turnover in State or turnover in Union territory in case of other suppliers.

Categories

Hence, any business registered in India with an aggregate sales turnover of less than Rs.75 lakhs in the preceding financial year can pay their GST liability in the form of a composition levy at prescribed rates. The aggregate sales turnover criteria for the GST composition scheme increased from Rs.50 lakhs to Rs.75 lakhs. In the case of manufacturers, the Ministry fixed the composition levy at 1% of the aggregate turnover in the State or Union Territory. In case of businesses involved in providing of food or drinks or other items for human consumption and not being alcohol, the composition levy has been fixed at 2.5%. Many small restaurants and eateries would qualify under this criteria as Clause (b) of Paragraph 6 of Schedule II states:Supply, by way of or as part of any service or in any other manner whatsoever, of goods, being food or any other article for human consumption or any drink (other than alcoholic liquor for human consumption), where such supply or service prefered through cash, deferred payment or other valuable consideration.Finally, any other suppliers who do not fall under any of the categories above and eligible for the composition levy scheme shall pay tax at 0.5% of the turnover in State or Union Territory.

Eligibility for GST Composition Scheme

The eligibility for payment of GST liability through for GST Composition Scheme for small businesses applies only if it that complies with the following conditions. The GST composition scheme has many stringent regulations and its important for all business owners to under the nuances of GST composition scheme, prior to making an application for registration.Casual Taxable Person

- The taxpayer cannot be a casual taxable person nor a non-resident taxable person

- “Casual taxable person” means a person who occasionally undertakes transactions involving supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory upon no fixed place of business.

- “Non-resident taxable person” means any person who occasionally undertakes transactions involving supply of goods or services or both, whether as principal or agent or in any other capacity, but no fixed place of business or residence in India;

- The goods held in stock by the taxpayer on the date GST came into force should not have been purchased in the course of inter-state trade or commerce or imported from a place outside India or received from a branch of the business situated outside the State or from the taxpayer's agent or principal outside the State.

- Thus only businesses purchased the stocks within the State can apply for the composition scheme.

- The goods held in stock by the taxpayer has should not have been purchased from an unregistered supplier and if purchased from an unregistered supplier, the taxpayer must then have paid GST on the purchase on reverse charge basis.

- Sub-section (4) of Section 9 states "The central tax in respect of the supply of taxable goods or services or both by a supplier, not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both."

Supply of Goods

- On the inward supply of goods or services or both, taxpayer should have paid tax under reverse charge basis.

- Sub-section (3) of Section 9 states "The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both."

- The taxpayer should not have been engaged in the manufacture of goods as notified under clause (e) of subsection (2) of section 10, during the preceding financial year.

- Clause (e) of subsection (2) of Section 10 states "he is not a manufacturer of such goods as may be notified by the Government on the recommendations of the Council"

- The taxpayer must mention the words “composition taxable person, not eligible to collect tax on supplies” at the top of the bill of supply issued by him.

- The taxpayer should mention the words “composition taxable person” on every notice or signboard displayed at a prominent place at his principal place of business and at every additional place or places of business.

Applying for GST Composition Levy

The procedure for applying for GST composition levy differs from persons migrated to GST having provisional GST registration and those obtaining fresh GST registration.For Taxpayers Who Migrated to GST

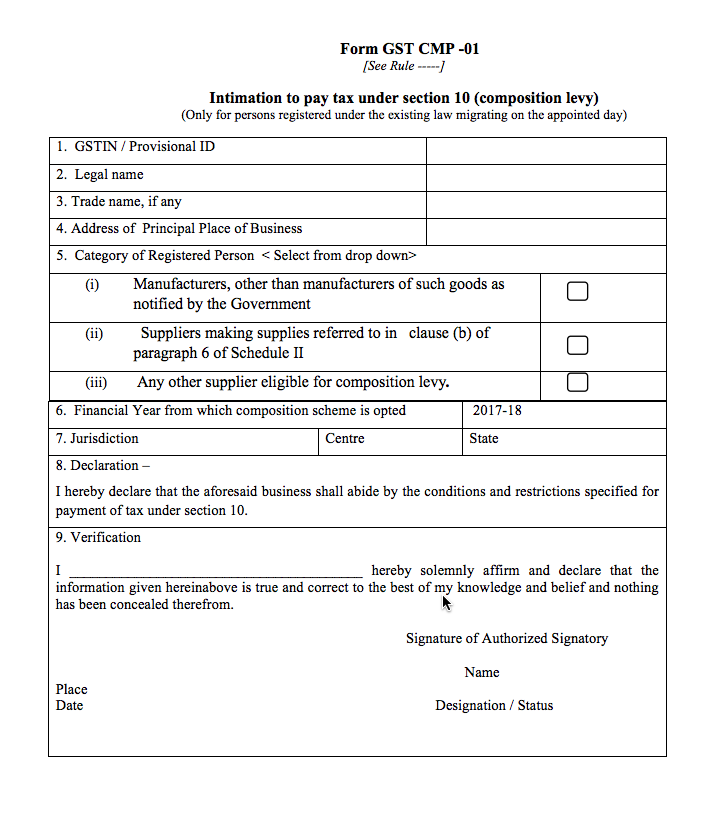

Any person with a provisional GST registration can apply for the GST Composition Levy scheme by filing Form GST CMP-01. The taxpayer can file Form GST CMP-01 on the GST Common Portal or a GST Facilitation Centre with the authorized signatory's sign. In addition, any person migrated from a service tax or VAT or central excise or other such registration subsumed under GST can also file Form GST CMP-01. [caption id="attachment_30670" align="aligncenter" width="719"] GST Form CMP-01

The registered taxpayers should file the Form GST CMP-01 for GST composition levy before the date of GST coming into force or within 30 days of GST coming into force or any further period as extended by the Commissioner.

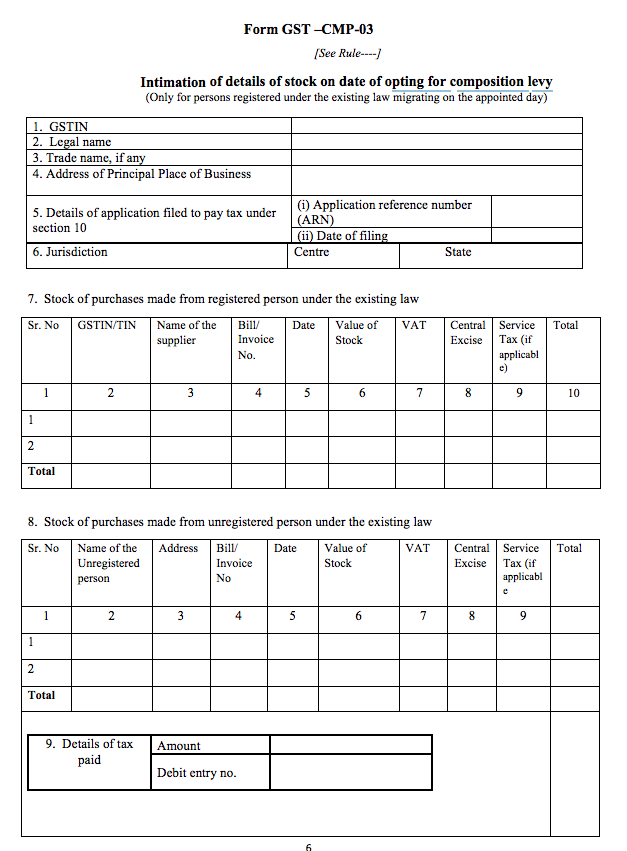

Taxpayers who migrated to the GST registration shall also file Form GST CMP-03, with details of stock, including the inward supply of goods received from unregistered persons, held by the taxpayer on the day preceding the date from which the taxpayer opts to pay tax under GST Composition levy.

[caption id="attachment_30673" align="aligncenter" width="627"]

GST Form CMP-01

The registered taxpayers should file the Form GST CMP-01 for GST composition levy before the date of GST coming into force or within 30 days of GST coming into force or any further period as extended by the Commissioner.

Taxpayers who migrated to the GST registration shall also file Form GST CMP-03, with details of stock, including the inward supply of goods received from unregistered persons, held by the taxpayer on the day preceding the date from which the taxpayer opts to pay tax under GST Composition levy.

[caption id="attachment_30673" align="aligncenter" width="627"] Form GST CMP-03

Form GST CMP-03

For Taxpayers Who Obtain Fresh GST Registration

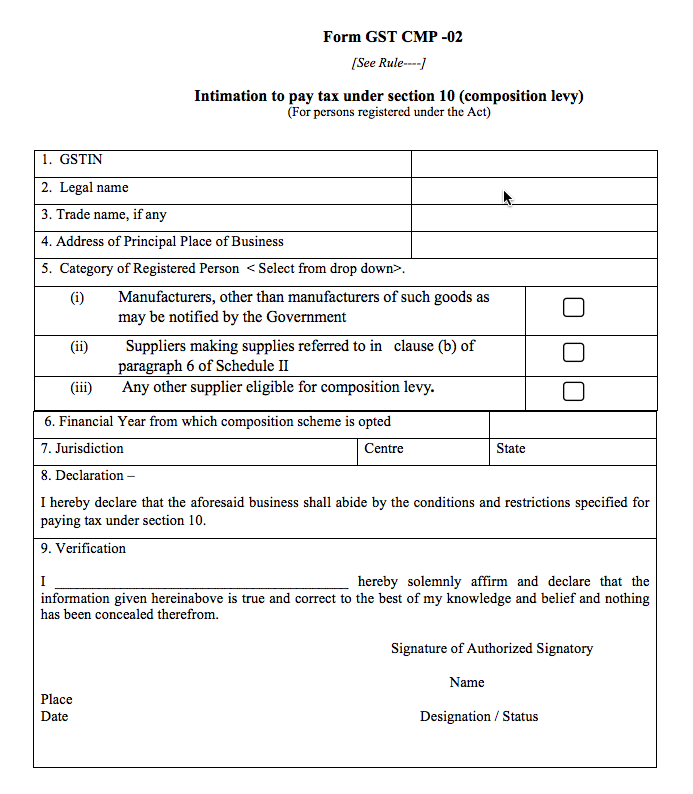

The taxpayers should file Form GST CMP-02 who obtains GST registration for the first time. The taxpayer should file GST CMP-02 prior to the commencement of the financial year for which the taxpayer would like to adopt the GST composition levy. Further, after filing GST CMP-02, the taxpayer must file FORM GST ITC-3 within 60 days from the commencement of the relevant financial year. [caption id="attachment_30672" align="aligncenter" width="693"] Form GST CMP-02

Form GST CMP-02

Validity of GST Composition Levy Registration

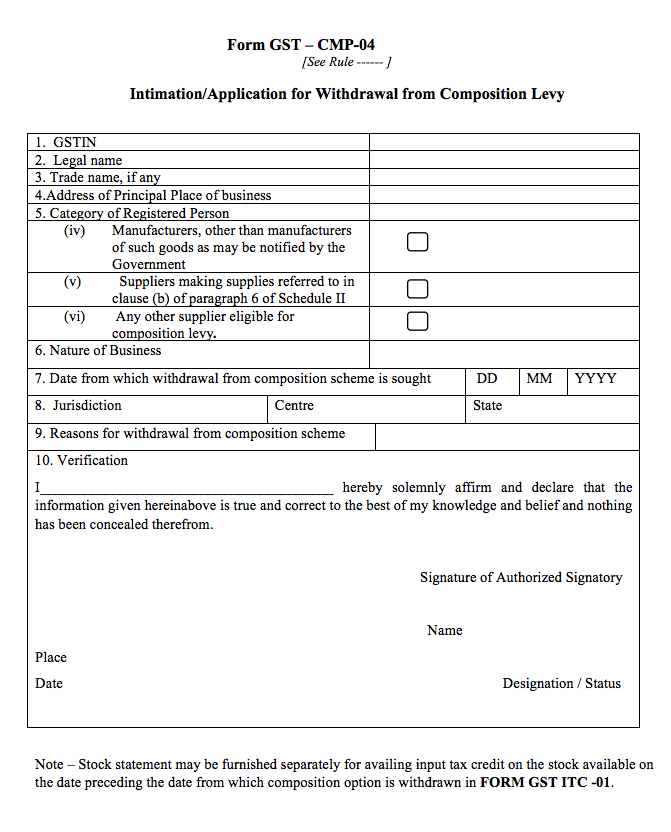

The option exercised by a registered taxpayer to pay tax under the GST composition levy scheme is valid as long as the business satisfies all the conditions mentioned in the eligibility criteria above. If the taxpayer fails to meet the any of the above-mentioned eligibility criteria, the taxpayer should cease claiming benefits under the GST composition levy scheme and begin issuing a tax invoice for every taxable supply made thereafter. To intimate the cancellation of the GST composition levy scheme, the taxpayer shall file an intimation for withdrawal in FORM GST CMP-04 within seven days of the occurrence of any event that makes the business ineligible for the GST composition levy. [caption id="attachment_30674" align="aligncenter" width="671"] Form GST CMP-04

For more information about GST Registration, GST Return Filing or other GST related queries, visit the IndiaFilings GST Portal.

Form GST CMP-04

For more information about GST Registration, GST Return Filing or other GST related queries, visit the IndiaFilings GST Portal.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...