Last updated: June 14th, 2024 3:38 PM

Last updated: June 14th, 2024 3:38 PM

GST Composition Scheme

Composition Scheme acts as an alternative method for levying a tax under GST. Small businesses registered under the GST composition scheme can pay GST at a fixed rate of turnover every quarter and file quarterly GST returns. Composition levy would be generally related to small taxpayers who are supplying goods and services or both to the end consumer with low turnover. Further, the composition scheme has been designed with the aim of making compliance more accessible and cost-effective for the taxpayers. In this article, let us look at the composition scheme under GST in detail.Eligibility Criteria

Any existing taxpayer whose annual turnover did not cross the Rs.1.5 crore threshold of Rs.75 lakhs in the preceding financial year.Special Eligibility

In the case of states under a special category, except Jammu & Kashmir and Uttarakhand, the limit of annual turnover has increased from Rs.50 lakhs to Rs.75 lakhs. Hence, the Ministry provided the turnover threshold for Jammu & Kashmir and Uttarakhand as Rs.1 crore and must register under the GST composition scheme.Conditions for Availing Composition Scheme

The following conditions must be satisfied to avail of this composition levy scheme.- The applicant availing for the GST Composition Scheme must have GST registration.

- No Input Tax Credit can be claimed by a dealer opting for composition scheme

- A person must not be an NRI taxable individual or a casual taxable individual

- The taxpayer cannot make any inter-state purchases or supply of goods from a branch located outside the state.

- The dealer cannot supply GST exempted goods.

- The taxpayer has to pay tax at normal rates for transactions under the Reverse Charge Mechanism.

- If a taxable person has different segments of businesses (such as textiles, electronic accessories, groceries, etc.) under the same PAN, they must register all such businesses under the scheme collectively or opt-out of the scheme.

- The taxpayer has to mention the words ‘composition taxable person’ on every notice or signboard displayed prominently at their place of business.

- In addition, the taxpayer has to mention the words ‘composition taxable person’ on every signboard, notice, and bill of supply issued and not a tax invoice.

- Those supplying goods can then provide services of up to Rs.5 lakh,

Composition Scheme Rules under GST – Compliance

The submission of various forms under the Composition Scheme Rules is meant for specific reasons. The list of forms under Composition Scheme Rules with the purposes and due dates are tabulated below for the reference.| S.No. | Forms to be Filed | Description | Due Date |

| 1 | Form GST CMP 01 | Intimation of willingness to opt for the scheme | Within 30 days |

| 2 | Form GST CMP 02 | Information pertaining to stock and inward supplies from unregistered individuals | Prior to the commencement of the Financial year |

| 3 | Form GST CMP 03 | Intimation of withdrawal from the scheme | Within 60 days of the exercise of an option |

| 4 | Form GST CMP 04 | Show-cause notice on contravention of the Act or rules by the proper officer | Within seven days of the occurrence of the event |

| 5 | Form GST CMP 05 | The replies to show cause notice | On contravention |

| 6 | Form GST CMP 06 | An issue of order | Within 15 days |

| 7 | Form GST CMP 07 | Registration under the Composition Scheme | Within 30 days |

| 8 | Form GST REG 01 | Information of inputs in the stocks finished or semi-finished goods | Prior to the appointed date |

| 9 | Form GST ITC 01 | Intimation of ITC available | Within 30 days of the option withdrawn |

| 10 | Form GST ITC 13 | Intimation of willingness to opt for the scheme | Within 60 days of the commencement of the Financial year |

Validity of Composition Levy

The validity of the composition scheme will depend upon the option exercised by a taxable person to pay tax to remain valid so long as all the conditions are fulfilled as specified in the law. However, individuals who are eligible for the scheme can choose to opt-out of it by simply filing an application.Online Application Procedure for GST Composition Levy

The taxpayers must follow the below steps to Opt for the Composition Levy on the GST Portal:Visit GST Portal

Step 1: Firstly, the taxpayers have to visit the Goods and Services Tax portal to Opt for the Composition Levy online. Step 2: The applicant shall click on the New Registration under the services tab that is visible on the home page. The following application procedure is of two parts:

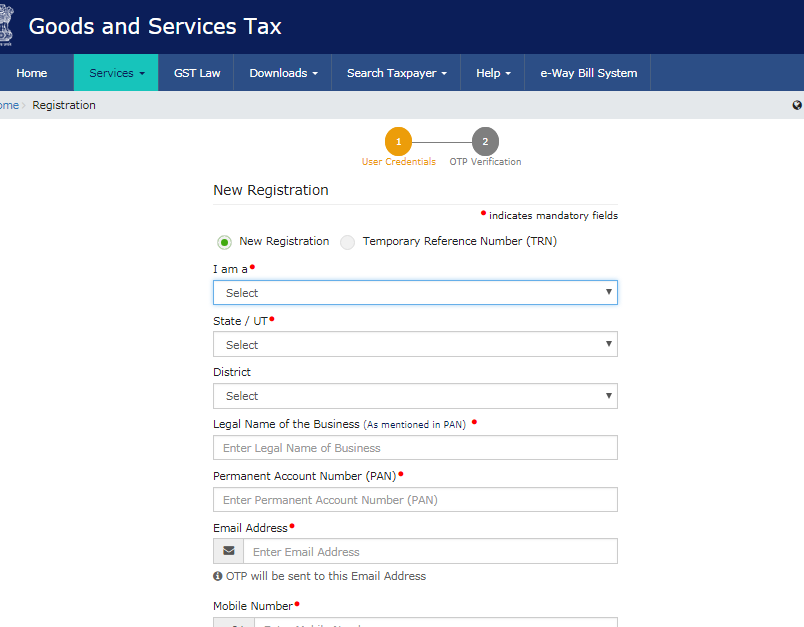

Step 2: The applicant shall click on the New Registration under the services tab that is visible on the home page. The following application procedure is of two parts:

- New Registration and

- Temporary Reference Number (TRN)

Step 3 - GST Composition Levy Scheme

Step 3 - GST Composition Levy Scheme

- Then the applicant shall the type of taxpayer from the drop-down list,

- Select the state and district for which the registration is required,

- Provide a legal business or entity name as mentioned in the PAN database,

- After providing the name, enter the PAN of the Proprietor or PAN of the business,

- Provide the email address and valid mobile number of the Primary Authorized Signatory,

- An OTP will be sent to the registered for mobile number and email address for the verification process as well as

- Enter the OTP and captcha given. Then click on the Proceed button.

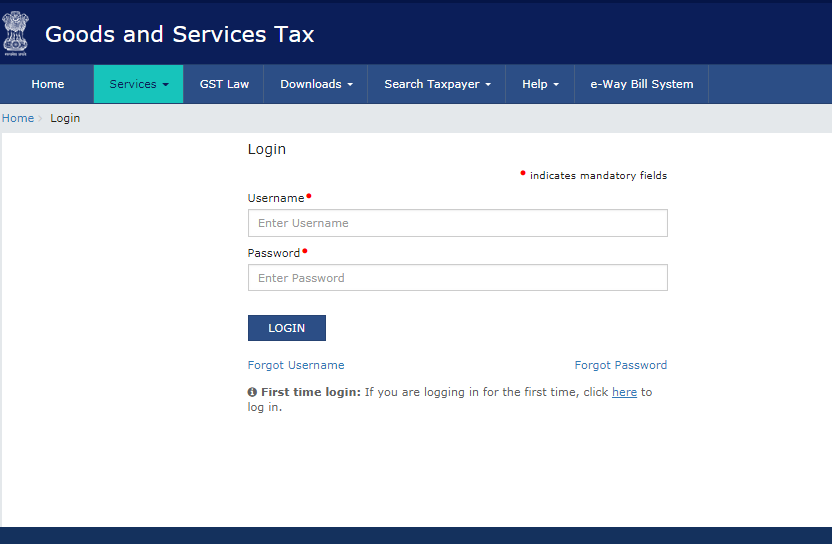

Login into Portal

Step 4: Click on the ‘Login’ button to access the username and password page. Step 5: Enter the correct ‘Username’ and ‘Password’ credentials along with the captcha in the required field and then click ‘login.’

Step 5: Enter the correct ‘Username’ and ‘Password’ credentials along with the captcha in the required field and then click ‘login.’

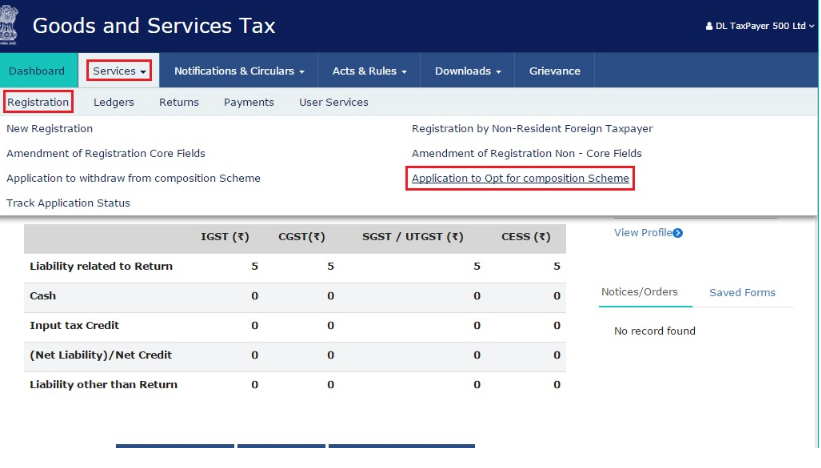

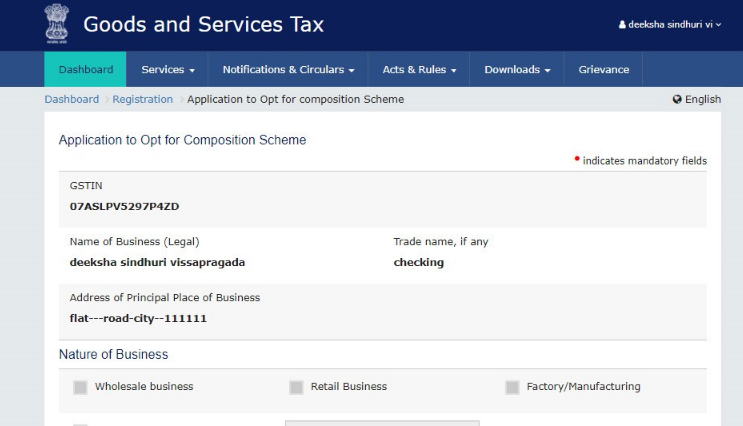

Application to Opt for Composition Levy

Step 6: After logging in, the applicant shall then select ‘Application to Opt for Composition Levy’ from the Registration Menu under the service tab that is visible on the home page. Step 7: The page shall redirect to the new page, where the Application to Opt for Composition Levy page will be displayed with the following details:

Step 7: The page shall redirect to the new page, where the Application to Opt for Composition Levy page will be displayed with the following details:

- GSTIN

- Legal Name of Business

- Trade Name (if any) as well as

- Address of Principal Place of Business

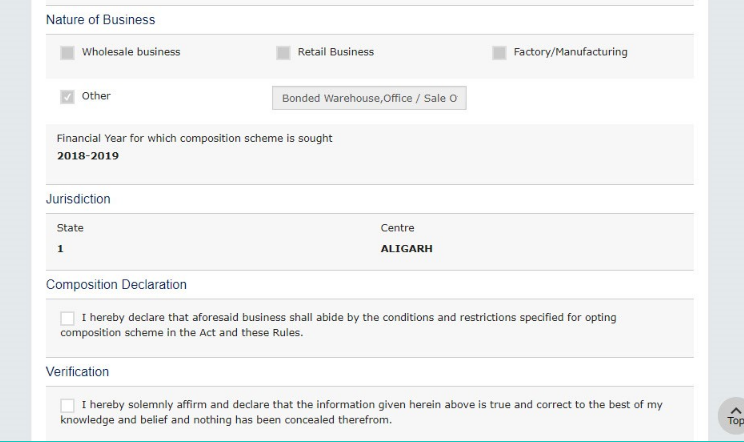

Step 8: Below these details, the Nature of business and Jurisdiction will be listed, as shown below:

Step 8: Below these details, the Nature of business and Jurisdiction will be listed, as shown below:

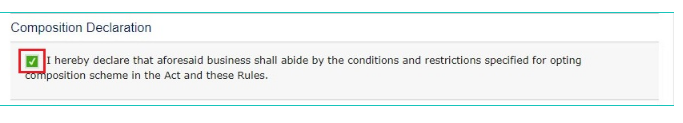

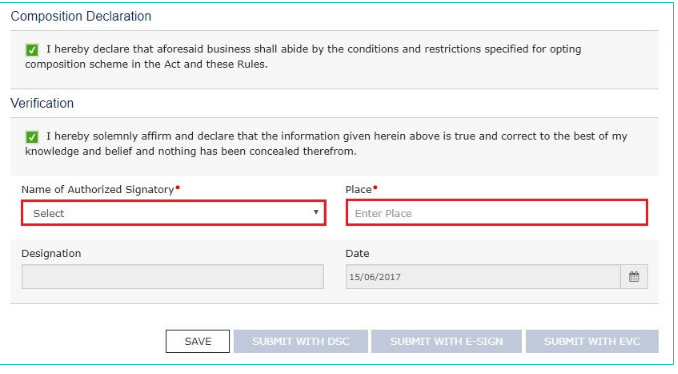

Step 9: Below these details, the page shall exhibit the Composition Declaration. The applicant must then check to pledge to abide by the rules and conditions for the Taxpayers who are under the Composition Levy.

Step 9: Below these details, the page shall exhibit the Composition Declaration. The applicant must then check to pledge to abide by the rules and conditions for the Taxpayers who are under the Composition Levy.

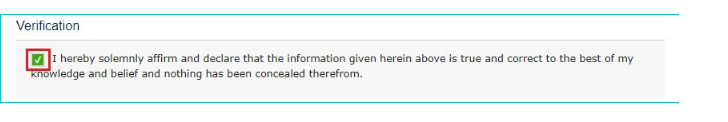

Verification Process

Step 10: Before submitting the application, the applicant must also check the box for the Verification process (below the Composition Declaration) that states that all the information given is true and that nothing has been concealed from the authority. Step 11: Finally, the applicant shall select the Authorized Signatory from the drop-down menu.

Step 12: Enter the place where the application is filed in the Place field.

Step 13: Click the ‘save’ button to save the application form and retrieve it later.

Step 11: Finally, the applicant shall select the Authorized Signatory from the drop-down menu.

Step 12: Enter the place where the application is filed in the Place field.

Step 13: Click the ‘save’ button to save the application form and retrieve it later.

Submit the Application

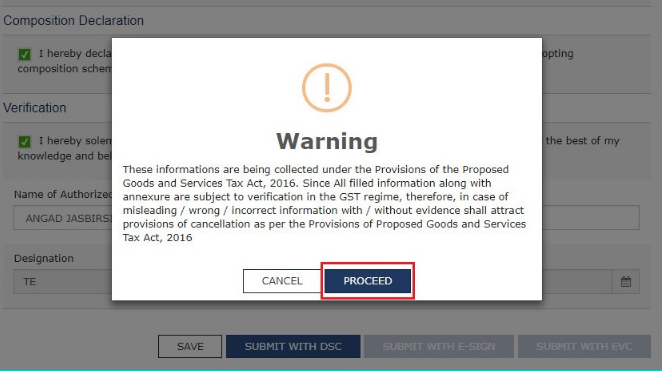

Step 14: The options to submit the form gets activated after selecting the Authorized Signatory and the Place. Step 15: Sign the form by using either the Digital Signature Certificate (DSC) or the EVC option. On selecting any of these options below, the applicant shall then receive an OTP.Using DSC Option

Step 16: If using a DSC, the applicant will be required to select the registered DSC from the emSigner pop-up screen and then proceed from there accordingly.Using EVC Option

Step 17: Enter the OTP and then click on the Validate OTP button. Step 18: The page will display a prompt to confirm the action. Click on Proceed to move forward.

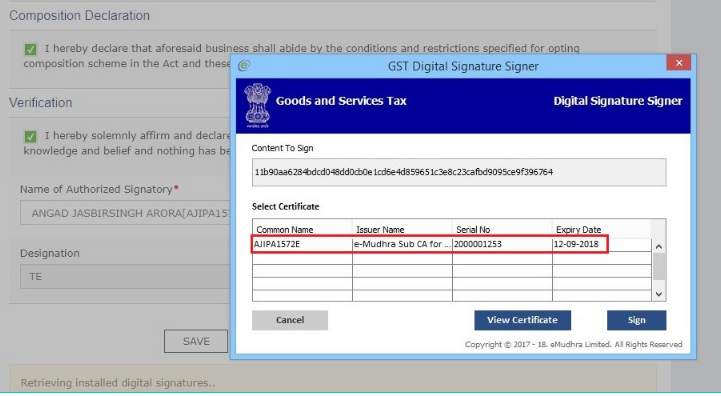

Digital Signature Signer

Step 19: The system retrieves the installed digital signatures available using the emSigner. The applicant shall receive a pop-up message to select the desired DSC. After receiving the pop-up message, select the desired signature to receive the confirmation message. [caption id="attachment_65004" align="alignleft" width="721"] Step 19 - GST Composition Levy Scheme

Step 19 - GST Composition Levy Scheme

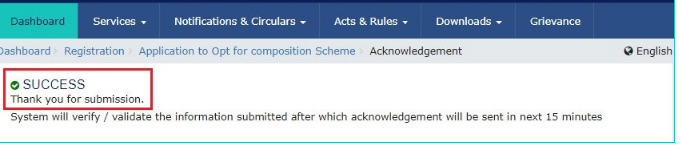

Acknowledgement Message

Step 20: On successfully filing the application for cancellation of registration, the system shall then generate the ARN and display a confirmation message. Step 21: GST Portal also sends a confirmation message to the registered mobile phone number and email. Step 22: On successfully filing the application to Opt for the Composition Levy, the system generates the ARN for the work item. The ARN shall generate and sends the link to the registered email and SMS within the next 15 minutes.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...