Updated on: February 27th, 2020 5:04 PM

Updated on: February 27th, 2020 5:04 PM

GST Composition Scheme for Restaurants

The GST Composition Scheme provides an easy and simple method for businesses to maintain GST compliance. Small businesses registered under the GST composition scheme can pay tax at a prescribed percentage of turnover every quarter and file quarterly GST returns. Thus small businesses registered under the Composition scheme will not be required to file monthly GST returns or remit monthly GST payments. In this article, we look at the applicability of GST composition scheme for restaurants in detail.Composition Scheme Registration for Restaurants

Restaurants whose turnover is up to Rs.150 lakhs per year are eligible to be registered under the GST composition scheme. In case of restaurants in the following states, restaurants with a turnover of up to Rs.75 lakhs can be registered under the GST composition scheme:- Arunachal Pradesh

- Assam

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Sikkim

- Tripura

- Himachal Pradesh

- The restaurant cannot be classified as a casual taxable person, i.e., cannot be a temporary or seasonal restaurant.

- In case the restaurant purchased any goods or services from an unregistered supplier, then the restaurant must have paid GST on reverse charge basis.

- Restaurant cannot make any inter-State outward supplies of goods.

- Restaurant cannot make any supply of goods through an electronic commerce operator who is required to collect tax at source.

- No restaurant shall manufacture the following goods:

- Ice cream and other edible ice, whether or not containing cocoa

- Pan masala

- Tobacco and manufactured tobacco substitutes

GST Payment for Restaurants

Restaurants registered under the GST composition scheme will have to pay GST at the rate of 5% of aggregate turnover, divided into 2.5% as SGST and 2.5% as CGST. For computing the aggregate turnover, the procedure shall include the value of all taxable supplies, exempt supplies and exports made by all persons with the same PAN, but excludes inward supplies under reverse charge as well as central, State/Union Territory and Integrated taxes and cess. Know the GST rate for restaurant and Hotel services. Further, restaurants registered under composition scheme need to ensure that GST is paid on reverse charge basis on any goods or services from an unregistered supplier. The recipient shall hold responsibility for the payment of GST, in a reverse charge.GST Invoice for Restaurants

Restaurants registered under the GST composition scheme will not be able to issue a GST tax invoice or collect GST. Instead, restaurants registered under composition scheme will have to issue a bill of supply. In a Bill of Supply, the only rate per quantity, quantity and the taxable value is specified. Further, restaurants registered under the Composition scheme must mention the words “composition taxable person, not eligible to collect tax on supplies” at the top of the bill of supply. Know more about GST invoice format.GST Return Filing for Restaurants

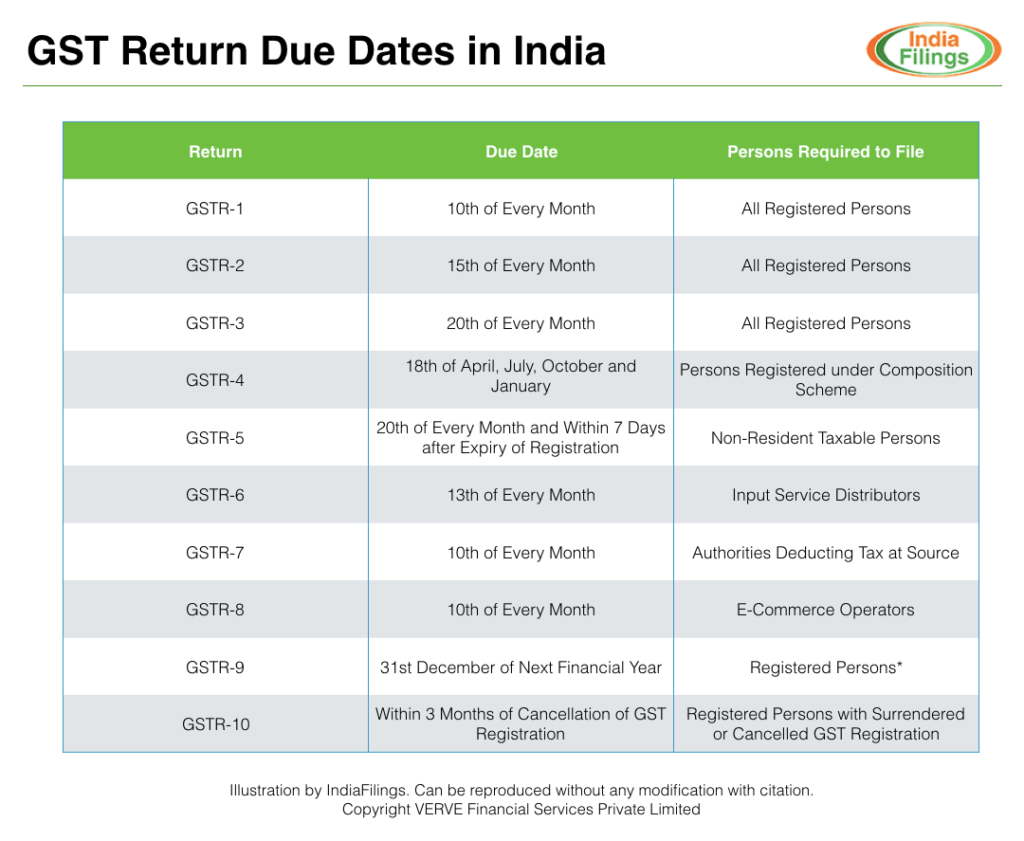

Restaurants NOT registered under the GST composition scheme will have to file monthly GST returns. On the other hand, restaurants registered under the composition scheme will have to electronically file quarterly returns in Form GSTR-4 on the GSTN common portal by the 18th of the month succeeding the quarter. For example return in respect of supplies made from October 2017 to December 2017 is required to be filed by 18th January 2018. Click here to read on Procedure and format for filing GSTR 4. Also, restaurants opting to pay tax under the composition scheme will not be eligible to take an input tax credit on input supplies. Hence, before switching or opting for the composition scheme, it is recommended that restaurant owners conduct a GST impact analysis for their business. GST Return Filing Due Dates

GST Return Filing Due Dates

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...