Last updated: November 14th, 2024 10:36 AM

Last updated: November 14th, 2024 10:36 AM

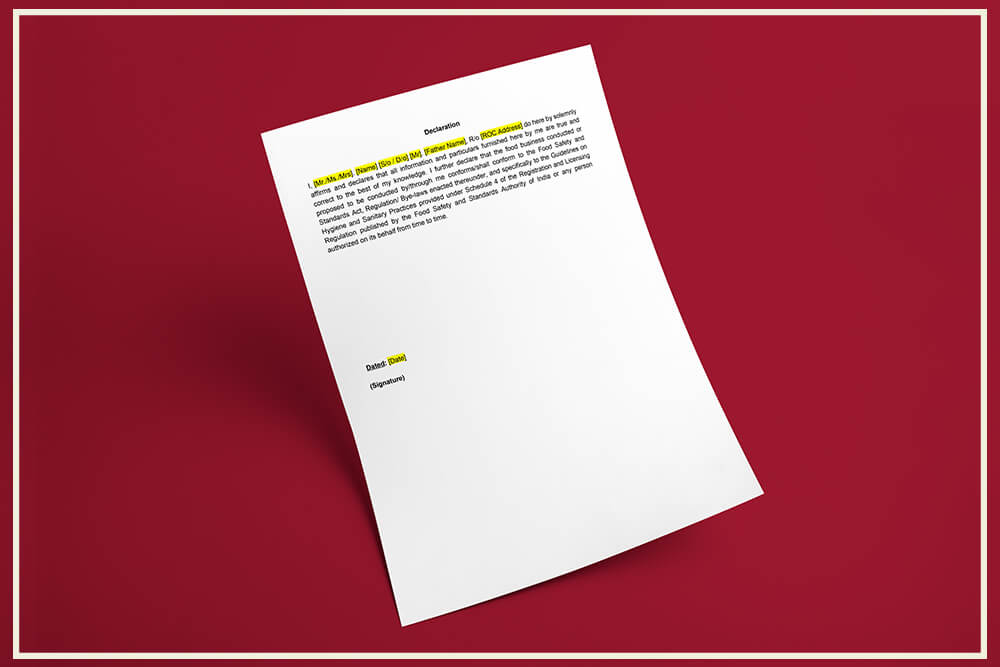

GST Declaration Format

GST or Goods and Services Tax is an indirect tax applicable on all goods and services sold in India. Businesses having an annual turnover of over Rs. 10 lakh in North-Eastern and Hill States and businesses having an annual turnover of over Rs.20 lakhs in all other States are required to obtain GST registration. Along with a GST Registration application, a GST Declaration approving the authorised signatory must be signed and submitted.Download GST declaration Letter Format

You can also download the GST declaration letter format in the following formats.Reason for Signing

GST Declaration for Authorised Signatory is a document signed by the promoters of a business, authorising and nominating one person from the business as an Authorised Signatory to apply for GST registration and complete all related formalities. This format of declaration must be used by all types of applicants like Proprietorship, Partnership Firm, LLP, Company, Trust, Society, etc., Through this document, businesses containing multiple Managing Directors or Partners or Officers, declare one person as an authorised signatory and agree that all actions of the authorised signatory would be binding on the business. In case of proprietorship firms or small businesses, the Proprietor or Sole Promoter can nominate him/herself as authorised signatory as well. In case of company, partnership firm, LLP, etc., a promoter of the business or officer or any other person in the business can be nominated as an authorised signatory.Drafting GST Declaration

You can quickly create a GST declaration using the IndiaFilings Live Edit Feature in less than 2 minutes. Once the document is created, print the declaration on letterhead of the business. The promoters of the business must then sign the document along with the authorised signatory. Once the document is signed and dated, the seal of the business must be placed on the document.Submitting GST Declaration

Completed GST declaration must be uploaded in PDF or JPG format along with the GST registration application on the GST Common Portal. If the document and application is seen fit by the verifying officer, GST registration would be approved.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...