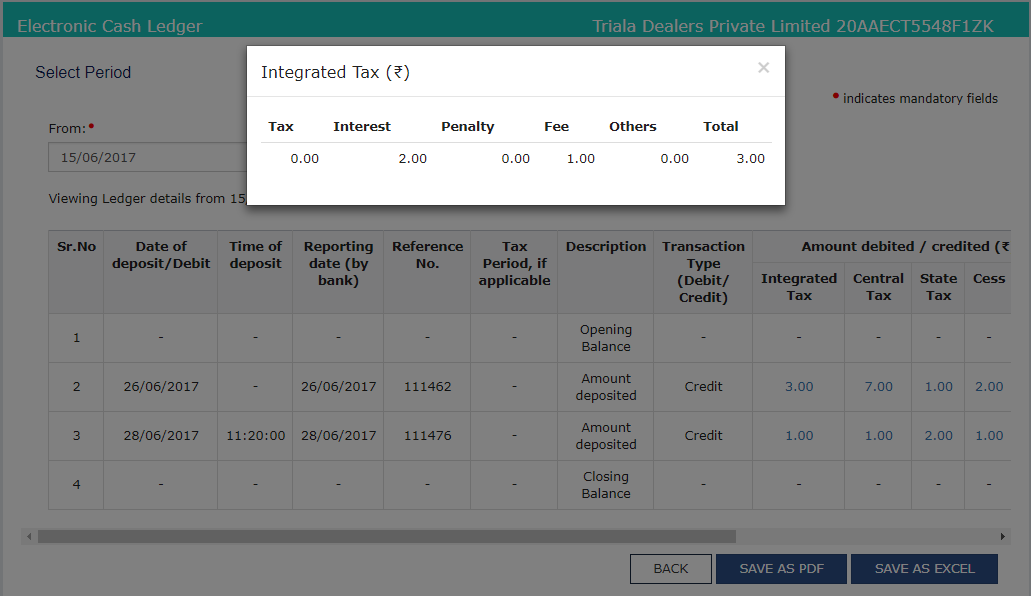

- By clicking the ‘Save as PDF’ button, the Electronic Cash Ledger is saved in the PDF format.

- By clicking the ‘Save as Excel’ button, the Electronic Cash Ledger is saved in the excel format.

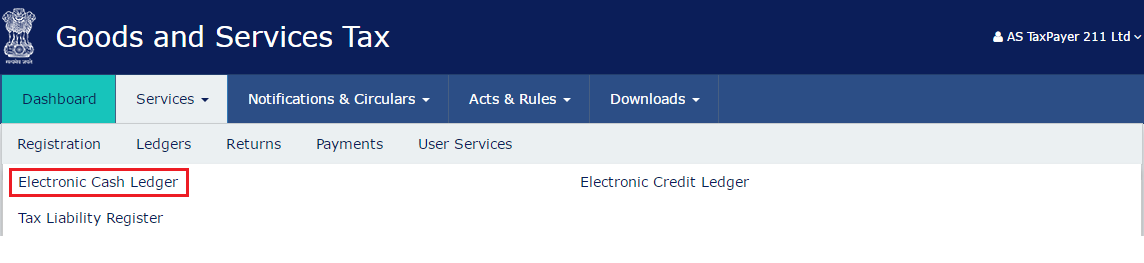

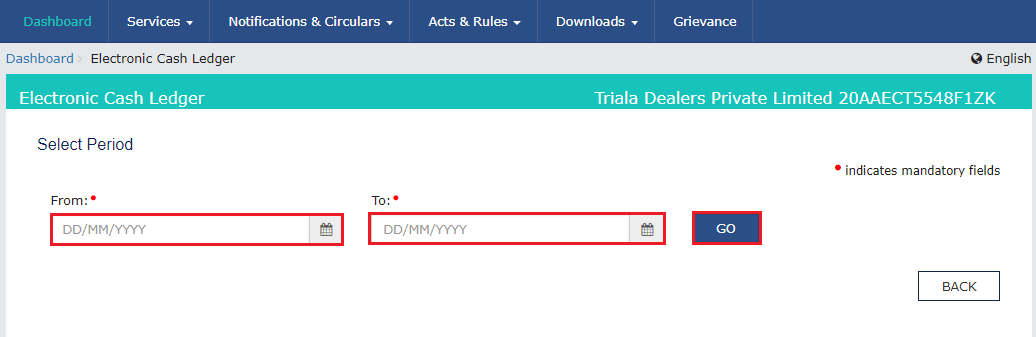

Viewing Details of Transactions

The taxpayer can view the details of the transactions that are made in the Electronic Cash Ledger for a specific duration. This option is available on the landing page of the Electronic Cash Ledger. A maximum of six months transactions can be viewed at a time.Deposit Update in the Cash Ledger

Once the payment is done, the deposit update in the cash ledger will be made as given below.| Mode of Payment | Deposit update in the Cash Ledger |

| Online payment by net banking in authorized Banks | On receipt of CIN from the bank. It is usually shared by the bank instantly but at times there may be a delay. |

| OTC payment made by cash and self-bank cheque in authorized banks | On receipt of CIN from the bank. It is usually shared by the bank instantly on receipt of cash or realization of cheque but sometimes there may be a delay |

| OTC payment made through other bank cheques of the same station in authorized Banks | On receipt of CIN from the bank. In the case of cheques Banks are given 90 days’ time period to share the CIN details |

| OTC payment made through other outstation bank cheques in authorized Banks | On receipt of CIN from the bank. In the case of cheques Banks are given 90 days’ time period to share the CIN details |

| Online NEFT/RTGS payments made through non-authorized but recognized Banks | As soon as RBI shares CIN details. Usually can be on the same day. |

| Over the counter NEFT/RTGS payments made through non-authorized Banks | As soon as RBI shares CIN details. Usually can be on the same day. |

| Payment through Credit Card/Debit Card | After 24 hours of Payment. But once the amount is debited and Payment Gateway confirms the receipt of the amount, Banks are given 45 days time to confirm the payment and then the cash ledger will be updated after final confirmation from the bank. |