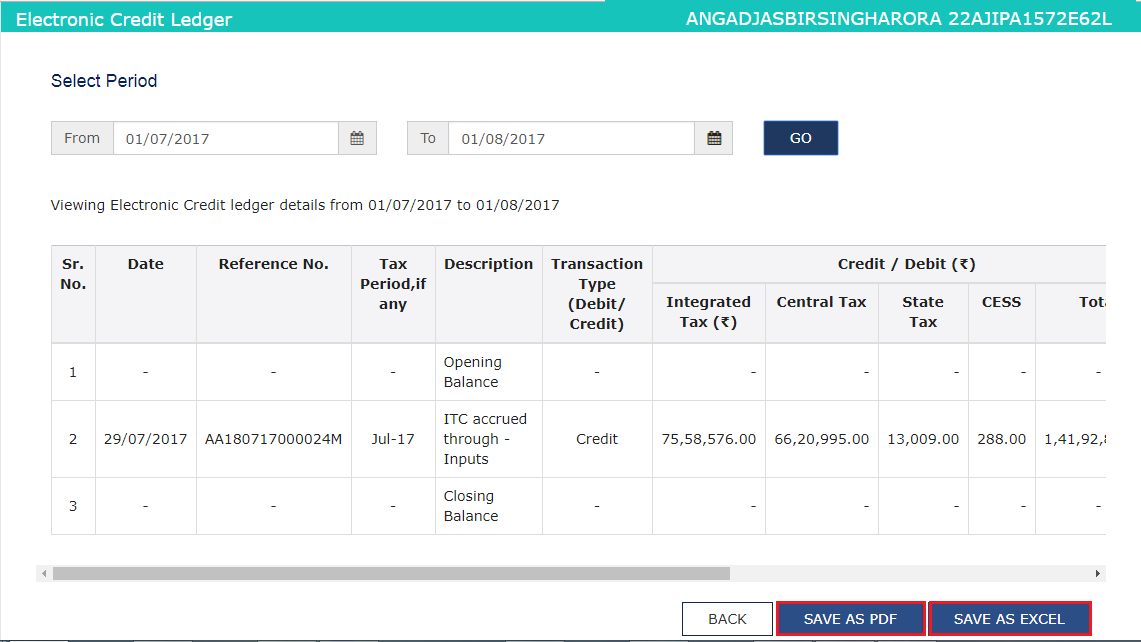

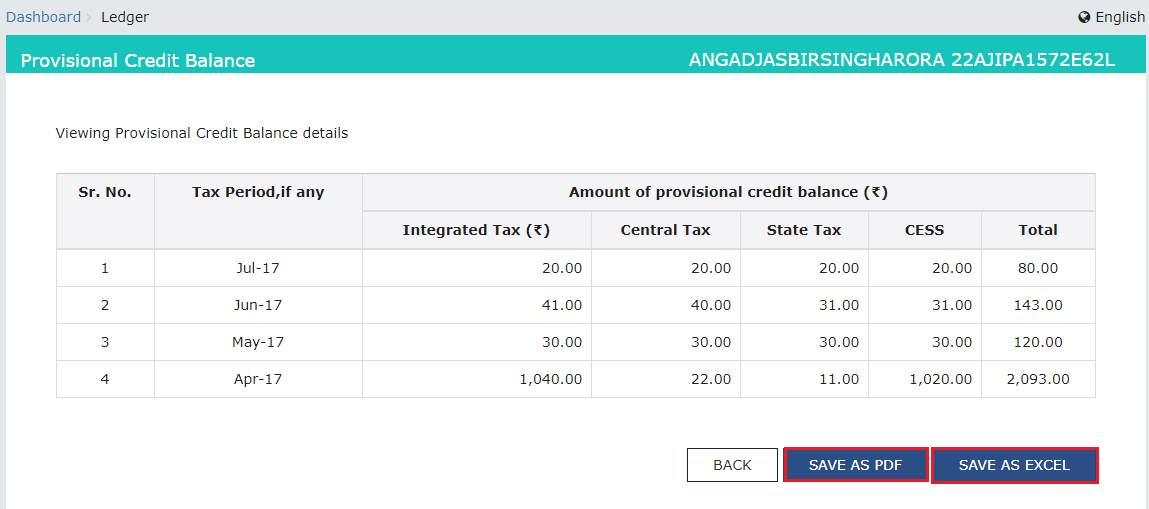

- By clicking the ‘Save as PDF’ button, the Portal saves the Provisional Credit Balance file in the PDF format.

- By clicking the ‘Save as Excel’ button, the Portal saves the Provisional Credit Balance file in the excel format.

Blocked Credit Balance

For authentication purposes, a Jurisdiction Officer can examine the ITC's amount claimed by the taxpayer through GST TRAN-1, GST TRAN-2 and other related forms. The concerned Jurisdiction Officer decides to temporarily block the ITC that is available to a taxpayer when there is a requirement of further investigation in the revenue. The officer may completely or partly block CGST, SGST, IGST and Cess balance. After the investigation, the concerned officer unblocks the ITC that was previously blocked. The taxpayer will be notified through an email and SMS while blocking and unblocking of ITC.Viewing Blocked Credit Balance

The taxpayer shall use the following procedure to view Blocked Credit Balance: Step 1: Log in to the Portal The taxpayer has to login to the official GST Portal. Step 2: Enter the Details The taxpayer has to enter the username and password. Step 3: Click Electronic Credit Ledger From the ‘Services’ tab, click ‘Ledgers’ and then select ‘Electronic Credit Ledger’ command. Step 4: Click Blocked Credit Balance The taxpayer has to click the ‘Blocked Credit Balance’ link. The Portal displays the Blocked Credit Balance on the screen. Step 5: Click Save The taxpayer has to either click on ‘Save as PDF’ or ‘Save as Excel’ button to save the Blocked Credit Balance.- By clicking the ‘Save as PDF’ button, the Portal saves the Blocked Credit Balance file in the PDF format.

- By clicking the ‘Save as Excel’ button, the Portal saves the Blocked Credit Balance file in the excel format.