Last updated: December 17th, 2024 11:28 AM

Last updated: December 17th, 2024 11:28 AM

GST Estimate Format

The GST Estimate format depicts the overall price value for the goods or service received or required. The supplier providing the goods or services provides the estimates to a customer before beginning supply or receiving payment. Once a tax invoice is issued, the supplier becomes liable for payment of GST, irrespective of receiving payment from the customer. Hence, issuing an estimate by the supplier after staring the supply or after receiving the payment from the customer is more advisable. For all other cases, an estimate or quote can be submitted to the customer. In this article, we look at the process for issuing a GST estimate along with GST estimate format.How to Create an Estimate?

You can easily create a GST ready estimate using LEDGERS software by following the following steps:- Login to your LEDGERS account. You can log in using this link.

- Once you have logged in to your account, select the business you would like to create an estimate.

- Go to Sales -> Create Estimate.

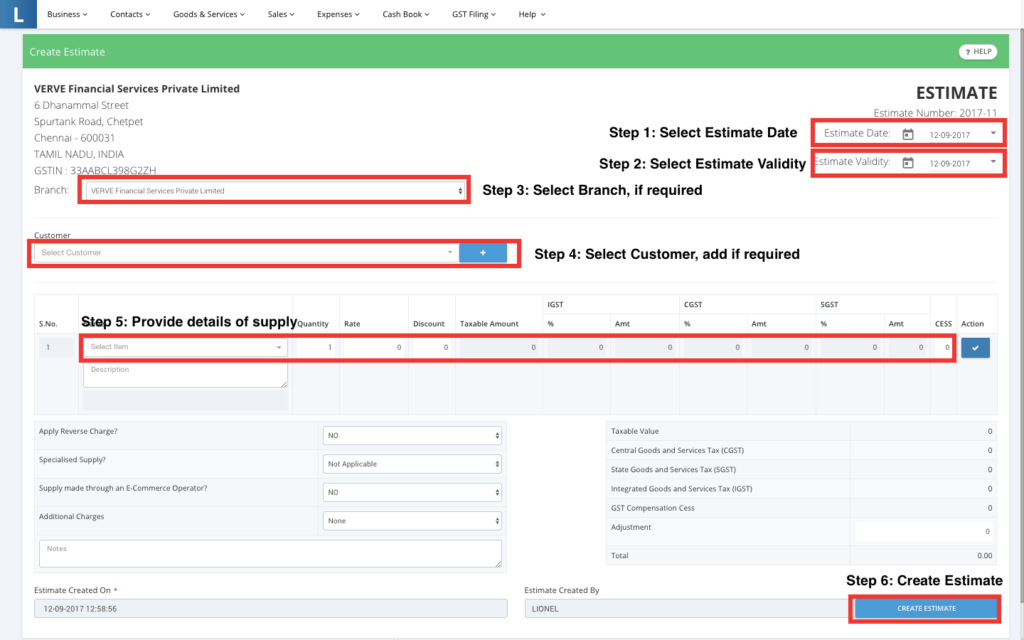

Creating a GST Estimate on LEDGERS GST Software

Creating a GST Estimate on LEDGERS GST Software

Estimate vs Invoice

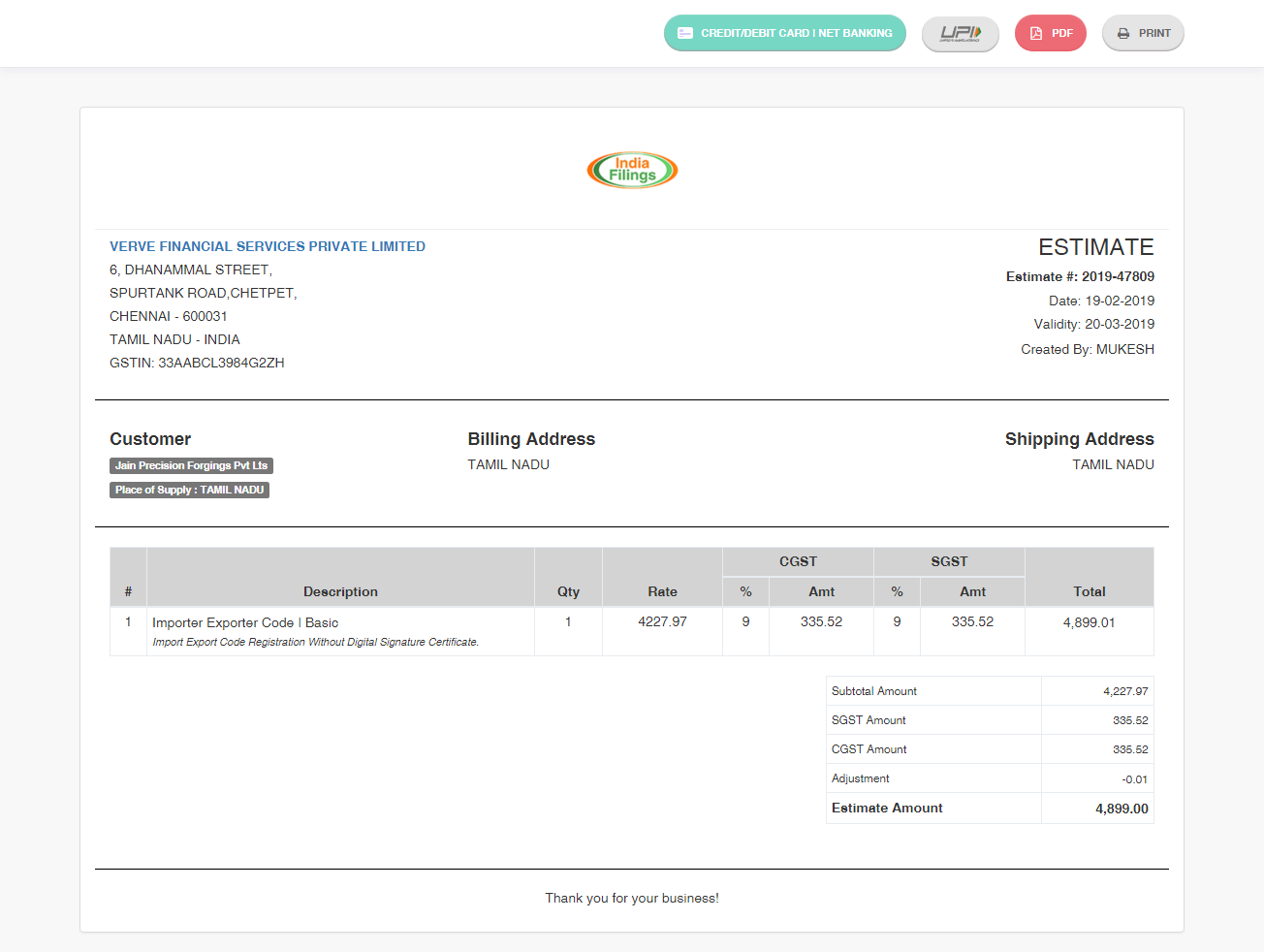

The supplier shall provide the estimate before creating the invoice for the said ordered products. An estimate shall apply when the customer fails to receive the payment and the customer yet to receive the goods or services as ordered. Hence, if the supplier creates an invoice, the liability to pay GST arises on the business, irrespective of the status of payment by the customer. Therefore, the supplier shall create the estimate as a pre-cursor to GST invoice, before payment or start of supply of goods or service. Also read: Guide to GST Invoices.Sample GST Estimate Created Using LEDGERS

A sample GST estimate created using LEDGERS GST software is shown below:

Video Guide to Creating GST Estimate

You can refer to the following video guide for creating a GST estimate using LEDGERS GST software.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...