Last updated: February 13th, 2020 11:46 AM

Last updated: February 13th, 2020 11:46 AM

GST e-Way Bill

GST e-Way Bill is a new methodology for tracking of goods in transit introduced under the Goods and Services Tax. Any taxable person registered under GST and causing movement of goods of consignment with a value of over Rs.50,000 is required to generate a GST e-Way Bill from the GST Common Portal. In this article we look at all aspects of a GST e-Way Bill in India.What is GST e-Way Bill?

GST e-Way Bill is a document issued under the GST Act for any transfer of goods of consignment with a value of over Rs.50,000. Any person having a GST registration and causing movement of goods of consignment for any of the following reasons is required to generate a GST e-Way Bill:- In relation to a supply; or

- If a taxable person under GST supplies any goods and the value of the consignment is over Rs.50,000, a GST e-Way Bill would have to be generated.

- Reasons other than supply;

- If a taxable person under GST transfers goods located in one godown to another and the value of the consignment is over Rs.50,000, a GST e-Way Bill need to be generated.

- Due to inward supply from an unregistered person.

- If a taxable person under GST purchases any goods from an unregistered person under GST and the value of the consignment is over Rs.50,000 a GST e-Way Bill should be generated.

Who can Generate GST e-Way Bill?

GST e-Way Bill can be generated by a taxable person registered under GST or a transporter or a person not registered under GST using the GST Common Portal.For GST Registration Holders

If a taxable person is registered under GST wants to transport goods using own vehicle or hired vehicle as a supplier or to be received in the course of business as a recipient, the taxable person can generate a e-Way Bill in Form GST INS-1 electronically on the GST Common Portal by providing information requested in Part B of FORM GST INS-01.For Transfer through Transporters

If a transporter is involved in the transfer of Goods, then the taxable person registered under GST must furnish information about the consignment in Part B of FORM GST INS-01 on the GST Common Portal. Using this information, the transporter would then generate a e-Way Bill on the basis of the information provided by the taxable person in Part A of FORM GST INS-01. Transporters are allowed to generate and carry e-way bill even if the value of the consignment is less than Rs.50,000.For Transport by Unregistered Persons

Finally, any unregistered person transferring goods to a taxable person under GST can also generate e-way bill in FORM GST INS-01 on the GST Common Portal. Know more about e-way bill applicability.How to Generate GST e-Way Bill or EBN?

GST e-Way Bill can be generated on the GST Common Portal by a taxable person registered under GST or an unregistered person or a transporter. On submission of the necessary documents on the GST Common Portal in FORM GST INS-01, a unique e-way bill number (EBN) would be provided to the supplier, the recipient and the transporter. Any registered taxable person would be intimated about the issue of a GST e-Way Bill or EBN on the common portal. The registered taxable person would have the option to accept or reject the consignment covered by the e-way bill. If a taxable person registered under GST does not communicate acceptance or rejection within 3 days of the details being made available on the GST Common Portal, then the GST e-Way Bill would be considered as accepted. Finally, all accepted GST e-Way Bill would be reconciled automatically on GSTR-1 during the filing of monthly GST Returns. If an unregistered person generated a GST e-Way Bill, then the status of the e-Way Bill would be updated to the registered mobile number or email of the unregistered person. Procedure for generating e-way bill:Validity of GST e-Way Bill

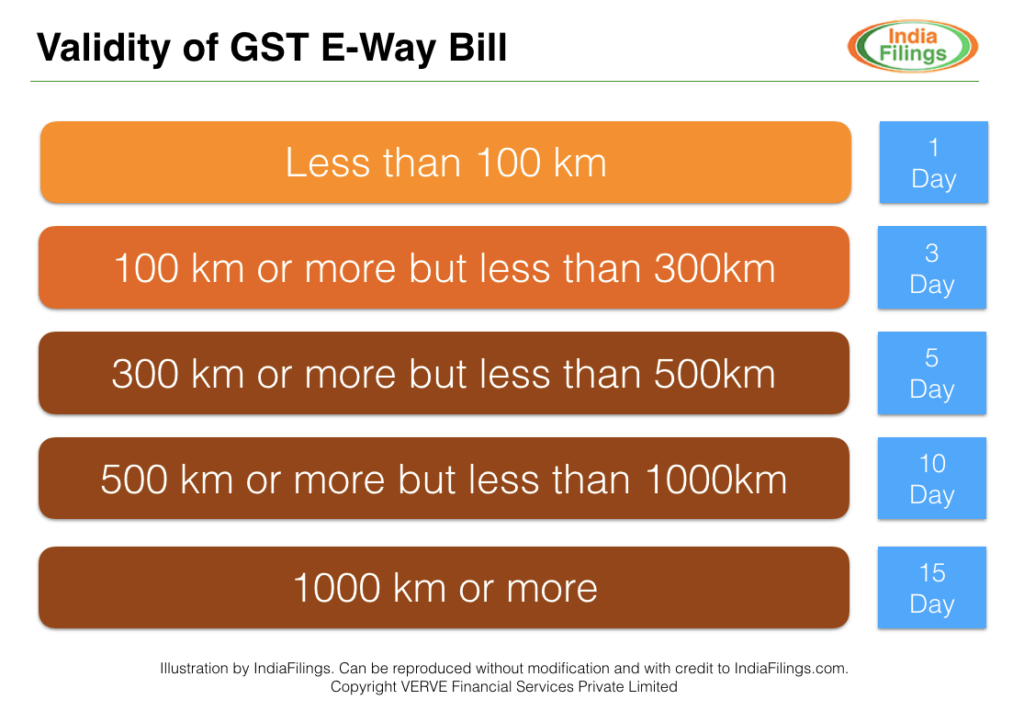

The validity of a GST e-Way bill is dependent on the distance the goods have to be transporters. For example, a GST e-way bill generated for transportation of goods for less than 100 kilometers are valid for a period of 1 day. The following table shows the validity of GST bills along with the distance mentioned on the GST e-way bill. Validity of GST e-Way Bill

Validity of GST e-Way Bill

Cancelling a GST e-Way Bill

Once a GST e-Way Bill is generated but goods were not transported or are not being transported, then the GST e-way bill can be cancelled through the GST portal or through a GST Facilitation Centre within 24 hours of generation of the e-way bill.Why GST e-Way Bill is Required?

The tracking of movement and storage of goods is key to reduce tax revenue leakage for the Government and reducing black-market products. Hence, registration under GST has been made mandatory for all transporters, godowns and warehouses. To track goods in transit, the GST e-way bill mechanism has been introduced by the Government. Thus, any transporter transferring goods is required to generate a new e-way bill on the common portal in FORM GST INS-01 specifying details and mode of transport.Documents Required for Transport under GST

In addition to the GST e-Way Bill, a person in-charge of conveyance of goods is required to carry the following documents for inspection by authorities at any time:- Invoice or bill of supply or delivery challan and invoice reference number from the GST common portal, obtained by uploading a copy of the GST tax invoice issued in FORM GST INV-1.

- Copy of the e-way bill or the e-way bill number, either physically or mapped to a Radio Frequency Identification Device (RFID) embedded on to the vehicle. in such manner as may be notified by the Commissioner.

Amendments to e-Way Bill Rules

e-way bill rules are governed by rule 138 of the CGST Rules, 2017. Government has undergone various amendments in the said rules from time to time, however, vide notification no. 12/2018-Central tax dated 7th March, 2018 issued by the Central Board of Excise and Customs the entire rule 138 of the CGST Rules, 2017 has been substituted. The following are the highlights of the major amendments made to the e-way bill mechanism through notification no. 12/2018-Central Tax dated 7th March, 2018:e-way bill generation in case of job work

Where the goods are sent by a principal located in one state or union territory to a job worker located in any other state or union territory, the e-way bill shall be generated either by the principal or the registered job worker, irrespective of the value of the consignment. Please note earlier only principal had the liability to generate e-way bill, however, after amendment, either principal or the registered job worker can generate e-way bill.Good transport by registered person as consignor

Procedure to be followed when goods are transported by registered person as a consignor or the recipient of supply as the consignee, by road, by railway, by air or by vessel:When goods are transported by road:

When a registered person undertakes transportation of goods as a consignor or the recipient of supply as consignee, the said person is required to generate the e-way bill in Form GST EWB-01 electronically on the common portal after furnishing information in Part B of Form GST EWB-01. Above procedure is applicable to transportation that has been undertaken by road through his own conveyance or hired one or a public conveyance.When goods are transported by railways, by air or by vessel:

In case goods are transported by railways or by air or by vessel, the e-way bill shall be generated by the registered person, whether supplier or the recipient. The e-way bill on the common portal is required to be generated either before or after the commencement of movement of goods. The registered person is required to furnish information in part B of Form GST EWB-01. Where goods are transported by railways, the railway authority will not deliver the goods unless the e-way bill required under the rule is produced at the time of delivery.Updating details of conveyance

e-way bill form GST EWB-01 has two parts Part A and Part B. Part A contains details of GSTIN of recipient, place of delivery, invoice / challan number and date, value of goods, HSN Code, Reason for transportation and transport document number etc. On the other hand, Part B contains transportation details like vehicle number etc. When goods are transferred from one conveyance to another, the consignor, the recipient or the transporter has to update the details of conveyance in the e-way bill on the common portal in part B of Form GST EWB-01. However, exception to above rule is that when the goods are transported for a distance upto 50 KMS within the state or union territory from the place of business of the transporter to the place of business of the consignee, the details of conveyance is not compulsorily required to be updated. In order to make updation in part B, the consignor or the recipient, who has furnished the information in Part A of Form GST EWB-01, may assign the e-way bill number to another registered or enrolled transporter so that the transporter can update the details in Part B of Form GST EWB-01.Validity period of e-way bill

The major amendment made effective vide notification no. 12/2018-Central Tax dated 7th March, 2018 is change in validity period of e-way bill. The new validity period provisions of e-way bill are tabulated hereunder:| Distance Travelled | e-way Bill Validity |

| Upto 100 Kms | 1 day in cases other than over dimensional cargo |

| For every 100 Kms or part thereof | 1 additional day in cases other than over dimensional cargo |

| Upto 20 Kms | 1 day in cases of over dimensional cargo |

| For every 20 Kms or part thereof | 1 additional day in cases of over dimensional cargo |

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...