Updated on: December 17th, 2024 11:30 AM

Updated on: December 17th, 2024 11:30 AM

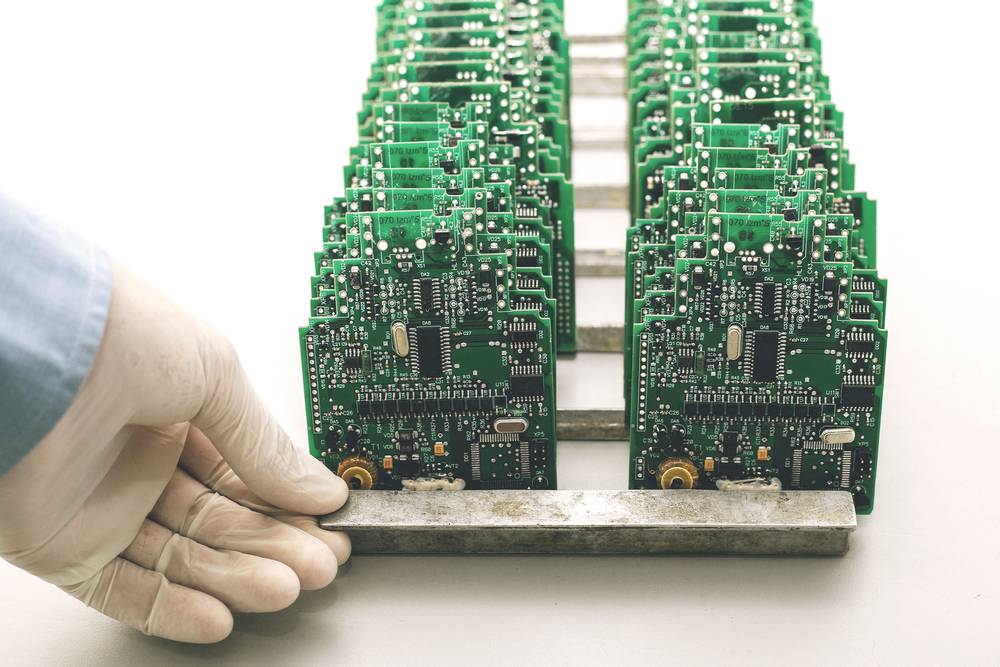

GST for ESDM Industries

Department of Revenue issued a circular clarifying the determination of place of supply of software or design services from a taxable territory to non-taxable territory by Electronics Semi-conductor and Design Manufacturing (ESDM) industries. The circular was released on 11th October 2019 through the circular No. 118/37/2019-GST. The Government of India (GoI) has provided various scheme and incentives to boost the Indian electronics manufacturing sector. The schemes and incentives were provided to increase productivity, increase employment, increase import and export and create competitiveness in the global market. Few schemes announced by the GoI are:- The Modified Special Incentive Package Scheme (MSIPS)

- The Electronic Development Fund (EDF)

- The Electronics Manufacturing Cluster (EMC)

- The location where the business has been established

- The location where the services have been provided or received in case of more than one establishment

- Where the services have been provided or received other than the business establishment

- If the organisation is placed in the taxable territory, the organisation is liable to pay tax

- If both the organisation is outside the taxable territory, GST is not applicable

- As per Chapter V of the Finance Act 1994, the tax shall be applicable to all the states except Jammu and Kashmir

- Non-Taxable territory shall mean that apart from Jammu and Kashmir all the other states shall be liable to pay tax

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...