Last updated: December 17th, 2019 6:58 PM

Last updated: December 17th, 2019 6:58 PM

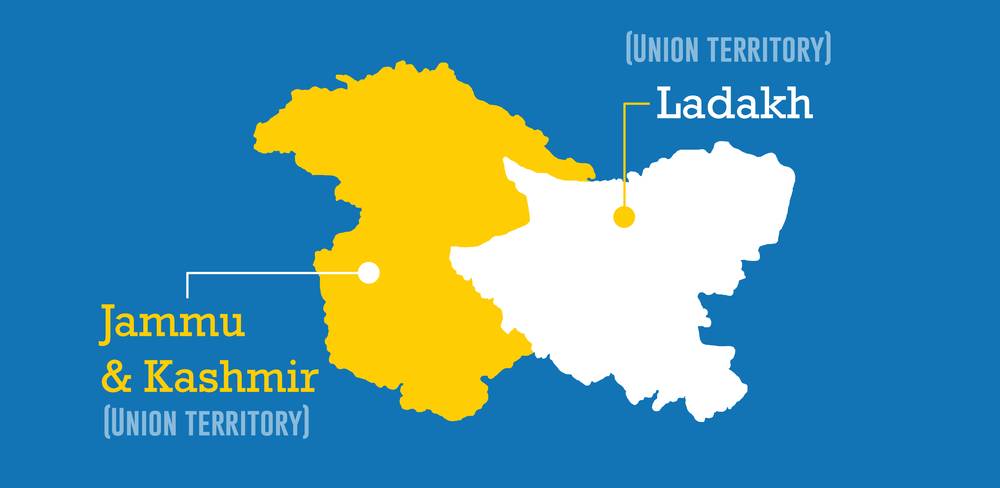

GST for Jammu & Kashmir and Ladakh

On 5th August 2019, the Indian Government withdrew the special status for the State of Jammu & Kashmir which was governed by Article 370 of the constitution of India. Further, the Indian Government, enacted the Jammu & Kashmir Reorganization Act, 2019 on 9th August 2019. However, the Jammu & Kashmir Reorganization Act, 2019 was made effective only on 31st October 2019. As soon as the Jammu & Kashmir Reorganization Act, 2019 was made effective, the State of Jammu & Kashmir got divided into two Union Territory, namely, Union Territory of Jammu & Kashmir and Union Territory of Ladakh. Obviously, with the division of the State of Jammu & Kashmir into two Union Territory, brought along with it lots of confusion with regard to the applicability of GST. Under the present article, we would try and understand the applicability of GST in the newly formed/bifurcated Union Territory of Jammu & Kashmir (Union Territory with legislature) and Union Territory of Ladakh (Union Territory without legislature).Position of GST prior to 31st October 2019

As per Article 279A clause (4) sub-clause (g), the State of Jammu & Kashmir is considered to be a special category state. Section 22 of the Central Goods and Service Tax Act, 2017 requires the taxpayer to obtain GST registration even in case of special category states on crossing the specified threshold limit. However, Explanation (iii) to Section 22 of the Central Goods and Service Act, 2017 excludes the State of Jammu & Kashmir within the term ‘Special Category States’. Thus, it can be concluded that under GST, the State of Jammu & Kashmir is not considered as ‘Special Category States’ and the normal State GST law applies to the same.Position of GST post 31st October 2019

In order to understand the GST position post-implementation of the Jammu & Kashmir Reorganization Act, 2019, it is important to note that post 31st October 2019 the State of Jammu & Kashmir is divided into following:- Union Territory of Jammu & Kashmir (Union Territory with legislature); and

- Union Territory of Ladakh (Union Territory without legislature)

Jammu & Kashmir Re-organization (Removal of Difficulties) Order, 2019

The above-concluded position can also be reconfirmed by going through the Jammu & Kashmir Re-organization (Removal of Difficulties) Order, 2019. In order to overcome the difficulties in implementing the Jammu & Kashmir Reorganization Act, 2019, the Government also notified the Jammu & Kashmir Re-organization (Removal of Difficulties) Order, 2019. Para 7 of the Jammu & Kashmir Re-organization (Removal of Difficulties) Order, 2019 covers the point Goods and Service Tax (GST). The following can be concluded by going through the para 7:- The Jammu & Kashmir Goods and Service Tax Act, 2017 will be applicable to the newly formed Union Territory of Jammu & Kashmir; and

- The Union Territory Goods and Service Tax Act, 2017 will be applicable to the newly formed Union Territory of Ladakh.

Conclusion

The following table clears up the GST position post 31st October 2019|

Situation |

Applicable taxes |

| Inter-State Supply | IGST |

| Intra-State Supply within the union territory of Jammu & Kashmir | CGST and J&K SGST |

| Intra-State Supply within the union territory of Ladakh | CGST and UTGST |

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...