Updated on: December 17th, 2019 5:21 PM

Updated on: December 17th, 2019 5:21 PM

GST Form ITC-01

GST Form ITC-01 is a declaration form that is used to claim the input tax credit. An input tax credit means that a taxpayer can claim the amount that has been already paid as GST while making GST payment to the Government which was collected from the customers.Entitlement of the Form

According to Section 18(1) of the CGST Act 2017, the registered person can claim an input tax credit by filing declaration form GST ITC-01. For inputs in stock as finished, semi-finished or capital goods, the credits can be availed as given below.- For once in a lifetime of the taxpayer, the day before the date of registration, it can be claimed according to Clause (a) or clause(b) of sub-section(1) of Section 18.

- During a financial year, the day before the day from when the taxpayer is liable to pay tax under Section 9, to claim according to Clause(c) of sub-section (1) of Section 18.

- Claims made according to Clause (d) of sub-section (1) of Section 18, all supplies claimed by a registered taxpayer from a day before the date is taxable.

Application Procedure

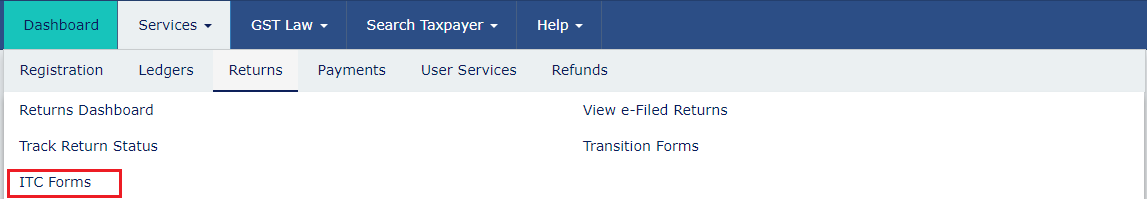

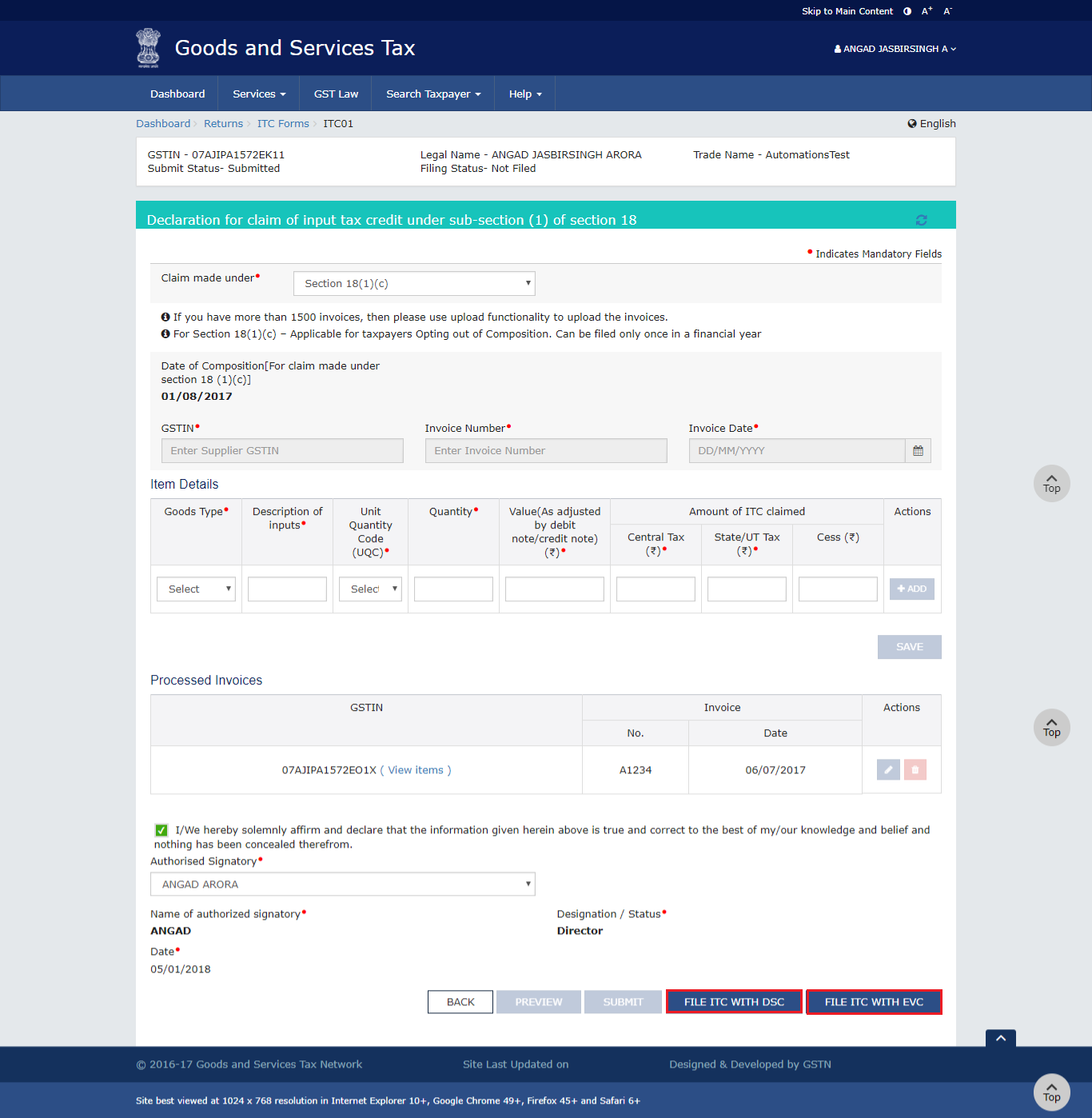

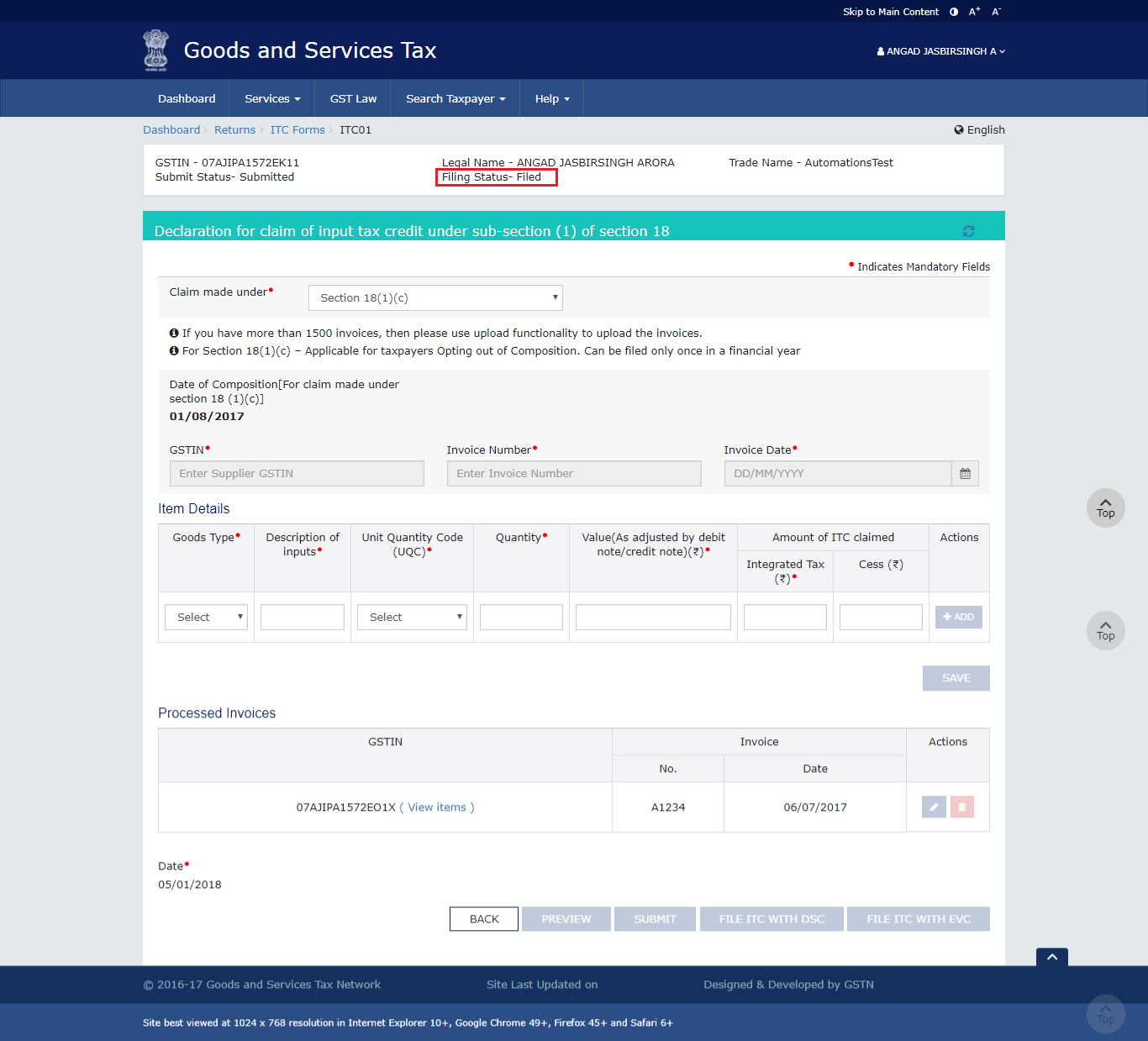

Given below are the steps to declare and file a claim of ITC under Section 18(1)(a) in Form ITC-01. Step 1: Login to the Portal The taxpayer has to login to the official GST Portal. Step 2: Enter the Details The taxpayer has to enter the username and password. Step 3: Click ITC Forms From the ‘Services’ tab, the taxpayer has to select ‘Returns’ and then click on ‘ITC Forms’. The GST ITC Forms page is displayed on the screen.

Updating Certifying Chartered Accountant’s or Cost Accountant’s Details

Once the form is submitted, and if the ITC claimed is more than Rs.2 Lakh, then the taxpayer has to update the Chartered Accountant/ Cost Accountant details.Application Procedure

Given below are the steps to upload the Chartered Accountant/ Cost Accountant certificate on the GST Portal. Step 1: Enter the Name The taxpayer has to enter the name of the firm that issued the certificate in the ‘Name of the Firm Issuing Certificate’ field. Step 2: Enter the Chartered Accountant or Cost Accountant The taxpayer has to enter the name of the Chartered Accountant or Cost Accountant in the ‘Name of the Certifying Chartered Accountant/ Cost Accountant’ field. Step 3: Enter the Membership Number The taxpayer has to enter the membership number of the Chartered Accountant or Cost Accountant in the ‘Membership Number’ field. Step 4: Date of Issuance of Certificate The taxpayer has to select the ‘Date of Issuance of Certificate’ using the calendar. Step 5: Upload the Certificate The taxpayer has to upload the ‘Chartered Accountant or Cost Accountant’ certificate in the JPEG format. The file should not be more than 500 KB. Step 6: Save CA Details The taxpayer has to click ‘Save CS Details’ to save all the details.

Benefits of Filing GST ITC-01

A taxpayer can avail the following benefits by filing GST ITC-01.- The form enables a newly registered taxpayer to take credit of input tax for inputs that are held in stock and inputs that are contained in a semi-finished or finished good that is in stock on the day immediately after the date from which he/she becomes liable to pay tax under GST provisions.

- The form benefits the taxpayers who have been taken registration in a voluntary basis, to take credit of input for inputs that are held in stock and inputs maintained as semi-finished or finished goods that are held in stock on the day immediately after the date of grant of registration.

- The form enables those taxpayers opting out of composition scheme and opting to pay tax as a normal taxpayer and to take credit of input tax for inputs that are held in stock, inputs maintained in semi-finished or finished goods that are held in stock or on capital goods on the day immediately after the date on which he becomes liable to pay tax under Section 9.

- The form entitles such registered people whose supply of goods and services to become taxable from exempt to take credit of input tax for inputs held in stock and inputs maintained in semi-finished or finished goods that are held in stock relatable to such exempt supply and on capital goods that are exclusively used for such exempted supply on the day immediately preceding the date from which such supply become taxable.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...