Last updated: December 17th, 2024 12:06 PM

Last updated: December 17th, 2024 12:06 PM

GST Invoice - Comprehensive Guide with Invoice Formats & Examples

GST invoice or tax invoice acts as a commercial document issued by a seller to a buyer. Entities registered under GST must issue GST invoice for every taxable supply of goods and services supplied. Invoices also serve as legal documents, demanding payment for goods or services. After making a payment by the entity to the invoice, the invoice shall serve as a legal document showing title to the property purchased. In this article, we look at invoicing under GST in detail along with GST invoice formats and examples.Details to Be Mentioned on GST Invoice

Detailed rules and guidelines for issue of invoice and GST invoice format have been provided for in the GST Tax Invoice, Credit and Debit Notes rules. As per the GST invoice rules, all GST invoices issued in India must have the following details mandatorily:- Name, address and GSTIN of the supplier of goods or services.

- Invoice number unique for each financial year which is a consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters - hyphen or dash and slash.

- Invoice date

- Name, address and GSTIN of the recipient of goods or services. In case the recipient is not registered under GST, then name and address of the recipient and the address of delivery must be mentioned on the invoice if the value of the taxable supply is more than Rs.50,000.

- If the invoice value is less than Rs.50,000 then name and address of the recipient and the address of delivery can be mentioned, if required or requested by the recipient of goods and service.

- HSN Code or SAC Code for the Goods or Service. The requirement for mentioning HSN code or SAC code on tax invoice has been relaxed for taxpayers whose turnover is below Rs. 1.5 crores.

- Description of the goods or services.

- Quantity and unit of measurement.

- Total value of the supply of goods or services.

- Taxable value of the supply of goods or services taking into account discount or abatement, if any.

- GST rate applicable along with the amount of CGST, SGST, IGST and GST Compensation Cess payable by the recipient.

- Place of supply along with the name of the State, in the case of a supply in the course of inter-State trade or commerce.

- Address for delivery of goods and services, if it is different from the place of supply.

- Whether tax is payable on reverse charge basis.

- Signature or digital signature of the supplier or authorised representative.

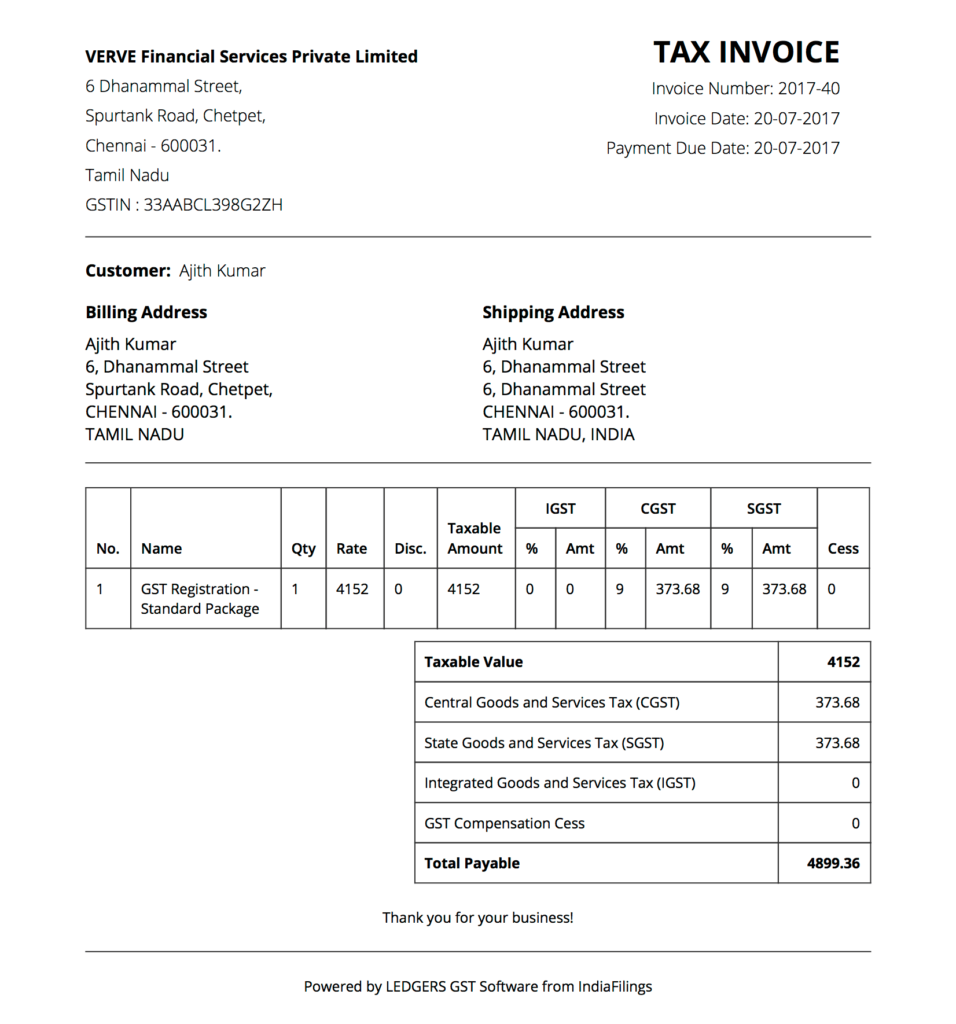

Sample GST Tax Invoice Format

The following is a sample GST tax invoice prepared using LEDGERS GST software: Sample GST Invoice Format

Sample GST Invoice Format

Issuing the Invoice

Time of supply for goods or service is when GST becomes payable. Issuance of a tax invoice is an important element in determining the time of supply. In most scenarios, the time of supply of goods or service is the date of issuance of an invoice or receipt of payment, whichever is earlier. The supplier should produce the invoice within a period of 30 days from the date of providing the goods or services. Hence, the concerned individual shall provide the GST invoice after reasonable assurance of payment for goods or services or after supplying the to the recipient. It's very important to note that the supplier becomes liable for remittance of GST to the government on the issuance of tax invoice, even if payment has not been received from the customer. Hence, if payment is not reasonably assured and goods or services have not been delivered, an estimate can be issued by the supplier. Read about the GST Software – Getting Started with LEDGERSProcedure for Issuing GST Invoice

The concerned individual shall prepare all the GST invoices in triplicate in case of a supply of goods. However, the individual shall mark the original copy as Original For Recipient and the duplicate copy should indicate Duplicate For Transporter and the triplicate copy should indicate Triplicate For Supplier. The concerned individual shall prepare the duplicate, in the case of the supply of services, in the following manner, namely, the original copy marked as Original For Recipient. In case of supply of services, the entity shall prepare the invoice as duplicate. The original copy should specify Original For Recipient and the duplicate copy should specify Duplicate For Supplier.Filing GST Invoice on GST Portal

The serial number of all invoices issued during a tax period should be filed every month in FORM GSTR-1. Also, GSTIN of all recipients registered under GST must be mentioned on GSTR-1 filing for B2B transactions. In case of recipients not registered under GST or B2C transactions, name, address and place of supply should be mentioned for high value transactions. GSTR-1 filing made by the supplier will automatically be auto-populated in the GSTR-2 filing to be submitted by the recipient of goods or service. Hence, GST invoicing plays an important role in input tax credit claims.Creating a GST Invoice using LEDGERS GST Software

The video below shows GST invoice creation using LEDGERS GST software: https://www.youtube.com/watch?v=O6mHxZ0Ei1QPopular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...