Last updated: December 23rd, 2022 8:07 PM

Last updated: December 23rd, 2022 8:07 PM

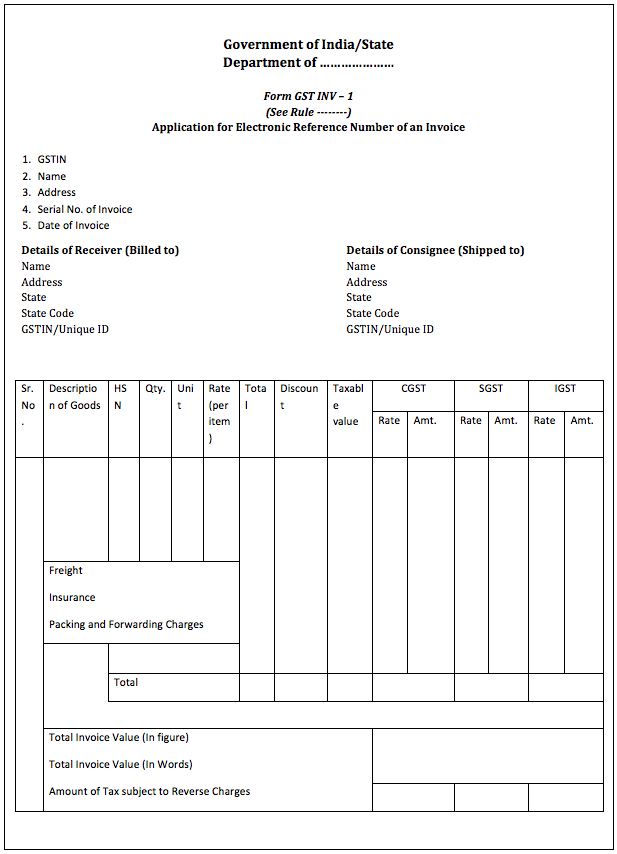

GST Invoice Format Rules & Time Limits

The rollout of GST in 2017 has necessitated changes to the invoice format for millions of businesses. GST Tax Invoice, Credit, and Debit Notes Rules explain the format for issuing the GST invoice and the related rules. In this article, let us look at the GST Invoice Format, manner of issuing invoice and time for issuing an invoice in detail. Easily generate GST Invoice using LEDGERS.Updating to Financial Year 2019-20

Rule 46 (b) of the CGST Rules 2017 specifies that the tax invoice issued by a registered person should have a consecutive serial number, not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters - hyphen or dash and slash symbolized as “-” and “/” respectively, and any combination thereof, unique for a financial year. Thus with the start of the new financial year 2019-20 (w.e.f. 01/04/2019), a new invoice series, unique for the financial year, is to be started by the GST taxpayers. A similar provision is there in Rule 49 of the CGST Rules 2017, in respect of the issue of Bill of Supply by registered taxpayers availing Composition Scheme or supplying exempted goods or services or both. If the GST invoice number is not updated by the taxpayer, then GST returns filing, and eWay Bill generation will be an issue for the taxpayer during the financial year 2019-20.Invoice Format

All invoice issued by businesses under GST must contain the following information:- Name, address, and also GSTIN of the supplier

- A consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters hyphen or dash and slash symbolized as “-” and “/” respectively, and any combination thereof, unique for a financial year.

- Date of its issue

- Name, address and GSTIN or UIN, if registered, of the recipient

- Name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un-registered and where the value of taxable supply is fifty thousand rupees or more;

- HSN code of goods or Accounting Code of services;

- Description of goods or services;

- Quantity in case of goods and unit or Unique Quantity Code thereof

- The total value of the supply of goods or services or both

- The taxable value of supply of goods or services or both taking into account discount or abatement, if any

- Rate of tax (central tax, State tax, integrated tax, Union territory tax or cess)

- Amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess)

- Place of supply along with the name of State, in case of a supply in the course of inter-State trade or commerce

- Address of delivery where the same is different from the place of supply

- Whether the tax is payable on a reverse charge basis; and

- A signature or digital signature of the supplier or his authorized representative.

Key Differences Between the New GST Invoice Format and Old Invoice Format

Invoice formats across the world have certain universal elements that are the same as the date of invoice, name, and address of the supplier and recipient, description of goods, quantity, the total value of supply, the taxable value of supply, rate of tax, amount of tax and final value. Under GST, GSTIN of the supplier is mandatorily required to be mentioned in the tax invoice along with a consecutive serial number that is unique for each financial year. Hence, businesses must adopt an invoice numbering format that takes into account the GST requirements. Small businesses can adopt an invoice number format starting with the financial year like 2017-XXXX, wherein the XXXX could be numerals for easily keeping track of the number of invoices issued by the business in a financial year. There is no requirement that the numbering starts from 1. Hence, the business can determine a starting number as per their requirements and consecutively number the invoices from the starting number. Large businesses, on the other hand, can adopt a serial numbering which includes alphabets to increase the number of available invoice numbers and to handle complexities like branch accounting.GSTIN of the Recipient

The GST invoice distinct rules for issuing an invoice to a recipient registered under GST and a recipient not having GST registration. Normally, businesses would have GSTIN and would be eligible for claiming input tax credit on the purchase, whereas recipients without a GSTIN would be end consumers/individuals - not being eligible to claim the input tax credit. Hence, in case of the recipient having GSTIN, the name, address, and GSTIN of the recipient should be mentioned. In case the recipient does not have GSTIN and the value of supply is more than Rs.50,000, then the following details of the recipient must be mentioned on the invoice:- Name

- Address of the recipient

- Address of delivery with State and State Code

HSN Code or Accounting Code of Services

The rate of tax under GST has been classified using the HSN Code and Accounting Code of Services. Harmonized System of Nomenclature (HSN) Codes has been issued for all goods, and the rate of tax has been fixed based on the HSN code. Hence, in all invoices, the goods sold by the business must be classified as per the HSN Code. In the case of services, the rate of tax under GST has been classified under the Accounting Code of Services. Hence, in all invoices for services, the business must be classified as per the Accounting Code of Services. Business with a turnover of less than Rs.1.5 crores is exempt from mentioning HSN code on the invoice. (Know more here.)Description, Quantity, Value of Supply and, Taxable Value and Rate of Tax

With the HSN or Accounting Code of Services, the description of goods, quantity, value of supply, taxable supply, and rate of tax must be mentioned in the invoice. The taxable value of the supply of goods or services is the value of supply, taking into account discount or abatement, if any. Finally, the place of supply along with the name of State, in case of a supply in the course of inter-state trade or commerce.Signature of Authorised Representative

Finally, the invoice must contain the signature or digital signature of the supplier or his authorized representative.GST Export Invoice

In case of issuing an invoice for export of goods or services, the invoice as mentioned above must contain the endorsement- SUPPLY MEANT FOR EXPORT ON PAYMENT OF INTEGRATED TAX; or

- SUPPLY MEANT FOR EXPORT UNDER BOND OR LETTER OF UNDERTAKING WITHOUT PAYMENT OF INTEGRATED TAX

GST Invoice Format

GST Invoice Format

How to Issue GST Invoice

The taxpayer shall prepare the invoice for the supply of goods as follows:- The original cop marked as ORIGINAL FOR RECIPIENT;

- The duplicate copy marked as DUPLICATE FOR TRANSPORTER;

- The triplicate copy marked as TRIPLICATE FOR SUPPLIER.

- The original copy marked as ORIGINAL FOR RECIPIENT;

- The duplicate copy marked as DUPLICATE FOR SUPPLIER.

Time Limit for Issuing Invoice

All invoices must be issued within a period of thirty days from the date of the supply of service. For more information about the time for issuing an invoice, you can also refer to the IndiaFilings GST Portal.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...