Updated on: April 15th, 2019 3:24 PM

Updated on: April 15th, 2019 3:24 PM

GST ITC-03 Filing

ITC 03 is a GST form meant for the taxpayers who have opted for the GST composition scheme. GST ITC 03 must be filed by taxpayers who are obligated to pay an amount which is equivalent to the Input Tax Credit (ITC) by means of an electronic credit or cash ledger. The payments, on the accounts of ITC, could be on the basis of:- Input held in stock.

- Input contained in semi-finished goods or finished goods held in stock.

- Capital goods or Plant and Machinery held in stock.

Eligibility

Taxpayers may file form ITC 03 on the satisfaction of the following conditions:- The Input Tax Credit (ITC) is availed by the taxpayers before reversing it through this form.

- The taxpayer has notified the concerned department on his/her enrollment into the composition scheme in CMP-02 at the start of the year.

- The taxpayer is in possession of a Digital Signature Certificate (DSC) or an Electronic Verification Code (EVC).

- A certificate has been produced from the Chartered Accountant certifying the value of goods (if the details of the invoice are not available).

Procedure for Filing ITC-03

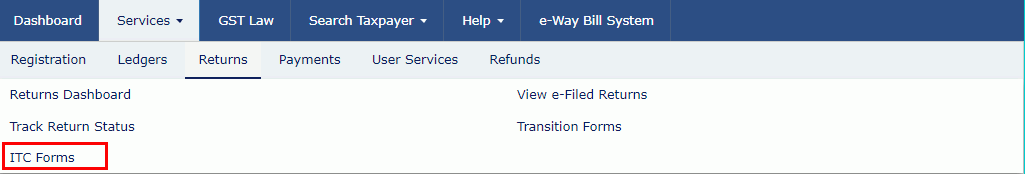

The procedure for filing form ITC-03 has been substantiated below: Step 1: The Portal The procedure can be initiated by logging into the official GST portal, wherein all the essential facilities are accorded to the taxpayer. Step 2: ITC Forms Click on the ‘Services’ drop-down menu, and choose ITC Forms from the ‘Returns’ option. ITC Forms

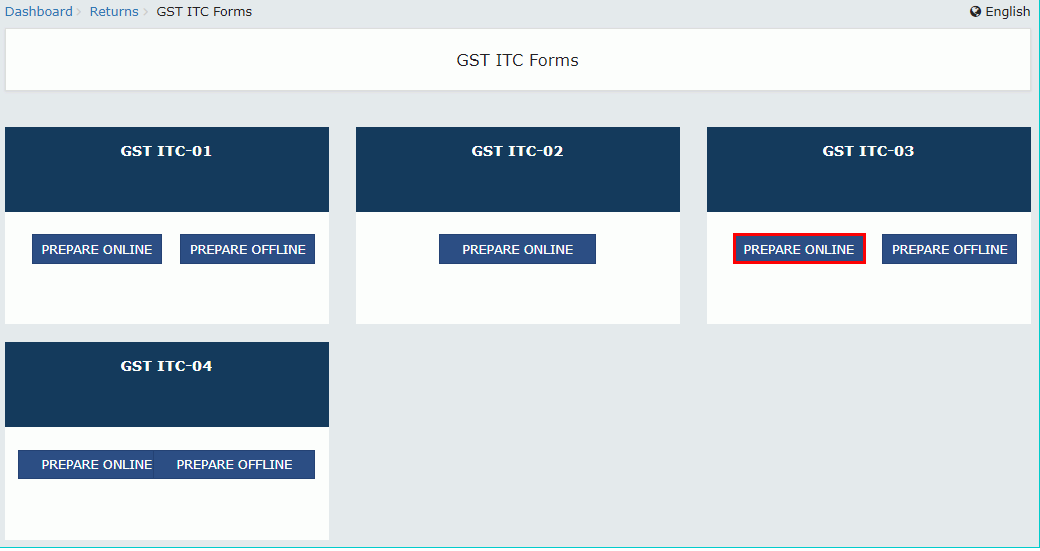

Step 3: Prepare Online

A page with a list of forms is depicted on the screen. Choose the 'Prepare Online' option, which is found under the GST ITC -03 tile.

ITC Forms

Step 3: Prepare Online

A page with a list of forms is depicted on the screen. Choose the 'Prepare Online' option, which is found under the GST ITC -03 tile.

Prepare Online

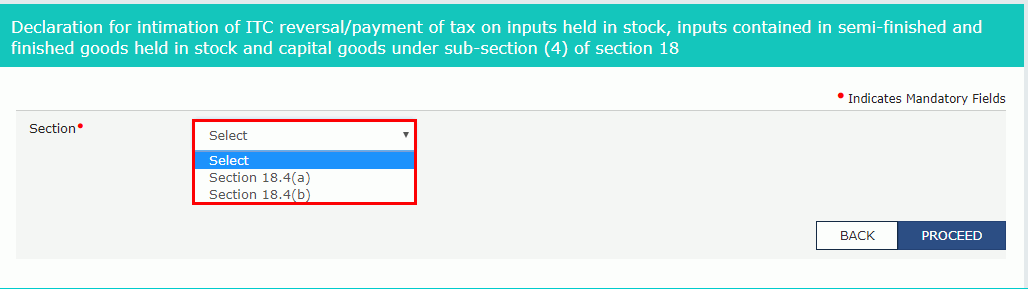

Step 4: Choice of Section

Select the appropriate section from the ‘Section’ drop-down list.

Prepare Online

Step 4: Choice of Section

Select the appropriate section from the ‘Section’ drop-down list.

Section drop-down list

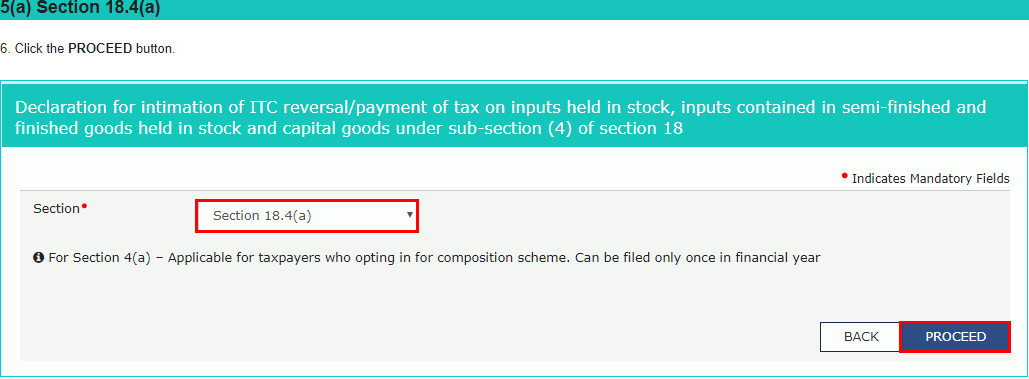

Step 5: Proceed

Click on the 'Proceed' button.

Section drop-down list

Step 5: Proceed

Click on the 'Proceed' button.

The Proceed Option

Step 6: Furnishing of Details

Form GST ITC 03 is now displayed on the screen. The user may now furnish the required details by clicking on the name of the tile.

The Proceed Option

Step 6: Furnishing of Details

Form GST ITC 03 is now displayed on the screen. The user may now furnish the required details by clicking on the name of the tile.

Form ITC-03

The procedure now takes a bifurcated course based on the options depicted in the following picture.

Form ITC-03

The procedure now takes a bifurcated course based on the options depicted in the following picture.

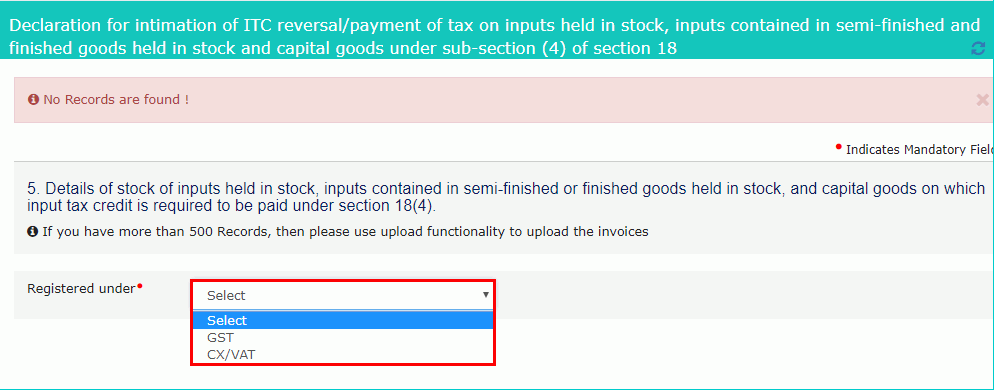

Goods Details with Invoices

Step 1: The First Option Click on the 'Goods Details With Invoices' tile, which is the first among the four options on display. Goods Details With Invoices

Step 2: Registration Number

Choose the appropriate ‘Suppliers Registration,’ among the following options and enter the details accordingly:

Goods Details With Invoices

Step 2: Registration Number

Choose the appropriate ‘Suppliers Registration,’ among the following options and enter the details accordingly:

- GST

- CX

- VAT

Type of Supplier's Registration

Step 3: Add and Save

The details will be successfully uploaded by clicking on the ‘Add’ and ‘Save’ button. A success message will be displayed along with the respective invoice. The user may choose to edit or delete the invoice.

Type of Supplier's Registration

Step 3: Add and Save

The details will be successfully uploaded by clicking on the ‘Add’ and ‘Save’ button. A success message will be displayed along with the respective invoice. The user may choose to edit or delete the invoice.

Add and Save

Add and Save

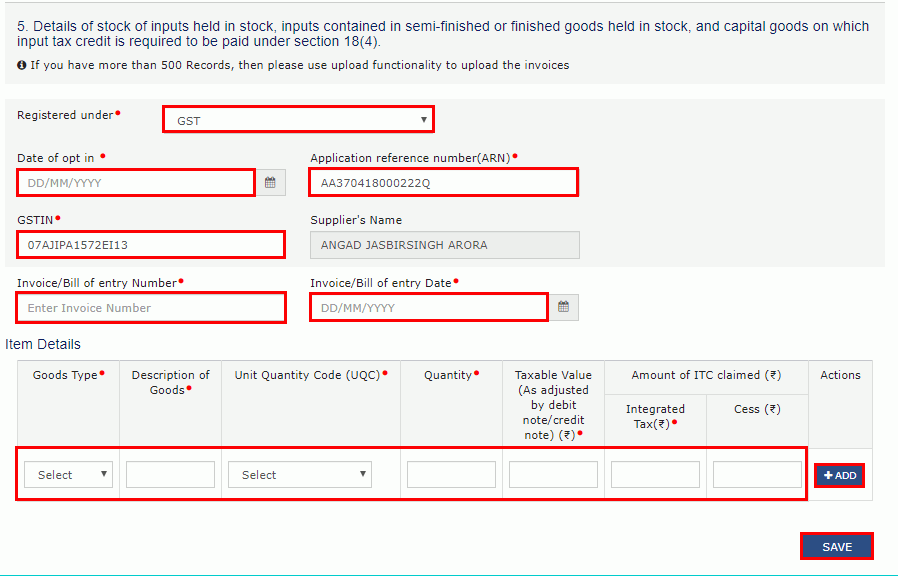

Goods Details without Invoices

Step 1: the Second Option The option “Goods Details Without Invoices” must be opted for. Goods Details Without Invoices

Step 2: Choice of User

Choose the appropriate ‘Suppliers Registration,’ among the following options and enter the details accordingly:

Goods Details Without Invoices

Step 2: Choice of User

Choose the appropriate ‘Suppliers Registration,’ among the following options and enter the details accordingly:

- GST

- CX

- VAT

Type of Supplier's Registration

Step 3: Add and Save

The details will be successfully uploaded by clicking on the ‘Add’ and ‘Save’ button. A success message will be displayed along with the respective invoice. The user may choose to edit or delete the invoice.

Type of Supplier's Registration

Step 3: Add and Save

The details will be successfully uploaded by clicking on the ‘Add’ and ‘Save’ button. A success message will be displayed along with the respective invoice. The user may choose to edit or delete the invoice.

Add and Save

Add and Save

Chartered Accountant/Cost Accountant Certification

The details of Chartered Accountant or Cost Accountant must be uploaded on the GST portal in the absence of invoices for certain particulars added by the taxpayer. The details to be included are:- The name of the form issuing the certificate.

- The name of the certifying Chartered Accountant or Cost Accountant.

- Membership number of the Chartered Accountant or Cost Accountant.

- The date of issuance of a certificate using the calendar.

Remittance of Payment

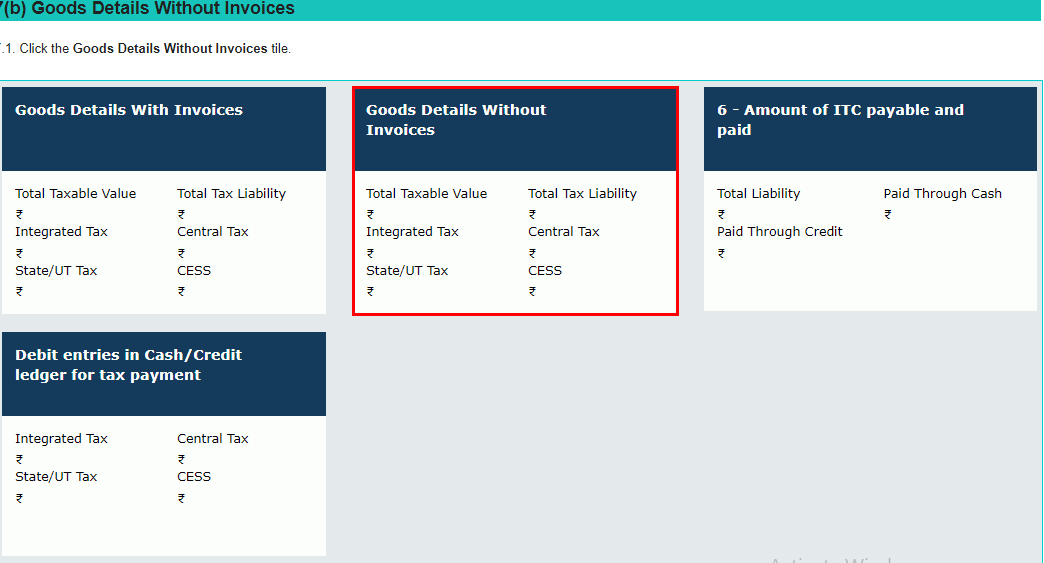

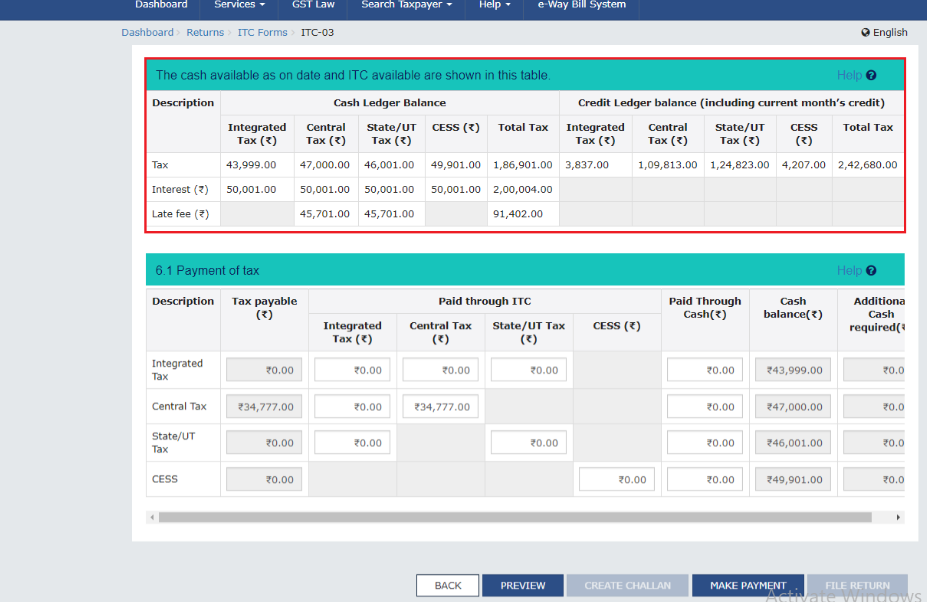

The next step in the line involves the remittance of payment, which involves the following procedures: Step 1: Amount of ITC Payable and Paid Opt for the ‘Amount of ITC payable and paid’ tag among the four options (two of which are for different purposes and have been covered above). Amount of ITC Payable and Paid

Step 2: Provision of Details

The next page will depict the cash and the Input Tax Credit available as on that date. Details regarding the amount of credit and cash to be utilized from the respective available credit heads must be mentioned.

Step 3: Remittance of Payment

Now comes the stage when the Input Tax Credit (ITC) availed by the taxpayer can be remitted using the availability of credit and cash in the ledger. Cash available on the electronic cash ledger will be deducted. In case of non-availability of cash, the payment can be remitted by generating a challan. The procedure for the same is explained below.

In the latter scenario, a challan is generated with auto-populated details of the liable amount. This can be deposited online by NEFT/RTGS or over the counter mode of payment. The taxpayer is advised to preview the form before making the deposits, as no changes can be effected later. The payment can be deposited by clicking on the ‘Make Payment’ option and remitting the actual amount of liability. The updated balance can be seen by selecting the ‘View’ option.

Amount of ITC Payable and Paid

Step 2: Provision of Details

The next page will depict the cash and the Input Tax Credit available as on that date. Details regarding the amount of credit and cash to be utilized from the respective available credit heads must be mentioned.

Step 3: Remittance of Payment

Now comes the stage when the Input Tax Credit (ITC) availed by the taxpayer can be remitted using the availability of credit and cash in the ledger. Cash available on the electronic cash ledger will be deducted. In case of non-availability of cash, the payment can be remitted by generating a challan. The procedure for the same is explained below.

In the latter scenario, a challan is generated with auto-populated details of the liable amount. This can be deposited online by NEFT/RTGS or over the counter mode of payment. The taxpayer is advised to preview the form before making the deposits, as no changes can be effected later. The payment can be deposited by clicking on the ‘Make Payment’ option and remitting the actual amount of liability. The updated balance can be seen by selecting the ‘View’ option.

Make Payment

Make Payment

Verification

Once the payment is remitted, the same must be verified through a digital or electronic signature.Frequency of Filing

Form GST ITC-03 can be filed by qualified taxpayers on not more than one occasion during a financial year. On the other hand, if the need for filing arises due to the reversal or payment of tax in cases of exemption of supplies, it can be performed multiple times as and when the notifications pertaining to such exemptions are issued by the government.Consequences of Non-filing

If a composition dealer isn’t compliant with the provisions of this Act, the proper officer is entitled to issue a show cause notice which may end up in the denial of the composition scheme to the former.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...