Last updated: January 30th, 2024 10:55 AM

Last updated: January 30th, 2024 10:55 AM

GST Number Search by PAN: Online Procedure

GST registration is mandatory for companies with an annual turnover of Rs. 20 lakhs or more who engage in the buying and selling of goods and services. Upon registration, every taxpayer is assigned a unique identification number called GSTIN (Goods and Services Tax Identification Number). The GST portal offers a convenient feature to search for GSTIN data using the PAN (Permanent Account Number). In this article, we will provide a step-by-step guide on how to search for a GST number using your PAN, offering a detailed and user-friendly explanation.What is GST Registration?

GST registration, also known as Goods and Services Tax registration, is a mandatory process for businesses and individuals in India that engage in the supply of goods or services and meet certain turnover criteria. It involves obtaining a unique GSTIN (Goods and Services Tax Identification Number) from the tax authorities. Here are the key aspects of GST registration:- Mandatory for Eligible Entities: Businesses and individuals whose aggregate turnover exceeds the prescribed threshold limit (Rs. 20 lakhs for regular taxpayers, Rs. 10 lakhs for special category states) must register for GST.

- Voluntary Registration: Even if their turnover is below the threshold, entities can opt for voluntary GST registration to avail of benefits such as claiming Input Tax Credit (ITC) and expanding their business presence.

- GSTIN: Upon successful registration, the taxpayer is assigned a unique 15-digit GSTIN. This number is used for all GST-related transactions and compliance.

- Online Application: The GST registration is primarily conducted online through the GST portal. Applicants must provide the necessary documents and details to complete the application.

- Composition Scheme: Small taxpayers with a turnover of up to Rs. 1.5 crores can opt for the Composition Scheme, simplifying compliance and tax payment.

- Regular Filing: Registered taxpayers must regularly file GST returns, which include details of their sales, purchases, and tax liability. These returns are filed monthly, quarterly, or annually, depending on the taxpayer's category.

- Input Tax Credit: One of the key benefits of GST registration is the ability to claim Input Tax Credit (ITC). Registered taxpayers can offset the GST they have paid on purchases against the GST they collect on sales.

- Compliance Requirements: GST registration comes with compliance obligations, including maintaining proper records, issuing tax invoices, and adhering to GST rates and rules.

- Penalties for Non-compliance: Failure to register for GST when required or non-compliance with GST rules can result in penalties and legal consequences.

GSTIN - Overview

The Goods and Services Tax Identification Number, abbreviated as GSTIN, is a unique 15-digit alphanumeric identifier assigned to each taxpayer registered under India's Goods and Services Tax (GST) regime. This PAN-based number is crucial in consolidating all GST-related payments and records onto a unified platform, simplifying tax administration for tax authorities and taxpayers. GSTIN allows for the seamless tracking of tax transactions and ensures that all tax-related activities are efficiently managed. Furthermore, because it is publicly accessible information, anyone can use GSTIN to verify the legitimacy of a business.Format of a GSTIN (Goods and Services Tax Identification Number)

The format of a GSTIN (Goods and Services Tax Identification Number) consists of 15 digits and follows a specific structure:- The first two digits represent the state code where the business is registered.

- The next ten digits correspond to the business entity's Permanent Account Number (PAN).

- The 13th digit is used to identify the total number of registrations a business has within a specific state and is known as the Entity Identification Number (EIN).

- The 14th digit is always "Z."

- The 15th and final digit can be either an alphabet or a number.

What is a PAN in GST?

As mentioned above, A PAN (Permanent Account Number) is an integral GSTIN (Goods and Services Tax Identification Number) component.Methods for Verifying GSTIN Information

Verifying GSTIN (Goods and Services Tax Identification Number) information is a crucial step to ensure the authenticity and compliance of a business or entity. There are primarily two common methods for verifying GSTIN information:- GSTIN Search by Name: Users can visit the official GST portal of their respective country or region and use the "GST Search by Name" option. By entering the name of the business or entity, along with any additional details like the state or region, users can access a list of GSTINs associated with the provided name and their status.

- GSTIN Search by PAN: Another method is to use the "GST Search by PAN" option on the official GST portal. By entering the PAN (Permanent Account Number) of the business or entity, users can retrieve a list of GSTINs associated with the PAN and their status.

GST Search by PAN

Searching for a GST number (GSTIN) using the PAN (Permanent Account Number) is a useful method, especially when dealing with registered businesspersons who may have multiple GSTINs across different states in India. Using the PAN of a registered taxpayer, you can efficiently search for and access all associated GSTINs, streamlining the process of tracking and verifying their tax registrations. This approach simplifies the task of managing GST compliance for businesses operating in multiple states.Benefits of searching GSTIN by PAN

Searching for GSTIN by PAN offers several benefits, including:- Verification of Legitimacy: Consumers and businesses can easily verify the legitimacy of a business entity by using the GSTIN search by PAN tool. This helps ensure that they are dealing with a registered and genuine business.

- Locating the State: GSTIN search by PAN allows users to determine where a vendor's business is active. This information can be useful for businesses when dealing with vendors across different states.

- Error Avoidance: Dealers and businesses can prevent errors in GST-related transactions by verifying the GST number using the PAN. This ensures that they are accurately recording and reporting GST information.

What information is available in a GST search by PAN

A GST search by PAN provides the following information:- List of GSTINs: Users will receive a list of GSTINs (Goods and Services Tax Identification Numbers) associated with the provided PAN.

- Status: For each GSTIN, the search will display the status, indicating whether the GSTIN is active or inactive.

- Additional Details: As a second step, users can access all details related to the GSTINs. This may include information about the business, registration status, and other relevant details associated with each GSTIN.

Online Procedure to Search Taxpayers Using PAN

To search the details of a taxpayer without login and after logging into the GST Portal using PAN, perform the following steps:Visit the GST Official Portal

Step 1: The applicant must visit the GST department's official portal.In the case of Pre-login

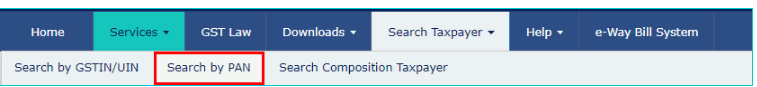

Step 2: Click the “Search taxpayer” tab on the portal's homepage. [caption id="attachment_66483" align="aligncenter" width="757"] Search GST Number Using PAN - Image 1

Search GST Number Using PAN - Image 1

Select Search by PAN

Step 3: Select the “Search by PAN” option under the menu search taxpayer.Provide PAN Number

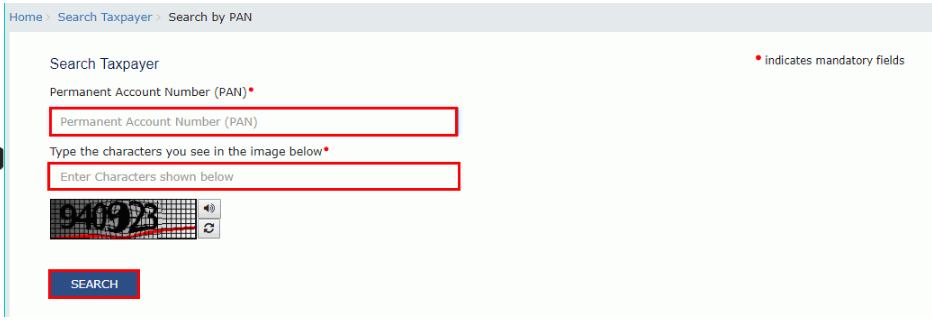

Step 4: Enter the taxpayer's PAN, whose details must be searched in the permanent account number in the field. Step 5: Enter the captcha text in the field “Type the characters in the image below” and click the “Search” button. [caption id="attachment_66485" align="aligncenter" width="785"] Search GST Number Using PAN - Image 2

Search GST Number Using PAN - Image 2

View Details

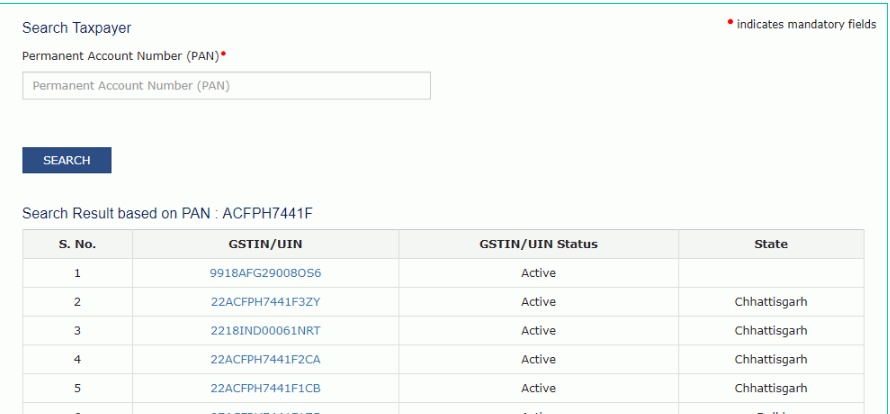

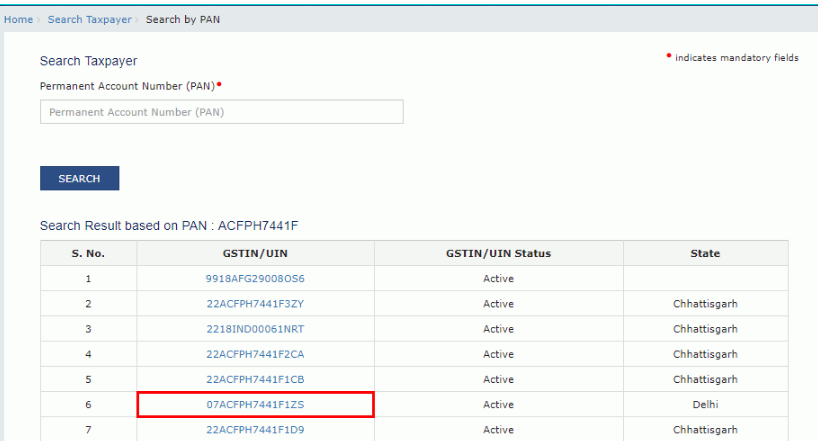

Step 6: The details that have been searched are displayed on the next page. [caption id="attachment_66486" align="aligncenter" width="713"] Search GST Number Using PAN - Image 3

Step 7: Click the GSTIN/UIN tab to know more about the GSTIN or UIN of the taxpayer.

[caption id="attachment_66488" align="aligncenter" width="757"]

Search GST Number Using PAN - Image 3

Step 7: Click the GSTIN/UIN tab to know more about the GSTIN or UIN of the taxpayer.

[caption id="attachment_66488" align="aligncenter" width="757"] Search GST Number Using PAN - Image 4

Search GST Number Using PAN - Image 4

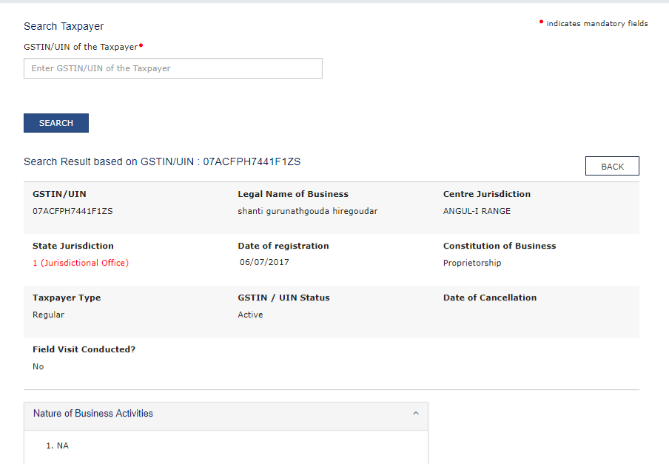

Search by GSTIN

Step 8: From the current page, the user will be redirected to the page search by GSTIN or UIN. Step 9: The GSTIN/ UIN selected will be prefilled on the Search taxpayer (pre-login) page. Step 10: Enter the CAPTCHA text in the field. Type the characters in the image below the field and click the “Search” button. [caption id="attachment_66490" align="aligncenter" width="659"] Search GST Number Using PAN - Image 5

Search GST Number Using PAN - Image 5

View GSTIN Details

Step 11: Then, the details of the GSTIN/UIN will be displayed on the screen. [caption id="attachment_66491" align="aligncenter" width="669"] Search GST Number Using PAN - Image 6

Search GST Number Using PAN - Image 6

In the case of post-login

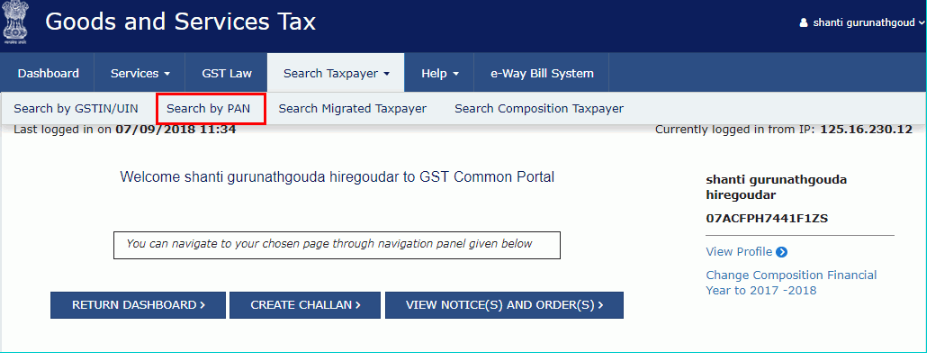

Step 1: The applicant has to log in with the valid credentials details. Step 2: Click the “Search taxpayer” tab on the portal's homepage.Select Search by PAN

Step 3: Select the “Search by PAN” option, which is under the menu search taxpayer. [caption id="attachment_66494" align="aligncenter" width="624"] Search GST Number Using PAN - Image 7

Provide PAN Number

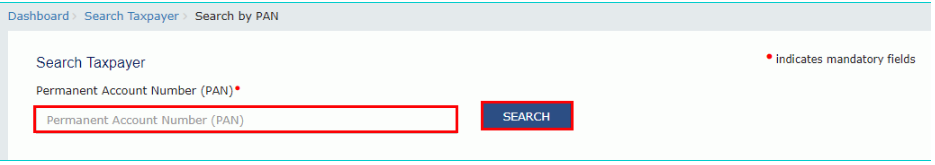

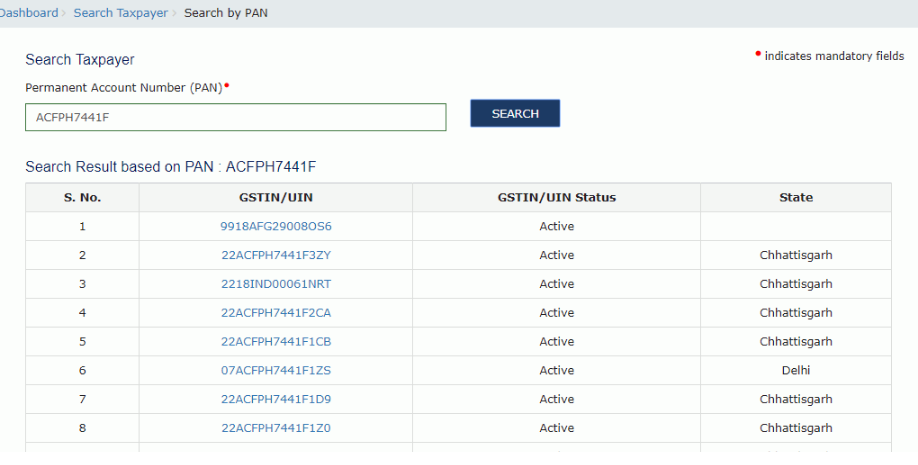

Step 4: Enter the PAN of the taxpayer whose details have to be searched in the permanent account number in the field and click on the “Search” button.

[caption id="attachment_66496" align="aligncenter" width="780"]

Search GST Number Using PAN - Image 7

Provide PAN Number

Step 4: Enter the PAN of the taxpayer whose details have to be searched in the permanent account number in the field and click on the “Search” button.

[caption id="attachment_66496" align="aligncenter" width="780"] Search GST Number Using PAN - Image 8

Step 5: The details that have been searched are displayed on the next page.

[caption id="attachment_66500" align="aligncenter" width="768"]

Search GST Number Using PAN - Image 8

Step 5: The details that have been searched are displayed on the next page.

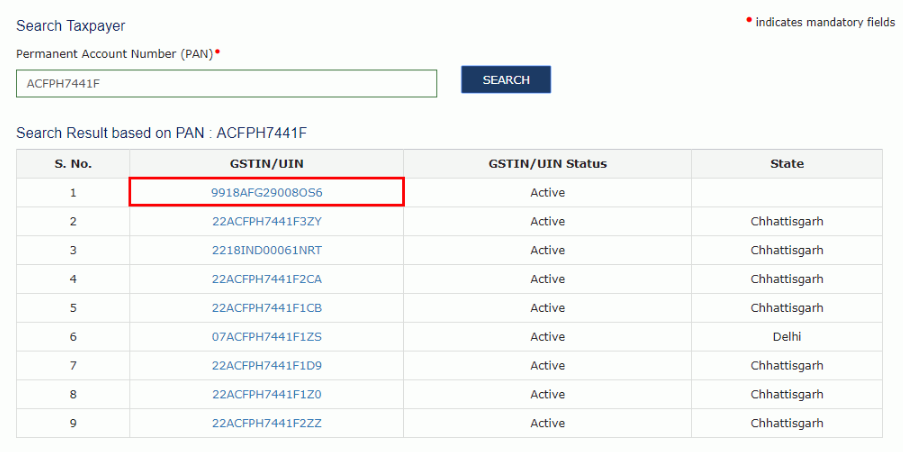

[caption id="attachment_66500" align="aligncenter" width="768"] Search GST Number Using PAN - Image 9

Step 6: Click the GSTIN/UIN tab to know more about the GSTIN or UIN of the taxpayer.

[caption id="attachment_66509" align="aligncenter" width="769"]

Search GST Number Using PAN - Image 9

Step 6: Click the GSTIN/UIN tab to know more about the GSTIN or UIN of the taxpayer.

[caption id="attachment_66509" align="aligncenter" width="769"] Search GST Number Using PAN - Image 10

Search GST Number Using PAN - Image 10

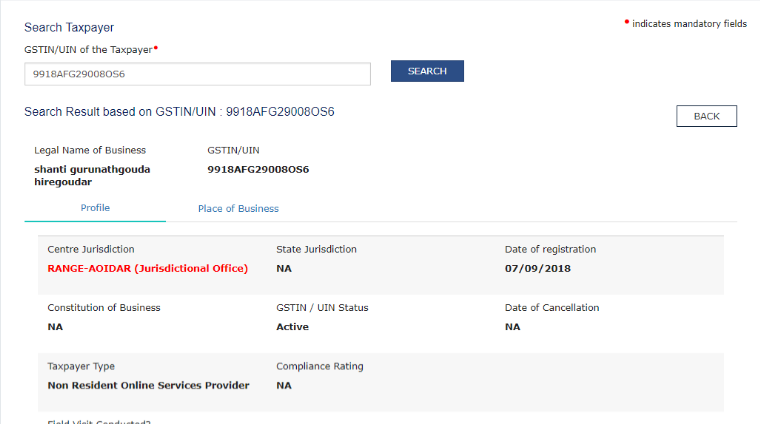

Search by GSTIN or UIN

Step 7: From the current page, the user will be redirected to the page search by GSTIN or UIN. [caption id="attachment_66512" align="aligncenter" width="760"] Search GST Number Using PAN - Image 11

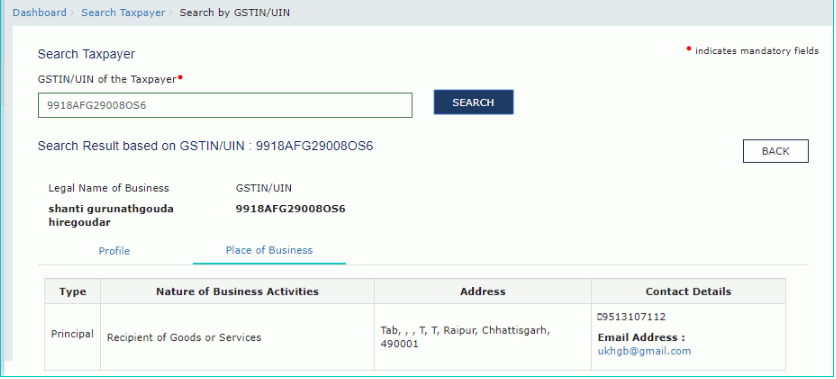

Step 8: Click the Place of Business tab to view the details of the place of business of the selected GSTIN.

View Details of Place of Business

Step 9: The taxpayer's place of business details will be displayed.

Search GST Number Using PAN - Image 11

Step 8: Click the Place of Business tab to view the details of the place of business of the selected GSTIN.

View Details of Place of Business

Step 9: The taxpayer's place of business details will be displayed.

Common errors in GST search by PAN

Common errors in GST search by PAN may include:- Incorrect PAN: Entering an incorrect Permanent Account Number (PAN) can lead to errors in the search results.

- PAN Linked to Another Person: A PAN may be linked to someone other than the registered person or entity searched for.

- Verify PAN: Double-check the PAN you have entered to ensure it is accurate and matches the PAN associated with the registered person or entity.

- Confirm Identity: If you suspect the PAN may be linked to another person, confirm the identity of the registered person or entity you are searching for.

Search GST Number Using PAN - Image 12

Search GST Number Using PAN - Image 12

GST Search by Name

Searching for GST information by name verification involves the following steps:- Ensure Accuracy: To use GST verification by name, inputting the correct business name is crucial.

- Minimum Characters: Enter at least 10 characters of the business name to ensure you get the desired results.

- Specify State: Remember that a business may be registered for GST in multiple states. Therefore, specifying where you are searching for GST information is helpful.

- Use Business Name: When seeking a firm's GST number or your GST number, search by entering the business's name.

Conclusion

In summary, registering for GST and looking up GSTIN with PAN is essential for businesses in India to comply with tax regulations. This straightforward process helps verify business legitimacy and manage GST records efficiently. For businesses looking for assistance, IndiaFilings offers expert help to make GST registration and searching for GSTIN by PAN simple and easy. [ ]Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...