Last updated: March 26th, 2019 12:26 PM

Last updated: March 26th, 2019 12:26 PM

GST Payment Problem - Government Help Desk

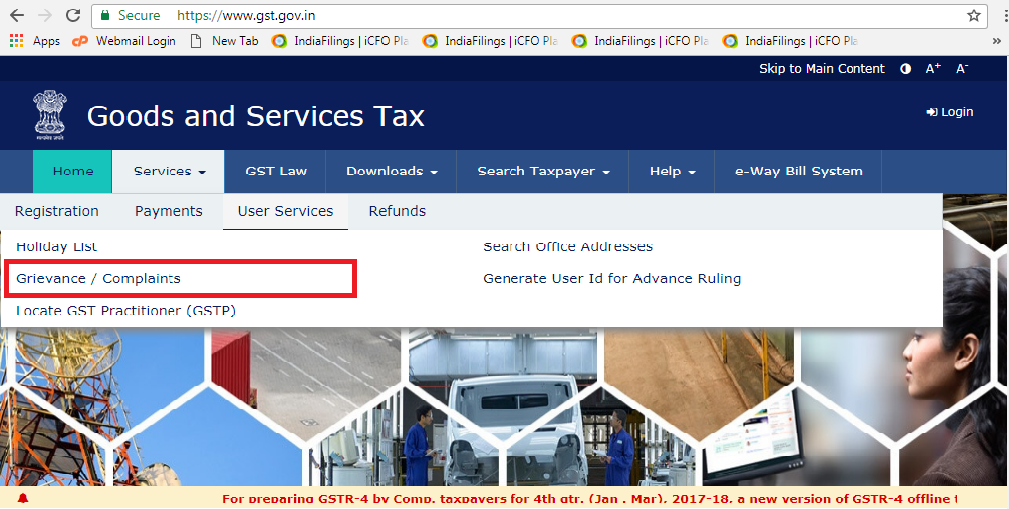

A ticket can be raised on GST Portal in case the user faces problem while obtaining GST registration or making GST payment. These help tickets are attended by dedicated GST Officials and support is provided in most cases within 24 to 28 hours. Know more about how to make GST payment here. You can follow the steps below to create a ticket, in case the payment you made is not reflected on your GST account. STEP 1: Access the GST Portal. STEP 2: Login with your credentials. Grievances can be submitted either before or after logging-in to the GST Portal. However, payment related grievances can only be submitted by registered users or taxpayers, since they are required to mention the GSTIN. STEP 3: Click the Services > User Services > Grievance / Complaints option as shown below. The Grievance / Complaints page is displayed. The Submit Grievance section will open by default. Raising GST Payment Problem Help Ticket

STEP 4: In case you have already filed a grievance and you are filing the grievance again, enter the previous grievance id in the Previous Grievance Number field.

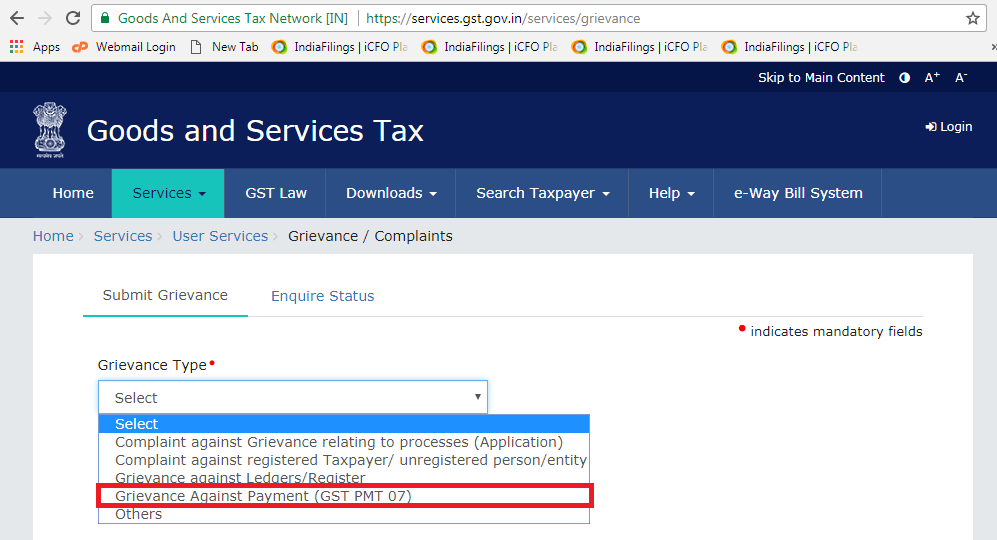

STEP 5: To begin creating a new ticket, in the Grievance Type drop-down list, select the Grievance against Payment (GST PMT 07) option.

STEP 6: In the Grievance Related To drop-down list, select one of the available two options:

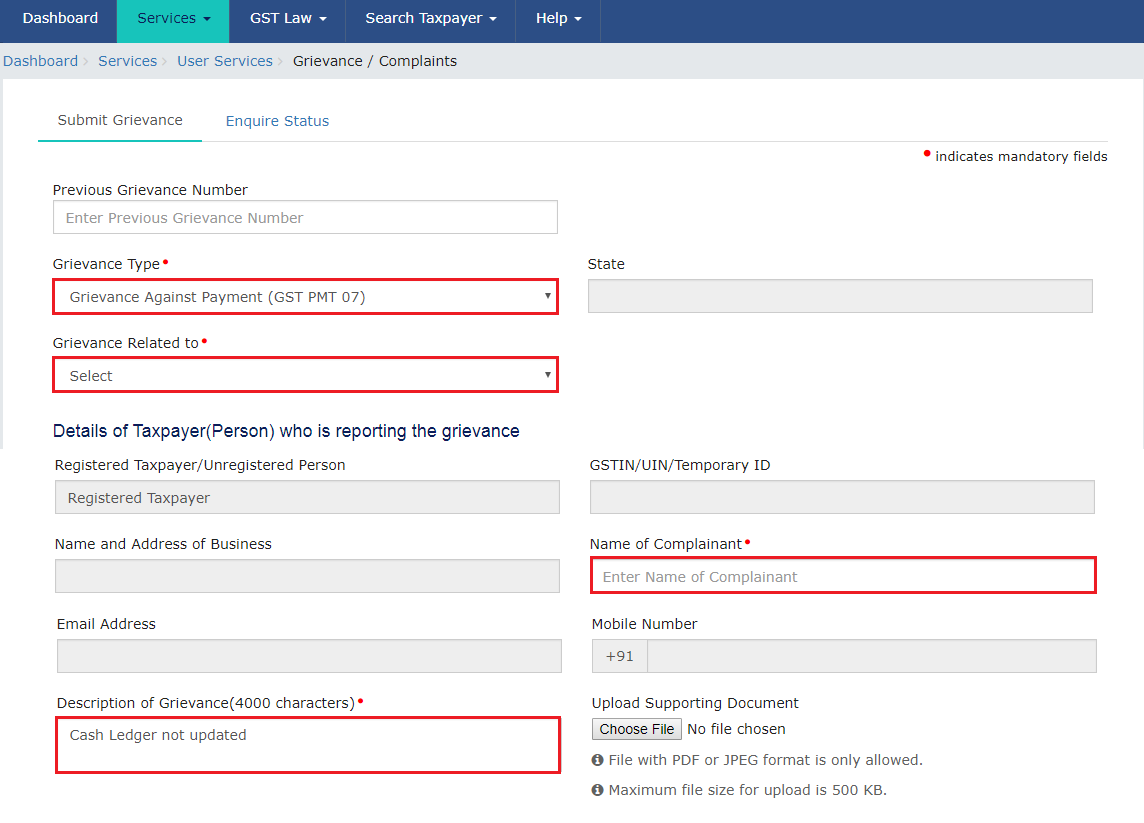

Raising GST Payment Problem Help Ticket

STEP 4: In case you have already filed a grievance and you are filing the grievance again, enter the previous grievance id in the Previous Grievance Number field.

STEP 5: To begin creating a new ticket, in the Grievance Type drop-down list, select the Grievance against Payment (GST PMT 07) option.

STEP 6: In the Grievance Related To drop-down list, select one of the available two options:

- Amount debited from the bank account, Cash ledger not updated.

- NeFT/ RTGS related issue.

Types of GST Payment Problems

STEP 7: Details of Taxpayer who is reporting the grievance are auto-populated. In case you have not logged in, you will need to enter your own details in the Details of Taxpayer who is reporting the grievance section.

STEP 8: In the Discrepancy In Payments section, in the CPIN field, enter the CPIN of the Challan.

Types of GST Payment Problems

STEP 7: Details of Taxpayer who is reporting the grievance are auto-populated. In case you have not logged in, you will need to enter your own details in the Details of Taxpayer who is reporting the grievance section.

STEP 8: In the Discrepancy In Payments section, in the CPIN field, enter the CPIN of the Challan.

Submission of GST Help Ticket

Submission of GST Help Ticket

GST Ticket for Payment Problem

STEP 9: Select the Sign with Authorized Signatory's PAN option and select the Authorized signatory.

STEP 10: Click the SUBMIT WITH DSC or SUBMIT WITH EVC button to submit the grievance form.

GST Ticket for Payment Problem

STEP 9: Select the Sign with Authorized Signatory's PAN option and select the Authorized signatory.

STEP 10: Click the SUBMIT WITH DSC or SUBMIT WITH EVC button to submit the grievance form.

No Late Fee for GSTR-1 & GSTR-3B Return

The biggest relief extended to small business by the 31st GST Council is the waiver of late fee for filing GSTR-1 and GSTR-3B return. The GST Council has announced: “Late fee shall be completely waived for all taxpayers in case FORM GSTR-1, FORM GSTR-3B &FORM GSTR-4 for the months/quarters July 2017 to September 2018, are furnished after 22.12.2018 but on or before 31.03.2019.” Thus, filing of Form GSTR-1, GSTR-3B and GSTR-4 will not attract any late fee penalty until 31st March 2019.GST Annual Return Due Date Extended

All entities having GST registration are required to file GST annual return in form GSTR-9. The due date for filing GST annual return is usually 31st December of each year for the financial year ended on 31st March of the same calendar year. As GST is newly introduced in India, the Government has decided to extend the due date for GST annual return filing to 30th June 2019. The due date for filing GST annual return was originally extended upto 31st March 2019, which has been further extended to 30th June 2019 by the GST Council. FILE WITH DSC:- In the Warning box that appears. Click the PROCEED button.

- Select the certificate and click the SIGN button.

- Enter the OTP sent on email and mobile number mentioned in the grievance form and click the VALIDATE OTP button.

Tracking Ticket Status

To monitor status of your submitted tickets / complaints regarding the GST Portal, perform the following steps: STEP 1: Access the GST Portal. STEP 2: Login with your credentials. Status of the grievances can be inquired before or after logging-in to the GST Portal. STEP 3: Click the Services > User Services > Grievance / Complaints command. The Grievance / Complaints page is displayed. STEP 4: Click the Inquire Status section. STEP 5: Enter either your Grievance Number or Date Range. In case you have not logged in you can only search the Grievance Number. STEP 6: Click the Search button.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...