Last updated: December 13th, 2024 2:21 PM

Last updated: December 13th, 2024 2:21 PM

GST Rate and Cess for Tobacco and Cigarettes

Tobacco and tobacco products are estimated to generate around 18,000 crores of revenue for the government and nearly 5000 crores in foreign exchange. Though the prominence of the tobacco industry has steadily declined over the years, it continues to be a major revenue earner for the government through taxes. In this article, we look at the tobacco GST rate and cigarette GST rate, along with the cess rate and HSN code.GST Rate for Tobacco

The Tobacco GST rate for all types of its products is 28%, except for tobacco leaves. GST rate for tobacco leaves is 5% under reverse charge. As GST for tobacco leaves is applicable under reverse charge, the recipient of the goods is required to pay the GST applicable directly to the Government. For example, if a tobacco manufacturing unit purchases tobacco leaves from a farmer, the tobacco manufacturing unit would be required to pay GST at the rate of 5% directly to the Government.GST Cess for Tobacco Products

Tobacco products are one of the items that attract the maximum amount of GST cess. The GST cess rate for tobacco products ranges from 11% to 290%. Hence, its important for all persons supplying tobacco and tobacco products to be well aware of GST Cess on tobacco calculation, its rules and regulations.GST Cess on Tobacco Calculation

The GST cess on tobacco products is designed specifically to address the health impacts of tobacco use and provide additional revenue for public health programs. The cess rates vary significantly depending on the type of tobacco product. For instance, unmanufactured tobacco products without lime tube attract a cess rate of 71%, while more processed products like pan masala containing tobacco, known as 'Gutkha', face a higher cess rate of 204%. The GST Cess on tobacco calculation involves adding this additional cess amount to the regular GST, making the final tax burden heavier on these harmful products.Tobacco GST Rate and Cess for PAN, Gutkha, PAN, Chewing Tobacco and Tobacco Products

In the table below, we have given the list of items and their respective tobacco GST rates and cess,| Item Description | Tobacco GST Rate | Tobacco GST Cess |

| Tobacco and Tobacco Products | ||

| Unmanufactured tobacco (without lime tube) – bearing a brand name | 28% | 71% |

| Unmanufactured tobacco bearing a brand name | 28% | 65% |

| Tobacco refuse, bearing a brand name | 28% | 61% |

| Chewing tobacco (without lime tube) | 28% | 160% |

| Chewing tobacco (with lime tube) | 28% | 142% |

| Filter khaini | 28% | 160% |

| Jarda scented tobacco | 28% | 160% |

| Pan masala containing tobacco ‘Gutkha’ | 28% | 204% |

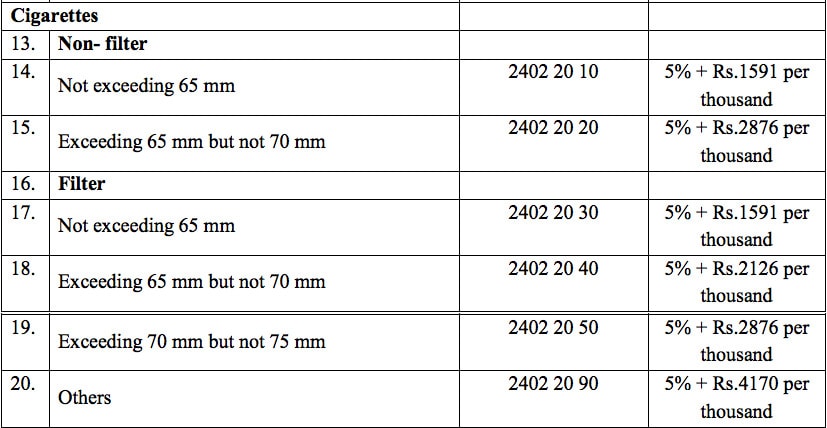

GST on Cigarettes

The GST on cigarettes applies to all types, including filter and non-filter cigarettes. The cigarette GST rate is intended to discourage smoking due to its health hazards and to generate significant revenue for the government. Additionally, a cess in a certain range is imposed on cigarettes, depending on the length and type, increasing the overall tax burden on this tobacco product.GST on Cigarettes, Rates, and Cess

Below, we have given information regarding GST on cigarettes, along with rates and Cess, This image essentially sums up the GST on Cigarettes.

This image essentially sums up the GST on Cigarettes.

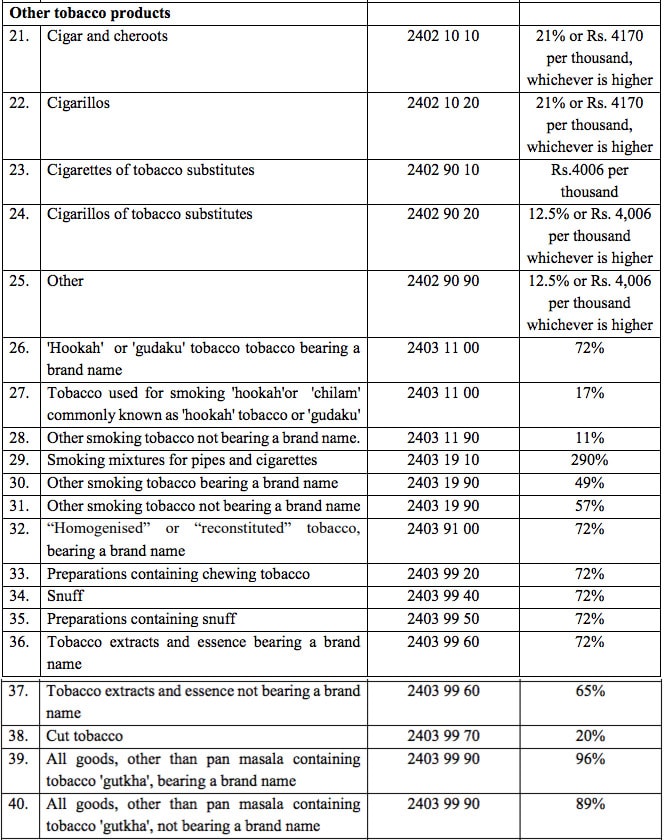

GST Rate and Cess for Other Tobacco Products

The cigarette GST rate and GST cess for other tobacco products like hookah, chewing tobacco, snuff and gutkha are as follows: Other Tobacco Products

Click here to read on GST Rate for Mobile Phones, Smartphones & Accessories

Other Tobacco Products

Click here to read on GST Rate for Mobile Phones, Smartphones & Accessories

HSN Code for Tobacco

Tobacco and tobacco products fall under Chapter 24 of the HSN Code. HSN Code is an internationally accepted system for classifying goods in the course of international trade. In the case of tobacco products, the following HSN code must be mentioned on the GST invoice based on the type of product sold:GST Rate and HSN Code for Unmanufactured Tobacco

| HSN Code | HSN Code Description | GST Rate |

| 2401 10 | Tobacco, not stemmed or stripped: | 28% |

| 2401 10 10 | Flue cured virginia tobacco | 28% |

| 2401 10 20 | Sun cured country (natu) tobacco | 28% |

| 2401 10 30 | Sun cured virginia tobacco | 28% |

| 2401 10 40 | Burley tobacco | 28% |

| 2401 10 50 | Tobacco for manufacture of biris, not stemmed | 28% |

| 2401 10 60 | Tobacco for manufacture of chewing tobacco | 28% |

| 2401 10 70 | Tobacco for manufacture of cigar and cheroot | 28% |

| 2401 10 80 | Tobacco for manufacture of hookah tobacco | 28% |

| 2401 10 90 | Other | 28% |

| 2401 20 | Tobacco partly or wholly stemmed or stripped: | |

| 2401 20 10 | Flue cured virginia tobacco | 28% |

| 2401 20 20 | Sun cured country (natu) tobacco | 28% |

| 2401 20 30 | Sun cured virginia tobacco | 28% |

| 2401 20 40 | Burley tobacco | 28% |

| 2401 20 50 | Tobacco for manufacture of biris | 28% |

| 2401 20 60 | Tobacco for manufacture of chewing tobacco | 28% |

| 2401 20 70 | Tobacco for manufacture of cigar and cheroot | 28% |

| 2401 20 80 | Tobacco for manufacture of hookah tobacco | 28% |

| 2401 20 90 | Other | 28% |

| 2401 30 00 | Tobacco refuse | 28% |

GST Rate and HSN Code for Cigarettes

| HSN Code | HSN Item Description | GST Rate |

| 2402 | CIGARS, CHEROOTS, CIGARILLOS AND CIGARETTES, OF TOBACCO OR OF TOBACCO SUBSTITUTES | |

| 2402 10 | Cigars, cheroots and cigarillos, containing tobacco: | 28% |

| 2402 10 10 | Cigar and cheroots | 28% |

| 2402 10 20 | Cigarillos | 28% |

| 2402 20* | Cigarettes, containing tobacco: | 28% |

| 2402 20 10 | Other than filter cigarettes, of length not exceeding 65 millimetres | 28% |

| 2402 20 20 | Other than filter cigarettes, of length exceeding 65 millimetres but not exceeding 70 millimetres | 28% |

| 2402 20 30 | Filter cigarettes of length (including the length of Free the filter, the length of filter being 11 millimetres or its actual length, whichever is more) not exceeding 65 millimetres. | 28% |

| 2402 20 40 | Filter cigarettes of length (including the length of Free the filter, the length of filter being 11 millimetres or its actual length, whichever is more) exceeding 65 millimetres not exceeding millimetres | 28% |

| 2402 20 50 | Filter cigarettes of length (including the length of Free the filter, the length of filter being 11 millimetres or its actual length, whichever is more) exceeding 75 millimetres but not exceeding 85 millimetres | 28% |

| 2402 20 60 | Filter cigarettes of length (including the length of Free the filter, the length of filter being 11 millimetres or its actual length, whichever is more) exceeding 75 millimetres but not exceeding 85 millimetres | |

| 2402 20 90 | Other | 28% |

| 2402 90 | Other: | 28% |

| 2402 90 10 | Cigarettes of tobacco substitutes | 28% |

| 2402 90 20 | Cigarillos of tobacco substitutes | 28% |

| 2402 90 90 | Other | 28% |

GST Rate and HSN for Tobacco Products and Substitutes

| HSN Code | HSN Item Description | GST Rate |

| 2403 | OTHER MANUFACTURE TOBACCO AND MANUFACTURED TOBACCO SUBSTITUTES; HOMOGENISED OR RECONSTITUTED TOBACCO; TOBACCO EXTRACTS AND ESSENCES | |

| Smoking tobacco, whether or not containing tobacco substitutes in any proportion: | ||

| 2403 11 | Water pipe tobacco | 28% |

| 2403 11 10 | Hookah or gudaku tobacco | 28% |

| 2403 11 90 | Other | 28% |

| 2403 19 | Other: | |

| 2403 19 10 | Smoking mixtures for pipes and cigarettes other than paper rolled biris, manufactured | 28% |

| 2403 19 21 | Smoking mixtures for pipes and cigarettes other than paper rolled biris, manufactured without the aid of machine | 28% |

| 2403 19 29 | Other | 28% |

| 2403 19 90 | Other | 28% |

| Other: | ||

| 2403 91 00 | "Homogenised" or "reconstituted" tobacco | 28% |

| 2403 99 | Other: | |

| 2403 99 10 | Chewing tobacco | 28% |

| 2403 99 20 | Preparations containing chewing tobacco | 28% |

| 2403 99 30 | Jarda scented tobacco | 28% |

| 2403 99 40 | Snuff | 28% |

| 2403 99 50 | Preparations containing snuff | 28% |

| 2403 99 60 | Tobacco extracts and essence | 28% |

| 2403 99 70 | Cut-tobacco | 28% |

| 2403 99 90 | Other | 28% |

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...