Last updated: February 15th, 2020 12:24 PM

Last updated: February 15th, 2020 12:24 PM

GST for Travel Agents and Transport Services

GST rate for all services and goods has been notified by the GST Council. GST Council fixed rates for all goods and services in five different slabs namely, 0%, 5%, 12%, 18% and 28%. GST portal was made live on 25th June 2017, and GST registration has been opened. GST return filing shall commence from July partly. GST is now all set to be rolled out from 1st July 2017. Hence, it is important for all business owners to adopt GST invoice formats, classify their services under appropriate HSN or SAC code and begin charging the correct GST rate for the goods or service. This article details GST on travel agents and GST on Transport Services.SAC Code for Services

All services supplied by a taxable person under GST must be classified under SAC Code. SAC code stands for Service Accounting Codes, a system of codes and classification created under the Service Tax Act and Rules to classify services supplied in India. If goods are supplied by a taxable person under GST, then the goods must be classified under the HSN code. HSN code stands for Harmonised System Nomenclature, an international system used for classifying goods in international trade.SAC Code for Travel Agent Services

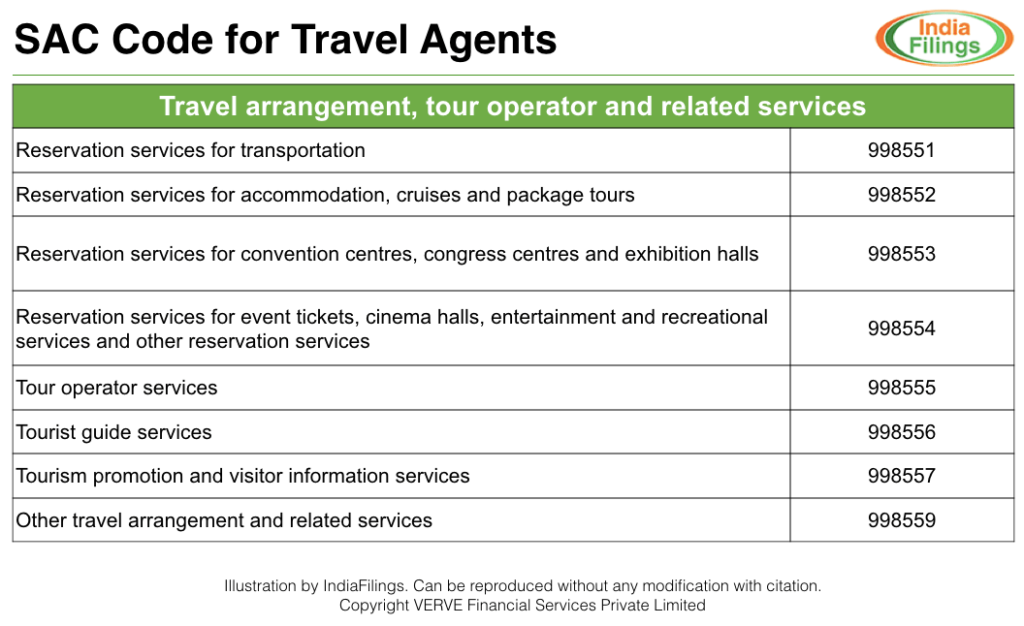

The following two infographics provide the SAC code for travel agent services and transport services. SAC Code for Travel Agents

SAC Code for Travel Agents

GST Rate for Travel Agents

As per the Schedule of GST Rates for services approved by the GST Council on 19th May 2017, the supply of tour operator services attracts 5% GST rate with no input tax credit. Also, services provided by a tour operator to a foreign tourist in relation to a tour conducted wholly outside India would continue to be exempt from GST, as it was exempt from service tax. Know more about GST rates applicable for hotels and restaurants.GST Rate for Transport Services

The following types of transport services attract 5% GST:- Transport of goods by rail

- Services of goods transport agency (GTA) in relation to transportation of goods [other than used household goods for personal use]

- Services of goods transport agency in relation to the transportation of used household goods for personal use.

- Transport of passengers by rail (other than sleeper class)

- Renting of a motor cab

- Transport of passengers by air in economy class

- Transport of passengers, by

- Air-conditioned contract/stage carriage other than a motor cab

- Radio taxi.

- Transport of passengers, with or without accompanied belongings, by air, embarking from or terminating in a Regional Connectivity Scheme Airport

- Transport of passengers by air in other than the economy class

Find the GST rate for all goods and services.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...