Last updated: December 29th, 2022 6:33 PM

Last updated: December 29th, 2022 6:33 PM

Hotels & Restaurants - GST Rates

After the implementation of GST, the GST Council announced the GST on hotels and GST on Restaurants. The GST Council determines the GST Rates for all the goods and services is determined by the GST Council in India. GST Council consists of members from the Central Government and State Government to regulate all aspects of GST implementation and administration in India. With GST set to be implemented in India from 1st July 2017, GST registration process has started, and GST Portal is now available for use by taxpayers. In this article, let us look at the GST rate applicable to hotels and restaurants in India.Old Tax System

Under the VAT, service tax and luxury tax regime, hotels and restaurants had to maintain compliance under VAT, service tax and luxury tax. The tax system created tremendous complexity for the hotel and restaurant industry. Under GST, hotels and restaurants would have to maintain compliance only under the tax system.SAC Code for Hotels and Restaurants

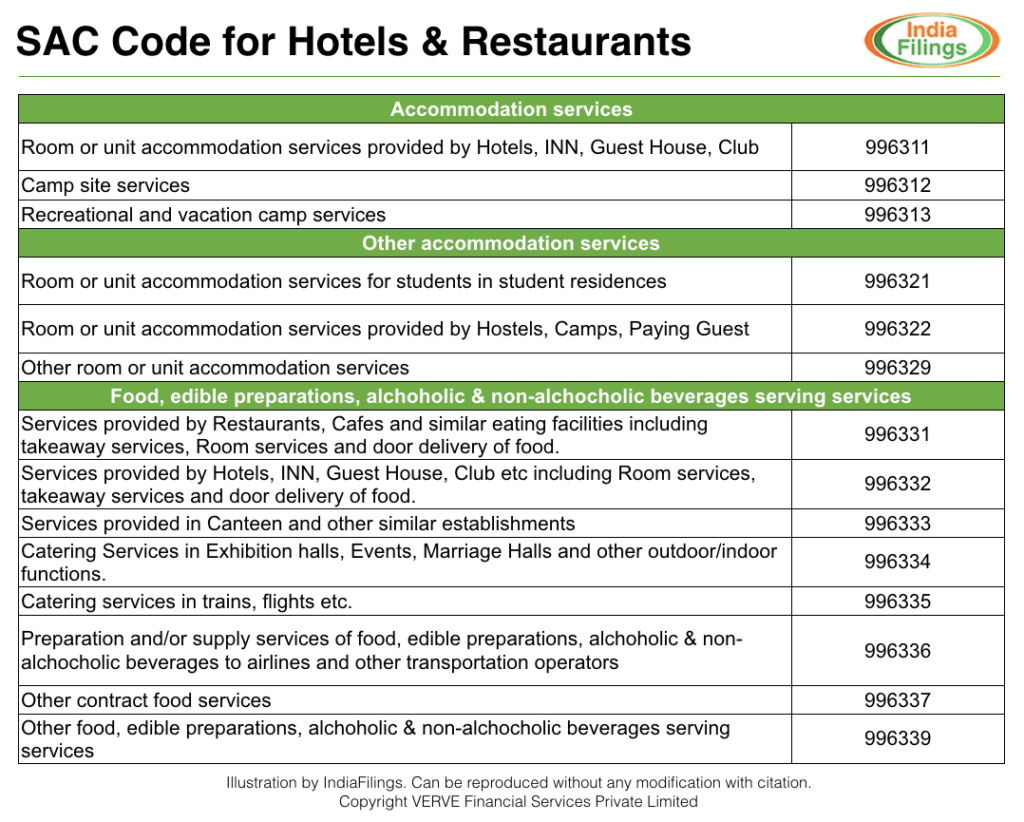

Under GST, all tax invoices raised contain an HSN Code or SAC code for the respective goods or services supplied. In the case of goods, the HSN code must be mentioned. HSN or Harmonised System Nomenclature is an international system used in over 200 countries for classifying goods in the course of international trade. Hotels and restaurants would have to use SAC Code or Services Accounting Code, used previously by the Service Tax Department. As most hotels and restaurants were enrolled under service tax, the migration to GST from service tax would be much simpler. The following are the SAC code for all hotel and restaurant services under GST: SAC Code for Hotels and Restaurants

SAC Code for Hotels and Restaurants

GST Rate for Hotels

The GST rate applicable for hotels, inns, guest houses, clubs, campsites or other places for temporary stay would depend on the type of facility, star rating and room rent per day charged.Hotels Rooms with Tariff of Less than Rs.2500 per Day

12% of GST shall apply while renting hotel rooms, inns or guest houses. In addition, the same GST rate shall also apply to clubs, campsites or other commercial places meant for residential or lodging purposes having room tariff Rs.1000 and above but less than Rs.2500 per room per day.Hotels Rooms with Tariff of Less than Rs.5000 per Day

18% of GST shall apply while renting of hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes where the room tariff ranges from Rs.2500 and above but less than Rs.5000 per room, per day.5 Star Hotels or Hotels Rooms with Tariff of more than Rs.5000 per Day

28% GST rate applies to accommodation in hotels including 5 stars and above rated hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes, where room rent ranges from Rs.5000 and above per night per room.GST Rate for Restaurants

The GST rate for the restaurants shall apply depending on the type of air-conditioning facilities provided. The different tax slab shall also vary if the restaurant provides liquor.Restaurants with No Air-Conditioning and No License to Serve Liquor

5% GST rate is applicable to supply of food/drinks in a restaurant not having a facility of air-conditioning or central heating at any time during the year and not to have a licence to serve liquor.Restaurants with Air-Conditioning

18% GST rate is applicable to the taxable value of supply of food/drinks in a restaurant having a facility of air-conditioning or central heating at any time during the year.Restaurants with License to Serve Liquor

18% GST rate is applicable to the supply of food/drinks in a restaurant having a licence to serve liquor.5 Star Hotel Restaurants

28% GST rate is applicable to the supply of food/drinks in an air-conditioned restaurant in the 5-star or above-rated hotel. Know more about GST rate for alcohol and beverages in India.GST Rate for Marriage Hall, Banquet Hall, Conference Center, etc.

18% GST rate is applicable on bundled service by way of supply of food or any other article of human consumption or any drink, in a premises (including hotel, convention centre, club, pandal, shamiana or any other place, specially arranged for organizing a function) together with renting of such premises.GST Rate for Outdoor Catering

Supply of food/drinks in outdoor catering attracts 18% GST rate in India.Know more about GST return filing or GST in India.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...