Last updated: January 27th, 2020 10:06 AM

Last updated: January 27th, 2020 10:06 AM

GST Refund for Deemed Exports

The registered taxable person (or exporter) is required to apply for the refund on the GST portal for the supplies of goods under deemed export. This article explains the process of making a refund for deemed export in detail.Deemed Exports

Deemed exports are supplies of goods that are notified by the government on the recommendation of the council under the following conditions are:- The goods supplied do not leave India.

- Payment for such supplies is collected in Indian Rupees or Convertible Foreign Exchange.

- Such goods are manufactured or produced in India.

Categories of Supply of Goods(Deemed Exports)

The following categories of supply of goods are considered as deemed exports are explained below:- The supply of goods by a registered individual against advance authorisation.

- The supply of capital goods by a registered individual against export promotion capital goods authorisation.

- The supply of goods by a registered individual to the export-oriented unit.

- The supply of gold by a bank or public sector undertaking.

Eligibility Criteria

If the registered taxpayer has paid any tax on inward supplies received which is considered as deemed exports, then the recipient of the deemed exports is eligible to claim their refund of the tax amount paid which is reflected as an input tax credit in their electronic cash ledger. Therefore, the declaration has to be provided by the supplier that no claim for refund performed concerning the said supplies.Documents Required

The applicant has to upload the required documents along with Form RFD-01A, as notified under CGST Rules or Circulars stated. Additionally, Statement 5B having details of invoices for which the refund is to be claimed or any other supporting documentation can be uploaded by the taxpayer, if needed by the sanctioning authority.Procedure To Claim Refund – Deemed Exports

To claim for a refund on account of the recipient of deemed exports, follow the steps mentioned below: Step 1: Kindly visit the official portal of GST department.Provide Login Details

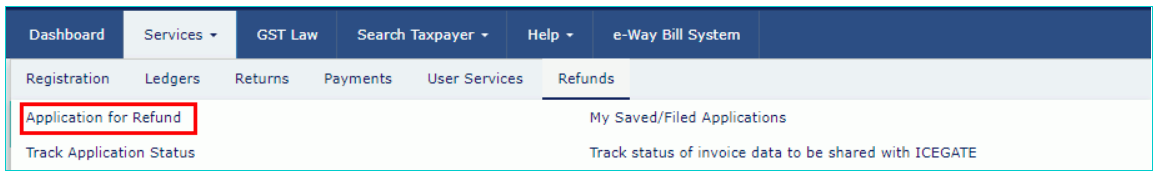

Step 2: Log in to the GST Portal with accurate details like username and password and click on the “Login” button. Step 3: Click the Services and select “Application for refund” option from Refund menu. [caption id="attachment_64697" align="aligncenter" width="566"] GST Refund - Deemed Exports - Image 1

GST Refund - Deemed Exports - Image 1

Choose Refund Type

Step 4: Select the "On account of Refund by Recipient of deemed export" option from the refund type. [caption id="attachment_64698" align="aligncenter" width="670"] GST Refund - Deemed Exports - Image 2

Step 5: Choose the Financial Year and Tax Period for which application has to be filed from the drop-down list and click the Create button.

Step 6: Select “Yes or No” option for a refund made for all previous tax periods starting from registration date.

GST Refund - Deemed Exports - Image 2

Step 5: Choose the Financial Year and Tax Period for which application has to be filed from the drop-down list and click the Create button.

Step 6: Select “Yes or No” option for a refund made for all previous tax periods starting from registration date.

In the case of Yes

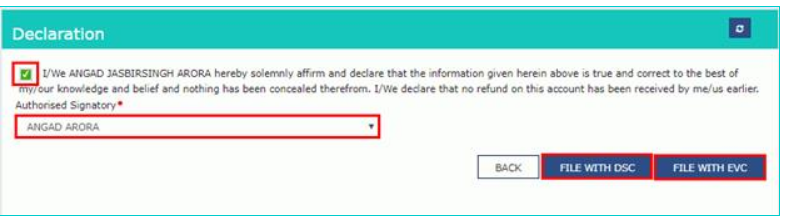

Step 7: Select the Declaration checkbox and choose the name of authorised signatory in the Name of Authorized Signatory drop-down list. Step 8: Click the "File with DSC" or "File with EVC" button. [caption id="attachment_64699" align="aligncenter" width="667"] GST Refund - Deemed Exports - Image 3

GST Refund - Deemed Exports - Image 3

Filing with DSC

- Click the Proceed button and select the certificate and click the SIGN button.

Filing with EVC

- Enter the OTP which is received to the email ID and mobile number of the Authorized Signatory and press the Verify button.

In the case of No

Step 9: The Refund on account of Refund by Recipient of the deemed export page is displayed.Download Offline Utility

Step 10: Click the “Download Offline Utility” link and press the “Proceed” button to continue. [caption id="attachment_64700" align="aligncenter" width="670"] GST Refund - Deemed Exports - Image 4

Step 11: Now open the excel sheet and enter the GSTIN and From and To Return Period in the prescribed format.

Step 12: Enter the details of Sr. No., invoices of inward supplies and tax paid and click the “Validate & Calculate” button.

[caption id="attachment_64730" align="aligncenter" width="659"]

GST Refund - Deemed Exports - Image 4

Step 11: Now open the excel sheet and enter the GSTIN and From and To Return Period in the prescribed format.

Step 12: Enter the details of Sr. No., invoices of inward supplies and tax paid and click the “Validate & Calculate” button.

[caption id="attachment_64730" align="aligncenter" width="659"] GST Refund - Deemed Exports - Image 5PNG

Step 13: The total number of records in the sheet is displayed. Click the “Ok” button.

Step 14: Click the “Create File To Upload” button and save the file.

[caption id="attachment_64735" align="aligncenter" width="645"]

GST Refund - Deemed Exports - Image 5PNG

Step 13: The total number of records in the sheet is displayed. Click the “Ok” button.

Step 14: Click the “Create File To Upload” button and save the file.

[caption id="attachment_64735" align="aligncenter" width="645"] GST Refund - Deemed Exports - Image 6

GST Refund - Deemed Exports - Image 6

Upload details of invoices of inward supplies in case refund is claimed by the recipient

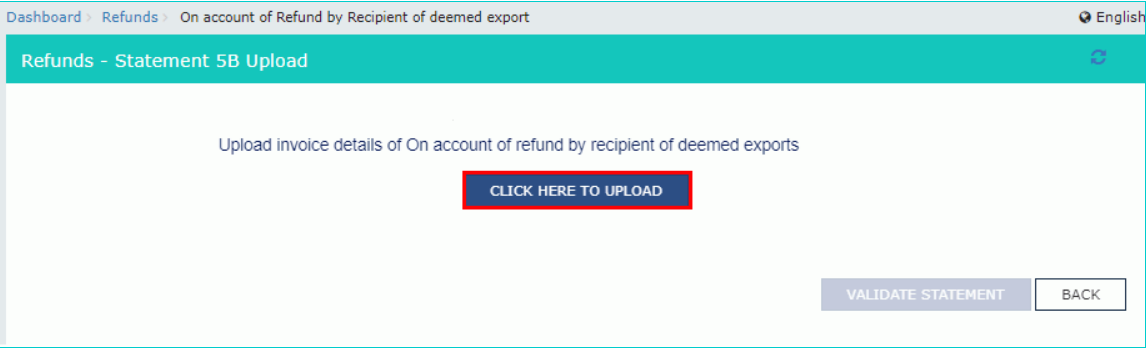

Step 15: Click the tab Click to fill the details of invoices of inward supplies in case refund is claimed by the recipient. Step 16: Now, Press the "Click here to upload" button. [caption id="attachment_64738" align="aligncenter" width="660"] GST Refund - Deemed Exports - Image 7

Step 17: Now save the refund statement file and click the “Open” button.

Step 18: Click the “Download Unique Invoices” tab to view the invoices that have been uploaded successfully and click Validate statement button.

[caption id="attachment_64740" align="aligncenter" width="656"]

GST Refund - Deemed Exports - Image 7

Step 17: Now save the refund statement file and click the “Open” button.

Step 18: Click the “Download Unique Invoices” tab to view the invoices that have been uploaded successfully and click Validate statement button.

[caption id="attachment_64740" align="aligncenter" width="656"] GST Refund - Deemed Exports - Image 8

Step 19: Upon statement validation, a confirmation message on the screen that the statement has been submitted successfully for validation. Click the “Back” button.

GST Refund - Deemed Exports - Image 8

Step 19: Upon statement validation, a confirmation message on the screen that the statement has been submitted successfully for validation. Click the “Back” button.

Refund by Recipient of Deemed Export

Step 20: Enter the value in statement 5B below for the tax period for which the refund to be claimed. Step 21: After filing the appropriate details in the statement-5B, provide the refund amount to be claimed in the table “Amount Eligible for Refund”. Step 22: Click the hyperlink Click to view Electronic Liability Ledger to see details of Electronic Liability Ledger that displays the liabilities/ dues of Returns and other than Returns and press the Go back to refund form to return to the refund application page. [caption id="attachment_64795" align="aligncenter" width="680"] GST Refund - Deemed Exports - Image 9

Step 23: Select the Bank Account Number from the drop-down list, and upload the supporting document and click the “Submit” button.

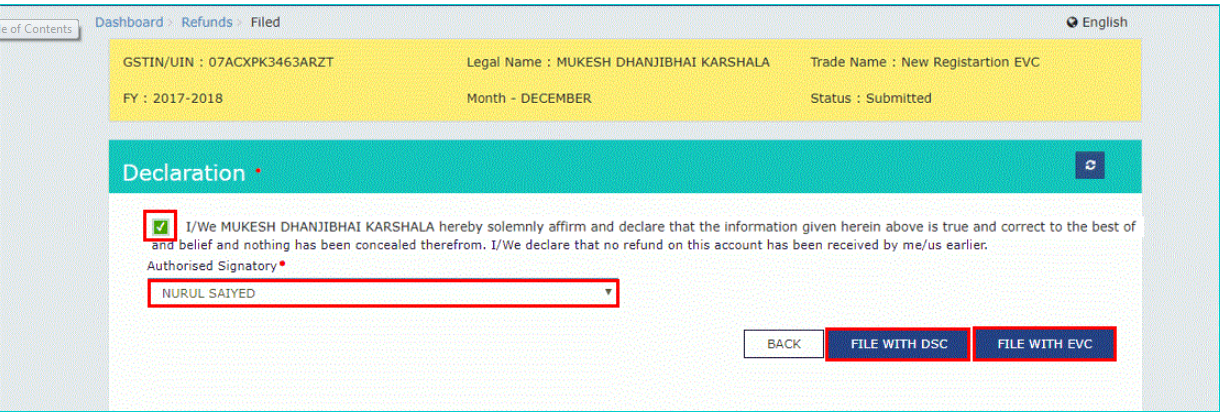

Step 24: After the statement successfully submitted a message is displayed for confirmation and click on the “Proceed” button.

Step 25: Select the name of authorised signatory in the name of the authorised signatory drop-down list. Choose the File with DSC or File with EVC button.

[caption id="attachment_64798" align="aligncenter" width="659"]

GST Refund - Deemed Exports - Image 9

Step 23: Select the Bank Account Number from the drop-down list, and upload the supporting document and click the “Submit” button.

Step 24: After the statement successfully submitted a message is displayed for confirmation and click on the “Proceed” button.

Step 25: Select the name of authorised signatory in the name of the authorised signatory drop-down list. Choose the File with DSC or File with EVC button.

[caption id="attachment_64798" align="aligncenter" width="659"] GST Refund - Deemed Exports - Image 10

GST Refund - Deemed Exports - Image 10

File With DSC- Method

- Click the “Proceed” button and select the certificate and click the “Sign.”

File With EVC – Method

- Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the Verify button.

GST Refund - Deemed Exports - Image 11

Note: Once the Application Reference Number is generated on the filing of form RFD-01A, a refund application is assigned to refund processing officer for processing. The request will be processed, and refund status will be updated in the portal.

GST Refund - Deemed Exports - Image 11

Note: Once the Application Reference Number is generated on the filing of form RFD-01A, a refund application is assigned to refund processing officer for processing. The request will be processed, and refund status will be updated in the portal.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...