Last updated: April 17th, 2019 12:58 PM

Last updated: April 17th, 2019 12:58 PM

GST REG-19 - Order for Cancellation of GST Registration

GST registration certificate can be cancelled in case of non-compliance with GST regulations. Prior to cancelling a GST registration, the concerned Officer would issue a show cause notice, allow for a personal hearing and provide time for regularisation. In case the taxpayer fails to comply with the show cause notice, then the GST registration can be cancelled and final amount payable on GST registration cancellation would be provided in the notice.When can GST registration be surrendered?

Persons registered under GST are allowed to surrender their GST registration at any point in time, when they are no longer required to be registered as per the GST Act. For example, if a business does not exceed Rs.20 lakhs of taxable supply (In most states of India) in a financial year or the promoters wish to windup their, then GST registration can be surrendered.When can GST registration be cancelled?

GST registration can be cancelled by a GST Officer at any time when any of the following conditions are satisfied:- The taxpayer has not followed GST Act or Rules.

- A person registered under GST has not filed GST returns for 6 months.

- A person registered under GST Composition Scheme has not filed GST returns for three-quarters.

- A taxpayer who registered for GST voluntarily has not commenced business within 6 months.

- The GST registration was obtained fraudulently or by misstatement of facts.

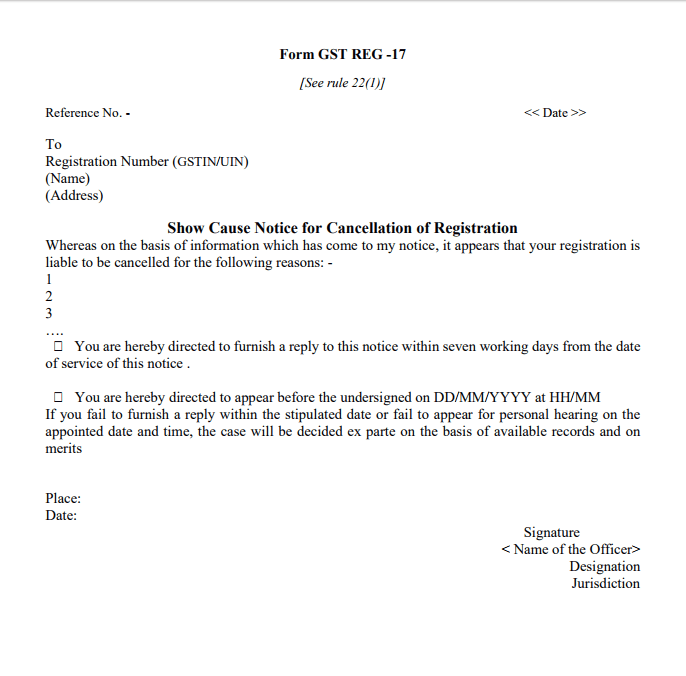

Sample GST REG-17

Sample GST REG-17

How to reply to an order for cancellation of GST registration?

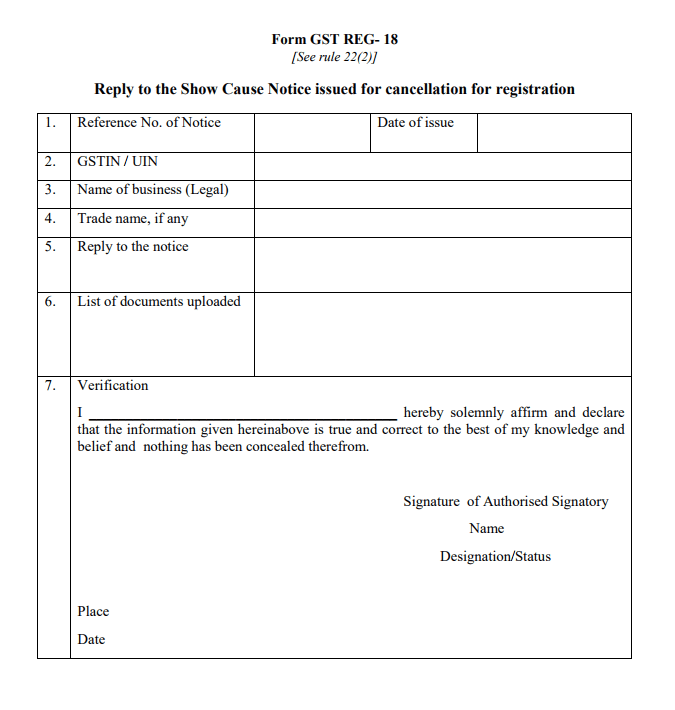

In case you have received the above notice from the GST department. It is advisable to file the pending GST returns due and correct the deficiencies cited in the show cause notice. Even if the issues cannot be corrected immediately within seven working days, the taxpayer can provide a written reply to the notice with a timeline for adhering to GST Act and Rules at the earliest and request for additional time. In addition to submitting a written response, the taxpayer should also appear before the concerned officer at the date and time mentioned in the notice. The reply to show cause notice issued for cancellation of GST registration must be submitted in GST REG-18 as shown below within 7 working days: [caption id="attachment_33161" align="aligncenter" width="675"] Form GST REG-18

Form GST REG-18

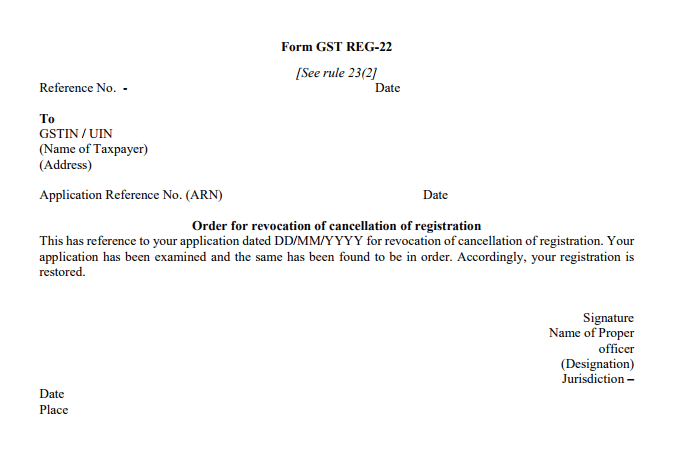

Dropping the Proceedings for Cancellation of GST Registration

In case the concerned officer is satisfied with the response submitted by the taxpayer in GST REG-18, the proceedings for cancellation of GST registration would be dropped. On cancellation of the proceedings, a confirmation for cancellation of the proceedings would be issued by the tax officer in GST REG-22 as shown below: [caption id="attachment_33162" align="aligncenter" width="676"] GST REG-22

GST REG-22

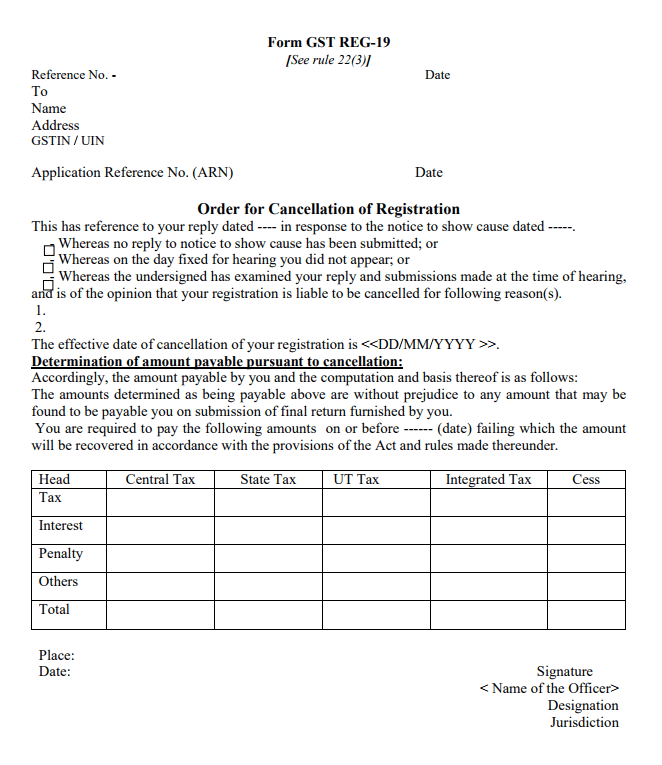

Cancellation of GST Registration

In case the concerned Officer is not satisfied with the reply submitted by the taxpayer or the taxpayer fails to submit a response within the time provided, an order would be passed by the GST officer for cancellation of GST registration. The order for cancellation of GST registration would be passed using Form GST REG-19 as shown below: [caption id="attachment_33163" align="aligncenter" width="662"] GST REG-19

On cancellation of the GST registration, the taxpayer would be required to pay the GST amount payable mentioned on GST REG-19 within the time provided. The GST amount payable would consist of taxes payable, interest, penalty and other charges as assessed by the tax officer.

GST REG-19

On cancellation of the GST registration, the taxpayer would be required to pay the GST amount payable mentioned on GST REG-19 within the time provided. The GST amount payable would consist of taxes payable, interest, penalty and other charges as assessed by the tax officer.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...