Last updated: July 8th, 2023 8:39 AM

Last updated: July 8th, 2023 8:39 AM

GST Registration - Documents Requested or Application Rejected

All entities engaged in providing a supply of more than Rs.40 lakhs of goods and more than Rs. 20 lakhs for services in most states are required to obtain GST registration (Check GST registration criteria). After submitting for the registration on the GST Common Portal, the applicant shall receive the GST registration certificate within 3 - 7 working days. However, some applicants may be required to provide additional documents to the GST department for further clarifications. In rare cases, the application for GST registration could also be denied. In this article, we look at such cases, wherein after submission of a GST registration application, additional documents are requested or the GST application is rejected.Submission of GST registration application

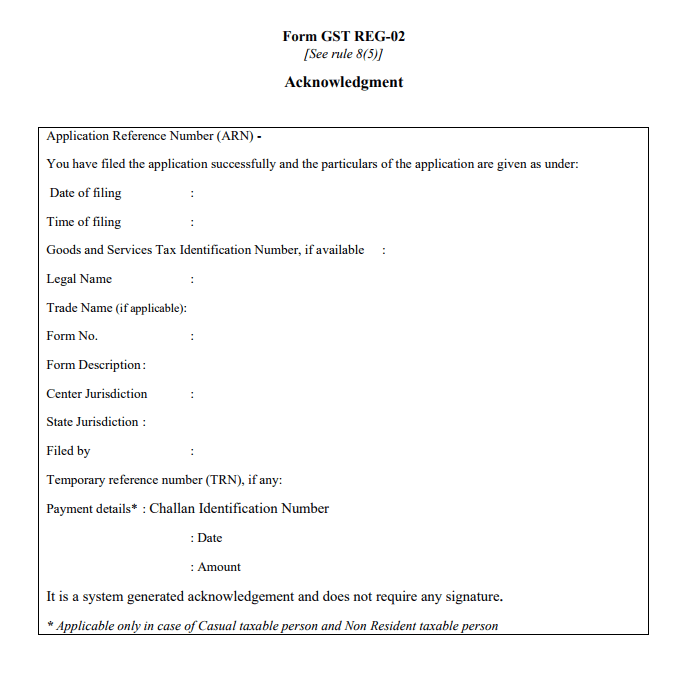

After submission of a GST registration application along with the list of documents required, an acknowledgement as shown below is provided to the applicant. [caption id="attachment_33155" align="aligncenter" width="686"] Sample GST Registration Acknowledgement

The applicant can use the ARN number as mentioned in the GST registration application acknowledgement to track the status of the application. It normally takes about 7 working days for the provisional GSTIN to be provided and an additional 2 days for providing final GSTIN with GST registration certificate. If the processing officer approves the application, the applicant shall receive the GST registration certificate as a soft-copy. The below image depicts a sample format for reference:

[caption id="attachment_33116" align="aligncenter" width="623"]

Sample GST Registration Acknowledgement

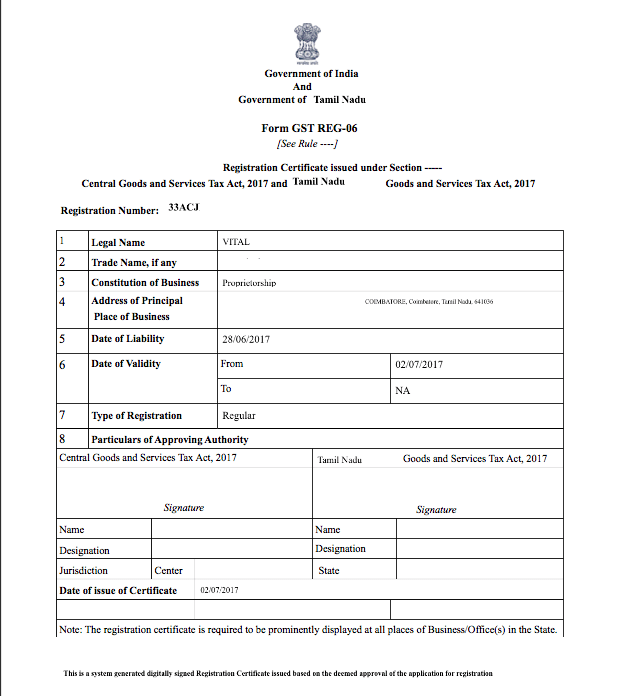

The applicant can use the ARN number as mentioned in the GST registration application acknowledgement to track the status of the application. It normally takes about 7 working days for the provisional GSTIN to be provided and an additional 2 days for providing final GSTIN with GST registration certificate. If the processing officer approves the application, the applicant shall receive the GST registration certificate as a soft-copy. The below image depicts a sample format for reference:

[caption id="attachment_33116" align="aligncenter" width="623"] GST Registration Certificate Sample - Annexure A

GST Registration Certificate Sample - Annexure A

Additional Documents Requested

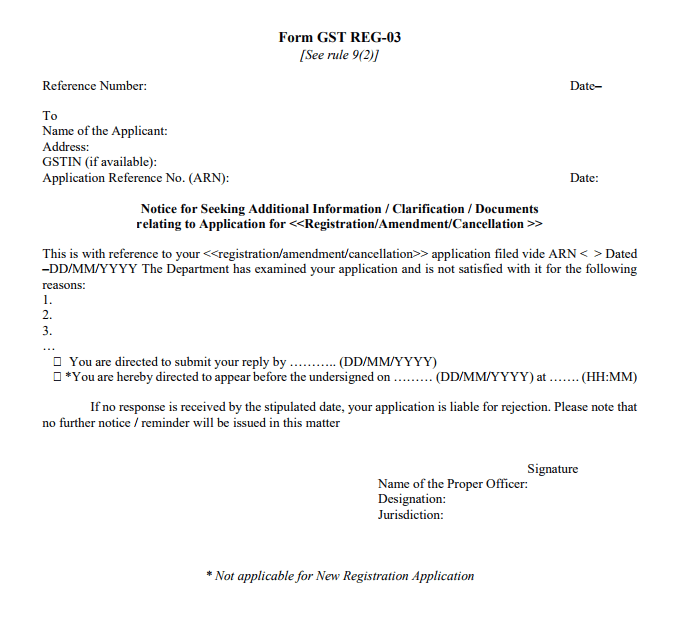

If the GST registration application does not contain all the necessary documents or information, then the GST officer processing the application would issue a notice seeking additional information or clarification or documents as shown below: [caption id="attachment_33156" align="aligncenter" width="682"] Sample GST REG-03

In such a case, the GST registration applicant can submit the required information or documents as cited by the GST Officer on the common portal before the date mentioned in the notice. The authorized officer shall approve the application upon satisfied with the information provided by the applicant for GST certificate. However, the authorized officer may also reject the application for GST certificate, if the applicant failed to provide all the required documents or submitting the application or documents on time.

It is important to note that a GST Officer cannot order for a personal hearing for issuing a new GST registration certificate. The GST officer shall communicate any information regarding the process of the application or any concerns regarding the registration only through the GST forms.

Sample GST REG-03

In such a case, the GST registration applicant can submit the required information or documents as cited by the GST Officer on the common portal before the date mentioned in the notice. The authorized officer shall approve the application upon satisfied with the information provided by the applicant for GST certificate. However, the authorized officer may also reject the application for GST certificate, if the applicant failed to provide all the required documents or submitting the application or documents on time.

It is important to note that a GST Officer cannot order for a personal hearing for issuing a new GST registration certificate. The GST officer shall communicate any information regarding the process of the application or any concerns regarding the registration only through the GST forms.

GST Registration Application Rejected

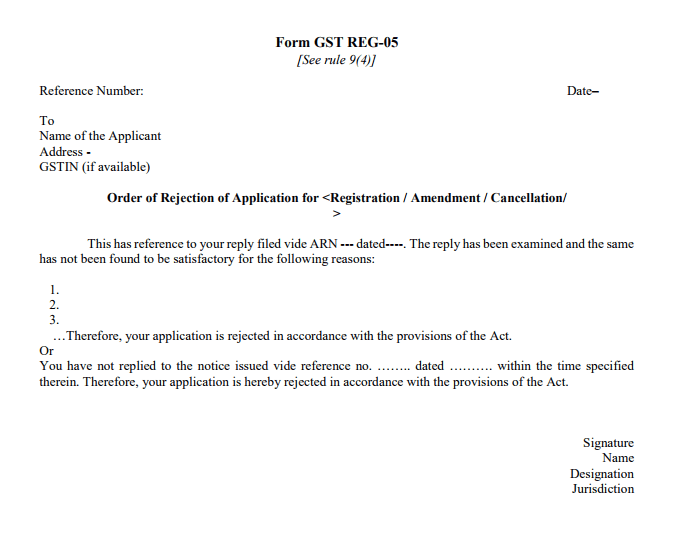

If the applicant fails to provide any reply, not satisfied with the reply or the applicant fails to submit a reply within the time mentioned, the processing officer can cancel the application. On rejection of a GST registration application, the GST Officer would issue the following notice to the taxpayer. As per the GST regulations, the authorized officer should convey to the applicant the reasons for rejection in writing. [caption id="attachment_33157" align="aligncenter" width="675"] GST Registration Application Rejection Order

If the taxpayer has rectified the issues mentioned in the GST registration cancellation order, a fresh GST registration application can be submitted. In case the applicant has questions regarding the reasons for rejection, the nearest GST Seva Kendra can also be approached for assistance.

GST Registration Application Rejection Order

If the taxpayer has rectified the issues mentioned in the GST registration cancellation order, a fresh GST registration application can be submitted. In case the applicant has questions regarding the reasons for rejection, the nearest GST Seva Kendra can also be approached for assistance.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...