Last updated: October 18th, 2022 6:03 PM

Last updated: October 18th, 2022 6:03 PM

GST Registration for Branches & Business Verticals

According to the CGST Act, all the suppliers of taxable goods and services should register with GST in the State or Union territory, from the place of taxable supply of goods or services. Furthermore, provisions have been provided in the GST Registration Rules for obtaining GST registration for branches. In this article, we look at GST registration for branches in detail.GST Registration for Branches in the Different States

GST registration should be obtained by a taxable person under GST in each of the State or Union Territory, from where the taxable supply of goods or services is made. For example, if a restaurant operates in the States of Maharashtra and Delhi, then separate GSTIN would have to be obtained for Maharashtra and Delhi. [caption id="attachment_33006" align="aligncenter" width="744"] GSTIN Format

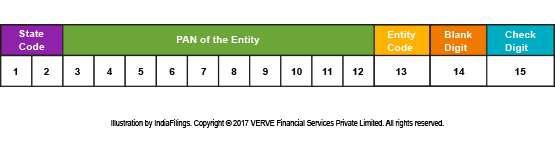

As shown in the GSTIN format above, the first two numbers in a GST registration number represents the state of registration. Hence, if a business is operating in two different states, then the first two numbers of the GSTIN would change, while the PAN of the entity would remain the same. Also, in case of more than 1 GST registration within a state, then the entity code would also change.

GSTIN Format

As shown in the GSTIN format above, the first two numbers in a GST registration number represents the state of registration. Hence, if a business is operating in two different states, then the first two numbers of the GSTIN would change, while the PAN of the entity would remain the same. Also, in case of more than 1 GST registration within a state, then the entity code would also change.

GST Registration for Branches within a State

The applicant can also apply for separate GST registration for branches within a state for businesses having multiple business verticals. To apply for separate GST registration for branches within a State, the entity shall follow the following conditions:- Have more than one business vertical. Business vertical means a distinguishable component of an enterprise that is engaged in the supply of individual goods or services or a group of related goods or services which are subject to risks and returns that are different from those of the other business verticals.

- The business must not be registered to pay tax under the GST Composition Scheme.

- All separately registered business verticals must pay tax on supply of goods or services to another registered business vertical of the same business and issue a tax invoice for such supply.

Obtaining GST Registration for Branches

The entity shall use FORM GST REG-01 for registering businesses with GST. Therefore, any entity or individual applying for GST registration for their branches or separate business verticals within the same state shall apply only through FORM GST REG-01. During the registration process, the applicant shall provide appropriate application and documents for the GST registration. After submission of the application for GST registration by the applicant, the authorized officer shall verify the application and documents provided by the applicant. After approval the officer shall provide the GST registration certificate within 7 working days. The GST registration certificate would show the principal place of business and additional place or places of business.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...