Last updated: April 24th, 2024 4:52 PM

Last updated: April 24th, 2024 4:52 PM

GST Registration Cancellation

If the GST regulations do not apply to you, if you're closing down your business or profession, or even if the tax authority requires it, you can Cancel the GST registration. This article overviews the various cancellation of GST registration scenarios and the corresponding procedures on how to cancel GST registration online. Knowing the necessary steps and forms is essential to ensure smooth GST cancellation online. If you're seeking professional assistance for the GST registration cancellation process, IndiaFilings can help you. With our expertise and vast experience, we can streamline the process, ensuring that all requirements are met with precision and timeliness. [shortcode_67]Definition - Cancellation of GST Registration

Cancellation of GST registration denotes that the individual or entity is no longer recognized as a registered taxpayer under GST. As a result, they are no longer obligated to collect, remit, or pay GST, nor can they claim input tax credits. Additionally, they are exempted from the requirement to file GST returns.Who is Eligible for GST Cancellation?

Under the GST framework, both a taxpayer and an official officer have the authority to commence the process of canceling a GST registration. If an official officer deems it necessary to begin the GST cancellation online process, they can issue a show-cause notice using the GST REG-17 form.GST cancellation Requested by the Taxpayer

The individual or entity holding the GST registration can initiate the cancellation process voluntarily if they believe they no longer need to be registered under GST or meet certain conditions for cancellation.GST cancellation By Tax Officers

Tax officials can cancel a GST registration if they determine that the taxpayer is not complying with the regulations or if there are discrepancies in their conduct or submissions.GST cancellation Requested by Legal Heirs

In the event of a taxpayer's demise, the legal heirs can request the cancellation of the deceased's GST registration.Who Cannot File for Cancellation of Registration Under GST?

- Tax Deductors / Tax Collectors: Those explicitly registered for deducting or collecting taxes cannot apply for cancellation.

- Unique Identity Number (UIN) Holders: Entities or individuals, typically foreign diplomatic missions, UN bodies, etc., who have been allotted a UIN cannot file to cancel their GST registration. They are given the UIN to claim a refund of taxes on their inward supplies.

Conditions When GST Registration Can Be Cancelled

Here’s a detailed explanation of the typical circumstances under which GST registration might be cancelled:Tax Officer – Suo Moto Cancellation

A tax officer can initiate the cancellation of GST registration in certain situations, including:- The taxpayer isn't conducting business from their registered place of business.

- The taxpayer is issuing tax invoices without actually selling any goods or services.

- There are violations of the provisions of the act or the rules set out by the GST Council.

- GST Registration was procured through fraudulent means or by misstating facts.

- A taxpayer under the regular scheme has yet to file returns for six consecutive months.

- A taxpayer under the Composition Scheme hasn't filed returns for three successive tax periods.

Taxpayer – Voluntary Cancellation

As per Section 29 of the CGST Act, the taxpayer can initiate and apply for the cancelled GST registration under the following circumstances. A registered taxpayer can voluntarily seek cancellation of GST registration under these circumstances:- The taxpayer has discontinued or closed their business operations.

- The business has been transferred because of amalgamation, merger, de-merger, sale, lease, etc.

- There's a change in the business structure, which leads to a change in PAN (like a proprietorship being converted into a private limited company).

- The taxpayer has voluntarily registered but has yet to start business operations within a specified timeframe.

- A taxable individual isn't required to be registered under the GST Act.

- The taxpayer is no longer liable to pay tax.

Legal Heirs

In the unfortunate event of the death of a sole proprietor, the legal heirs have the authority to apply for the cancellation of the GST registration for the proprietorship firm.Consequence of Cancellation of GST registration

- No GST Payments: The taxpayer must no longer pay GST once the GST registration is cancelled.

- Mandatory Registration: Some businesses are obligated to be registered under GST. If they cancel their GST registration but continue to operate, it violates GST regulations and can result in severe penalties.

Forms Used for GST Registration Cancellation:

The following forms are used for cancellation of registration under GST:- GST REG 16: This form is relevant when a taxpayer, on their own initiative, applies for the cancellation of their GST registration. This form is applicable only if there's no other consideration for the application and at least one year has elapsed since the original GST registration.

- GST REG 17: This form is employed by an authorized GST officer to serve a show-cause notice regarding the potential cancellation of GST registration to the registered taxpayer or business entity. The officer's process to cancel the registration commences after issuing the GST REG 17 form. The officer asks the taxpayer why the registration should not be terminated through this form.

- GST REG 18: The taxpayer or entity can reply to the show cause notice served through the GST REG 17 form using the GST REG 18 form. This reply, providing a defence or explanation against the potential cancellation, must be submitted within seven days of receiving the initial notice.

- GST REG 19: The GST officer uses this form to issue a formal order to cancel the GST registration. This order must be issued within 30 days of either the initial application date or the response received through the GST REG 18 form.

- GST REG 20: If the officer is satisfied with the response to the show cause notice, they can decide to revoke any proceedings to cancel the registration. The decision is conveyed using the GST REG 20 form in such cases.

Required Information for Filing cancellation of Registration under GST

The following information must be mandatorily specified by the applicant while applying for cancellation in Form GST REG-16:- Contact address, which includes the mobile number and e-mail address.

- Grounds of cancellation.

- The desired date of cancellation.

- Particulars of the value and the tax payable on the stock of inputs, the inputs available in semi-finished goods, inputs available in finished goods, and the stock of capital goods/plant and machinery.

- Details of entity registration if the existing unit merged, amalgamated, or transferred.

- Particulars of the latest return filed by the taxpayer along with the ARN of the particular return.

Payment Requisites

While applying for a cancellation, the applicant must pay the input tax contained in the stock of inputs, semi-finished goods, finished goods, and capital goods or the output tax liability of such goods, whichever is higher.- The payment can be made by debiting the electronic credit or cash ledger.

- Though considered essential, the obligation may be fulfilled when submitting the final return in GSTR-10.

Process of Cancellation of GST Registration

The taxpayers must follow the below steps for the process of cancellation of GST registration and ensure to check the GST cancellation status regularly after the completion: Step 1: First, taxpayers must visit the Goods and Services Tax portal to Cancel their GST Registration. [caption id="attachment_64407" align="aligncenter" width="709"] GST Portal

Step 2: Click the 'Login' button to access the username and password page.

[caption id="attachment_64409" align="aligncenter" width="856"]

GST Portal

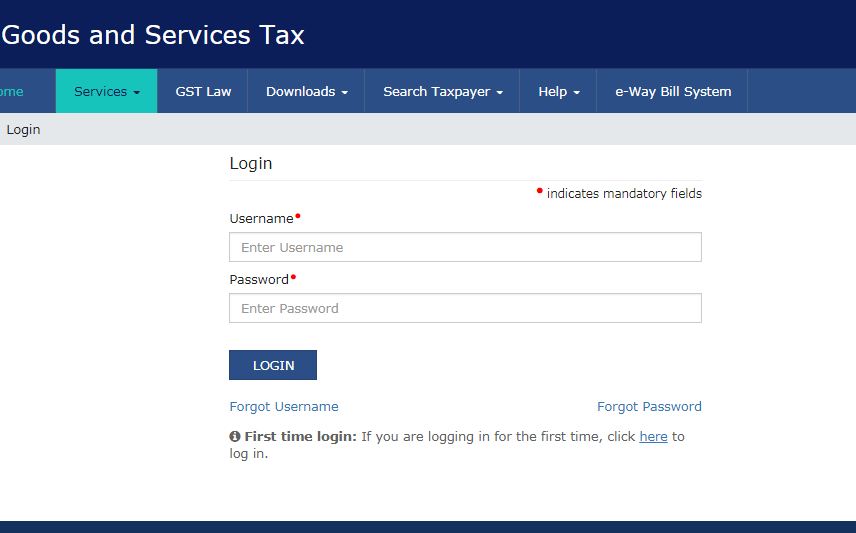

Step 2: Click the 'Login' button to access the username and password page.

[caption id="attachment_64409" align="aligncenter" width="856"] Login Page

Step 3: Enter the correct 'Username' and 'Password' credentials along with the captcha in the required field and click 'login'.

Step 4: Click on the Application for Cancellation of Registration link under the services tab on the home page.

[caption id="attachment_64411" align="aligncenter" width="778"]

Login Page

Step 3: Enter the correct 'Username' and 'Password' credentials along with the captcha in the required field and click 'login'.

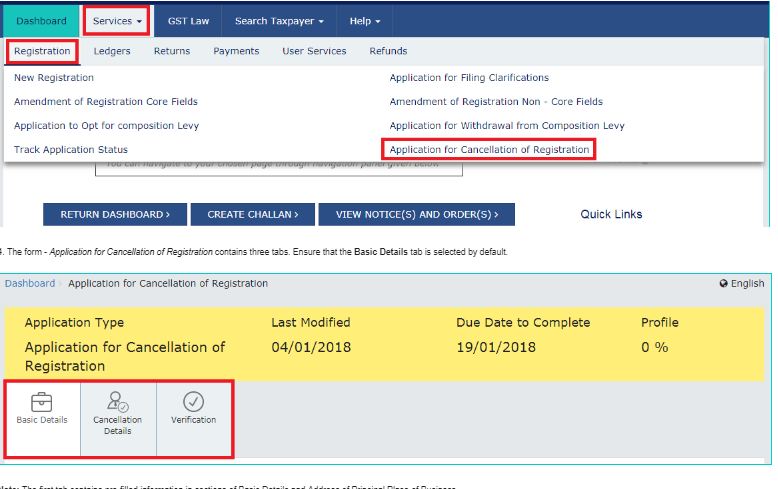

Step 4: Click on the Application for Cancellation of Registration link under the services tab on the home page.

[caption id="attachment_64411" align="aligncenter" width="778"] Application Page

Step 5: The portal displays various tabs for cancelling the registration form. There are three tabs: Basic Details, Cancellation Details, and Verification. Click on each tab to enter the details.

Application Page

Step 5: The portal displays various tabs for cancelling the registration form. There are three tabs: Basic Details, Cancellation Details, and Verification. Click on each tab to enter the details.

Provide Basic Details

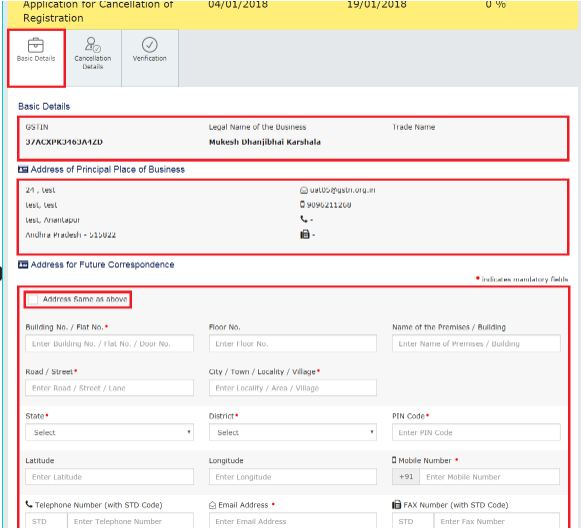

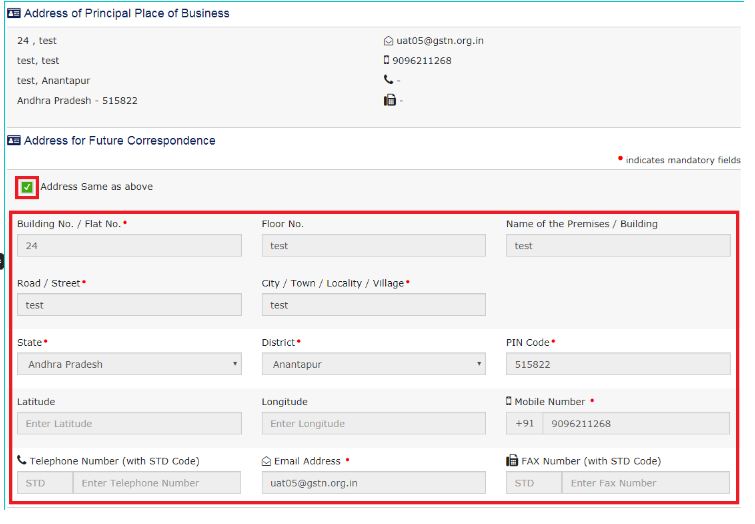

Step 6: The Basic Details tab displays the pre-filled information in the Basic Details and Address of Principal Place of Business sections. [caption id="attachment_64413" align="aligncenter" width="581"] Details and Address of Principal Place of Business

Step 7: The applicant must manually fill in the address for future correspondence or check the Address option, same as the above, to copy the address in the Address of Principal Place of Business field.

Step 8: Then click on the "Save and Continue" button. A blue tick will appear on the Basic Details section indicating completing the Basic details. Now proceed with the next tab.

[caption id="attachment_64414" align="aligncenter" width="755"]

Details and Address of Principal Place of Business

Step 7: The applicant must manually fill in the address for future correspondence or check the Address option, same as the above, to copy the address in the Address of Principal Place of Business field.

Step 8: Then click on the "Save and Continue" button. A blue tick will appear on the Basic Details section indicating completing the Basic details. Now proceed with the next tab.

[caption id="attachment_64414" align="aligncenter" width="755"] Address

Step 9: After filling in all the mandatory fields under the Basic Details tab, the next tab, Cancellation Details, will become active.

Address

Step 9: After filling in all the mandatory fields under the Basic Details tab, the next tab, Cancellation Details, will become active.

Provide Cancellation Details

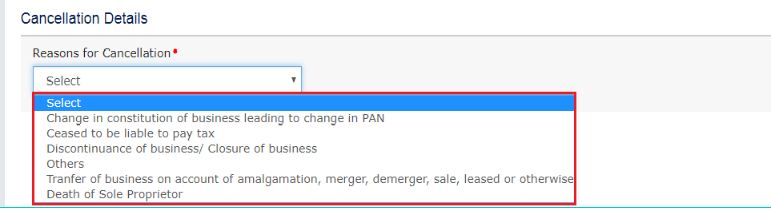

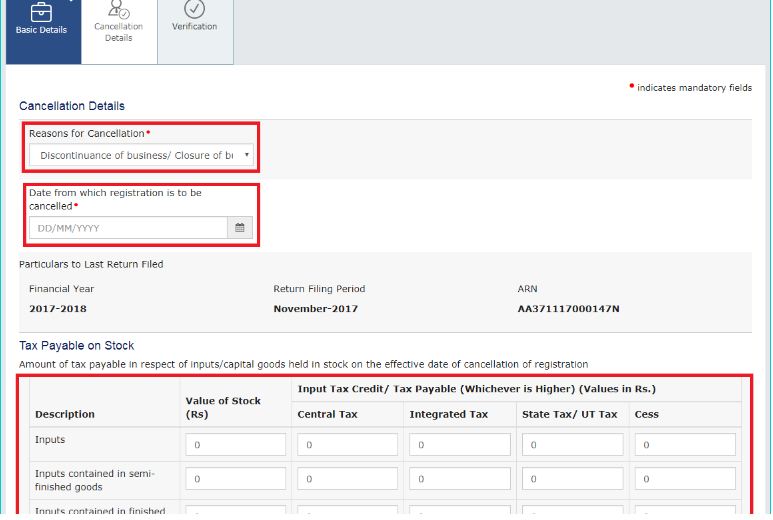

Step 10: Select a suitable reason from the Reason for Cancellation drop-down list. [caption id="attachment_64415" align="aligncenter" width="764"] Cancellation of GST Registration

Step 11: The below following five reasons are available in the drop-down list for the selection:

Cancellation of GST Registration

Step 11: The below following five reasons are available in the drop-down list for the selection:

- Change in the constitution of business leading to a change in PAN

- Ceased to be liable to pay tax

- Discontinuance of business / Closure of business

- Others

- Transfer of business on account of amalgamation, de-merger, sale, lease or otherwise.

Cancellation of GST Registration

Cancellation of GST Registration

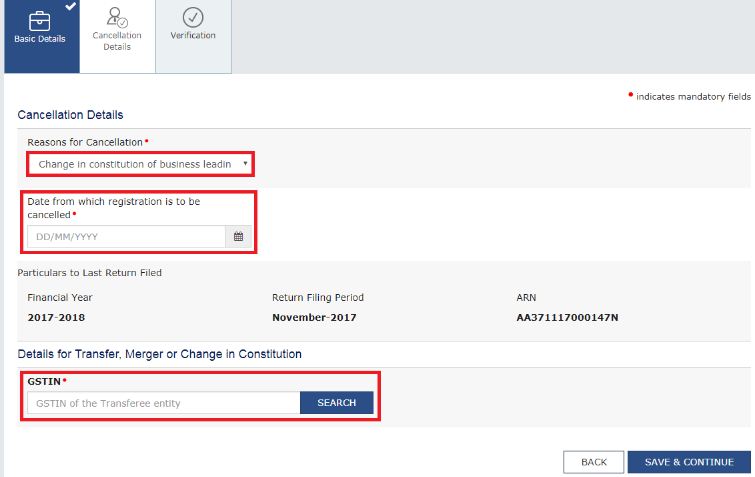

Change in the constitution of business leading to a change in PAN

On selecting the Change in the constitution of business, leading to a change in PAN option, the applicant should enter the following details:- The required date for cancelling the registration.

- Then, enter the transferee's GSTIN under the Details for Transfer, Merger, or Change in Constitution section. The system will validate the GSTIN and auto-populate the Trade Name based on the business's legal name.

- Then click on the "Save and Continue" button.

Step 11 - Change in the constitution of business leading to change in PAN

Step 11 - Change in the constitution of business leading to change in PAN

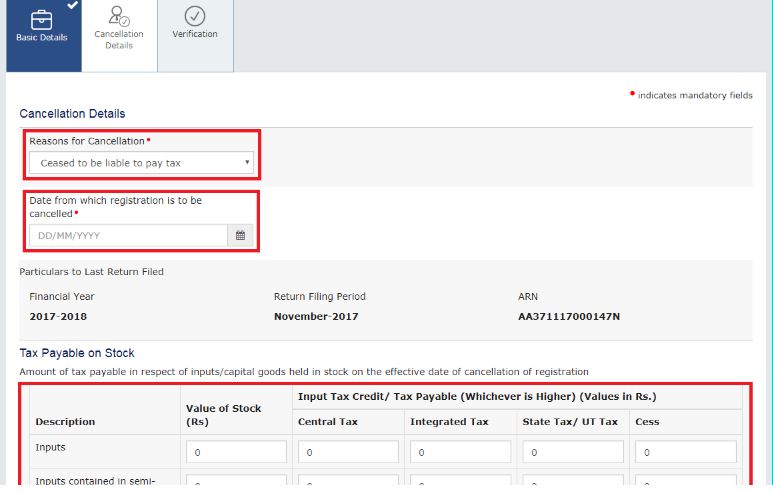

Ceased to be liable to pay tax

On selecting the Ceased to be liable to pay the tax option, enter the following details:- The required date for cancelling the registration.

- Enter the stock's value and the corresponding tax liability on the stock.

- Based on the entered stock details, manually enter the value to offset the liability required for offset from either the GST credit ledger- Electronic Credit Ledger or Electronic Cash Ledger, or both.

- On submitting the application form, the system deducts the amount from the respective Electronic Credit Ledger, the Electronic Cash Ledger, or both. The portal then makes debit entries after the deduction

- Click on the "Save and Continue" button.

Reason

Reason

Discontinuance of business/Closure of business

On selecting the Discontinuance of business/Closure of business option, Enter the following details:- The required date for cancelling the registration.

- Enter the stock's value and the corresponding tax liability on the stock.

- Based on the entered stock details, manually enter the value to offset the liability that requires offset from either the Electronic Credit Ledger, the Electronic Cash Ledger, or both.

- When the application form is submitted, the system deducts the amount from the respective Electronic Credit Ledger, the Electronic Cash Ledger, or both. The portal then makes debit entries after deduction.

- Click on the "Save and Continue" button.

Reason

Reason

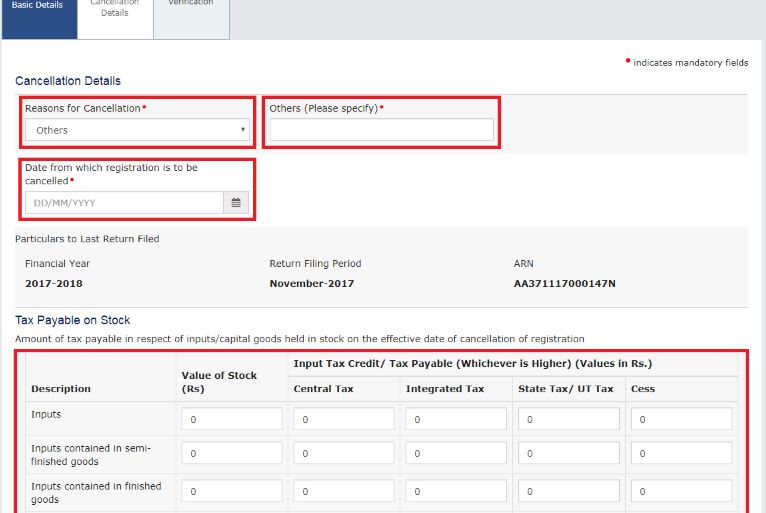

Others

On selecting the Discontinuance Others option, enter the following details:- Specify a proper reason for the GST cancellation.

- Enter the stock's value and the corresponding tax liability on the stock.

- Based on the entered stock details, manually enter the value to offset the liability required for the offset from either the Electronic Credit Ledger, the Electronic Cash Ledger, or both.

- On submitting the application form, the system deducts the amount from the respective Electronic Credit Ledger, the Electronic Cash Ledger, or both. The portal then makes debit entries after the deduction

- Click on the "Save and Continue" button.

Others

Others

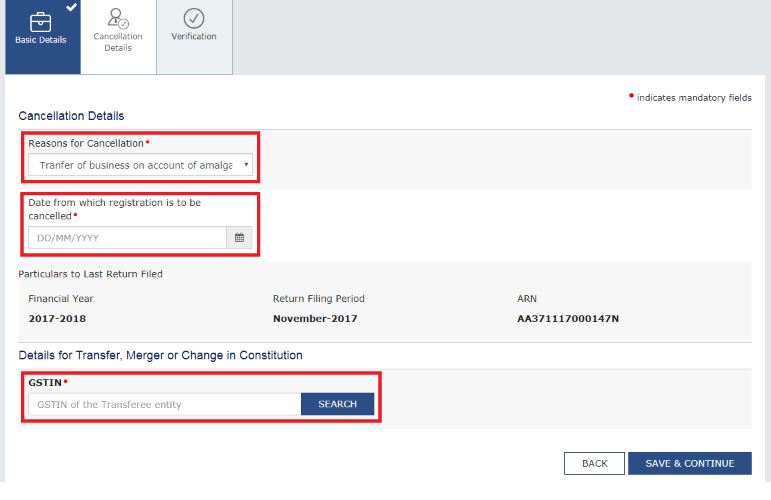

Transfer of business on account of amalgamation, de-merger, sale, lease or otherwise.

On selecting the "Transfer of business on account of amalgamation, de-merger, sale, leased or otherwise" option, enter the following details:- The required date for cancelling the registration.

- Enter the GSTIN of the transferee entity under the Details for Transfer, Merger or Change in the Constitution section. The system will validate the same and, based upon its Legal Name of Business, will auto-populate the Trade Name.

- Click on the "Save and Continue" button.

GSTIN

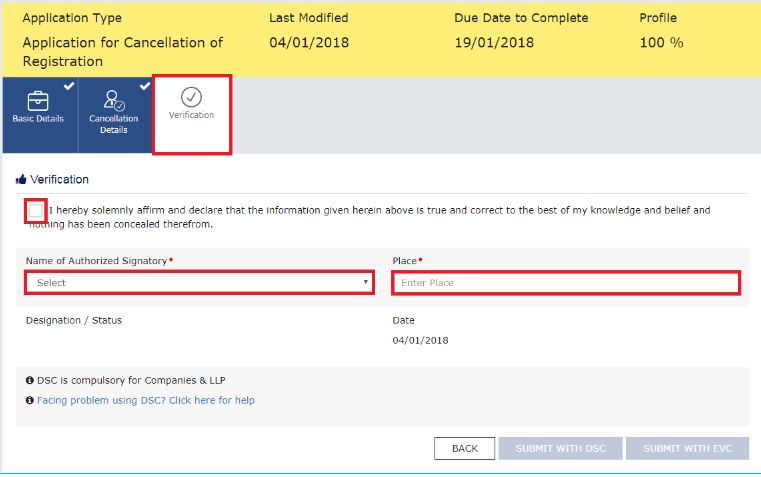

Step 12: The next tab, Verification Details, will become active after you fill in all the mandatory fields under the Cancellation Details tab.

GSTIN

Step 12: The next tab, Verification Details, will become active after you fill in all the mandatory fields under the Cancellation Details tab.

Verification Tab

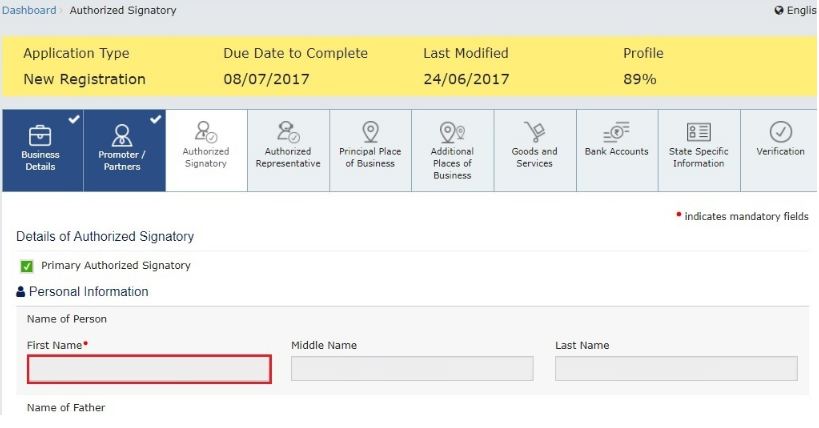

Step 13: Check the Verification statement box to declare that all the information provided in the form is legally correct. [caption id="attachment_64439" align="aligncenter" width="761"] Details

Step 14: Select the name of the authorised signatory from the Name of Authorized Signatory drop-down.

Note: The system auto-populates the authorised signatory's designation or status.

Step 15: Enter the Place of making this declaration.

[caption id="attachment_64441" align="aligncenter" width="819"]

Details

Step 14: Select the name of the authorised signatory from the Name of Authorized Signatory drop-down.

Note: The system auto-populates the authorised signatory's designation or status.

Step 15: Enter the Place of making this declaration.

[caption id="attachment_64441" align="aligncenter" width="819"] Details

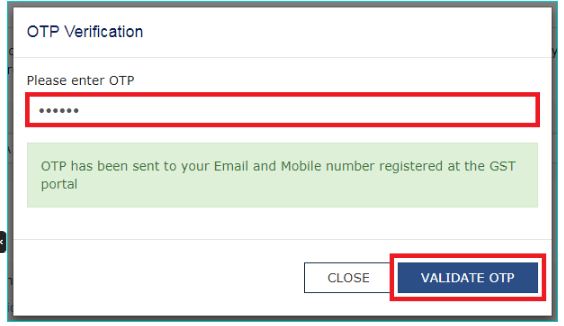

Step 16: Sign the form using either the Digital Signature Certificate (DSC) or the EVC option. After selecting any of these options, the registered user receives an OTP.

[caption id="attachment_64442" align="aligncenter" width="564"]

Details

Step 16: Sign the form using either the Digital Signature Certificate (DSC) or the EVC option. After selecting any of these options, the registered user receives an OTP.

[caption id="attachment_64442" align="aligncenter" width="564"] OTP

OTP

- If using a DSC, the user shall select the registered DSC from the emSigner pop-up screen and proceed accordingly.

- Enter the OTP and click the Validate OTP button.

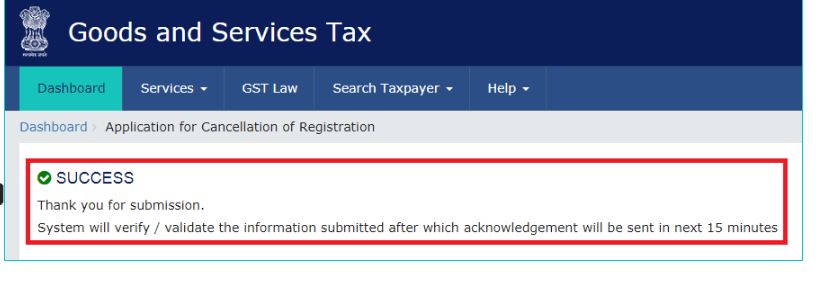

- On successfully filing the application for cancellation of registration, the system will generate the ARN and display a confirmation message.

Confirmation

Step 17: GST Portal will also send a confirmation message on the registered mobile phone number and e-mail-ID.

Step 18: After this process, the concerned Tax Official will review the application and decide accordingly.

Confirmation

Step 17: GST Portal will also send a confirmation message on the registered mobile phone number and e-mail-ID.

Step 18: After this process, the concerned Tax Official will review the application and decide accordingly.

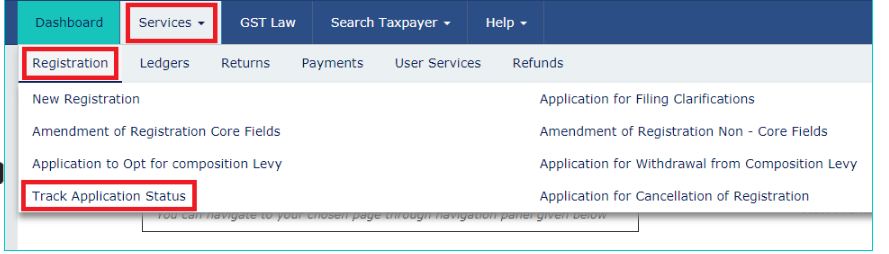

Now Track and Check Application Status

Step 19: To view the ARN, click on the "Track Application Status" under the services tab on the home page. [caption id="attachment_64444" align="aligncenter" width="889"] Application Status

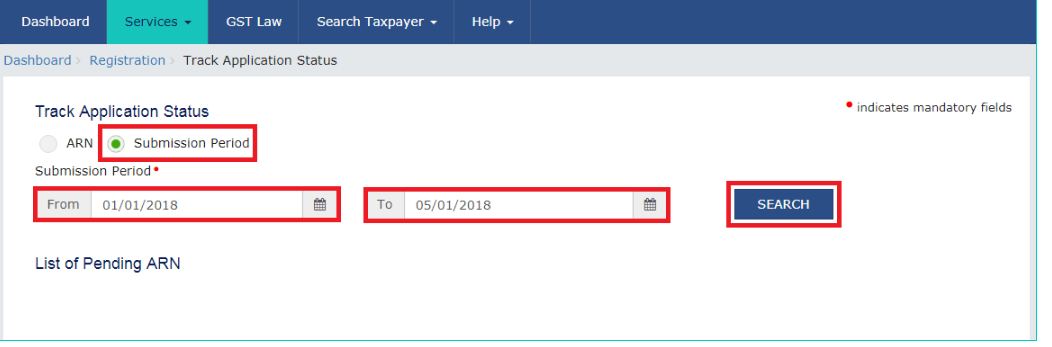

Step 20: Select the Submission Period radio button.

Step 21: Enter the From and To dates as mentioned in the form for cancellation of registration.

[caption id="attachment_64446" align="aligncenter" width="867"]

Application Status

Step 20: Select the Submission Period radio button.

Step 21: Enter the From and To dates as mentioned in the form for cancellation of registration.

[caption id="attachment_64446" align="aligncenter" width="867"] Application-Status

Step 22: Click the Search button. Clicking the 'search' button, will display the ARN corresponding to the filled application and the GST cancellation status.

Application-Status

Step 22: Click the Search button. Clicking the 'search' button, will display the ARN corresponding to the filled application and the GST cancellation status.

Grounds of Non-acceptance of Application

The concerned officer may decide against accepting the application based on the following:- The submitted application is incomplete.

- In the event of transfer, merger or amalgamation of business, the new entity hasn't registered with the tax authority before the submission of the application.

Final Return

Every person whose registration has been cancelled must file a final GST return in Form GSTR-10 within three months of the date of cancellation or the date of order of cancellation, whichever is later. This is done to ensure that the taxpayer is devoid of liabilities which could have been incurred under Section 29 of the CGST Act. The due date stipulated for the same is December 31, 2018. It may be noted that Input Service Distributors or non-resident taxpayers who are required to pay tax under section 10, section 51, or section 52 are exempted from this provision.Final Return Not filed

If the final return isn't filed in Form GSTR-10, the taxpayer will receive a notice in GSTR-3A prompting him/her to do so within 15 days of the notice's issuance. If the taxpayer fails to comply with the notice, initiatives will be taken to assess the taxpayer's liability based on the information available to the concerned officer. The assessing order will be withdrawn if the applicant files the return within 30 days of the issue of notice. However, the taxpayer wouldn't be reprieved for remitting the late fee and interest. IndiaFilings experts are available to assist you with filing GSTR-10 [shortcode_103]Can a Business Re-register for GST after Cancellation?

Yes. After cancellation, whether voluntary or by a tax officer, there's no limitation against re-registering for GST.How to Activate a Cancelled GST Registration?

The following information would be helpful to re-register your GST number after cancellation. The taxpayer can apply for Revoking a Cancelled GST Registration application, if in the case that the GST officer cancelled involuntarily.The applicant should file for the cancelled GST registration process in the GST portal within 30 days from the date of cancellation by the concerned officer.However, upon GST cancellation online due to failure in filing GST returns, the taxpayer can appeal for GST revocation only after filing the GST returns and paying the tax amount as required, along with any amount payable towards interest, penalty and late fee payable. After filing the delayed GST returns and paying the penalty, an application can be made by a taxpayer for revocation of cancellation of registration. The GST Officer would then verify the reasons for revocation of cancellation of registration. If satisfied about the grounds for revocation of registration, he would revoke the cancellation of registration.

IndiaFilings: Your Trusted Partner in GST Registration Cancellation

Navigating the intricacies of GST Registration Cancellation can be challenging. Fortunately, IndiaFilings stands ready to assist businesses and individuals on how to cancel GST registration online and ensuring a hassle-free experience. With a team of expert professionals and a proven track record, IndiaFilings has become a trusted partner for countless entities looking to comply with GST regulations. [shortcode_67]Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...