Last updated: December 17th, 2024 2:59 PM

Last updated: December 17th, 2024 2:59 PM

GST Registration Certificate

As per the GST Act, all the taxpayers registered with GST shall receive GST registration certificate (GST RC). All entities in India having an annual turnover of more than Rs.20 lakh in case of service providers and Rs.40 lakh in case of goods suppliers must obtain GST registration. In addition to the aggregate turnover criteria, various other criteria could also make a business liable for GST registration (GST Turnover Limit). You can check GST registration eligibility here. In this article, we look at the GST registration certificate in detail.GST Registration Certificate Sample - Annexure A

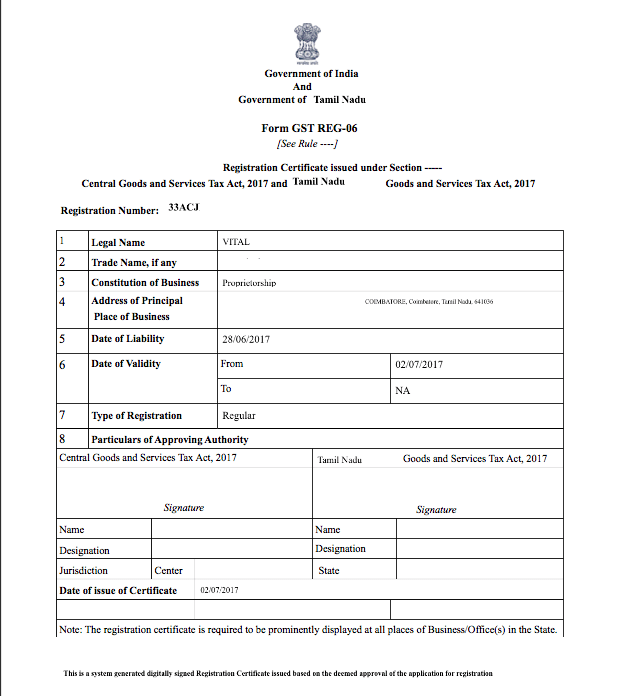

GST RC has four annexures. The following is a GST registration sample for Annexure A containing details of the business, GST registration validity and address of the principal place of business. In Annexure A, the GST registration number is provided on the top left-hand side corner followed by the legal name of the business, trade name, constitution, the address of principal place of business, the date on which the business became liable to register for GST and GST registration validity date. Only GST registration for casual taxable persons and non-resident taxable persons have an expiry date. GST registration for normal taxpayers does not have an expiry date.

The type of GST registration and particulars of the person approving the GST registration is also provided in Annexure A along with the date of issue of GST registration certificate.

In Annexure A, the GST registration number is provided on the top left-hand side corner followed by the legal name of the business, trade name, constitution, the address of principal place of business, the date on which the business became liable to register for GST and GST registration validity date. Only GST registration for casual taxable persons and non-resident taxable persons have an expiry date. GST registration for normal taxpayers does not have an expiry date.

The type of GST registration and particulars of the person approving the GST registration is also provided in Annexure A along with the date of issue of GST registration certificate.

Signature on GST Registration Certificate

GST registration certificates are provided in soft-copy pdf format only. There are no hard copies provided by the Government. Further, as the certificate is digitally generated, the signature of the authority sanctioning the certificate will not be visible on the certificate. The system generated document itself is proof of registration under GST.Display of GST Registration

According to the GST Act, GST RC must be displayed in all branches of the business. In the case of composition supplier, the words "composition supplier, not eligible to collect tax" must also be displayed prominently. Click here to read on Rules on Display of GST Registration CertificateGST Registration Certificate Sample - Annexure B

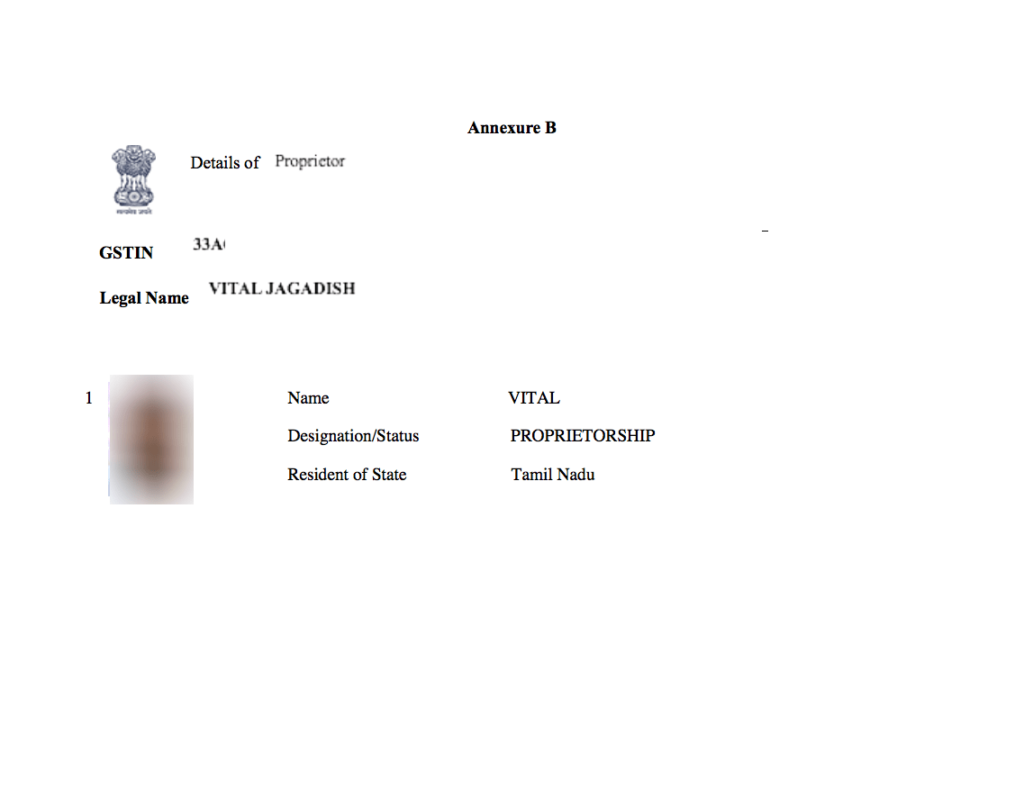

In Annexure B of the GST Registration Certificate, details of the promoters of the business are provided. Fora proprietorship, there would be only one promoter. In other types of entities including private limited company, LLP and others, there would be more than one promoter. The name of the promoter, photo and designation are provided in Annexure B as shown above in the sample GST RC.

The name of the promoter, photo and designation are provided in Annexure B as shown above in the sample GST RC.

GST Registration - Additional Places of Business

Under GST, each branch engaged in the supply of goods or services is required to be registered. Hence, if more than one branch is registered, the details of such branches would be provided in the GST RC - Additional Places of Business Page. Entities having only one address will not have any information on this page. Know more about GST registration for branches.

Provisional GST Registration Certificate

The GST RC displayed above is a sample GST RC that is final. Before the issue of final GST RC, a provisional GST RC as shown below will be issued. Until the taxpayer receives the final certificate, the entity shall use the provisional GSTIN and provisional certificate. In addition to the provisional GSTIN, which will become final GSTIN on the issue of GST RC, a provisional GST RC will also contain details of VAT registration or Service Tax Registration held by the business.

Simplify the GST registration & GST return filing process with IndiaFilings experts!

In addition to the provisional GSTIN, which will become final GSTIN on the issue of GST RC, a provisional GST RC will also contain details of VAT registration or Service Tax Registration held by the business.

Simplify the GST registration & GST return filing process with IndiaFilings experts!

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...