Last updated: August 12th, 2024 10:52 AM

Last updated: August 12th, 2024 10:52 AM

GST Registration for Proprietorship

In the dynamic business world, entrepreneurs must stay ahead of the curve and ensure compliance with relevant regulations. The Goods and Services Tax (GST) registration is a crucial proprietor requirement. Obtaining GST registration not only enables proprietors to establish their legitimacy but also allows them to benefit from various tax-related advantages. This comprehensive guide will delve into the intricacies of GST registration for proprietorship businesses in India and outline the documents required for a seamless registration process. IndiaFilings can assist you with obtaining GST registration for your proprietorship, ensuring a streamlined and compliant process. [shortcode_4]Sole Proprietorship

A proprietorship is a business structure where a single individual owns and manages the company. A sole proprietorship does not require compulsory registration. Registering a sole proprietorship under any specific law or act is not mandatory. However, certain licenses and registrations, such as GST or MSME registration, may be required depending on the nature of the business.- While no legal formalities are required to start a sole proprietorship in India, complying with applicable regulations and obtaining necessary licenses and registrations for business activities is essential.

- GST registration for sole proprietorship is necessary if the turnover exceeds the prescribed threshold or the proprietorship firm engages in interstate sales or e-commerce or wants to claim the input tax credit.

- MSME registration is not mandatory for a sole proprietorship, but it can provide certain benefits and access to government schemes and incentives for eligible businesses.

GST Registration for Proprietorship

GST, or Goods and Services Tax, is a unified indirect tax system introduced by the Government of India to replace multiple taxes levied on goods and services. It is a destination-based tax applicable throughout the country, ensuring a streamlined taxation process. GST registration is mandatory for businesses whose turnover exceeds the prescribed threshold limits determined by the government.Eligibility for GST Registration for Sole Proprietorships

While GST registration is a critical step for compliance, not all sole proprietorships are mandated to register. The requirements vary primarily based on the annual turnover and the nature of the business. Additionally, certain types of sole proprietorship businesses are required to register for GST irrespective of their turnover. Here is a detailed breakdown of these eligibility criteria:Turnover Limits

Sole proprietorships can operate either in the merchandise or services sector. The GST registration thresholds are set differently depending on the type of business:- Merchandise-based Businesses: Mandatory registration is required if the turnover exceeds Rs. 40 lakhs annually.

- Service-based Businesses: The threshold is Rs. 20 lakhs.

- Businesses in Hilly Areas: Both goods and service-based businesses in designated hilly regions and North-Eastern states have a reduced threshold of Rs. 10 lakhs for mandatory GST registration.

Mandatory GST Registration for Sole Proprietorships

Registration for GST is compulsory for specific proprietorship businesses due to the nature of their operations, regardless of turnover:- E-commerce Operators/Aggregators: Those facilitating supplies through online platforms.

- Casual Taxpayers: Those who undertake transactions occasionally through a temporary stall or setup.

- Non-resident Businesses: Proprietorships based outside India but engaged in business activities in India.

- Importers and Exporters: Essential for international trade compliance.

- Businesses under GST Reverse Charge Mechanism: Where the recipient of goods or services is liable to pay GST.

- Taxpayers Registered Under Previous Tax Regimes: Transitioning to GST without exemptions.

- Interstate Suppliers: Providing goods or services across state lines.

- Online Information and Database Access Providers (OIDAR): These providers offer digital or electronic services across states or internationally.

Voluntary GST Registration for Sole Proprietorships

For sole proprietorships operating below these thresholds, opting for voluntary GST registration can be beneficial. This allows businesses to claim input tax credits, enhancing their operational capacity and market presence. It strategically positions the business for potential growth and increased flexibility.Composition Scheme

The Composition Scheme offers a simplified tax framework for sole proprietorships with an annual turnover of up to Rs. 1.5 crores. Participants benefit from a reduced flat tax rate, fewer compliance requirements, and a simplified invoicing process. However, they cannot claim input tax credit and are restricted to intra-state transactions only. Opting for this scheme involves a straightforward application process and provides a simplified operational framework within the GST regime.When to get GST Registration for Proprietorship Firm?

GST registration for a proprietorship is required in the following situations:- When the annual revenue of the proprietorship exceeds 40 lakh rupees: If the proprietorship firm's annual turnover crosses the threshold limit of 40 lakh rupees (or 20 lakh rupees for some particular category states), it becomes mandatory to register for GST.

- When the proprietorship firm sells goods or services across state lines: If a proprietorship firm engages in interstate sales, i.e., selling goods or providing services from one state to another, GST registration is mandatory regardless of the turnover.

- When the proprietorship firm engages in e-commerce: If it operates in the e-commerce sector, irrespective of the turnover, it must register for GST.

- When the sole proprietorship intends to claim an input tax credit:To avail of the input tax credit, which allows businesses to claim a credit for the GST paid on purchases, GST registration is necessary.

- Voluntarily: A sole proprietorship firm can voluntarily register for GST even if the above conditions are unmet. This can be beneficial if the firm wants to expand its business, establish credibility, or deal with other entities requiring GST registration.

Is It Mandatory to Have a GST License for a Sole Proprietor Firm?

A GST (Goods and Services Tax) license is not mandatory for a sole proprietor firm in India unless certain conditions are met. The requirement for GST registration depends on the turnover and nature of the business activities.- As mentioned above, If the annual turnover of the sole proprietor firm exceeds the prescribed threshold, currently set at 40 lakh rupees (or 20 lakh rupees for particular category states), GST registration becomes mandatory.

- GST registration is compulsory if the sole proprietor firm engages in interstate sales or e-commerce activities or intends to claim the input tax credit.

Benefits of GST Registration for Proprietorship

Obtaining GST registration for sole proprietorship business offers several advantages, including:- Legitimacy and Compliance: GST registration establishes the legitimacy of a proprietorship business, enabling it to operate within the legal framework. It ensures compliance with tax regulations and helps build trust among customers and business partners.

- Input Tax Credit (ITC): Registered businesses can claim Input Tax Credit, allowing them to offset the GST paid on inputs against the GST liability on output supplies. This reduces the overall tax burden and enhances cash flow.

- Interstate Transactions: GST registration is mandatory for businesses engaged in interstate trade or providing services across state borders. It enables the smooth movement of goods and services across India and eliminates the complexities associated with multiple state taxes.

- Competitive Advantage:GST registration provides a competitive edge to proprietorship businesses, allowing them to participate in the formal economy. Registered businesses can avail themselves of government tenders, expand their market reach, and establish customer credibility.

Bank Account Requirement for GST Registration

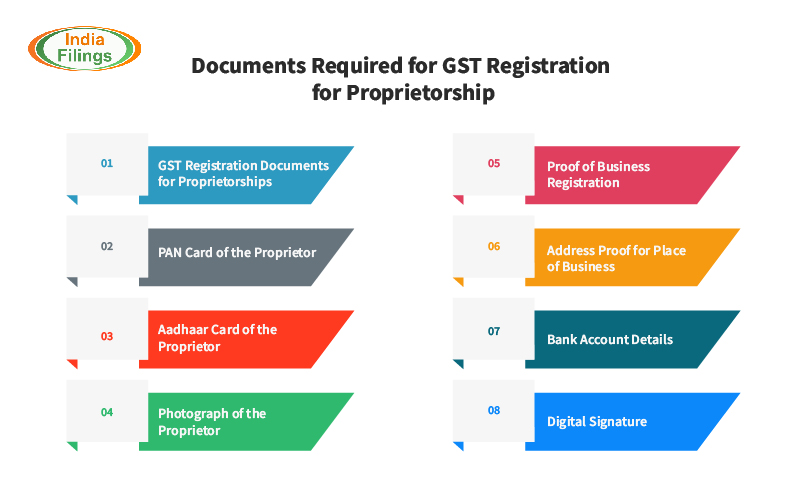

For GST registration, a single proprietorship firm must have a bank account. The proprietor must open a bank account specifically for the sole proprietorship firm and conduct all business transactions related to the firm through that account. The bank account should be in the name of the sole proprietorship firm to ensure proper identification and tracking of financial transactions for GST compliance.New GST Registration Documents for Proprietorship

To register for GST as a sole proprietorship in India, you'll need to prepare and submit a set of specific documents that verify your identity, address, and the legitimacy of your business. Here's a comprehensive list of New GST Registration Documents for Proprietorship:PAN Card of the Proprietor

A scanned copy of the proprietor's PAN card is essential for GST registration. It serves as a unique identifier for all tax-related activities, ensuring accurate documentation and establishing the proprietor’s identity within the national taxation ecosystem.Aadhaar Card of the Proprietor

The Aadhaar card is crucial for verifying the identity of the proprietor during the GST registration process. This document enhances the security and authenticity of the registration, aligning with the government's focus on Aadhaar-based verification for financial and regulatory activities.Photograph of the Proprietor

Recent passport-sized photographs provide visual confirmation of the proprietor’s identity on the GST application. This requirement strengthens the verification process, ensuring the applicant matches the identification documents provided.Address Proof for Place of Business

The type of address proof required varies:- For owned premises: Recent property tax receipt, Municipal Khata, or electricity bill.

- For rented or leased premises: Valid rental or lease agreement and proof of lessor’s ownership.

- For premises not owned by the proprietor: Supporting documents such as a board resolution or consent letter from the legal owner.

- For virtual/shared office spaces: Rental agreement, lessor’s ownership proof, and a consent letter.

- For addresses in Special Economic Zones: Government-issued certificates. Proper documentation ensures compliance with specific verification criteria and facilitates a seamless GST registration process.

- Bank Account Details: Submitting bank account details, including a cancelled cheque or a bank statement, is necessary to link the financial operations of the business with the GST system, aiding in efficient transactions and GST refunds.

- Digital Signature: A digital signature certificate (DSC) is required for the proprietor, who acts as the authorized signatory, to sign the GST application electronically. Issued by certified authorities, the digital signature secures and authenticates the registration process, supporting modern digital security standards.

New GST Registration Documents for Proprietorship

New GST Registration Documents for Proprietorship

GST Registration for Proprietorship - Application Procedure

To obtain GST (Goods and Services Tax) registration for a proprietorship, you can follow the procedure outlined below:Step 1: Visit the GST Portal

Access the official GST portal. Navigate to the GST portal's registration section and click "New Registration."Step 2: Fill out the Application Form

Fill in the details requested on Form GST REG-01, which includes:- Legal Name: Provide the legal name of the proprietorship as mentioned in the business documents.

- PAN: Enter the Permanent Account Number (PAN) of the proprietor.

- Email Address and Mobile Number: Provide a valid email address and mobile number for correspondence and verification purposes.

- State and District: Select the state and district where the business is located.

- Business Details: Enter the business name, constitution (proprietorship), and the business commencement date.

- Authorized Signatory: Provide the details of the authorized signatory (proprietor).

Step 4: Verify Details and Submit Application

Verify all the information provided and apply. You may need to digitally sign the application using a Class 2 or 3 digital signature certificate.Step 5: ARN Generation and Acknowledgment

After submission, an Application Reference Number (ARN) will be generated, and an acknowledgement receipt will be issued. Keep this ARN for future reference and tracking.Step 6: Verification and Approval

The GST authorities will review the application and may conduct a verification process if necessary. They may also request additional documents or information.Step 7: GST Registration Certificate

Upon successful verification, the GST registration certificate will be issued. You can download the certificate from the GST portal.Conclusion

Navigating business regulations like GST registration is essential for staying compliant and competitive. GST registration is vital for proprietorships that meet certain criteria, offering legal credibility and financial benefits such as tax credits and the ability to conduct inter-state business. Properly understanding and managing this process is key to ensuring smooth business operations.Simplify GST Registration with IndiaFilings

IndiaFilings can guide you through the GST registration process, helping you meet all legal requirements efficiently. Start your GST registration with IndiaFilings today and ensure your business is set up for success. [shortcode_59]Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...