Last updated: December 17th, 2024 3:02 PM

Last updated: December 17th, 2024 3:02 PM

GST Registration Issues - Problems & Solutions

Nearly 1 crore businesses have obtained GST registrations in India. GST registration can be obtained through India Filings with Expert Support or you can do it yourself on the Government GST Portal. In this article, we look at some of the issues faced by many taxpayers along with the solutions.No Provisional ID

Problem: You do not have a provisional ID or username to start the GST registration process. Solution: All taxpayers applying for new GST Registration must first provide their name, business name, PAN, email and mobile number for starting the registration process. The process for GST registration starts at https://reg.gst.gov.in/registration/ . Make sure you start from this page. Once you provide the information mentioned above, an OTP is sent to the email id and mobile number for verification. On successful completion, the temporary reference number is provided to start the GST registration process. In case your are a non-resident taxable person under GST and do not have an Indian mobile number for receiving OTP, use the mobile number of the Authorised Signatory. All non-resident taxable persons must appoint a person in India to act as an Authorised Signatory.Provisional ID Cancelled (Applicable for GST Migrations Only)

Problem: Your RC or Provisional ID is Cancelled. In case you are migrating to GST from a VAT or Service Tax registration, you will have to follow the process for completing GST migration. During GST migration, if you had not filed service tax or VAT returns for a long-time, your GST registration could have been cancelled. In such cases, you will have to visit the nearest GST Seva Kendra and request the assistance of a GST officer for moving forward the provisional ID to a GSTIN, manually.Unable to Select Range Code

Problem: No Range Code available During the GST registration process, you will be required to select the applicable GST jurisdiction based on Range Code. In some cases, the drop-down list containing the range code would not populate. In such cases, make sure that your browser is compatible with the GST Portal. GST portal is best viewed in 1024 x 768 resolution in Internet Explorer 10+, Google Chrome 49+, Firefox 45+ and Safari 6+. In case of lower resolution, the above issue could arise. Try refreshing the page or try accessing the GST registration application form using a different computer.Digital Signature Errors

Problem: You are having a problem with the digital signature required for GST registration. Solution: Digital signature is mandatory for the following types of GST registration applicants :- Public Limited Company

- Private Limited Company

- Unlimited Company

- Foreign Company

- Limited Liability Partnership (LLP)

- Foreign Limited Liability Partnership

- Public Sector Undertaking

Step 1 : Log in to GST Portal

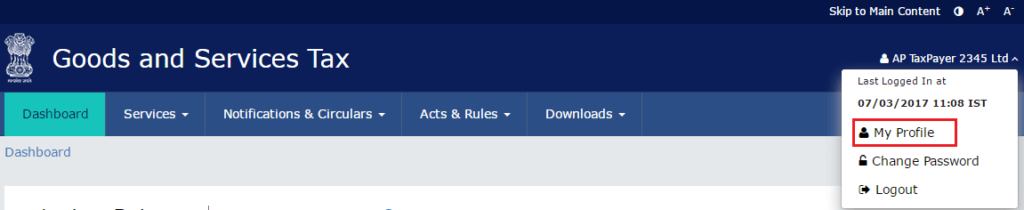

Login to the GST Portal using the temporary reference number and select My Profile. Step 1 - My Profile

Step 1 - My Profile

Step 2: Register DSC

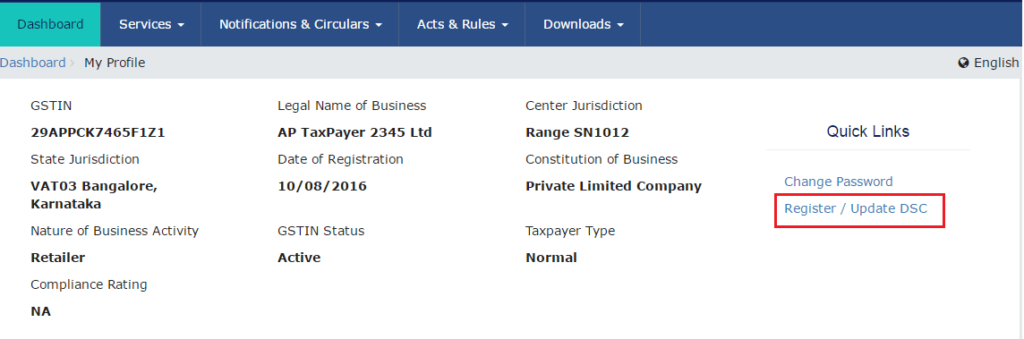

Select Register or Update DSC on the My Profile page. Step 2 - Register DSC

Step 2 - Register DSC

Step 3: Select PAN

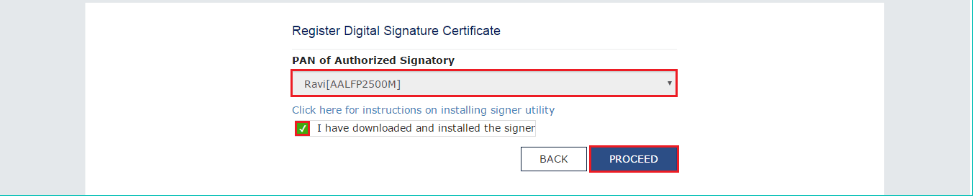

Select PAN of the authorised signatory for whom DSC was earlier obtained. Step 3 - Select PAN

Step 3 - Select PAN

Step 4: Select DSC Certificate

Select DSC certificate of the authorised signatory from emSigner. Step 4 - Select DSC from emSigner

Step 4 - Select DSC from emSigner

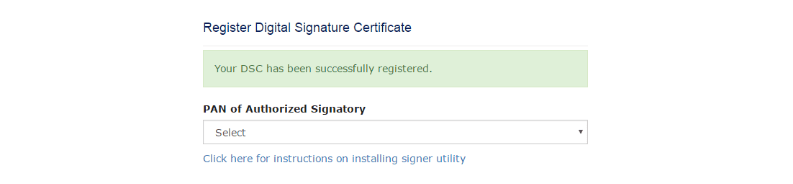

Step 5: DSC Registered

On submission, DSC would be registered, if the steps above are followed. Step 5 - Successfully Saved

Step 5 - Successfully Saved

Incorrect PAN Details

Problem: Incorrect PAN details. Solution: While registering for GST, you will have to provide PAN of the authorised signatory and the promoters. The PAN details provided on the GST portal must match the PAN database. The data submitted on GST portal is immediately verified against the PAN database. Hence, if there is any discrepancy, the application would not be able to proceed. In case your PAN has wrong information and you wish to insert correct data in GST registration application, you will first have to change PAN data. Process for changing PAN data is provided in this article.ARN Number Not Received

If you had submitted all the information correctly and you have not received any ARN number, contact the GST Helpdesk at:GST helpdesk 0124-4688999 or at 1800-1200-232

GST Registration Certificate Not Received

In case you have not received GST registration certificate after about 5 - 10 days of submission of application, check whether the GST Officer has raised any queries on the GST Portal by accessing with the Temporary Reference Number. In case, there are no queries and you have not received GST registration certificate or GSTIN, the registration would be deemed to be issued after 10 working days. You can also contact the GST helpdesk or GST Seva Kendra for additional support in obtaining the GST registration certificate.Incorrect Information on GST Registration Certificate

If you have received a GST registration certificate with incorrect information, you can contact the GST helpdesk or GST Seva Kendra. In case you would like to change GST mobile number or email id, check out the following guides: Simplify the GST registration & GST return filing process with IndiaFilings experts!Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...