Last updated: March 17th, 2020 2:45 PM

Last updated: March 17th, 2020 2:45 PM

GST RFD–01

RFD–01 is an application for processing refund under GST. Any individual registered under GST can claim a refund of taxes, interests paid more than the accumulated input tax credit in the electronic credit ledger where the output tax liability is nil or balance in the electronic cash ledger due to excess cash payment by filing RFD–01 (Online Filing) or RFD-01A (Manual Filing). In this article, we look at GST RFD–01 application for refund in detail.Form RFD–01

Any taxpayer registered under GST can file for a refund using form RFD–01 or RFD–01A. Refund will be initiated only when the refund amount exceeds thousands of rupees. As stated above, RFD–01 is an application for online processing of refund under GST. It is to be filed on the GST portal.RFD–01A

RFD-01A is a replica of RFD–01, introduced as a temporary solution until the online facility is enabled for claims of refund.Types of Refunds for RFD–01

RFD–01 can be used for the following types of reimbursement- Refund due to appeal assessment, provisional assessment

- Excess balance in electronic cash ledger

- Export of goods and service (tax paid)

- Export of products and service (tax not paid)

- Tax paid under CGST and SGST, which is subsequently considered as IGST, or vice versa

- Supplies made to SEZ unit and SEZ developer

- Excess payment of tax

- Accumulated ITC due to excess tax paid on inputs than outward supplies

Types of Refunds for RFD – 01A

The following types of refund under GST are being manually processed, and RFD -01A can be used to claim the refund.- ITC on exports under the letter of undertaking or bond

- Claims in case of deemed exports

- IGST paid on zero-rated supplies Excess balance inElectronic cash ledger

- Refund claim on account of inverted duty structure

Non-Applicability of RFD–01/RFD–01A

RFD-01 or RFD-01A cannot be filed for all cases of refund claims as mentioned below:- Export of goods involving the payment of export duty

- UN or embassies and certain persons notified

- Exports of goods or services where IGST is paid and shipping bill is by default considered the application for refund

- Casual taxable persons / non-resident taxable persons

- In case the supplier avails the drawback scheme of the CGST, SGST and IGST paid on the supplies

Prerequisites for Applying for Refund

In case of applying for a refund of tax paid or the accumulated ITC without payment of output tax (in case of zero rate supplies and deemed exports), the applicant needs to file the GST returns in GSTR 1 of the month for which the claim is made and GSTR 3B of the previous month.Time Limit and Frequency of Filing RFD-01

The refund claim needs to be made within two years from the relevant date in RFD-01/ RFD-01A. The RFD-01A need to be filed on a monthly basis for the following cases:- Refund claims in case of zero-rated supplies

- Refund claims in case of the Inverted Duty Structure

- Refund claims in case of Deemed Exports

- Refund of excess balance in the Electronic Cash ledger

File Quarterly

RFD 01A can be filed quarterly instead of monthly in case the taxpayer has a turnover of less than Rs. 1.5 crore and has opted to file quarterly returnsSupply of Goods to SEZ

In the case of supply of goods to SEZ units or SEZ developer, a supplier need to file RFD–01, once the receipt of goods is confirmed by authentication from the prescribed officer of that zone. In case of supply of service to SEZ developer or SEZ unit a supplier has to file RFD–01, once the evidence of receipt of service is confirmed by authentication from the specified officer of that zone.Format of Refund Form RFD - 01

The format of refund form RFD 01 is divided into following parts:- Basic Form

- Declarations and Verification

- Annexure - 1

- Annexure – 2

Basic Form

The basic form of RFD - 01 contains the following details:- The GSTIN or Temporary ID

- Legal name

- Trade name if any

- Address of principal place of business

- Tax periods for which the claim of refund is to be made

- The amount of CGST, IGST and SGST, Interest or cess

- Grounds for the claim of refund

- Details of Bank account into which the refund to be deposited

- Documentary evidence required to be submitted

- Verification: The authorised person has to sign the form confirming the correctness of information and declarations given

Declarations and Verification

In the RFD – 01, some declarations have to be made for certain types of refund claims made by the taxpayer. The declarations are needed to state the fact that the tax burden is upon the claimant of refunds and no other person can claim. You need to declare the following items:- The goods exported will not subject to any export duty

- The taxpayer have not availed any drawback on goods or services or both

- The taxpayer has not claimed the refund of the integrated tax paid on supplies in respect of which refund is claimed

- Special Economic Zone unit or the SpecialEconomic Zone developer has not availed of the input tax credit of the tax paid by the applicant

- Self Declaration

- Verification

Annexure 1

Different Declarations in Statements as documentary evidence required to be made or furnished under different types of refund claims. There are total eleven statements prescribed for different types of refund application in RFD - 01. The statements in 1A, 1, 3, 5A and 5B, is applicable in case of filing RFD-01A, depending on the type of refund claim Documentary evidence is not required to be produced if the amount of refund claimed is below Rs. 2 lakhs. Instead, a self-declaration that the recipient of goods or services does not claim the ITC benefit is to be furnished. The annexure – I of RFD – 01 contains the detail of Date, Value, Goods/Service, HSN/SAC, Taxable value, UQC, QTY, State, Integrated Tax, Central Tax, State Tax, UT Tax and CESS. The format of Annexure – 1 is attached here:Annexure 2

Annexure 2 is a format of a certificate issued by Chartered Accountant or Cost Accountant. It is required to be annexed along with the Refund application in RFD - 01 or RFD -01A.Calculation of GST Refund Amount

Amount of refund under GST is usually the tax, interest or cess if any that is paid as per the tax invoices in most of the cases. If the invoice details are amended including the export, a refund will be allowed as per the calculation based on amended value.Calculation of Refund of ITC

For refund of ITC accumulated, two formulae are prescribed. The only proportionate amount of accumulated ITC can be claimed that commensurate the value of turnover related to zero-rated supplies or inverted rated supply to the total turnover earned by the taxpayer for the period referred.Calculating the Refund Amount of ITC

If zero-rated supplies are made without Tax payment by executing a Letter of undertaking/Bond, the formula to calculate the refund of the amount of ITC is given here: Net ITC x (( Turnover of zero-rated supply of goods + Turnover of zero-rated supply of services)/ Adjusted total turnover)Significance

- Net ITC - Input tax credit availed on inputs and services during the relevant period

- Turnover of zero-rated supply of Goods - Value of supply of goods during the relevant period formed without tax payment by executing a letter of undertaking for the relevant period

- Turnover of zero-rated supply of Services -Value of supply of services during relevant period performed without tax payment by executing the letter of undertaking

- In case the services are zero-rated supplies, turnover includes the advance received in prior period for which services are provided and reduced by advance received for which services are yet to be provided for the relevant period

- Adjusted total turnover means that the total turnover in a State or Union territory excluding exempt value supplies for the relevant periods

- Relevant period means that the period for which the claim of refund is filed. It differs for each claim of refund.

Formula to calculate the Maximum Refund amount of ITC

If the rate of tax on Inward supplies exceeds the Outwardsupplies (inverted duty structure), the formula to compute the maximum refund amount of ITC is given here: (Net ITC x (Turnover of inverted rated supply of Goods/Adjusted Total Turnover)) - Output tax payable on the Inverted rated supply of Goods Significance:- Net ITC means the input tax credit availed on inputs used in the supply of inverted rated goods during the relevant period

- Turnover of inverted rated supply of goods means the turnover for the supply of goods that fall under the Inverted rated category

- Adjusted total turnover - Total turnover in a state or union territory excluding exempt value supplies for the relevant periods.

- Output tax payable on the inverted rated supplies of goods means that the tax liability for the applicable period payable on the inverted rated supply of goods

Procedure to Apply for GST Refund

The procedure to apply for GST refund is explained in detail below: Step 1: You need to access the home page GST web portal and login to the portal to file GST refund. Step-1 - GST RFD–01

Step-1 - GST RFD–01

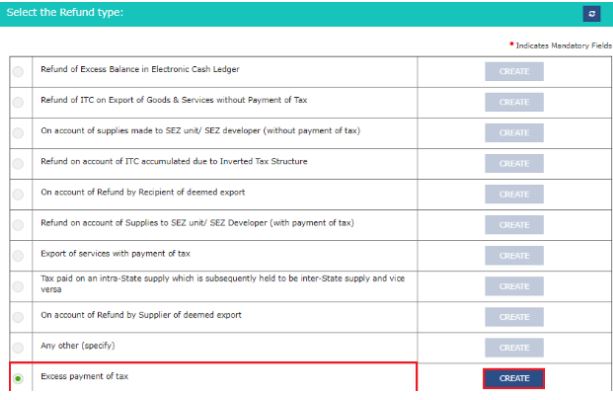

Step-2 - GST RFD–01

Step-2 - GST RFD–01

Step-3 - GST RFD-01 Application for Refund

Step-3 - GST RFD-01 Application for Refund

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...