Last updated: May 13th, 2019 8:44 PM

Last updated: May 13th, 2019 8:44 PM

GST Saheli Portal Registration

Gujarat government has launched a portal called GST Saheli to handle GST related services to Micro, Small and Medium Enterprises (MSME), Industries, Sakhi Mandals, Cooperative groups and PSUs. The Gujarat Livelihood Promotion Company (GLPC), a public sector undertaking authorised by the Gujarat Government, started this web portal in Gujarati/Hindi/English language. In this article, let us take a closer look at the portal.Overview of the Portal

In order to make people understand the technicalities involved in GST, the Commissionerate of Urban Development has launched this initiative. GST Saheli is an integrated GSP-ASP solution that is approved by the Goods and Services Tax Network (GSTN). This portal would be a giant leap to enhance women empowerment and self-employment of youths. The State Government provides training to this initiative in five different districts.Features of the Portal

The following are the unique features of the GST Saheli Portal.- Invoice based easy data entry.

- Complex GST Returns that are automatically generated.

- Besides English, services are available in Gujarat and Hindi.

- Secured database.

- Virtual GST Service Provider (GSP) platform registered with GSTN.

- Commerce and accounting graduates skilled as GST Sahayak to provide services at an affordable cost than CAs/CS for MSMEs and Co-operatives.

- In addition to GST Returns, additional features like cash/credit register, client dashboard, invoice matching are also provided.

Services Offered

All GST related services would be given to Micro and Small Industries, Sakhi Mandals, Cooperative Groups with less than Rs. 5 Crore turnover at a minimal cost of Rs. 1250 per annum. On the other hand, for other industries, the rate is Rs. 1750 per annum. All Government Public Sector undertakings can avail these services at Rs. 3000 per annum. Individuals can easily file GSTR-3B, GSTR-1, GSTR-2 and GSTR-3 returns, raise invoices, identify any data mismatch, avoid unnecessary handling of JSON files and even import data in Excel format. In addition to this, the Chief Minister has also facilitated the first woman entrepreneur who paid tax through GST Saheli web portal.Registration Procedure

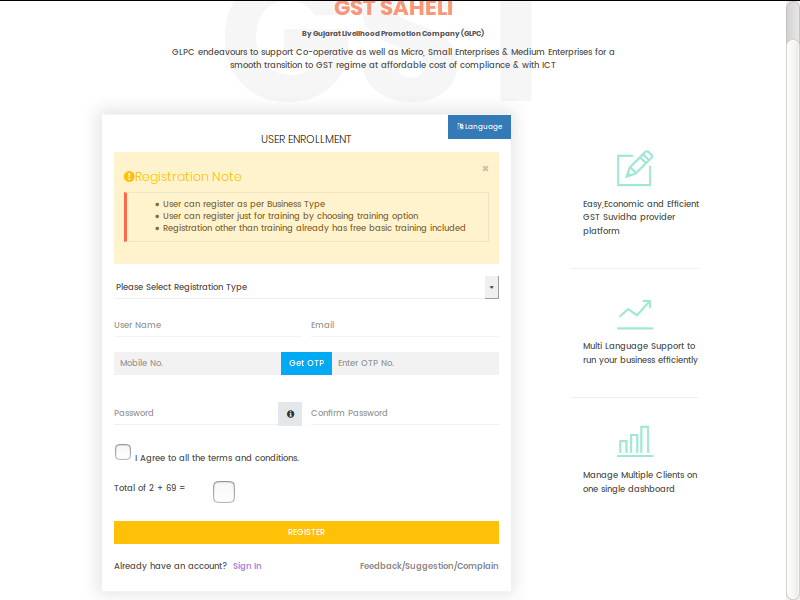

The portal assists in financial inclusion of women and youths under GST. The important features of GST Saheli comprise of invoicing, return filing, comprehensive dashboard for ITC ledger and Challan Generation. Step 1: Login to the portal The applicant has to login to the official website. Step 2: Click Register The home page opens, in which the applicant has to click the 'Register' tab. [caption id="attachment_81349" align="aligncenter" width="800"] Step 2: GST Saheli Portal Registration

Step 3: User Enrollment Form

The GST Saheli User Enrollment Form appears on the screen. The applicant has to enter all the required details.

[caption id="attachment_81351" align="aligncenter" width="800"]

Step 2: GST Saheli Portal Registration

Step 3: User Enrollment Form

The GST Saheli User Enrollment Form appears on the screen. The applicant has to enter all the required details.

[caption id="attachment_81351" align="aligncenter" width="800"] Step 3: GST Saheli Portal Registration

Step 4: Click Register

Once all the details are entered, the applicant has to click the 'Register' button at the bottom of the page.

Step 3: GST Saheli Portal Registration

Step 4: Click Register

Once all the details are entered, the applicant has to click the 'Register' button at the bottom of the page.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...