Updated on: December 17th, 2019 5:24 PM

Updated on: December 17th, 2019 5:24 PM

GST TDS Rate - Applicability and Procedure for Deduction

Tax Deduction at Source or TDS is a tax collection system wherein the tax liability is paid in part by the recipient of the goods or service at the time of making payment to the supplier. TDS ensures that the responsibility for payment of GST is shared by both the supplier and recipient for certain transactions. Hence, TDS ensures regular cash flow to the Government, introduces checks and balances, prevents tax evasion and increases tax base. GST also has provisions for TDS similar to the provisions for TDS under Income Tax Act. In this article, we look at TDS under GST and the applicable GST TDS rate.GST TDS Applicability in India

Regular taxpayers under GST are not required to deduct tax at source while making GST payments. Only the following types of taxpayers are required to comply with GST TDS provisions:- Department or an establishment of the Central Government or State Government;

- Local authority;

- Governmental Agencies;

- Any other persons or category of persons as notified by the Government on the recommendations of the GST Council.

GST TDS Rate

GST TDS should be deducted at 1% of the payment made to the supplier of taxable goods or services or both. GST TDS should be deducted only if the taxable value of supply under a contract exceeds Rs.2,50,000. While calculating the taxable value of supply, the applicable amount of IGST, CGST, SGST and GST Cess is not taken into consideration. Also, while considering the applicability of GST TDS, its important to consider the contract value rather than the value of individual bills. If the total contract value is more than Rs.2.5 lakhs, then GST TDS would be applicable, irrespective of value of individual tax invoices. Finally, GST would be applicable only if the supplier and the place of supply are in the same State or Union Territory. If the location of the supplier and the place of supply is in a State or Union Territory which is different, then GST TDS should not be deducted. Find GST rate for all goods and services in India.GST TDS Certificate

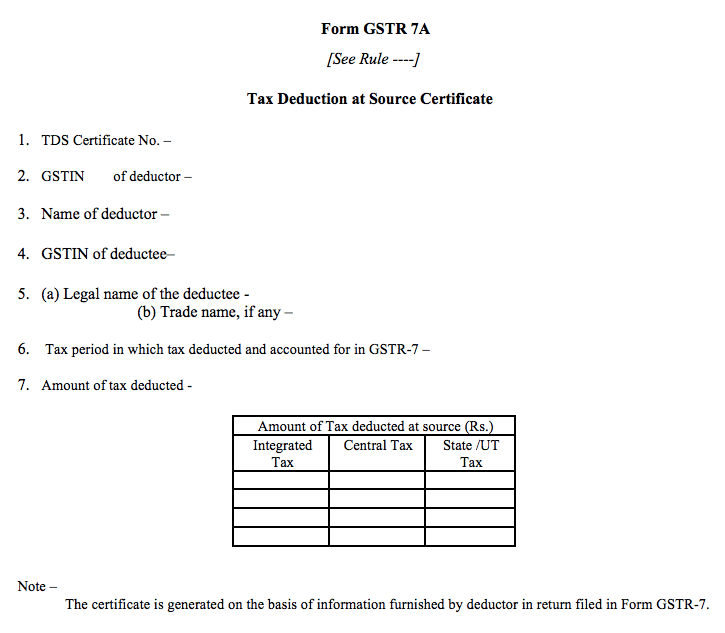

GST TDS should be deposited to the Government account by the deductor by 10th of every month. If GST TDS is not deposited, penalty would be levied as interest on the amount of tax deducted and not deposited. Further, all GST TDS Deductors are required to issue a GST TDS certificate in Form GSTR-71 to the supplier, within 5 days of crediting the amount to the Government. If GST TDS certificate is issued within 5 days of crediting the amount to the Government, then the GST TDS deductor would be liable for payment of late fee of Rs. 100/- per day from the expiry of the 5th day till the certificate is issued. This GST TDS certificate late fee penalty is capped at Rs. 5000/-. GST TDS Certificate

GST TDS Certificate

GST Registration for TDS Deductors

GST registration is mandatory for those required to deduct GST. GST registration for TDS deductors can be obtained by filing GST REG-07. GST registration for GST TDS Deductors can be obtained using TAN or PAN. The Drawing and Disbursing Officer of the Government Agency or Department can make the application along with his or her Digital Signature. The following documents must be submitted for obtaining GST registration for TDS Deductors.Own Premises

Document in support of the ownership of the premises like latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill.For Rented or Leased Premises

Copy of the valid Rent / Lease Agreement with any document in support of the ownership of the premises of the Lessor like Latest Property Tax Receipt or Municipal Khata copy or copy of Electricity Bill.Other Cases

A copy of the Consent Letter with any document in support of the ownership of the premises of the Consenter like Municipal Khata copy or Electricity Bill copy.GSTR-7 Filing

GSTR-7 must be filed by all persons registered to deduct GST at source. GSTR-7 is due every month on the 10th. If the supplier is unregistered, name of the supplier rather than GSTIN should be mentioned in the GSTR-7 return. Once GSTR-7 is filed, the details of the GST TDS would be made available to the supplier in Part C of GSTR-2A to take input tax credit. Hence, GST TDS would be made available as credit in the electronic cash register and the supplier can use the same for payment of tax or any other liability.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...