Last updated: March 6th, 2020 12:46 PM

Last updated: March 6th, 2020 12:46 PM

GSTR 1 Return Format 2019-2020

GSTR 1 return is due on the 11th of every month. After filing GSTR 3B returns, registered taxpayers belonging to all business shall file GSTR 1 return. The applicable taxpayers shall file GSTR 1 every month. The Form contains the details of outward supplies as performed by the business entity. In this article, we look at the procedure for filing GSTR 1 return along with the format.Due Dates for 2020

The Ministry of Finance classified the filing of GSTR 1 into two categories:|

S.No. |

Applicable for |

Month |

Due Date |

|

1 |

For taxpayers having an aggregate turnover of up to Rs.1.5 cr |

January - March 2020 |

April 30th 2020 |

|

2 |

For taxpayers having an aggregate turnover exceeding Rs.1.5 cr |

Feburary 2020 |

March 11th 2020 |

Due Dates Modified for 2019

The following modified due date for the year 2019 shall apply to registered taxpayers with a turnover of above Rs.1.5 cr.:- April 2019 – 11th May 2019

- May 2019 – 11th June 2019

- June 2019 – 11th July 2019

- July 2019 – 11th August 2019

- August 2019 – 11th September 2019

- September 2019 – 11th October 2019

- October 2019 – 11th November 2019

- November 2019 – 11th December 2019

Import of E-way Bill Data

It is essential for taxpayers to validate the data of their transactions before proceeding with the process of filing returns, as it saves time and unnecessary data entry. To cater to this purpose, the GST portal has now been integrated with the E-way Bill Portal (EWB). The integration enables the users to import the B2B and B2C invoice sections and the HSN-wise-summary of outward supplies section. Using these details, the taxpayers may verify the data and complete the filing. The feature has been introduced considering the major data gaps between self-declared liability in Form GSTR 1 and Form GSTR 3B. A similar rule also applies to Input Tax Credit (ITC) claimed in GSTR 3B, as it could be compared with the credit available in Form GSTR 2A. Data validation and comparison can be pursued through the following tabs of the portal:- Liability other than export/reverse charge

- Liability due to reverse charge

- Liability due to export and SEZ supplies.

- ITC credit claimed and due

No Late Fee for GSTR-1 & GSTR-3B Return

The biggest relief extended to small business by the 31st GST Council is the waiver of late fee for filing GSTR-1 and GSTR-3B return. The GST Council has announced: “Late fee shall be completely waived for all taxpayers in case FORM GSTR-1, FORM GSTR-3B &FORM GSTR-4 for the months/quarters July 2017 to September 2018, are furnished after 22.12.2018 but on or before 31.03.2019.” Thus, filing of Form GSTR-1, GSTR-3B and GSTR-4 will not attract any late fee penalty until 31st March 2019.GST Annual Return Due Date Extended

All entities having GST registration are required to file GST annual return in form GSTR-9. The due date for filing GST annual return is usually 31st December of each year for the financial year ended on 31st March of the same calendar year. As GST is newly introduced in India, the Government has decided to extend the due date for GST annual return filing to 30th June 2019. The due date for filing GST annual return was originally extended upto 31st March 2019, which has been further extended to 30th June 2019 by the GST Council.Who should file GSTR 1 Return?

GSTR 1 must be filed by all regular taxpayers having GST registration. Only dealers registered under Composition Scheme, Non-Resident Taxable person and casual taxable persons are not required to file GSTR 1 return.What is the due date for filing GSTR 1 Return?

GSTR 1 return must be filed on or before the 11th of each month. In the GSTR 1 return, the taxpayer would provide details of all supplies made during the previous month. Hence, in the GSTR 1 return filed on December, details of outward supplies in the month of November would be submitted.What is the penalty for not filing GSTR 1 Return?

If a taxpayer does not file GSTR 1 return on or before the due date, penalty of Rs.20 shall apply for nil returns. For other taxpayers, Rs.50 shall apply per day. The penalty shall max up to Rs.10000.GSTR 1 Format

In the following sections, we have broken down the GSTR 1 format into various sections to help you prepare GSTR 1 return. Instead of preparing the return manually, you can also click on the link below to signup for LEDGERS and prepare the GSTR 1 return automatically using the GST software.[crumina_label style="success" ]Prepare GSTR 1 using LEDGERS GST Software[/crumina_label]

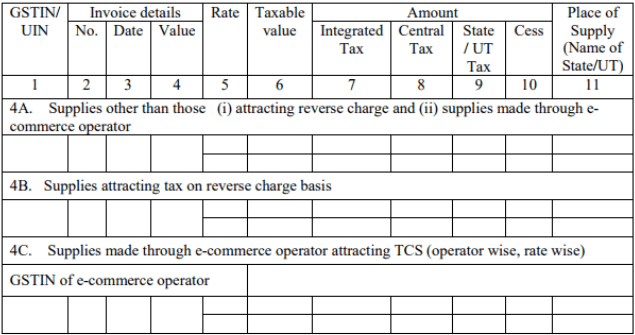

Taxable Supplies Made to Registered Persons

In the first table of the GSTR 1 return, as shown below, details of taxable supplies made to registered persons including UIN holders must be provided. Registered taxpayer is anyone having a GST registration and UIN holder is an embassy and consulate having GST Unique ID. [caption id="attachment_33377" align="aligncenter" width="635"] Taxable Supplies Made to Registered Persons

In the first table, the following information must be provided for each of the GST invoice issued by the taxpayer to a person having GSTIN (i.e., B2B Transaction) during the previous month.

Taxable Supplies Made to Registered Persons

In the first table, the following information must be provided for each of the GST invoice issued by the taxpayer to a person having GSTIN (i.e., B2B Transaction) during the previous month.

- GSTIN or UIN of the Customer

- Invoice Number

- Invoice Date

- Invoice Value

- GST Rate

- Taxable Value

- Amount of IGST Applicable

- Amount of CGST Applicable

- Amount of SGST Applicable

- Amount of GST Cess Applicable

- Place of Supply

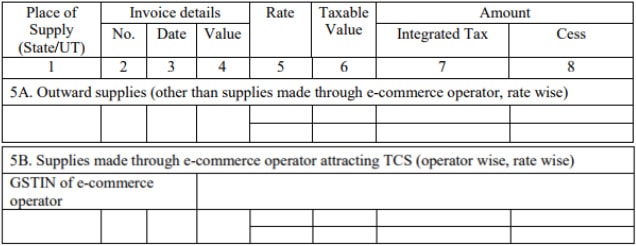

Taxable Inter-State Supplies to Unregistered Persons (Invoice Value >Rs.2.5 Lakhs)

[caption id="attachment_33378" align="aligncenter" width="636"] Interstate supplies to unregistered persons

In the above table, information about taxable inter-State supplies to un-registered persons where the invoice value is more than Rs 2.5 lakh must be provided. Hence, this table would contain only information of invoices wherein the value is more than Rs.2.5 lakhs and the customer is not registered under GST (i.e., B2C Transaction).

The information in this part must be divided into supplies normally made by the taxpayer and supplies made through an e-commerce operator. For both types, the following information must be provided:

Interstate supplies to unregistered persons

In the above table, information about taxable inter-State supplies to un-registered persons where the invoice value is more than Rs 2.5 lakh must be provided. Hence, this table would contain only information of invoices wherein the value is more than Rs.2.5 lakhs and the customer is not registered under GST (i.e., B2C Transaction).

The information in this part must be divided into supplies normally made by the taxpayer and supplies made through an e-commerce operator. For both types, the following information must be provided:

- Place of supply (State or Union Territory)

- Invoice number

- Invoice date

- Invoice value

- GST rate applicable

- Taxable value

- Amount of Integrated Tax

- Amount of GST Cess

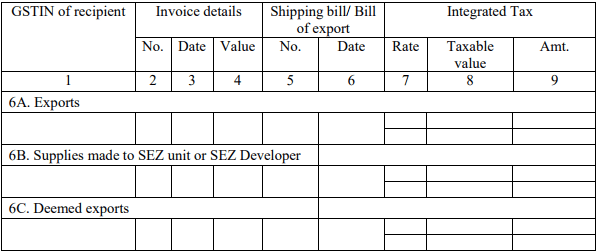

Zero Rated Supplies and Deemed Exports

[caption id="attachment_33379" align="aligncenter" width="599"] GSTR-1 Zero rated supplies

In the above table, information about zero rated supplies and deemed exports must be provided along with GSTIN of the customer. Under GST, exports and supplies to SEZ units are treated as zero-rated supplies. For all zero-rated supplies and deemed exports, the following information must be provided in GSTR 1 filing.

GSTR-1 Zero rated supplies

In the above table, information about zero rated supplies and deemed exports must be provided along with GSTIN of the customer. Under GST, exports and supplies to SEZ units are treated as zero-rated supplies. For all zero-rated supplies and deemed exports, the following information must be provided in GSTR 1 filing.

- GSTIN of customer

- Invoice number

- Invoice date

- Invoice value

- Shipping bill or bill of export number

- Shipping bill or bill of export date

- Integrated tax rate

- Integrated tax applicable

- Taxable amount

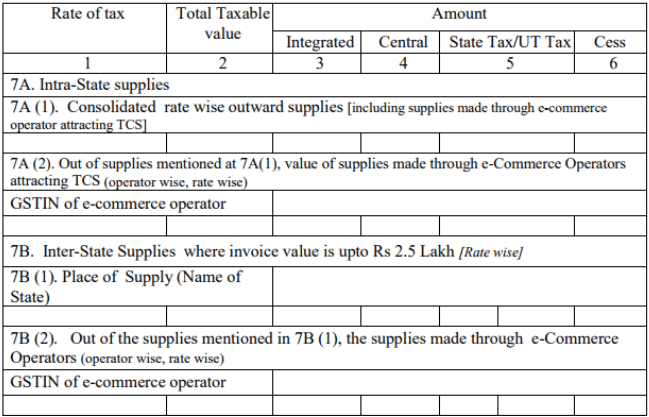

Taxable Supplies Made to Unregistered Persons

[caption id="attachment_33380" align="aligncenter" width="649"] GSTR 1 Supplies to Unregistered Persons

In this table, consolidated information about all supplies made by the taxpayer to persons not having GST registration must be provided. For most businesses like restaurants, grocery stores, salons and other types of consumer-facing businesses, this table would be significant as majority or all sales would fall under the above category.

Also, this table contains only information wherein the tax invoice value is less than Rs.2.5 lakhs. If the value of the invoice was over Rs.2.5 lakhs, then it must be reported under taxable inter-State supplies to un-registered persons where the invoice value is more than Rs 2.5 lakh.

GSTR 1 Supplies to Unregistered Persons

In this table, consolidated information about all supplies made by the taxpayer to persons not having GST registration must be provided. For most businesses like restaurants, grocery stores, salons and other types of consumer-facing businesses, this table would be significant as majority or all sales would fall under the above category.

Also, this table contains only information wherein the tax invoice value is less than Rs.2.5 lakhs. If the value of the invoice was over Rs.2.5 lakhs, then it must be reported under taxable inter-State supplies to un-registered persons where the invoice value is more than Rs 2.5 lakh.

7.A Intra-State Supplies

Intra-state supplies are supplies made within the state. In the case of restaurants, grocery stores and other kind of shops, the supplies undertaken in the normal course of business would be intra-state supplies. For such sales within the state of the taxpayer, the following consolidated information must be provided rate-wise.- Rate of tax

- Total Taxable value

- Amount of CGST applicable

- Amount of SGST applicable

- Amount of GST Cess applicable

- Rate of tax = 18%

- Total Taxable value = Rs.10,00,000

- Amount of CGST applicable = Rs.90,000

- Amount of SGST applicable = Rs.90,000

- Amount of GST Cess applicable

- Rate of tax = 5%

- Total Taxable value = Rs.10,00,000

- Amount of CGST applicable = Rs.25,000

- Amount of SGST applicable = Rs.25,000

- Amount of GST Cess applicable - Rs.0

- Rate of tax = 12%

- Total Taxable value = Rs.10,00,000

- Amount of CGST applicable = Rs.60,000

- Amount of SGST applicable = Rs.60,000

- Amount of GST Cess applicable - Rs.0

Supplies through E-Commerce Operators

If any taxpayer supplies goods or services through an e-commerce operator, then the details must be provided for separately along with the GSTIN of the e-commerce operator, rate wise. In the grocery store example, if the supplies were made by the taxpayers to customers in Tamil Nadu through Amazon and Flipkart, then the following information should be provided.- Supplies through Amazon (Amazon GSTIN)

- Rate of tax = 5%

- Total Taxable value = Rs.10,00,000

- Amount of CGST applicable = Rs.25,000

- Amount of SGST applicable = Rs.25,000

- Amount of GST Cess applicable - Rs.0

- Supplies through Flipkart (Flipkart GSTIN)

- Rate of tax = 12%

- Total Taxable value = Rs.10,00,000

- Amount of CGST applicable = Rs.60,000

- Amount of SGST applicable = Rs.60,000

- Amount of GST Cess applicable - Rs.0

7.B Inter-State Supplies

Inter-state supplies apply to supplies made by a taxpayer outside of the state. Any taxpayer undertaking inter-state supplies is required to obtain GST registration mandatorily, irrespective of aggregate annual turnover. In this section, the taxpayer must submit information about all supplies made out of state during the previous month. For example, if a tools manufacturer based in Tamil Nadu, made supplies to Karnataka and Maharashtra, then the following information should be provided.- Supplies to Karnataka

- Rate of tax = 5%

- Total Taxable value = Rs.10,00,000

- Amount of IGST applicable = Rs.50,000.

- Amount of GST Cess applicable - Rs.0

- Supplies to Maharashtra

- Rate of tax = 12%

- Total Taxable value = Rs.10,00,000

- Amount of IGST applicable = Rs.1,20,000

- Amount of GST Cess applicable - Rs.0

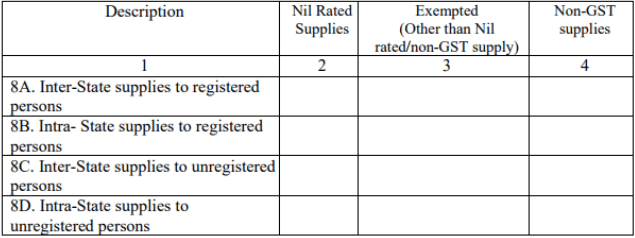

Nil, Exempt and Non-GST Supplies

[caption id="attachment_33381" align="aligncenter" width="635"] GSTR 1 - Nil and Exempt Supplies

During the previous month, if the taxpayer supplied any goods or services at 0% GST rate or goods exempted from GST or any other non-GST supplies, then such information must be provided in the above section.

All nil rates supplies, exempted supplies and non-GST supplies must be categories and submitted under the following heads:

GSTR 1 - Nil and Exempt Supplies

During the previous month, if the taxpayer supplied any goods or services at 0% GST rate or goods exempted from GST or any other non-GST supplies, then such information must be provided in the above section.

All nil rates supplies, exempted supplies and non-GST supplies must be categories and submitted under the following heads:

- Inter-state supplies to registered persons

- Inter-state supplies to unregistred persons

- Intra-state supplies to registered persons

- Intra-state supplies to unregistered persons

This article is continued under

[crumina_text_highlight style="colored" size="default"]GSTR 1 Return Filing[/crumina_text_highlight]

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...